- Speculate on a falling price by opening a short position.

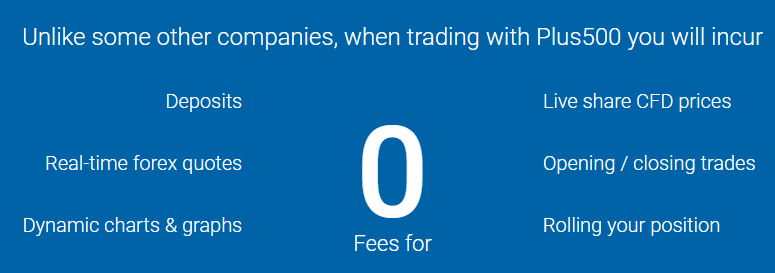

- Benefit from low transaction fees and no commissions.

- Try investing without risk with a free demo.

Online brokers

In this informative section you can read a lot about brokers. Before you open a demo account with a broker, it would be wise to check which broker best fits your personal situation. Our list of best brokers makes it easy to select a broker that suits your needs!

Tips: Take a look at these articles

Is Plus500 a scam? Scam investigation!

Are you curious whether Plus500 is a scam? In this article, I investigate whether Plus500 is a fraud or not.

Tip: Try first with a demo account

Do you doubt whether Plus500 is a scam? Then it may be wise to get acquainted with the broker by opening a free demo account. You can open a free demo account with Plus500 by clicking the button below:

Is Plus500 a scam?

Plus500 is not a scam. I have extensively researched Plus500 and the company has a long track record. During my investigation, I found the following:

- Plus500 has been around since 2008 and has a long history.

- Plus500 has welcomed beyond 23 million investors since inception.

- The broker operates in more than 50 different countries.

- The company is listed on the stock exchange and makes a profit every year.

- Plus500 is regulated by different authorities.

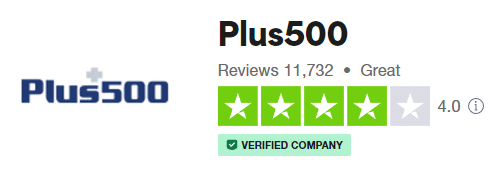

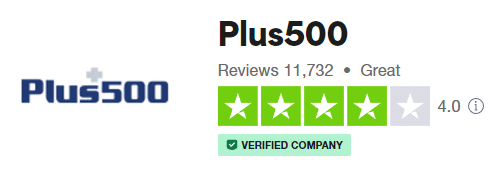

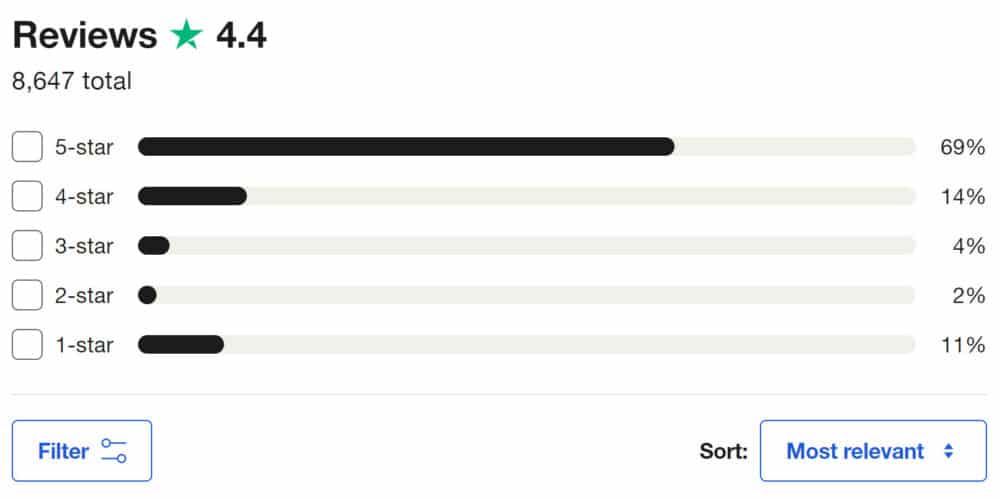

- Plus500 scores more than 4.0 on Trustpilot.

- Plus500 sponsors multiple football teams.

Illustrative prices

Is Plus500 legitimate?

Plus500 is a legitimate company that has been active since 2008. To further investigate the company, I even visited their headquarters in Haifa. Plus500 shares a nice office building with Microsoft. All employees can eat free ice cream there, and they even have a gym in the building. I was able to speak with many employees, and they indicated that they enjoy working for the company.

Plus500 has many subsidiaries:

- Plus500UK Ltd

- Plus500CY Ltd

- Plus500AU Ltd

- Plus500SG Pte Ltd

- Plus500IL Ltd

- Plus500SEY Ltd

The company is also supervised by different authorities:

- Financial Conduct Authority (FRN 509909)

- Cyprus Securities and Exchange Commission (CySEC Licence No. 250/14)

- AFSL #417927 issued by the Australian Securities and Investments Commission (ASIC)

- FSP No. 486026 issued by the FMA in New Zealand

- Authorised Financial Services Provider #47546 issued by the FSCA in South Africa

- Monetary Authority of Singapore (License No. CMS100648-1)

- Seychelles Financial Services Authority (Licence No. SD039)

It is a positive sign that Plus500 is active in so many countries and has official registrations. This confirms once again that the company is not a scam.

Is Plus500 popular?

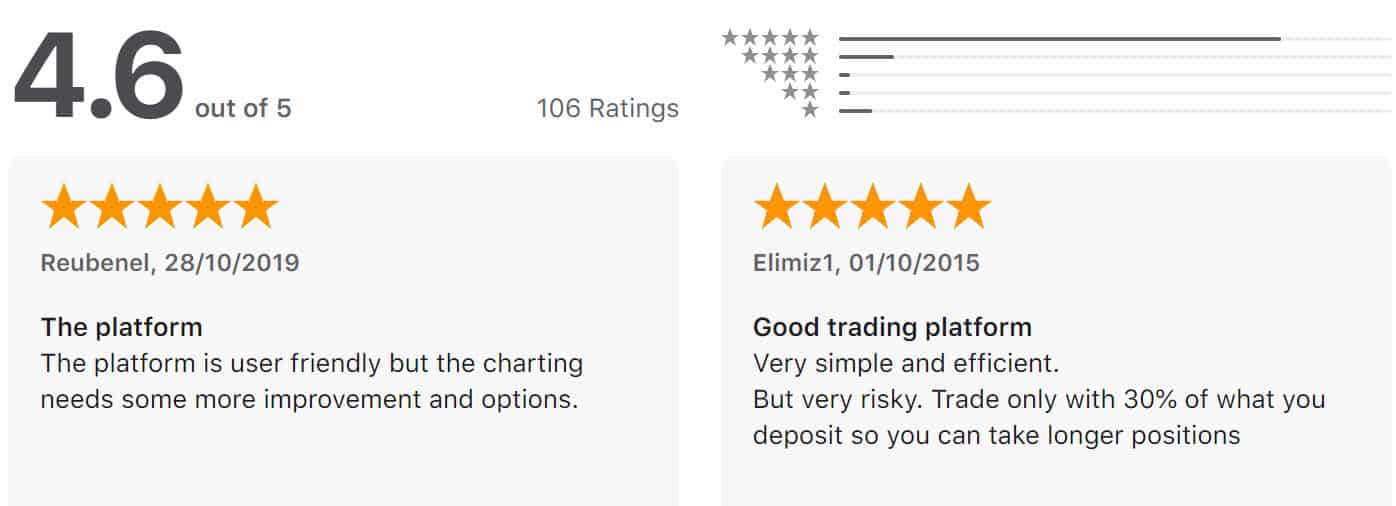

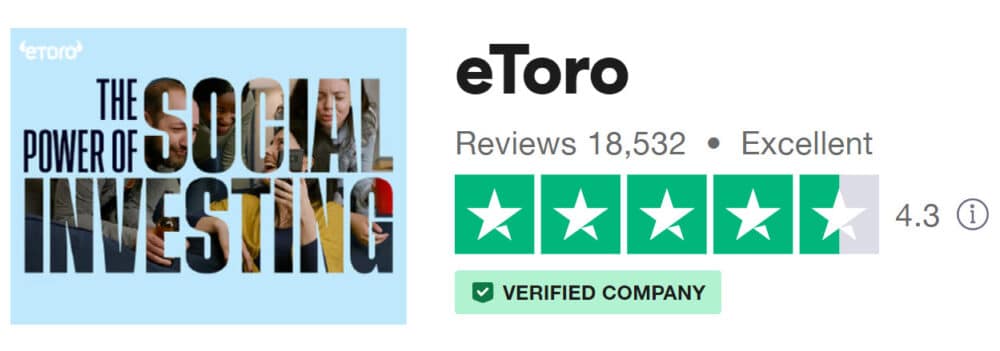

Plus500 receives many positive reactions on the internet. At the time of writing (August 2023), Plus500 has an average score of 4.0 based on more than 11,000 reviews!

I found many positive reactions on the internet, but also some negative ones. Some people incorrectly called Plus500 a scam. This is often because people have lost their money with their investments. They feel deceived and blame the broker.

Remember that investing with Plus500 is not a game. You risk money, and you could lose a large part of your deposit. Therefore, only invest with money that you can afford to lose.

How does Plus500 make money?

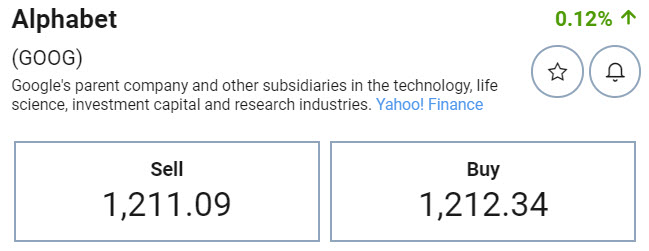

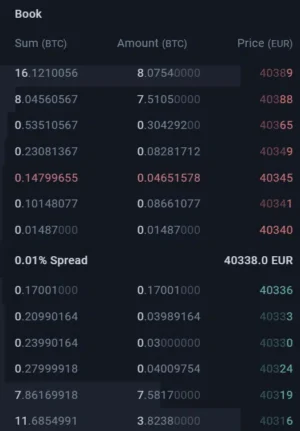

Some people think that Plus500 is a scam because they do not charge fixed commissions. However, this is certainly possible: the company makes money by charging a spread.

The spread is the difference between the buy and sell price of, for example, a CFD share. Click here to read more about how a spread works.

Claims that money has not been paid out for Plus500

When you search the internet for whether Plus500 is a scam, you come across some claims that some people make that their money has not been paid out. However, Plus500 states that these people have abused the broker’s terms and conditions. For example, they have created multiple accounts or have created an account with false information. If this comes to light, Plus500 is forced by law to close the account of these people.

There are also claims online that trading CFDs at Plus500 is not fair. This is mainly due to people’s ignorance about this method of investing. Trading in CFDs is not the same as investing in stocks. On our page, you can read more information about CFD trading with brokers like Plus500.

Do you want to know how the payout process works at Plus500? Then read this article!

Is your money secure with Plus500?

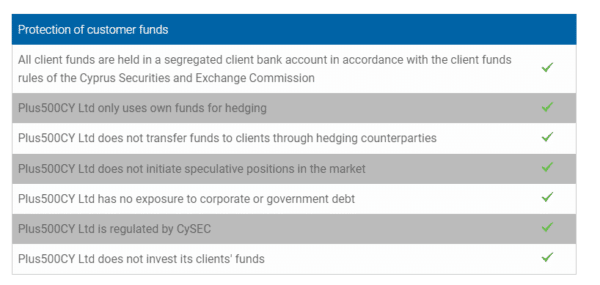

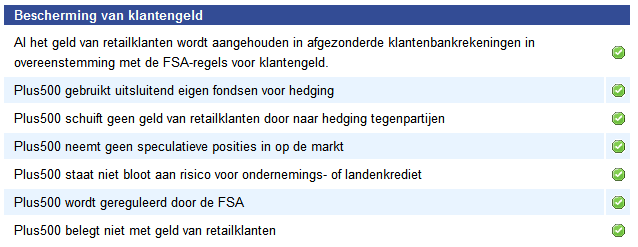

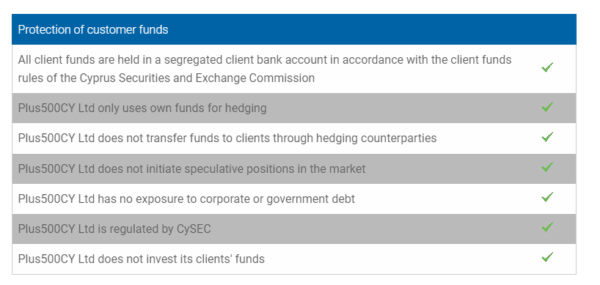

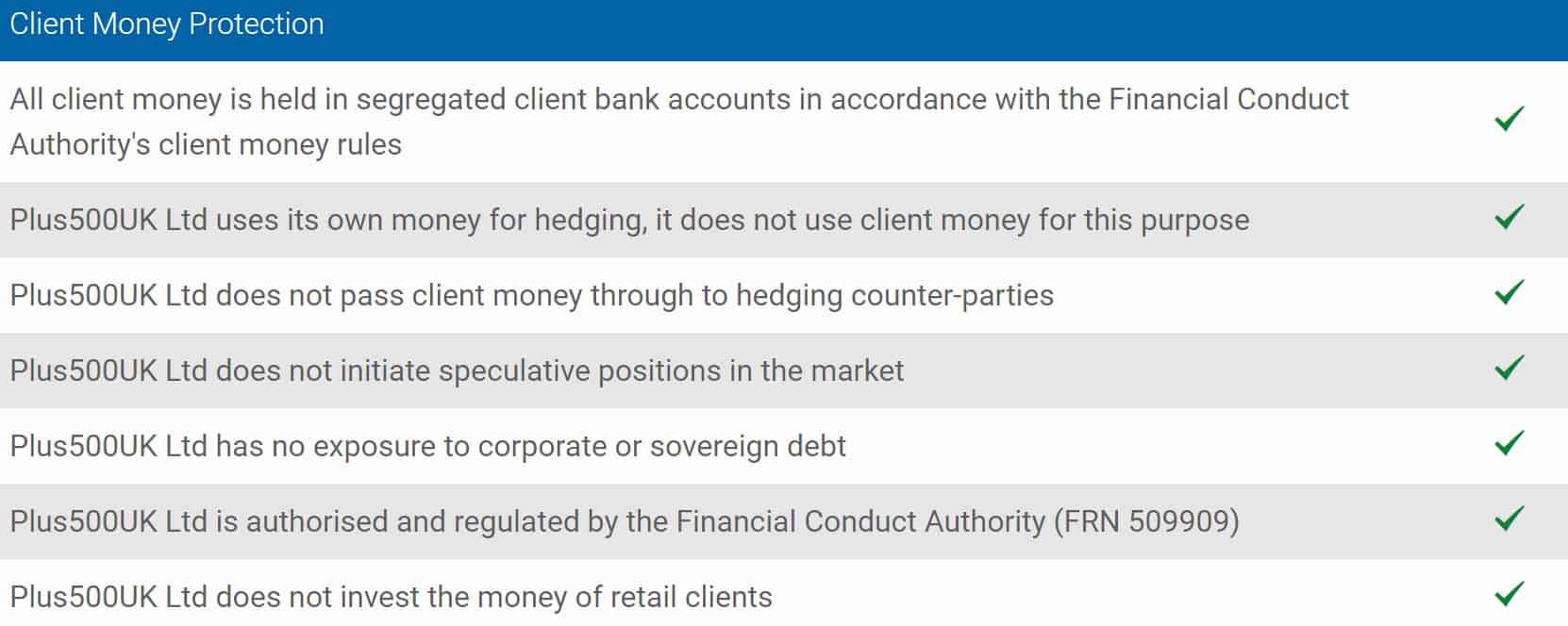

When you deposit money at Plus500, it is handled carefully. Customer funds are stored in a separate account and the company will not invest them.

Due to the ESMA rules, user accounts within Europe are also protected against a negative balance.

With the Investor Compensation Fund, users are also protected under conditions under the company’s bankruptcy. You can read about the characteristics of this fund here.

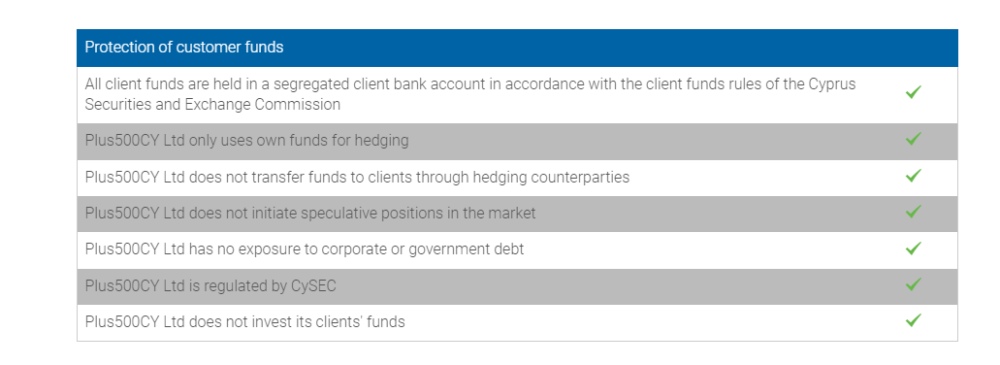

All client funds are held in a segregated client bank account in accordance with the Cyprus Securities and Exchange Commission’s (CySEC) client funds rules. For more information you visit – https://www.plus500.com/Help/ClientMoneyProtection;

Characteristics of a reliable broker

When investing money with an online broker, it is natural to be concerned about reliability. Someone could set up a fake website with the aim of scamming people. It is therefore wise to pay attention to some characteristics when choosing a broker that demonstrates the site’s reliability.

At Plus500, you can tick more of these characteristics than with most other brokers that offer their services online. For example, Plus500CY Ltd is regulated by the CySec (#250/14). This is an independent authority that closely monitors the behaviour of financial institutions in Europe.

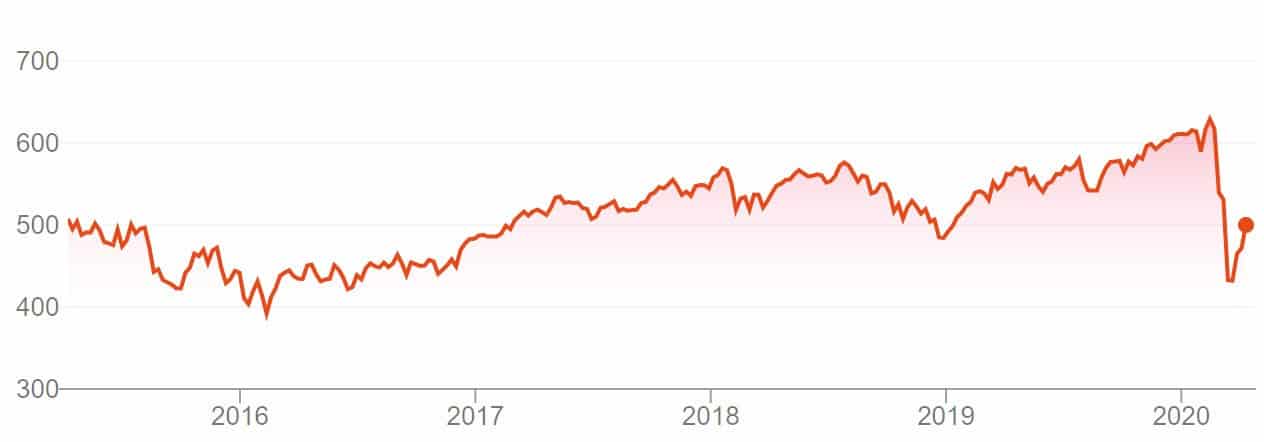

An additional characteristic that shows the reliability of Plus500 is the fact that they are listed on the stock exchange. As shares of Plus500 are available on the London Stock Exchange, they have to be transparent. Moreover, as a listed company, they also have to meet a whole range of additional legal requirements.

Why I would recommend Plus500

Once you are familiar with the risks and the way CFD trading works, Plus500 is a reliable CFD broker.

Some characteristics of the broker that ensure this are:

- The user-friendly software and the free demo you can create.

- The website & software of Plus500 are fully available in multiple langiages.

- No fixed commissions are charged on your investments.

All of this makes Plus500 one of more reliable CFD brokers. Click here to open a free demo account with Plus500:

Plus500 review & experiences (2024): pros & cons

In this review of Plus500, I share my experiences with this trading platform. After reading this comprehensive Plus500 review, you will know if this platform is a good fit for you.

What are the biggest advantages of Plus500?

- Extensive offering: You can trade in more than 2800 CFD securities with Plus500. In some countries, you can also invest in 2700 real shares and in the USA you can trade in futures.

- User-friendliness: The software of Plus500 is very user-friendly.

- Free unlimited demo: You can try the possibilities at Plus500 for free with a demo account.

- Speculation: It is also possible to speculate on decreasing prices with Plus500.

- Transparency: Plus500 does not charge any hidden costs for withdrawing or depositing money.

What are the biggest disadvantages of Plus500?

- Customer service: Plus500 is only accessible via online chat, email or Whatsapp (24/7, but you cannot call them).

- Limited software: You cannot perform advanced analyses with the Plus500 software.

- Limited education: Plus500 offers limited education in their trading academy.

Try Plus500 for free with a demo!

Read the rest of the Plus500 review to read in detail about my experiences with the trading platform. Do you want to try out if Plus500 is a good fit for you? Than open a free demo account with this provider:

What is Plus500?

Plus500 was founded in Israel in 2008 and has since grown into a large company with more than 23 million customers (since inception) spread across 50 countries! Plus500 mainly focuses on speculation with CFDs, but it is also possible to buy stocks with this broker.

| Free demo: | Yes |

| Offer: | CFD's on stocks, Forex, crypto and commodities |

| Minimum deposit: | $100 |

| Minimum withdraw: | $50 |

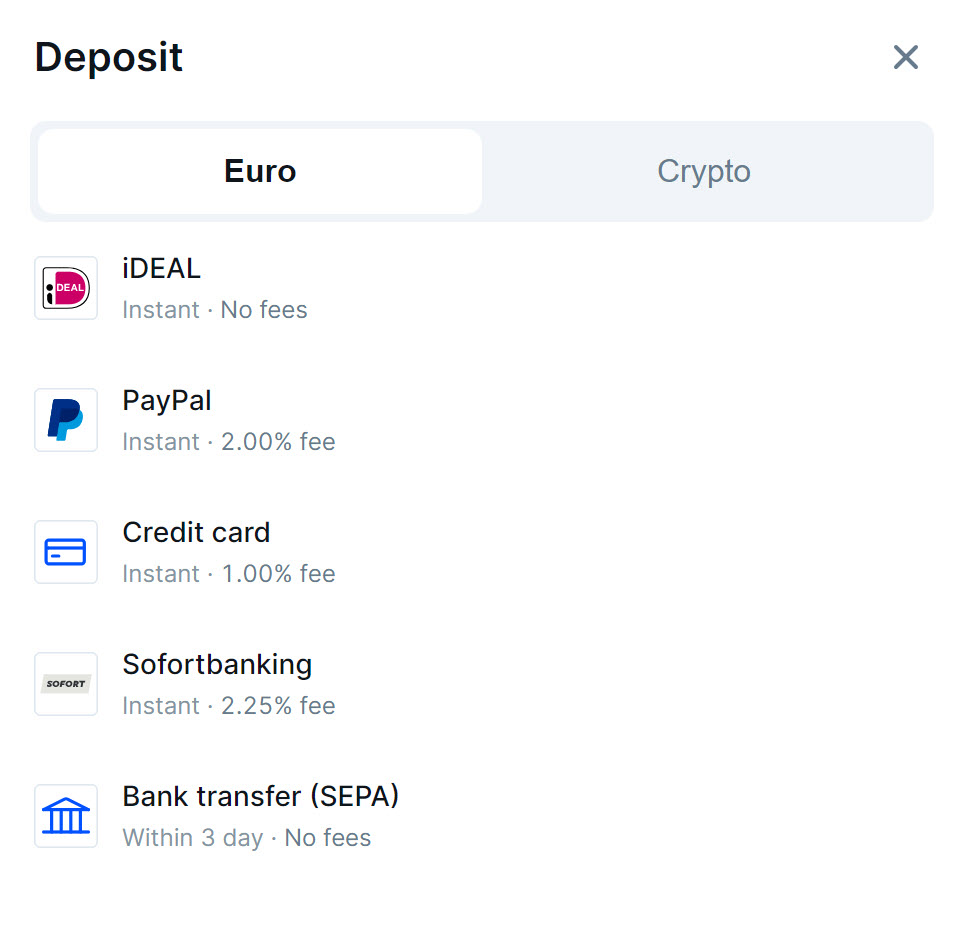

| Deposit money: | Bank transfer, iDEAL, PayPal & creditcard |

| Fees: | Commission free on CFD's |

| Currency exchange costs: | 0,7% |

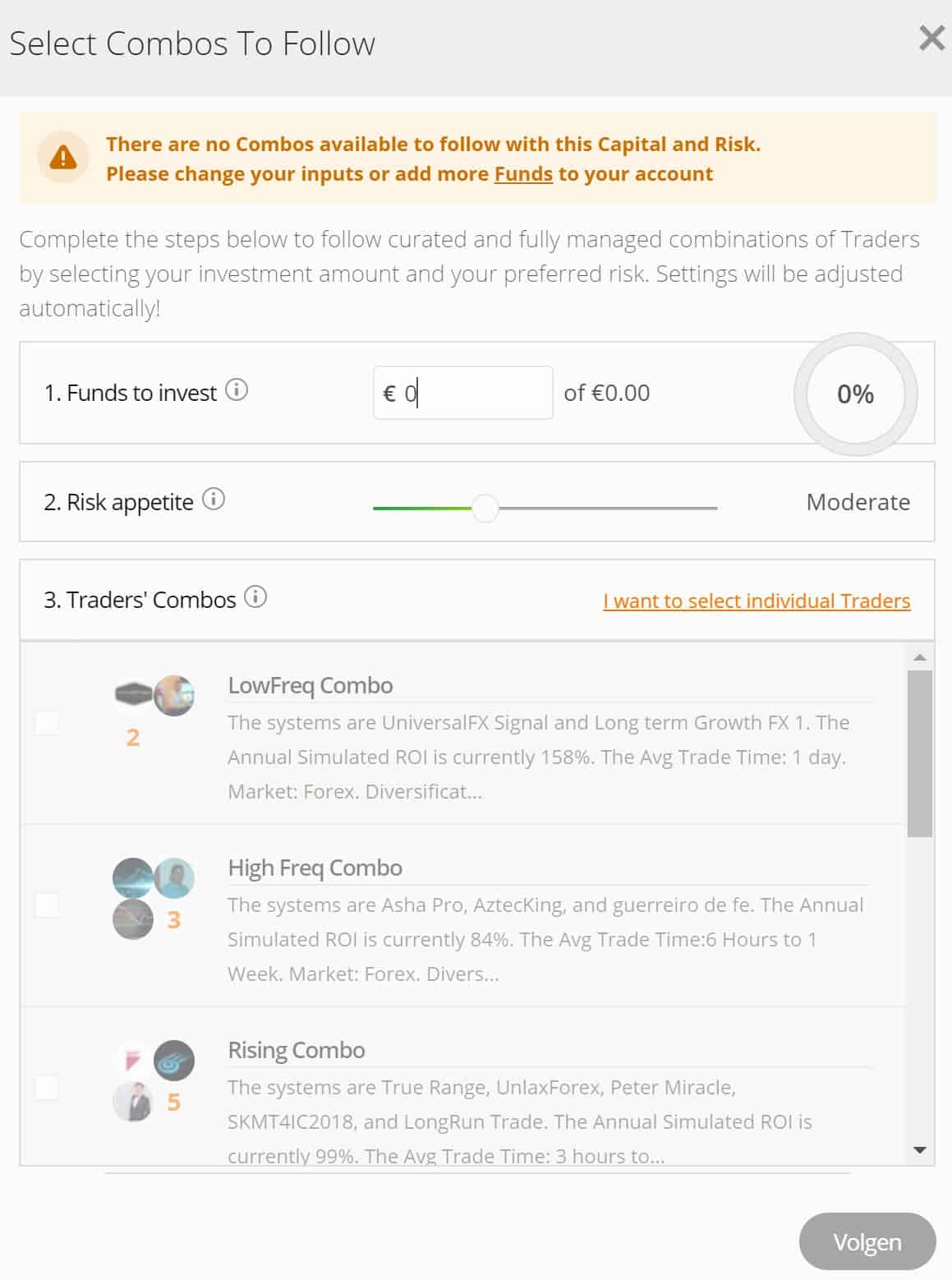

| Copytrading: | No |

| Costumer Service | Ticket & live chat |

| Copytrading | No |

| Account | Euro / dollar account |

How to invest with Plus500?

Option 1: Active trading with Plus500

Most investors use Plus500 CFD at Plus500. With Plus500 CFD, you can actively speculate on the price movements of popular CFD stocks. When investing in CFDs, the following applies:

- No ownership: You invest in a derivative, not the underlying asset.

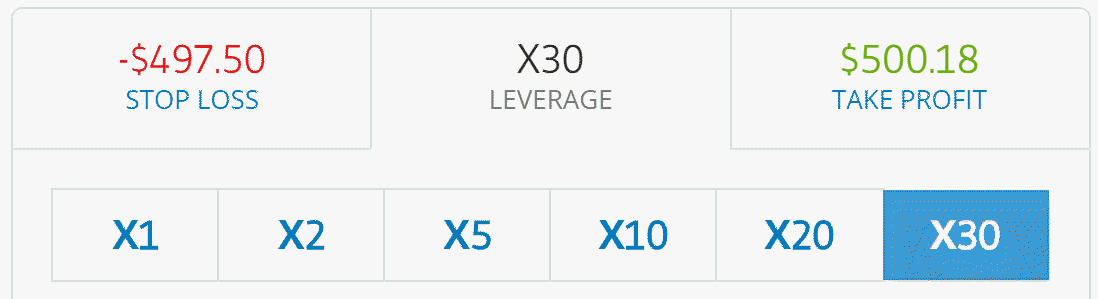

- Leverage: You can open a larger position with a small amount of money.

- Short position: Besides buying, it is also possible to speculate on decreasing prices.

- Short-term: CFD trading is only suitable for the short term.

Do you want to know in detail how investing in CFDs works? Read this article!

Option 2: buy stocks with Plus500

Since 2023, it is also possible to directly buy and sell stocks with Plus500 Invest. In this case, you do pay commissions on your transactions, but this method of investing is also suitable for the long term.

Option 3: futures (in United States)

Users in the United States can trade futures with the platform of Plus500.

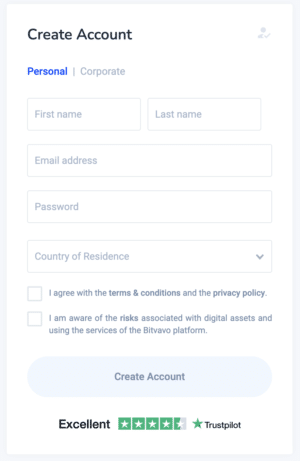

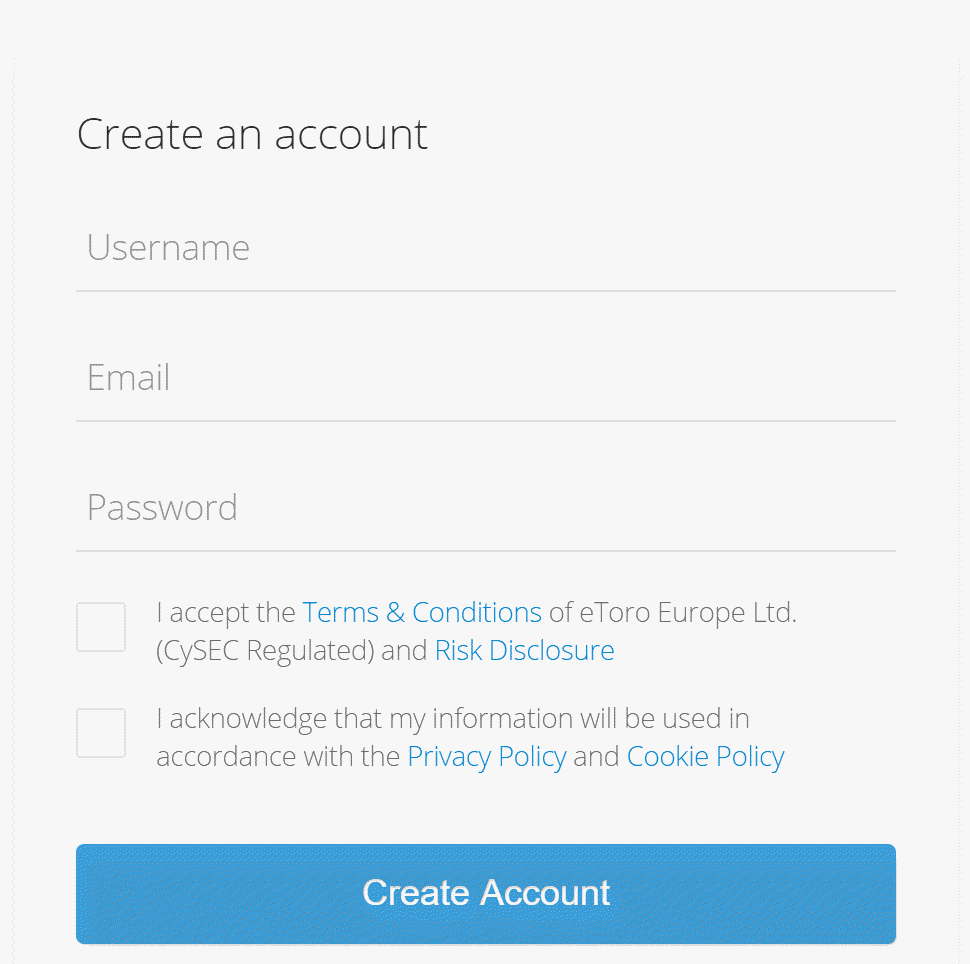

How to open an account with Plus500?

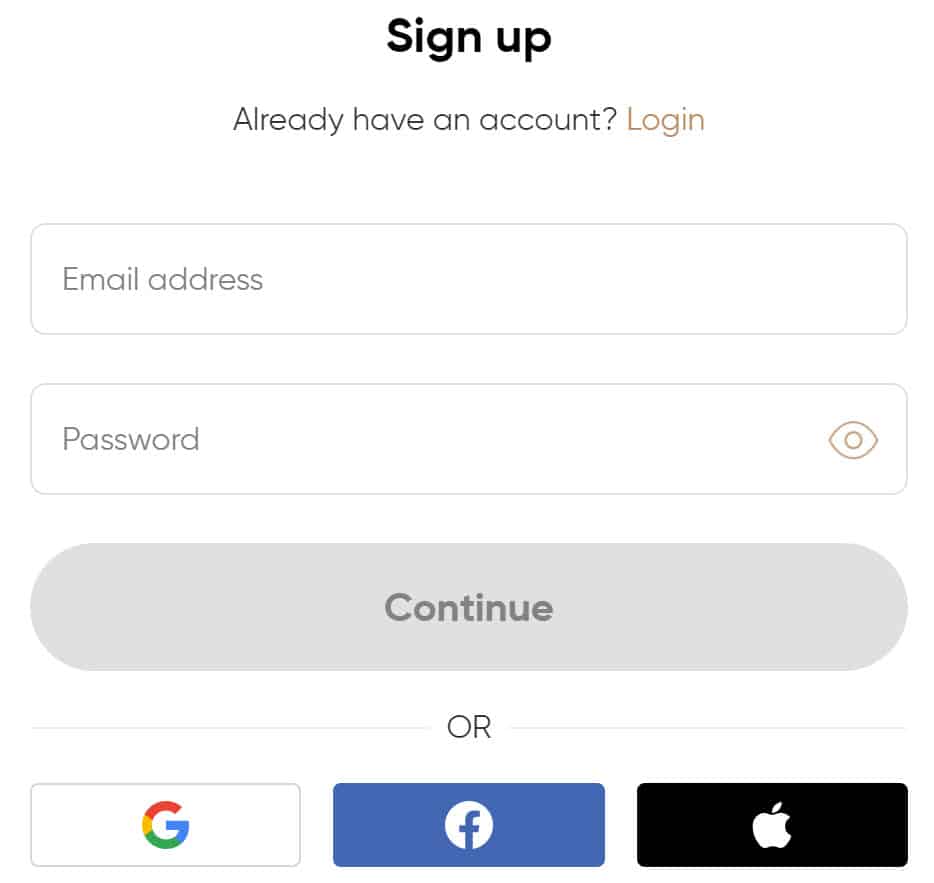

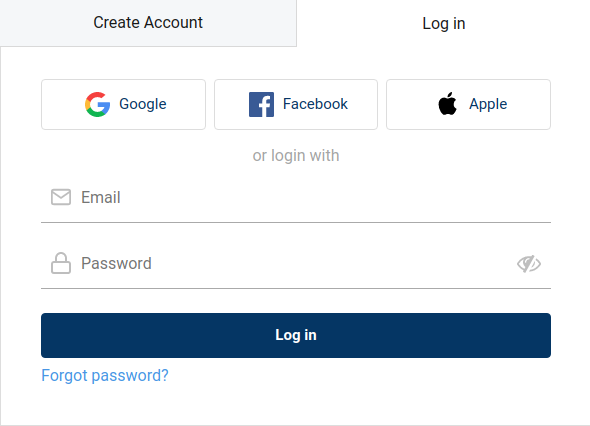

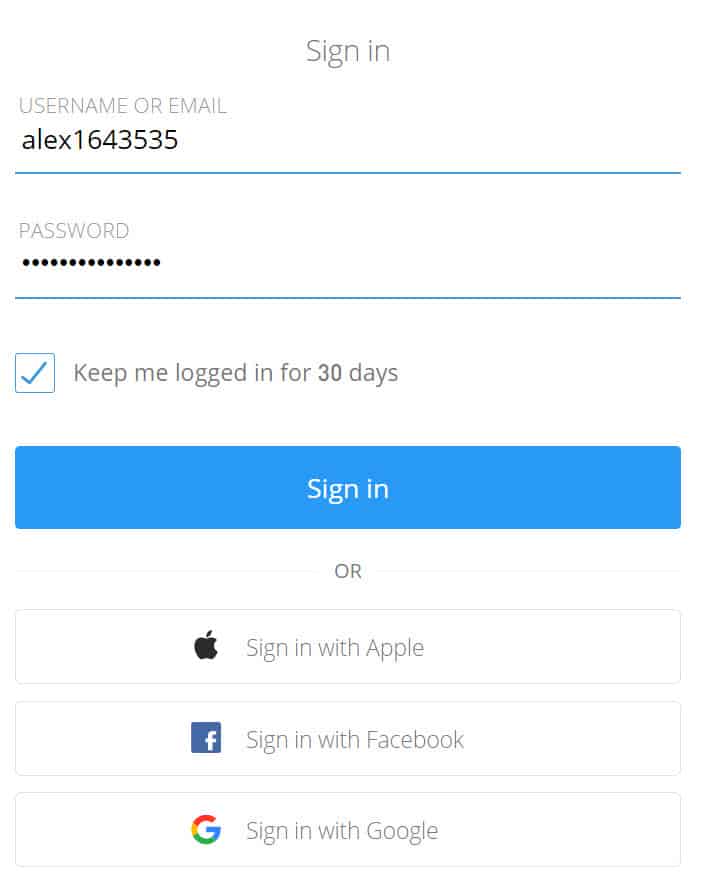

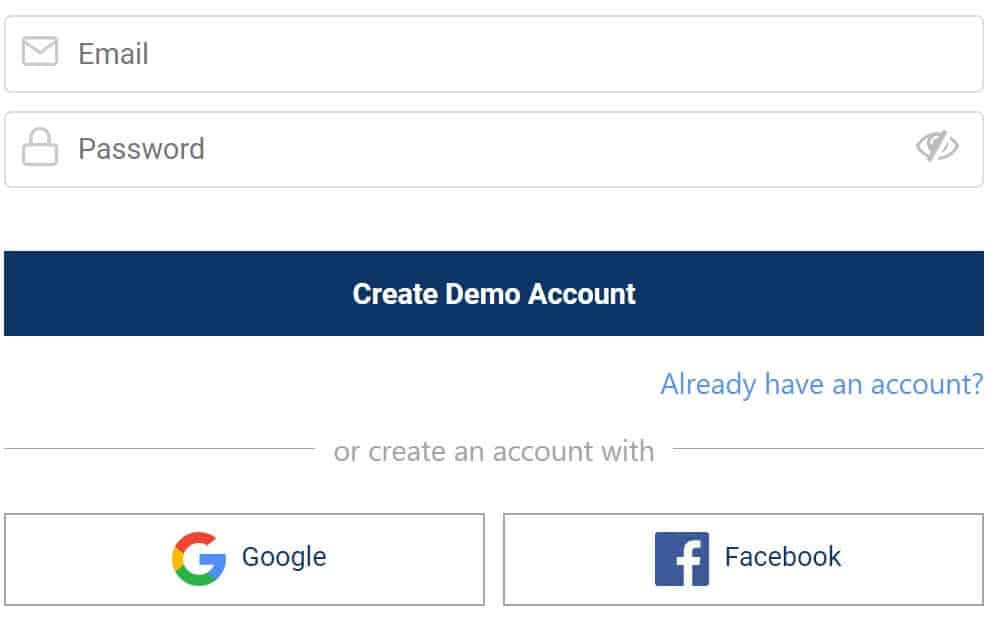

Opening a demo account with Plus500 is quick and easy: just click the Try free Demo button on the website. Do you want to create an account with Plus500 yourself? Click here!

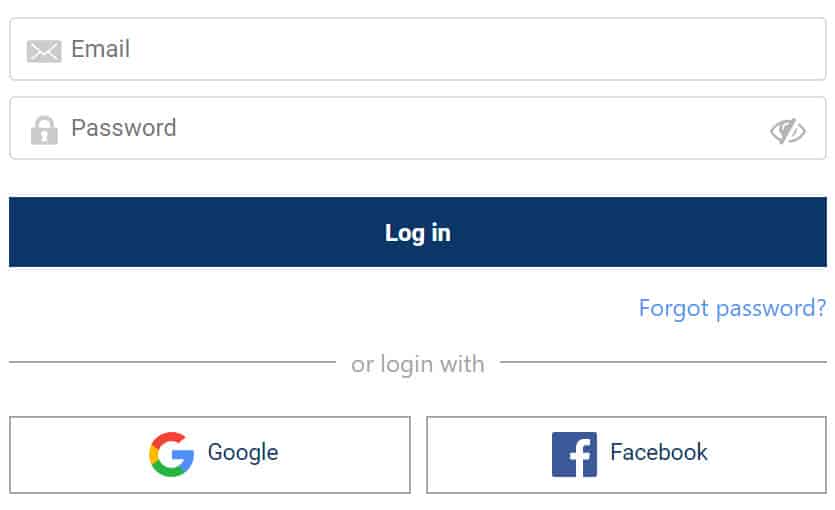

You only need to leave an email and a password. It is even possible to open an account directly with your Google, Facebook or Apple account.

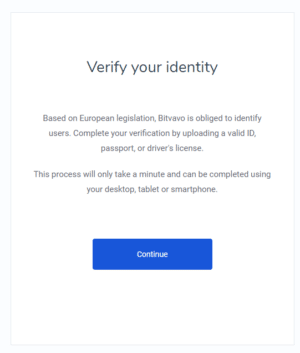

With the free demo, you can try out all the features of the Plus500 software for free and without risk. If you want to invest with real money, you still have to go through some additional steps. It is required to confirm your identity and address and to pass a knowledge test.

Is Plus500 reliable?

I believe that Plus500 is a reliable trading platform:

- 14 years active: Plus500 has been active for over 14 years.

- 23+ million customers since inception: with 22 million opened accounts in 50 countries, Plus500 is a large player.

- Regulated: Plus500 is under supervision, which is a positive sign for its reliability.

- Segregated account: customer funds are stored in segregated accounts at Plus500.

- Tradable: Plus500’s shares are tradable on the stock exchange.

- Sponsor: Plus500 sponsors various sports teams.

On the internet, Plus500 receives an average score of 4.1 at the time of writting:

Below is an overview of all the parties that regulate Plus500:

- Financial Conduct Authority (FRN 509909)

- Cyprus Securities and Exchange Commission (CySEC Licence No. 250/14)

- AFSL #417927 issued by the Australian Securities and Investments Commission (ASIC)

- FSP No. 486026 issued by the FMA in New Zealand

- Authorised Financial Services Provider #47546 issued by the FSCA in South Africa

- Monetary Authority of Singapore (Licence No. CMS100648-1)

- Seychelles Financial Services Authority (Licence No. SD039)

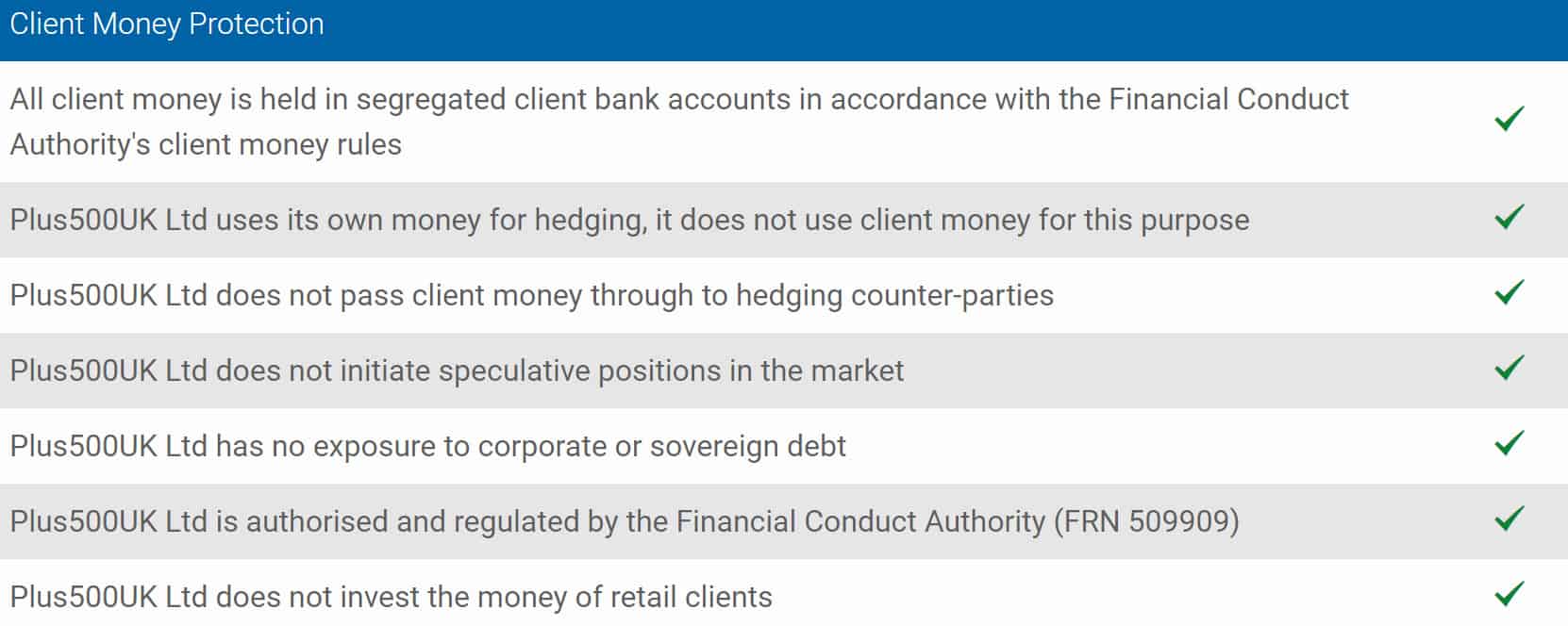

Plus500 also takes adequate measures to protect its clients’ funds. In the overview below, you can see the steps they take:

I have personally visited the Plus500 office in Israel and everything looked reliable. If you still are keen to know more about the reliability of Plus500, you can read one of the following articles:

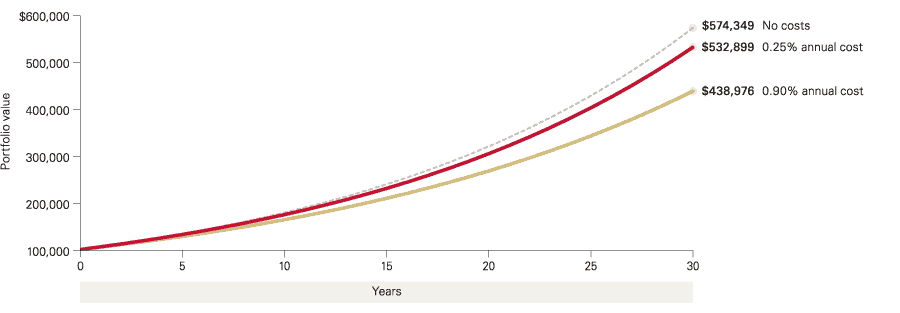

What are the costs of investing with Plus500?

- No commissions: You do not pay any commissions when trading CFDs with Plus500.

- Deposit & withdrawal: Depositing and withdrawing money is free with Plus500.

- No service fees: You do not pay any service fees on your account.

- Inactivity: If you do not log in for three months, you will be charged $10 per month.

- Conversion fees: You pay 0.7% for currency conversion.

- Spread: You pay a spread on each transaction.

- Leverage: You pay financing costs on your transactions.

- Guaranteed stop loss: You pay an extra charge for this feature.

I find it a positive point that Plus500 does not charge hidden costs: for example, depositing and withdrawing money is free. Because your costs are relative to the investment position you open, Plus500 is very suitable for active traders.

However, the costs are too high if you want to invest with Plus500 for the long term. I would not recommend Plus500 CFD for long-term investors.

The costs of Plus500 Invest are reasonable: especially on US stocks, the costs are low at $0.006 per share.

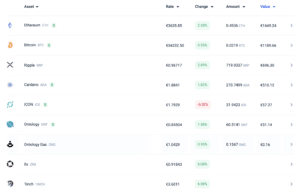

What can you invest in with Plus500?

You can invest in over 2800 CFD’s and 2700 real stocks and ETF’s (in some regions).

(CFD) stocks

With Plus500 Invest, you can invest in stocks, while with Plus500 CFD, you can actively trade in stocks. You can trade in over 2000 shares from European countries, America, Australia, Japan, and Hong Kong at Plus500. A positive point within the review is that you can also speculate in smaller, local CFD stocks.

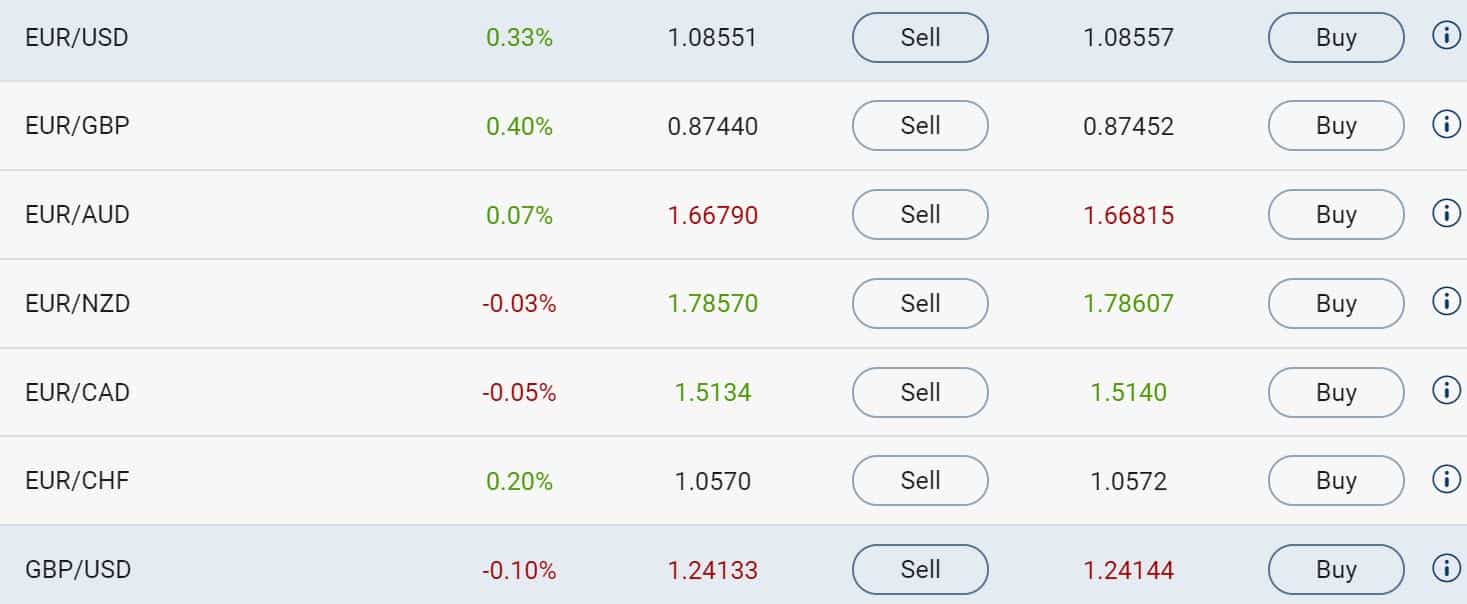

Forex

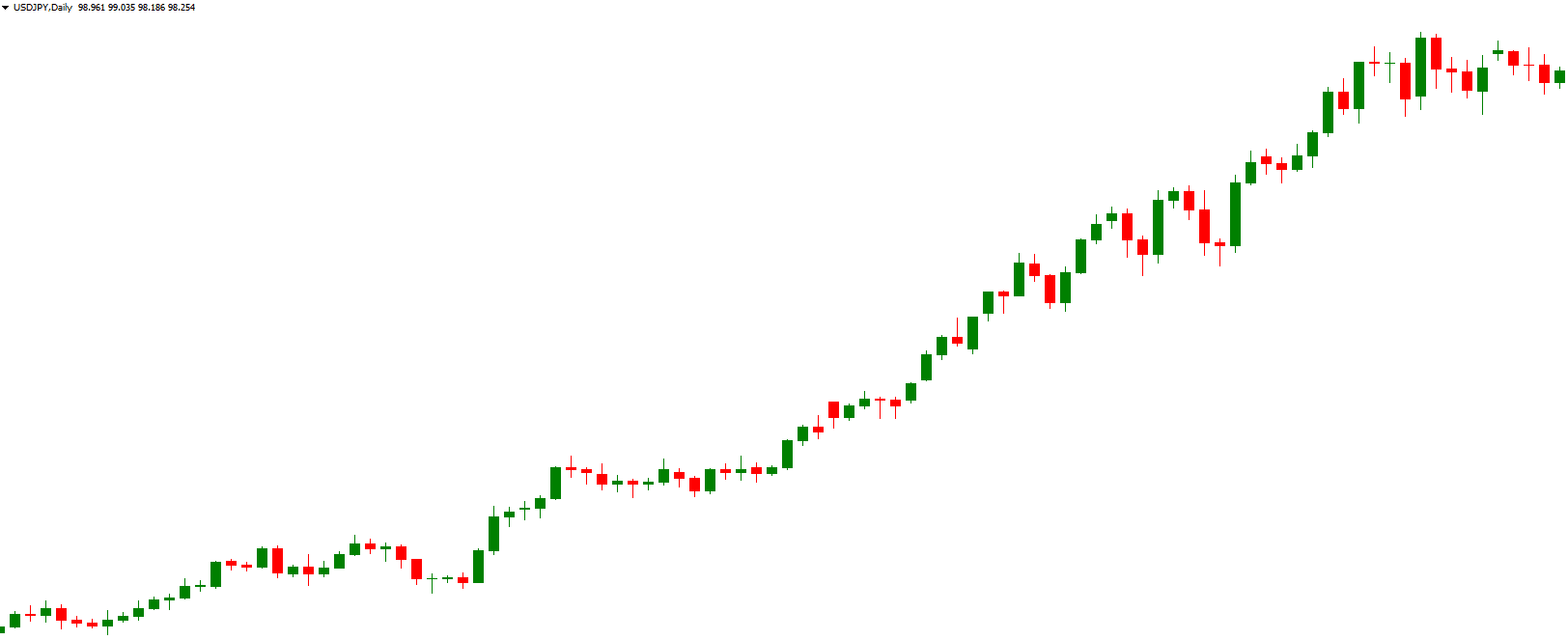

At Plus500, you can trade in both major and minor currency pairs. The spread on EUR/USD was only 2 pips at the time of writing (September 29, 2022, 23:00). Plus500 also allows you to trade in many exotic forex pairs, such as USD/PLN, USDN/RON, and USD/MXN.

Commodities

It is also possible to actively speculate in commodities with CFDs at Plus500. In addition to the well-known gold, silver, and oil, you can also trade in, for example, slaughter pigs and soybeans.

Indexes

You can also trade in different indexes at Plus500, such as the VIX volatility index, the AEX, and sector-specific indexes.

Crypto

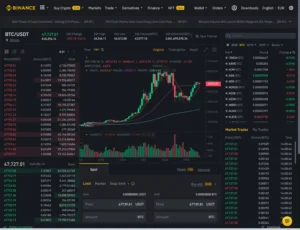

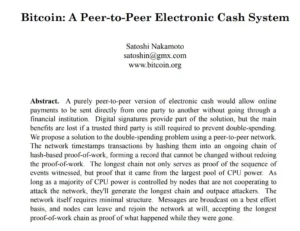

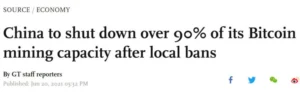

With a leverage of 1:2, you can also actively speculate in cryptocurrencies at Plus500. It is also possible to speculate on falling crypto prices with CFDs. If you want to invest in cryptocurrencies, a party like Bitvavo can be a good option.

Options

If you want to invest with a high leverage, you can speculate on options by using CFDs. Options already have a built-in leverage, which means that your potential profit and loss can increase faster. Click here to read about investing in options in more detail.

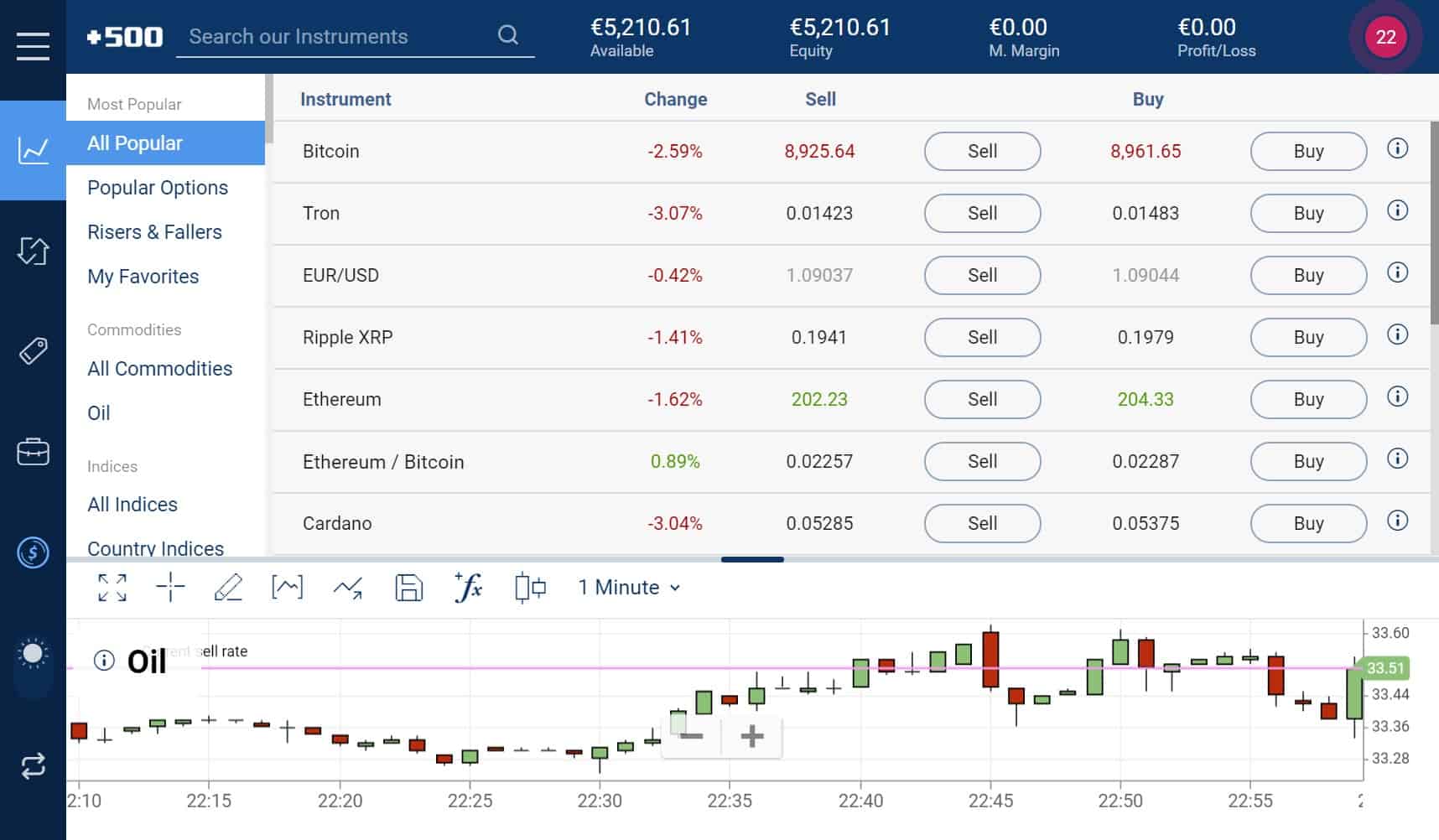

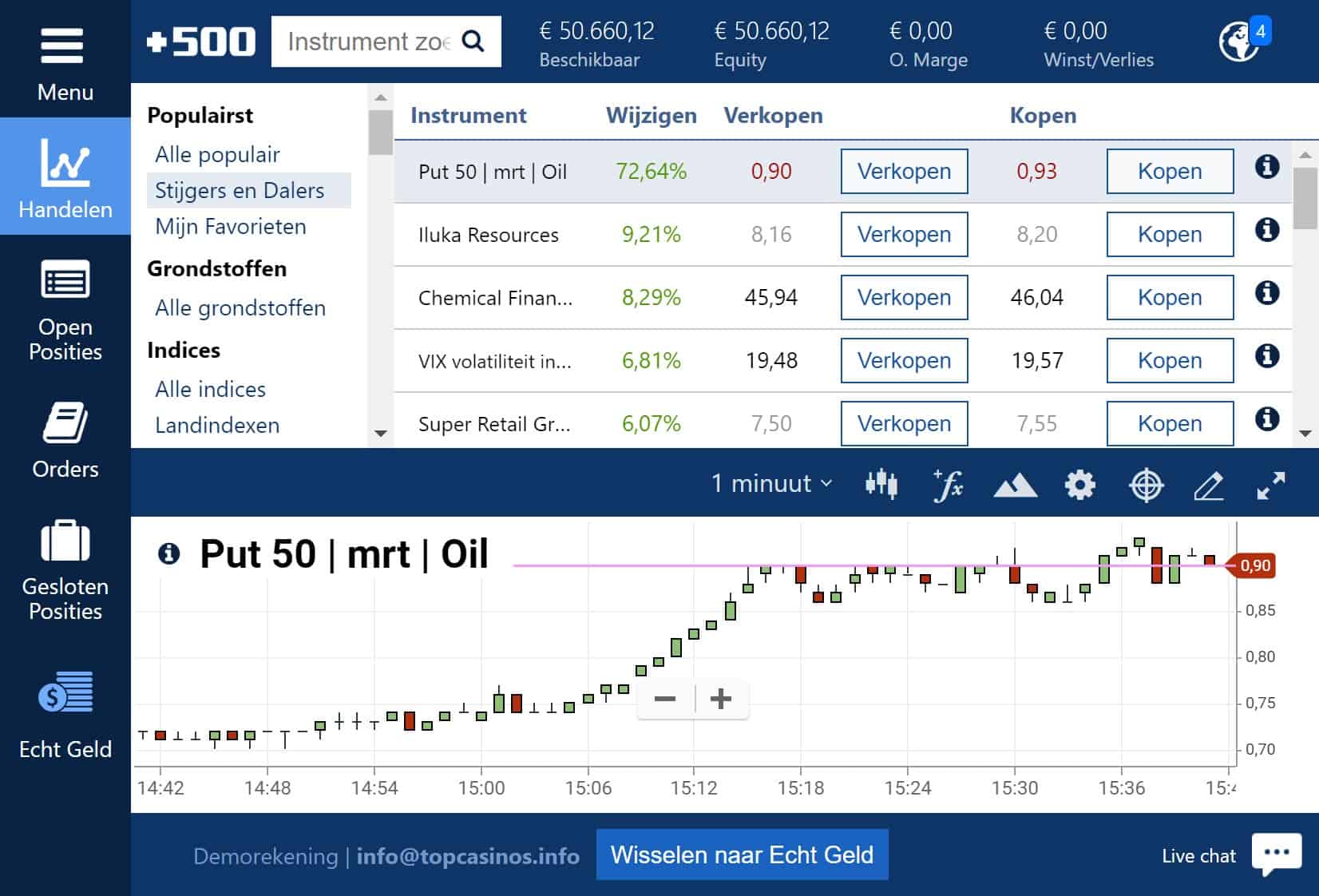

Review of the Plus500 software

In this part of the review, I will share my experiences with the Plus500 trading platform.

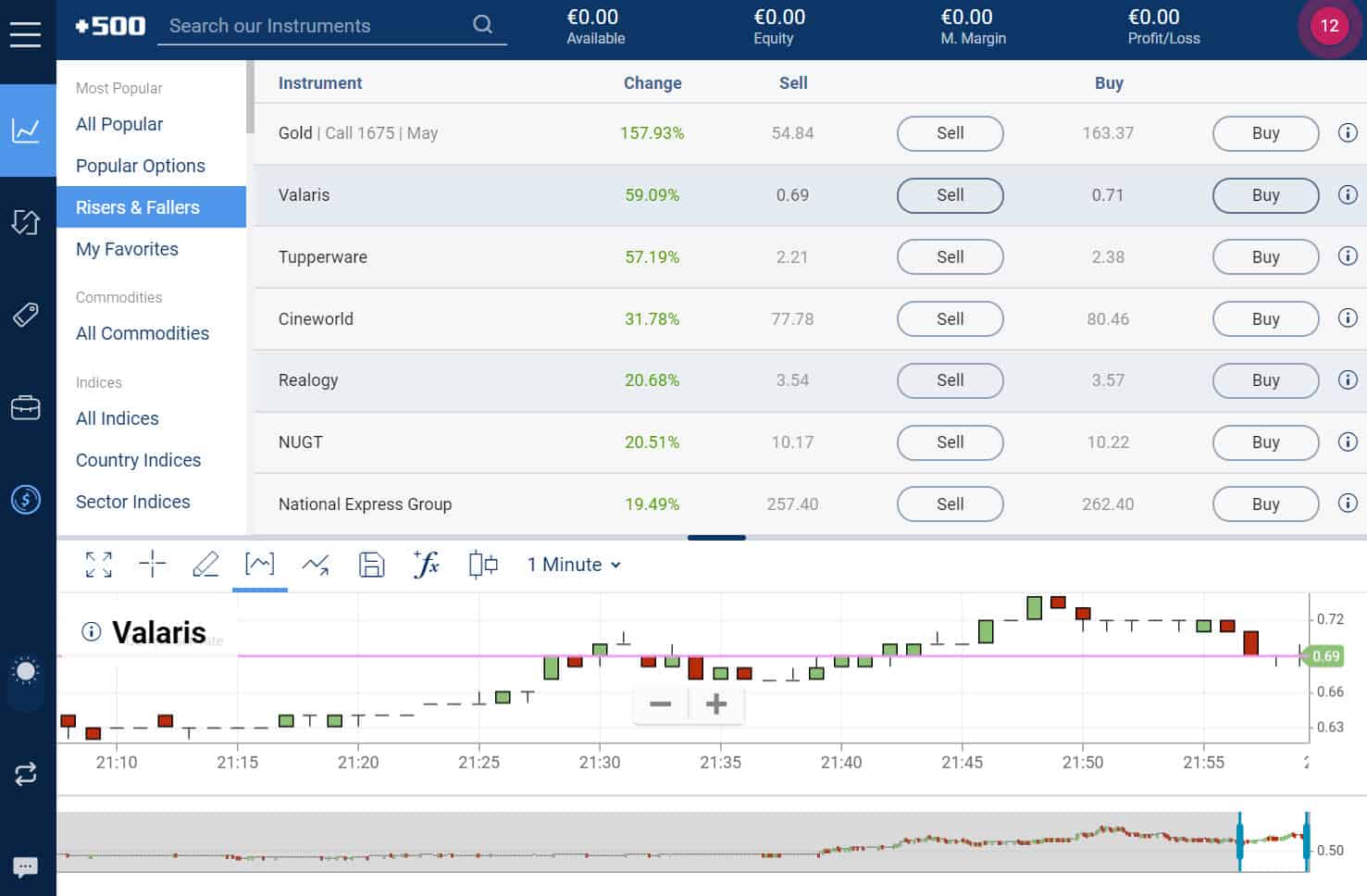

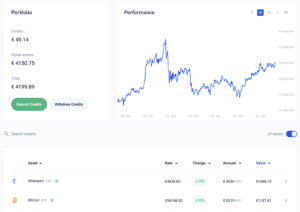

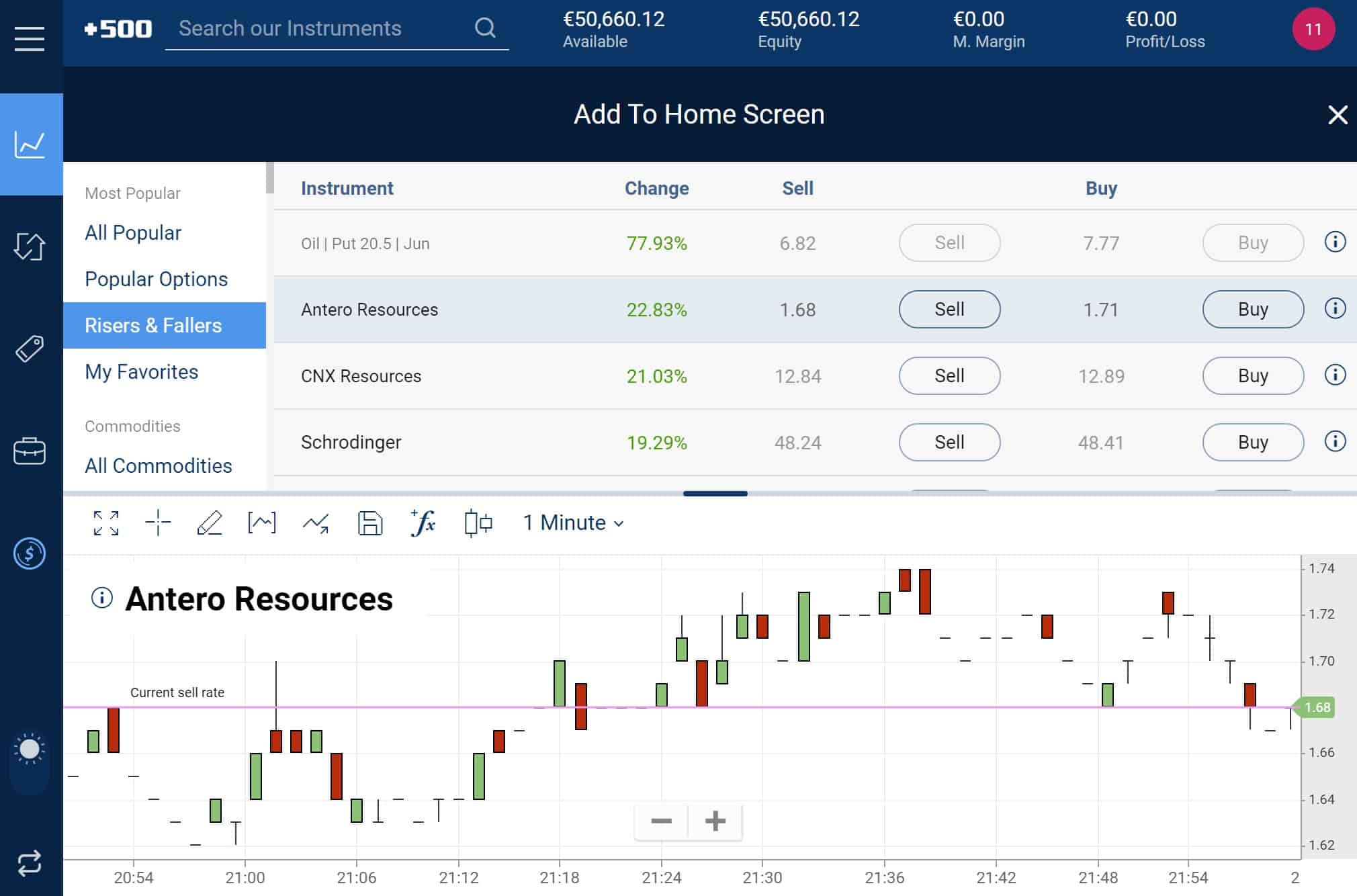

My experiences with the trading platform

For this review, I extensively tested the Plus500 trading platform. The high user-friendliness is a big plus of the software.

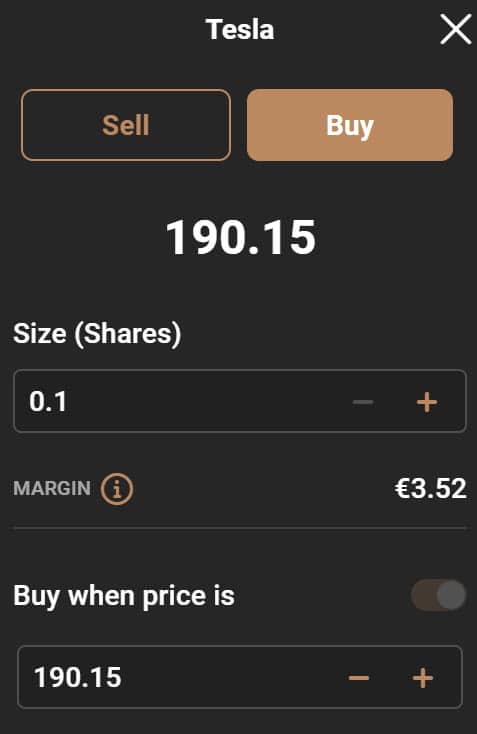

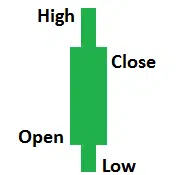

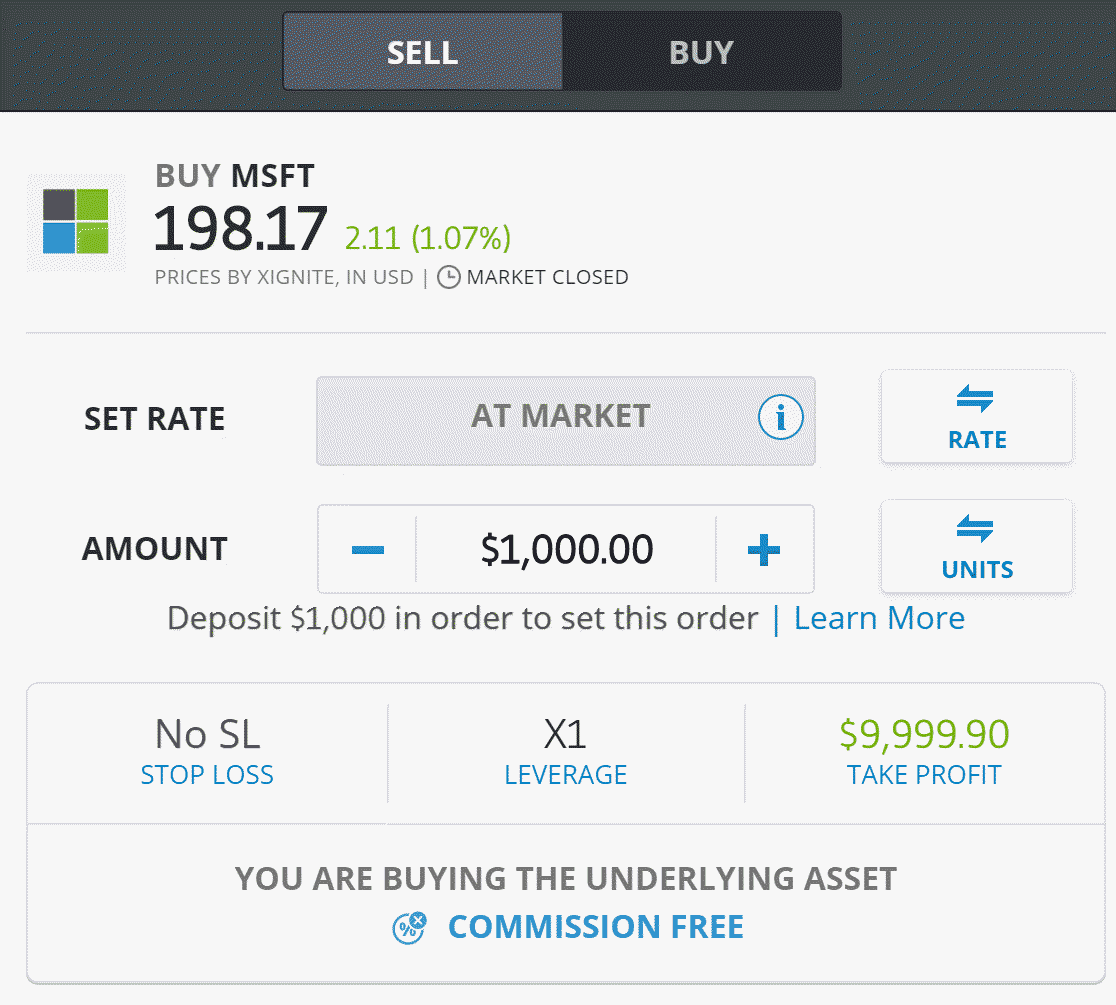

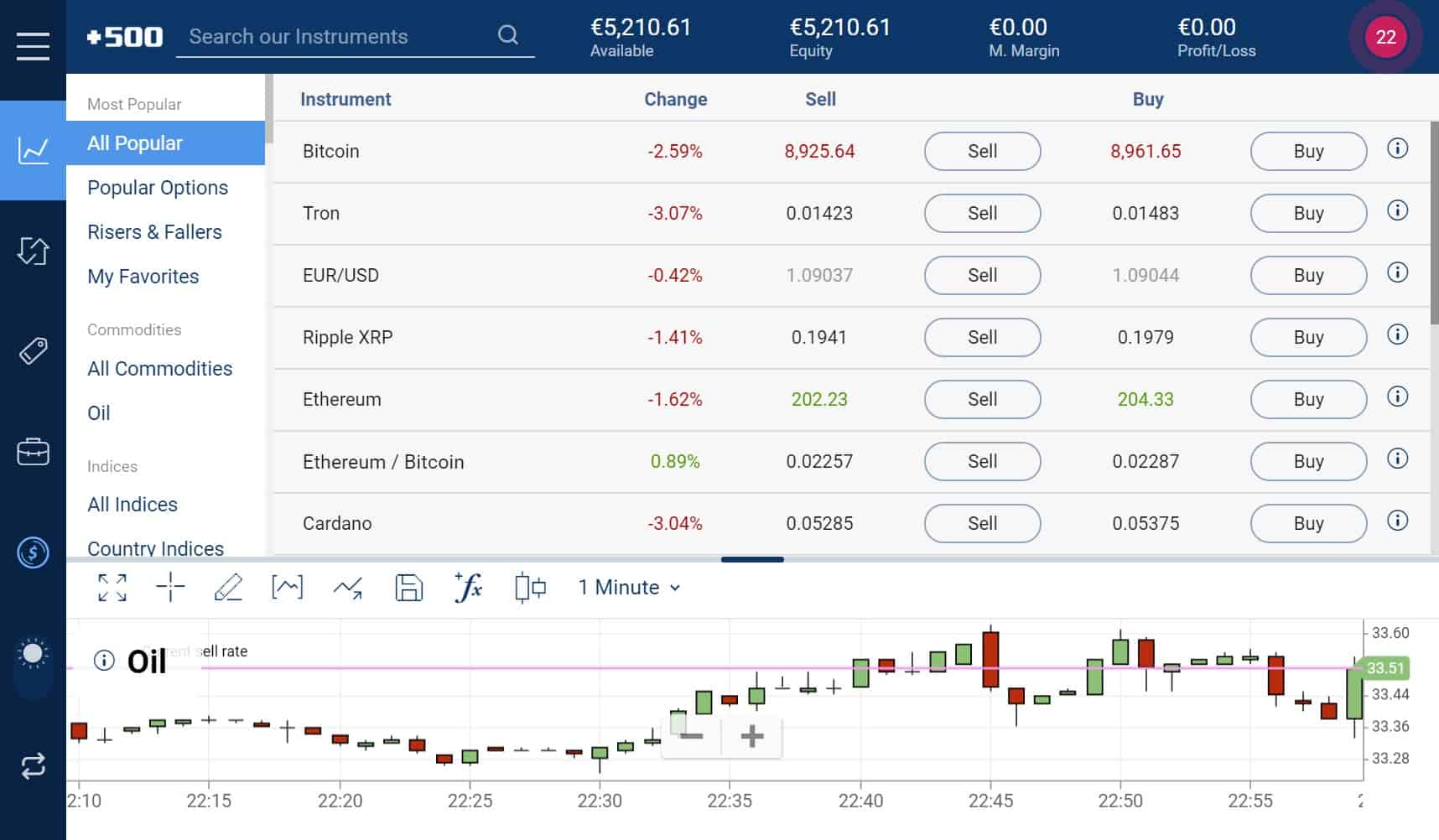

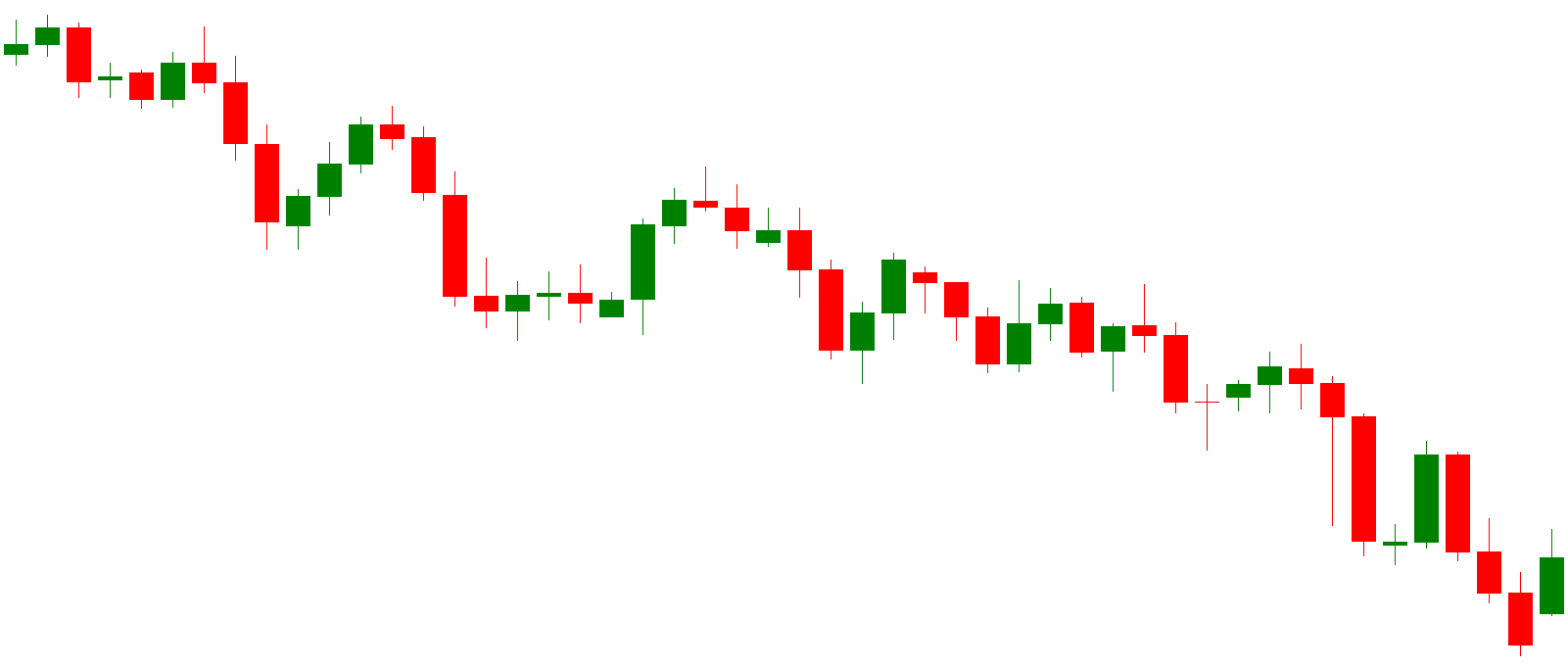

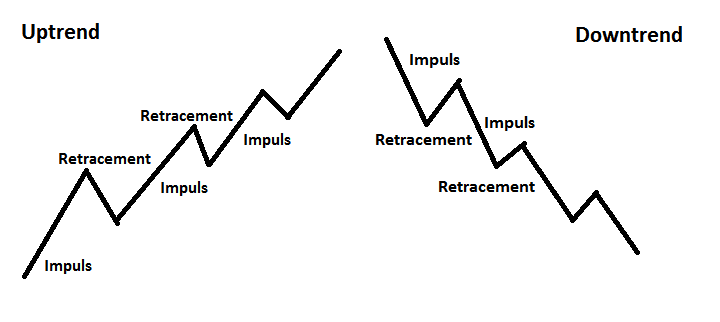

To find an asset, you can use the search function or the list function. When you want to open a position, you can choose to buy (you speculate on a price increase) or sell (you speculate on a price decrease).

On the left, you always have an overview of the menu. Here, you can find the following items:

- Menu: view the complete overview of options.

- Trade: open a new trading position here.

- Open Positions: view the overview of your current investments.

- Orders: view all your outstanding orders at Plus500.

- Closed Positions: view all your closed positions.

- Real Money: switch to trading with real money with this button.

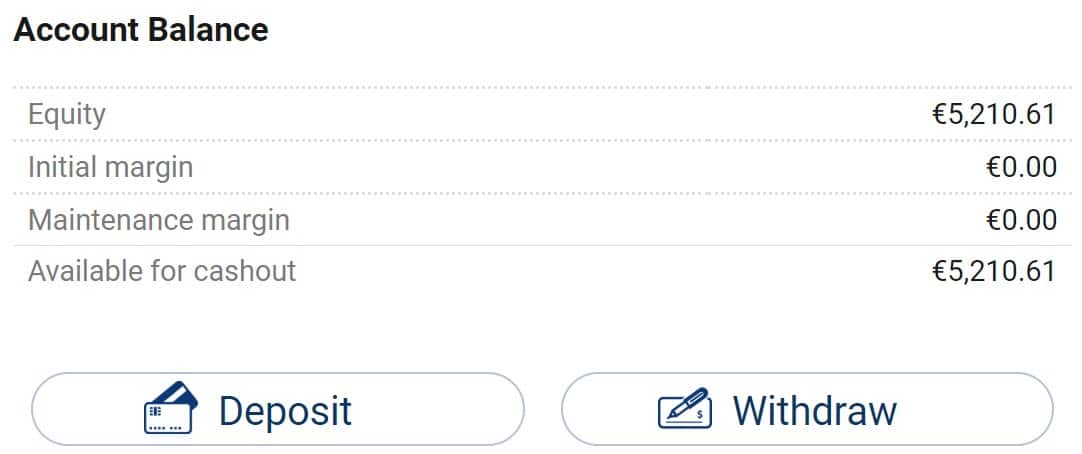

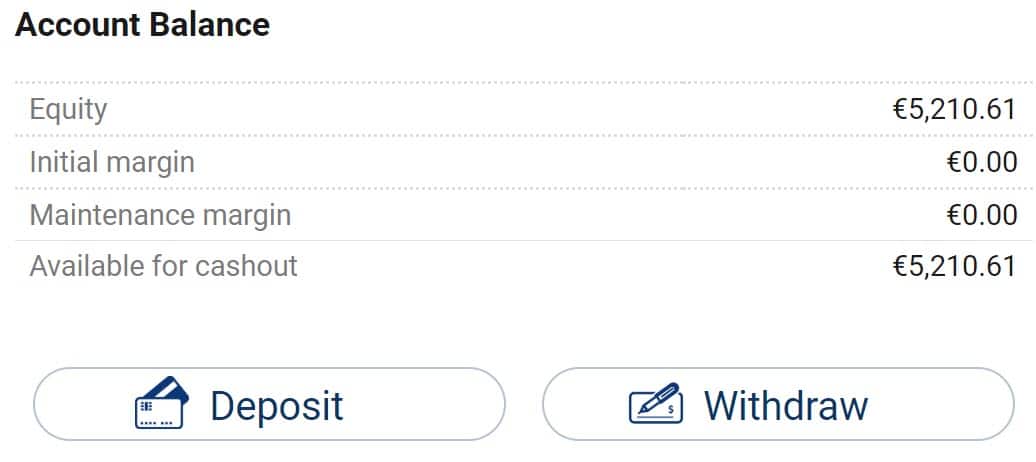

At the top of the screen, you also have an overview of the financial situation within your account. You can see how much money you have available and how much space you have to open new positions. It is important to keep an eye on your margin: if there is not enough money in your account, you can lose all your investments.

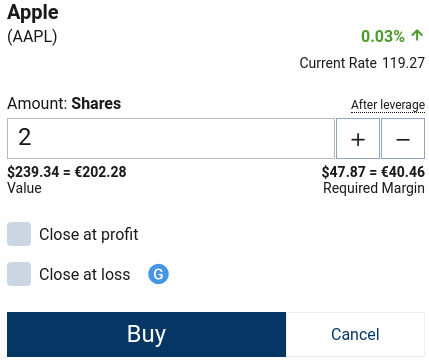

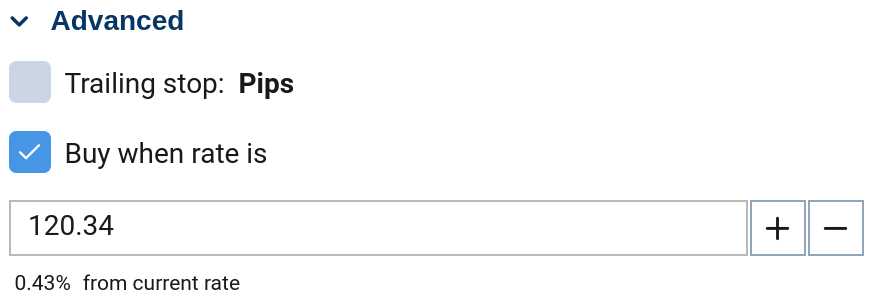

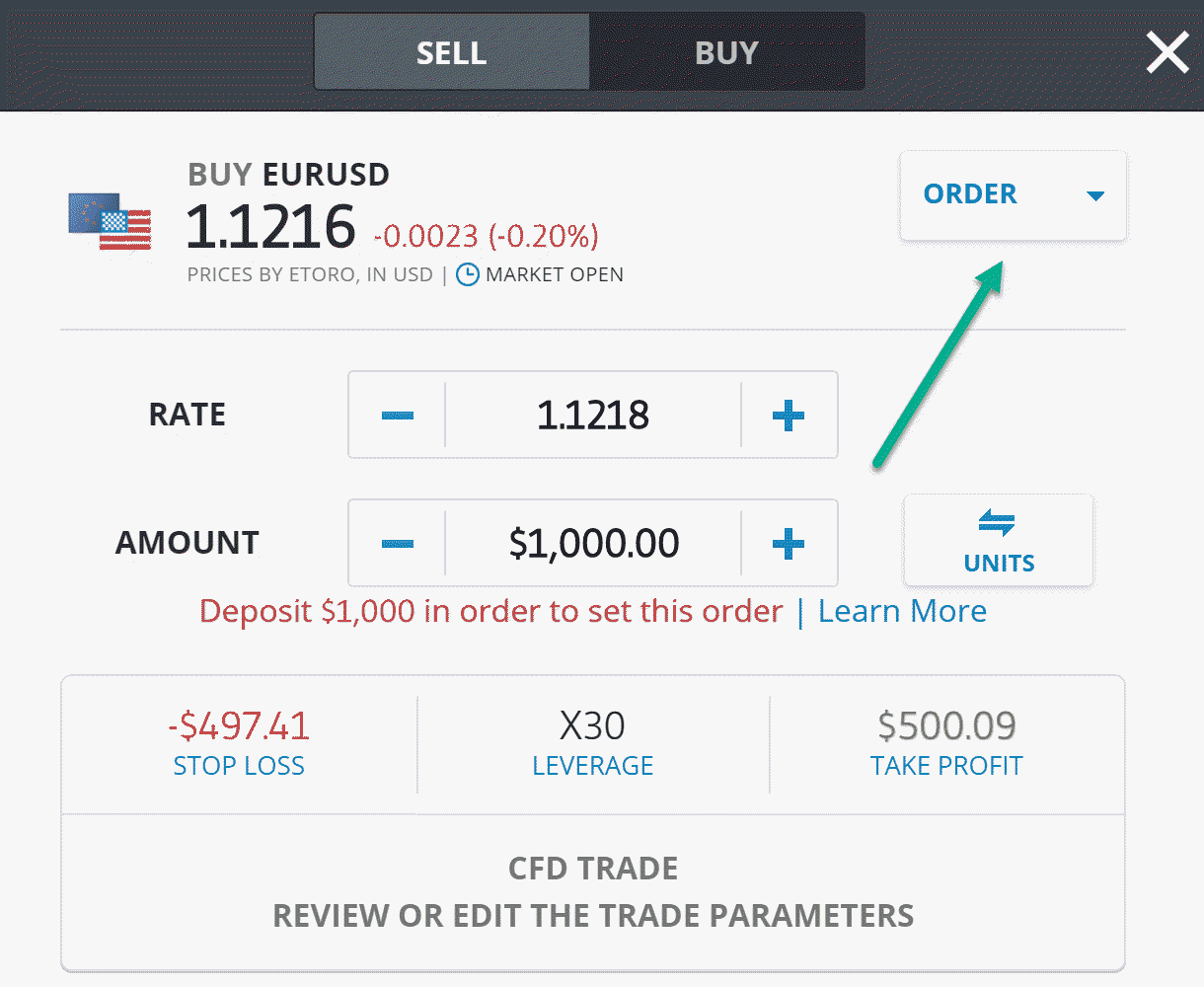

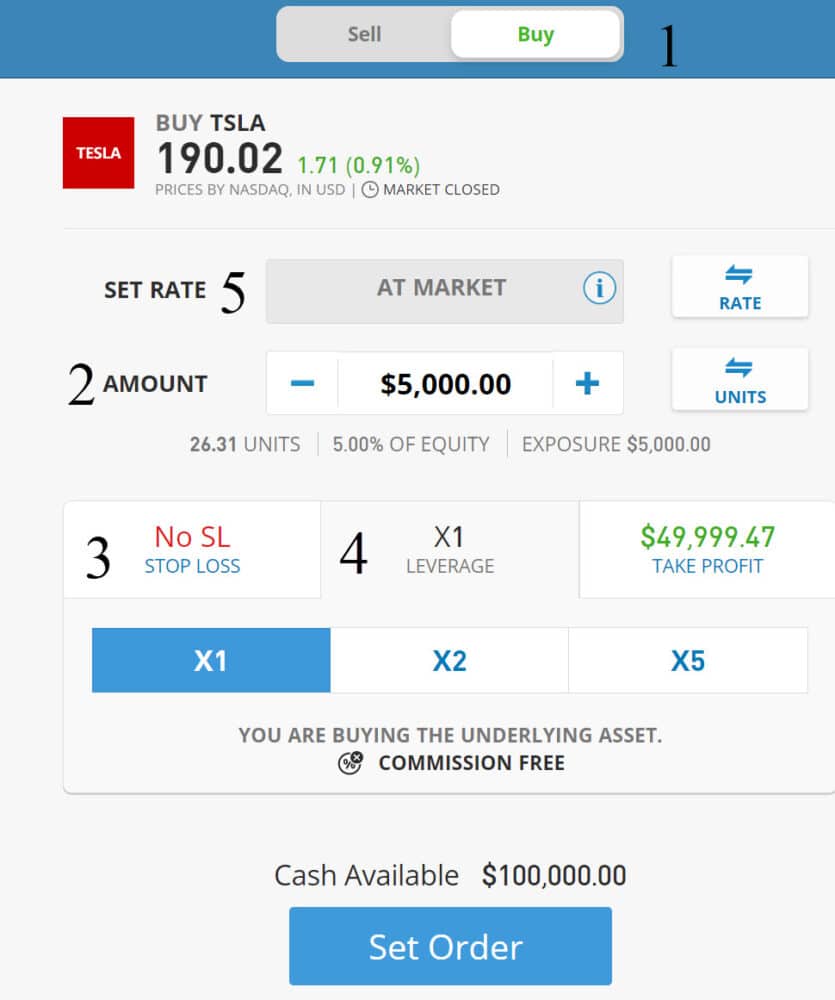

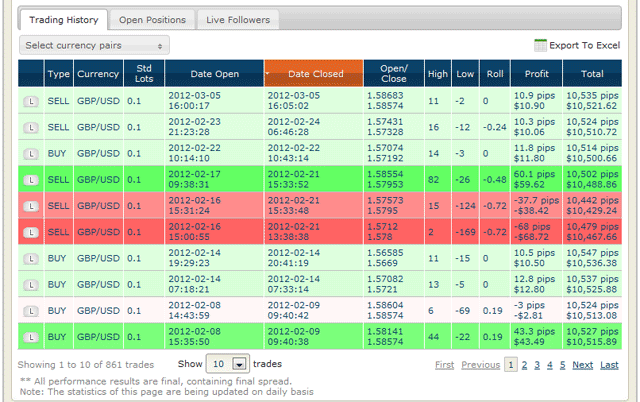

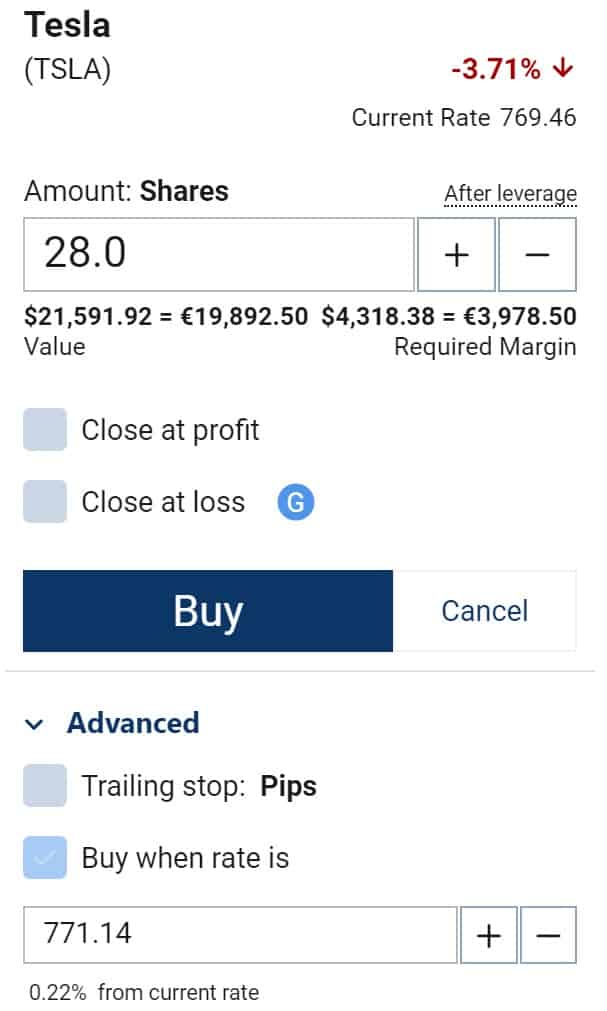

How to open a position at Plus500?

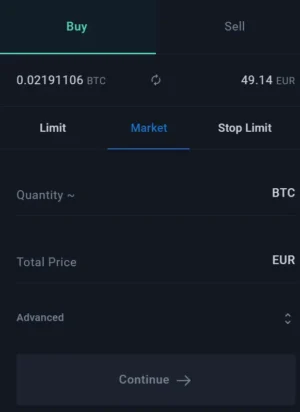

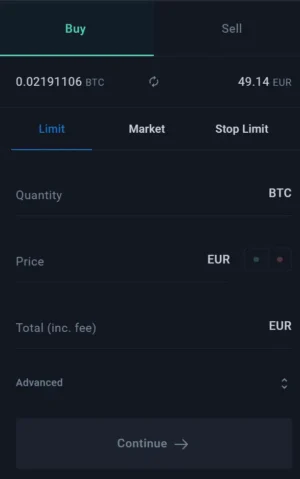

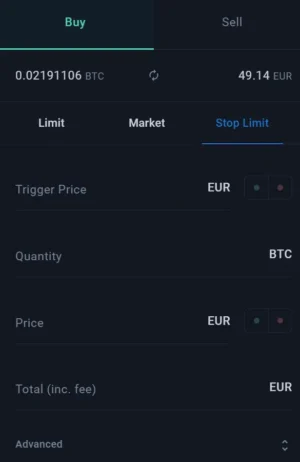

You can open a position within the trading platform by clicking on the buy or sell button. You have two options:

- Market order: you can buy or sell the CFD share directly at the prevailing price.

- Limit order: you can set the price at which you want to buy or sell the CFD share.

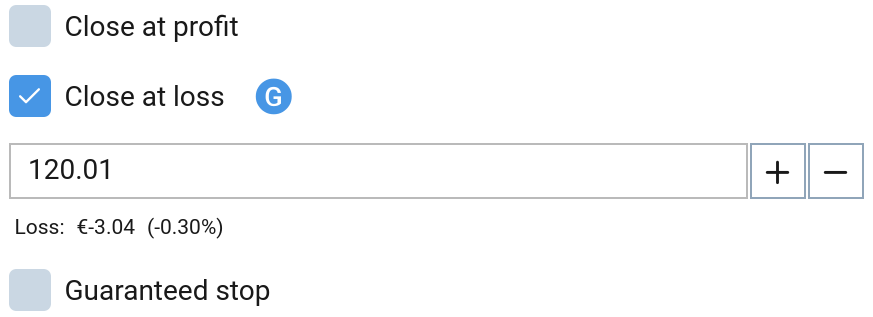

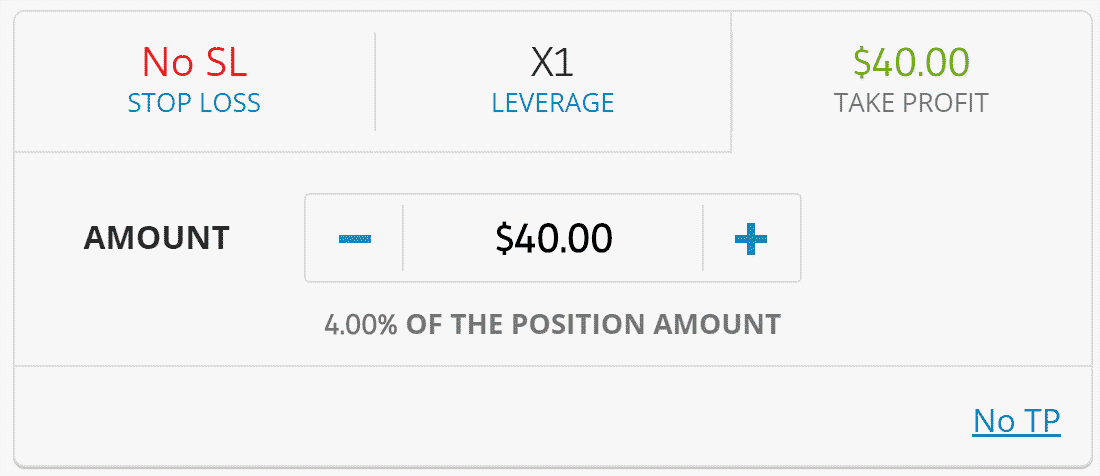

With close at profit and close at loss, you can set an amount at which your position will automatically close. It is also possible to use a trailing stop, which is a stop loss that automatically moves with your investment. Finally, for an additional fee, you can use a guaranteed stop loss.

Don’t forget to review all the data and costs of the CFD before opening a position under information.

After the position is opened, you can manage it under open positions. Here, you can see live updates of your profit or loss on the investment.

Do you want to learn more about how to invest with Plus500 in more detail?

Analysis Tools on Plus500

You can also use various analysis tools within the software to support your decision-making. However, our review found that there are more advanced programs available. If you want to be a professional day trader, a program like MetaTrader may be useful for making more complex analyses.

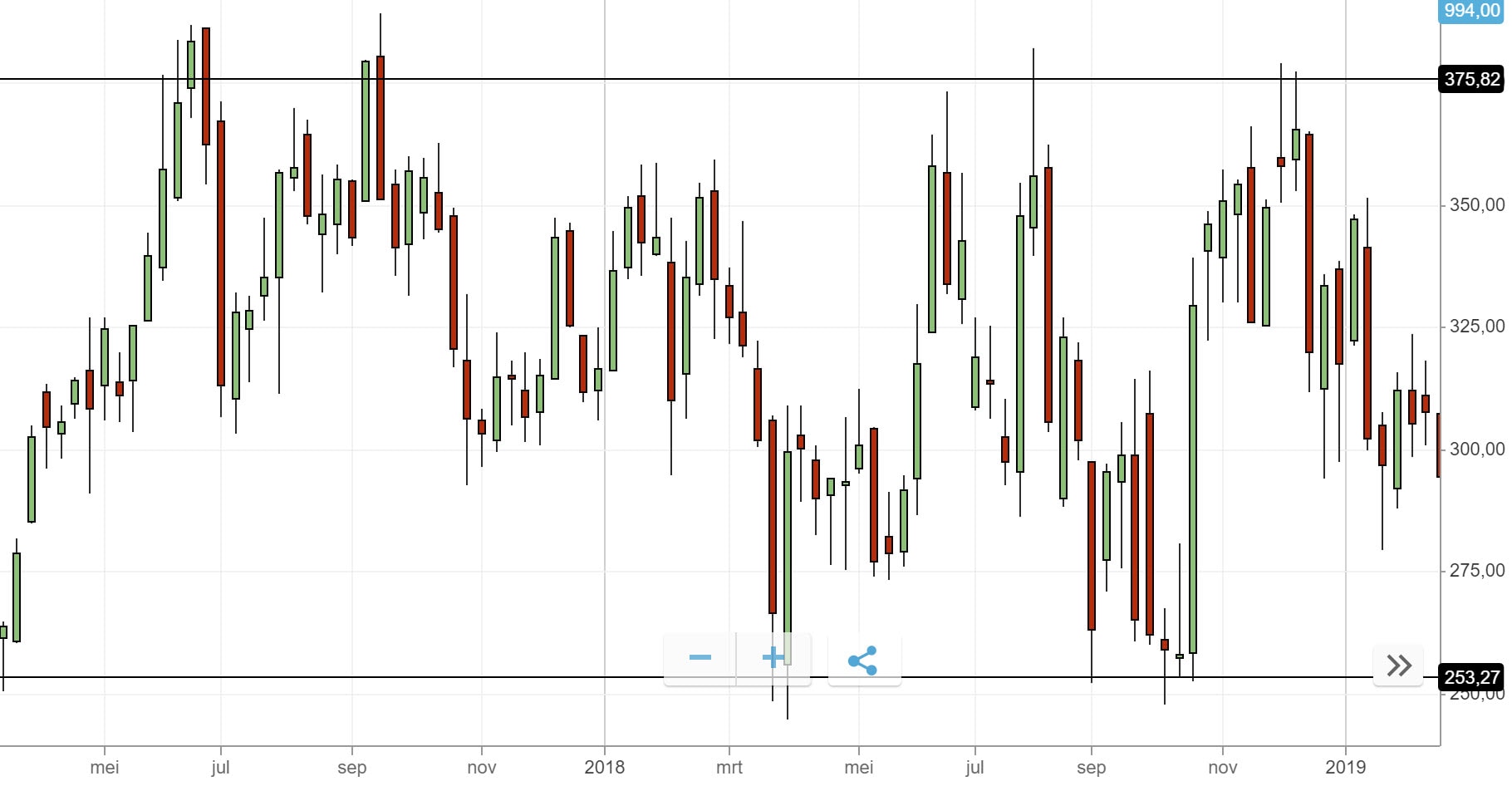

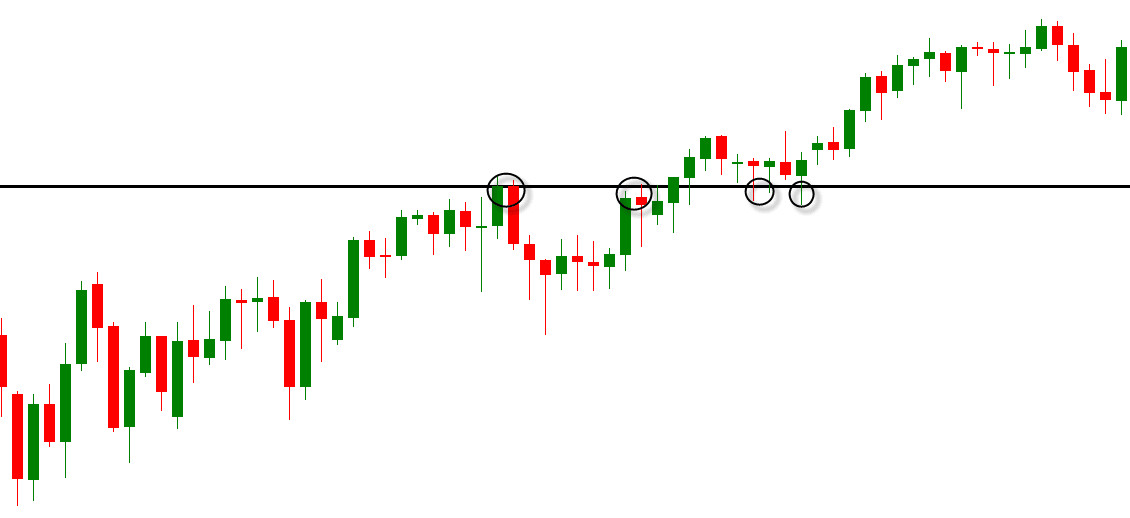

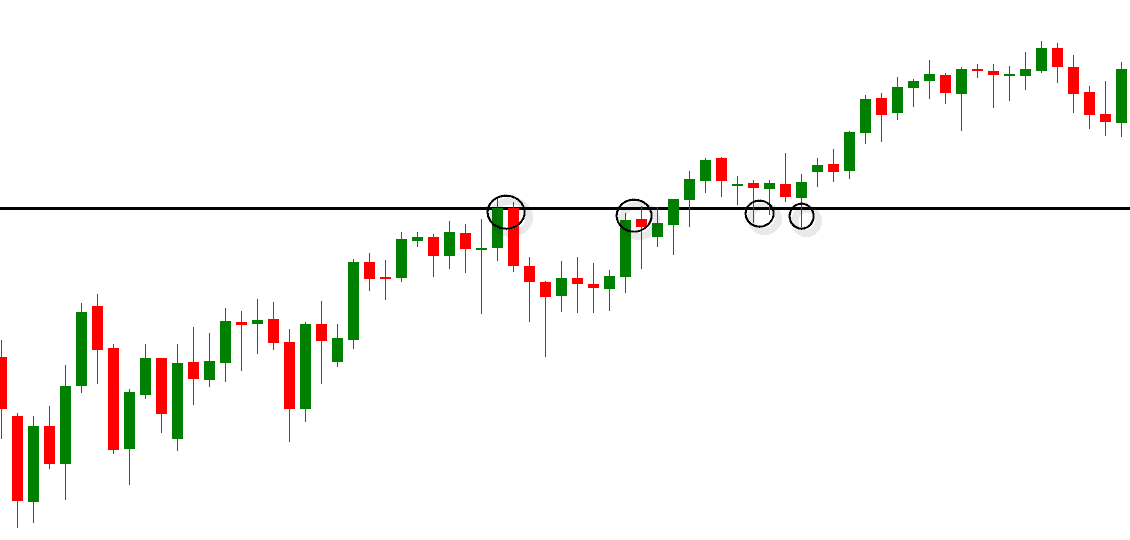

You can enable various technical indicators on the chart (110!), which can help you select buying and selling moments.

You can also draw on the chart within the Plus500 software. For example, you can indicate horizontal levels where the price often bounces off. When you perform analyses on multiple charts, it can become somewhat cluttered within the software.

Finally, you can see the sentiment of other traders on Plus500. This can give you an extra boost in confidence when making your own investment decisions.

Quality of the Demo Account

Within this review, I found the demo account to be very pleasant. You can try the possibilities with a fictitious amount of money. The results within the demo are identical to the results within a real money account. This allows you to become familiar with the possibilities of Plus500 perfectly. As soon as you are ready, you can switch to a real money account with a single click.

Users can set the amount of their demo account (with a maximum of €40.000) and can also reset it at any moment.

Guidance and Education

The guidance at Plus500 is limited. You can use the economic calendar to see which events may influence the price. You can also use technical analysis by adding indicators to the chart.

Plus500 also recently launched a Trading Academy which offers a free eBook, video traders guide and FAQs.

The Plus500 software excels in user-friendliness, but does not offer an enormous number of possibilities. Whether this is a problem, depends on your investment plans.

The Plus500 Mobile Platform

Plus500 has developed an application that allows you to invest anytime, anywhere. Evidently, the mobile application is less extensive than the desktop version. For example, you cannot perform technical analysis within the mobile application.

You can use the Plus500 mobile application primarily to keep track of your current trading positions. When you start investing with Plus500, the mobile application is a handy additional method for accessing your account.

The mobile application receives good reviews

How Does Depositing and Withdrawing Money Work at Plus500?

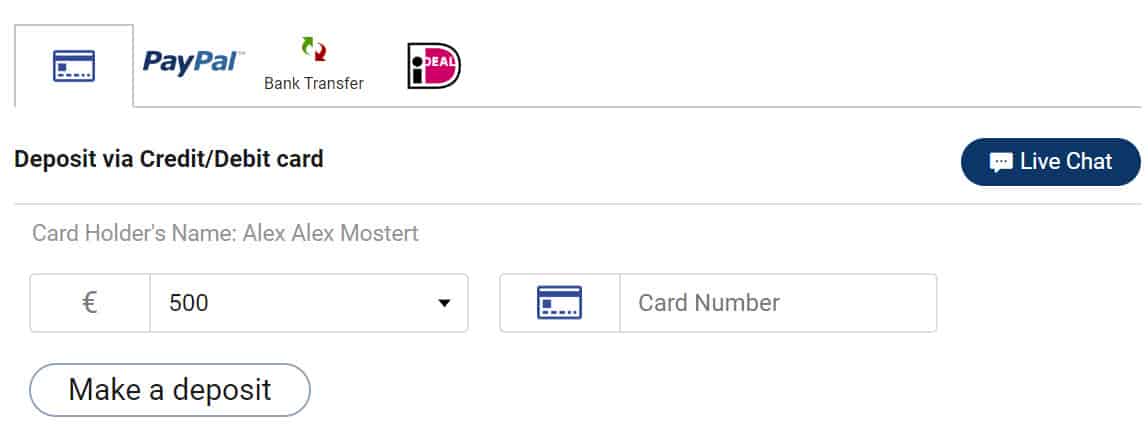

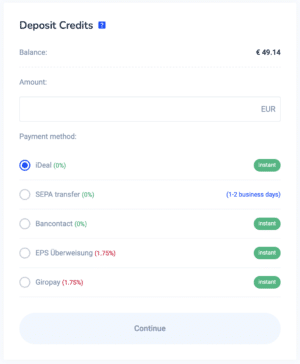

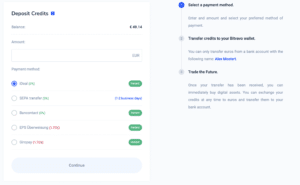

After completing the verification process, you can deposit money into your account (minimum $100). You can directly deposit money into your account via Trusty, Apple Pay, Google Pay, credit card, and PayPal. It is also possible to deposit money by bank transfer, but this takes longer. Depositing money at Plus500 works well and Plus500 scores well in the review.

You can deposit money at Plus500 using all popular methods

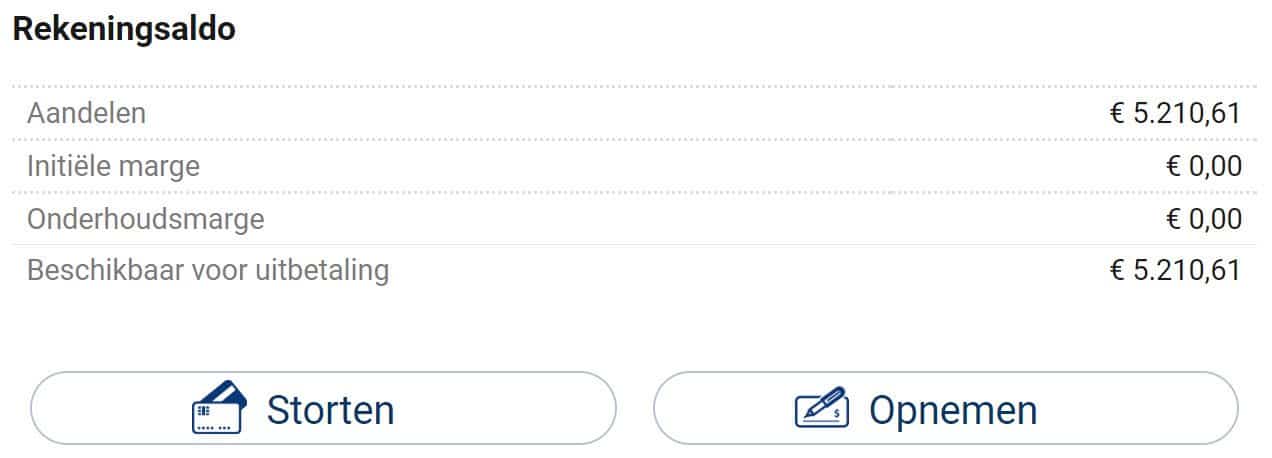

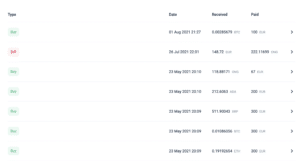

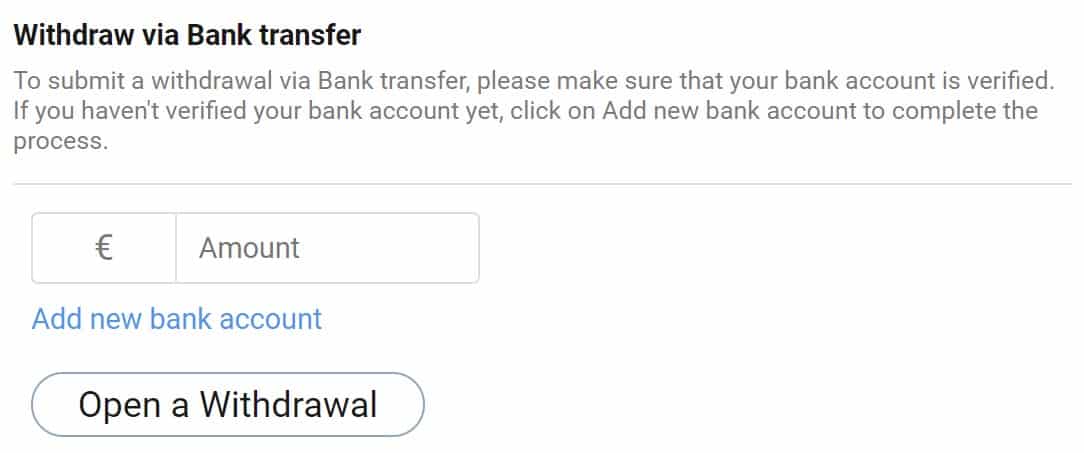

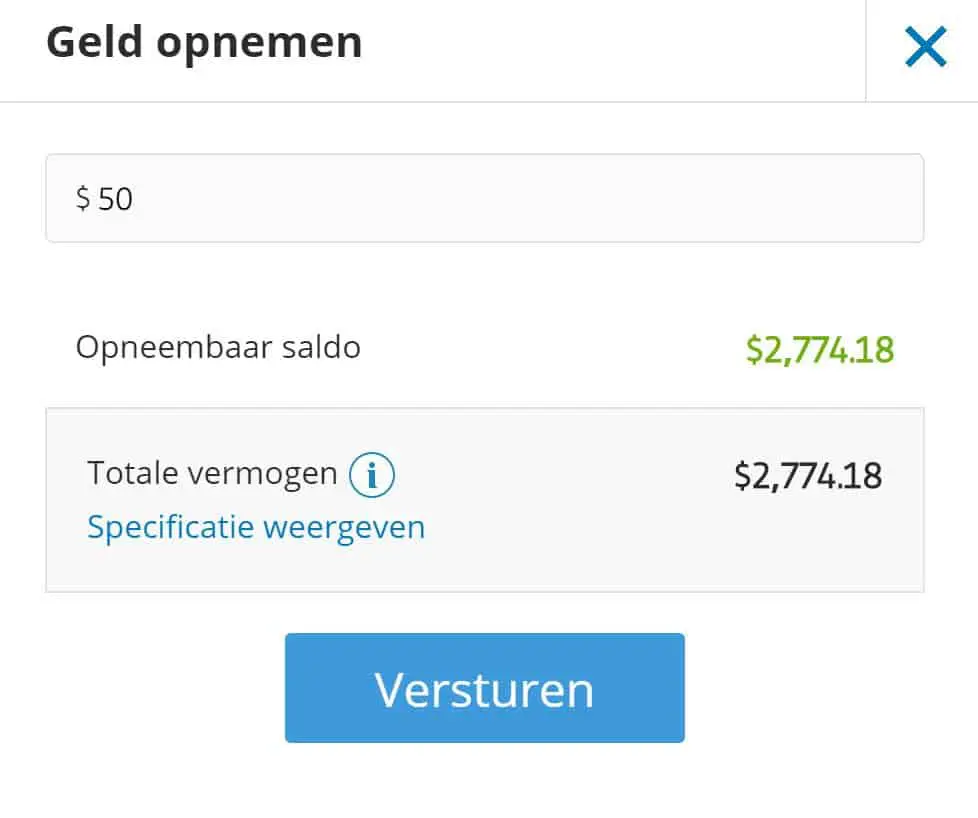

Withdrawing Money from Plus500

Withdrawing money is possible from$100 for bank transfers and $50 for PayPal and Skrill at Plus500. If you do not have this amount in your account and still want to withdraw your money, you can make a deposit and then withdraw the full amount.

Withdrawing money is 100% free at Plus500. Only if you withdraw money more than five times in a month, you will be charged a fee. This is a positive point within the review, since some brokers charge high transaction fees for withdrawing money.

Withdraw requests are processed quickly: in my case it took about three days for the withdrawal request to be processed, and the money appeared in my bank account a day later. Withdrawing money works smoothly at Plus500!

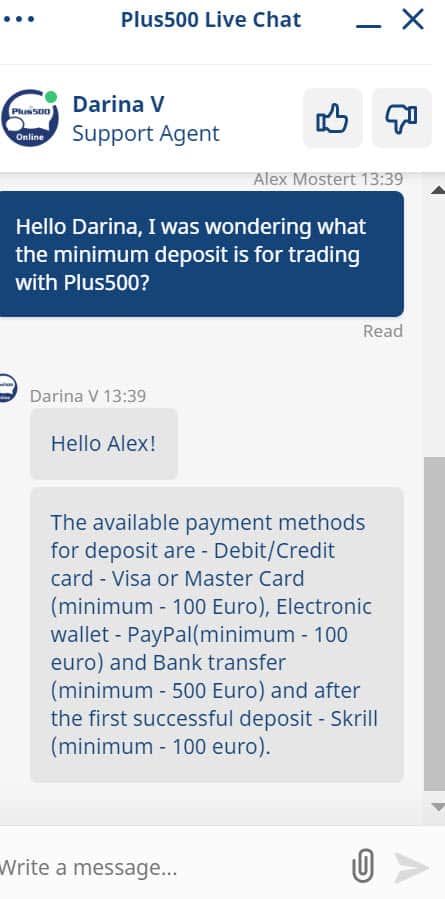

How is Plus500’s customer service?

A weak point of Plus500 is their customer support. Whenever you have a problem, it is always resolved. Unfortunately, this support only works via email, live chat or WhatsApp. The costumer service can be reached 24/7 which is a big plus. I would appreciate it if it was possible to speak to someone directly over the phone. Plus500 could improve on its accessibility.

Of course, we have tested whether customer service responds to inquiries. The live chat is fast: you get someone to speak to who will answer your question within a few seconds. Sending an email is less effective as it can take several days to receive a response.

With the Plus500 live chat you receive a quick reply

Conclusion of Plus500 review: is this a good broker?

I have been using Plus500 for active speculation for years. For example, I used Plus500 during the corona pandemic to actively speculate on the price of oil. However, Plus500 is not suitable for everyone: it is mainly suitable for active trading and the risks involved are considerable.

Are you curious if Plus500 is right for you? Then open a free demo account at Plus500:

Frequently asked questions about Plus500

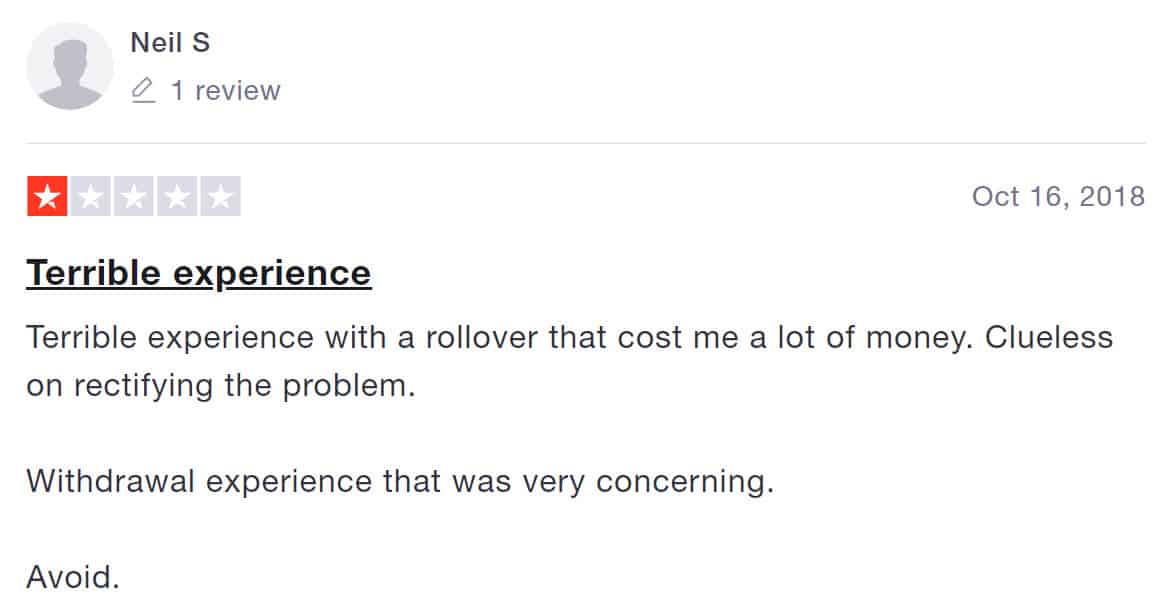

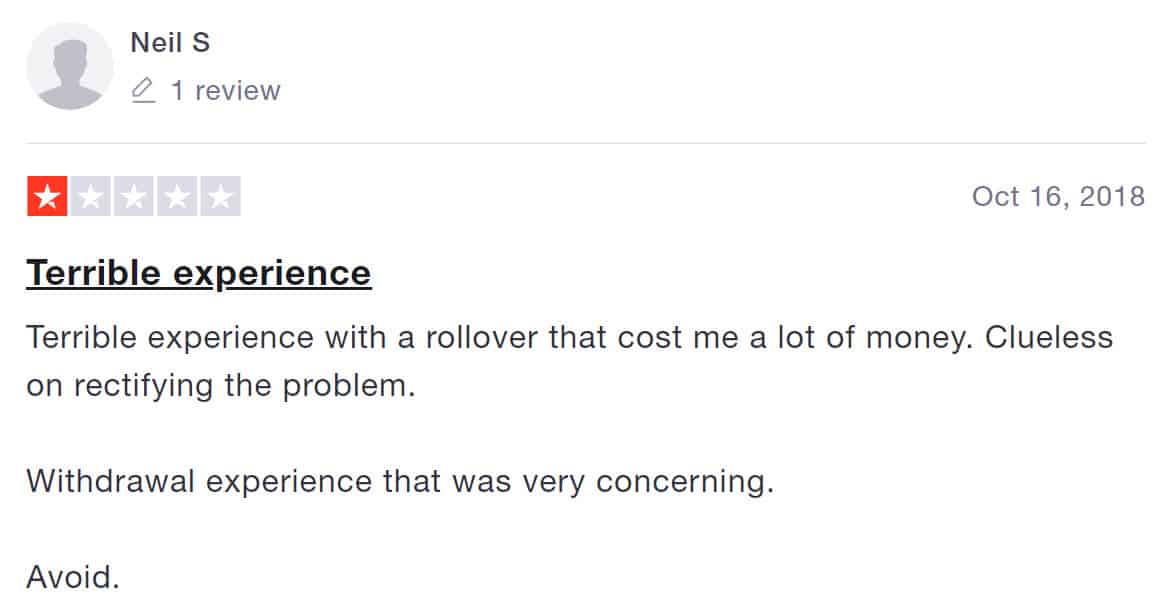

You can find many negative reviews from investors who have used Plus500 on the internet. This is largely due to people not fully understanding CFD trading. Below is a clear example of a review from a customer who lost money at Plus500:

It is a well-known fact that you can lose money with investing. If you start investing without experience, there is indeed a high chance that you will lose some of your investment. It is therefore important to practice enough with Plus500’s software so that you understand how CFD trading works.

Furthermore, ask yourself if CFDs are right for you: these are risky and complex investment products with a high chance of loss.

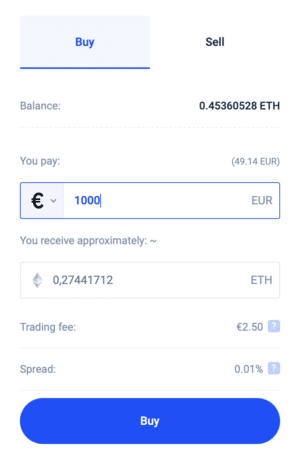

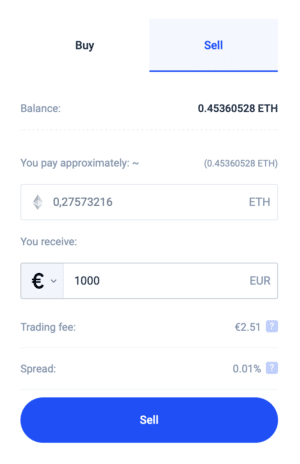

When buying and selling securities, there is always a difference between the selling and buying value of a security. These are the transaction fees you pay at Plus500. These costs are always relative, so you can also invest with a smaller amount.

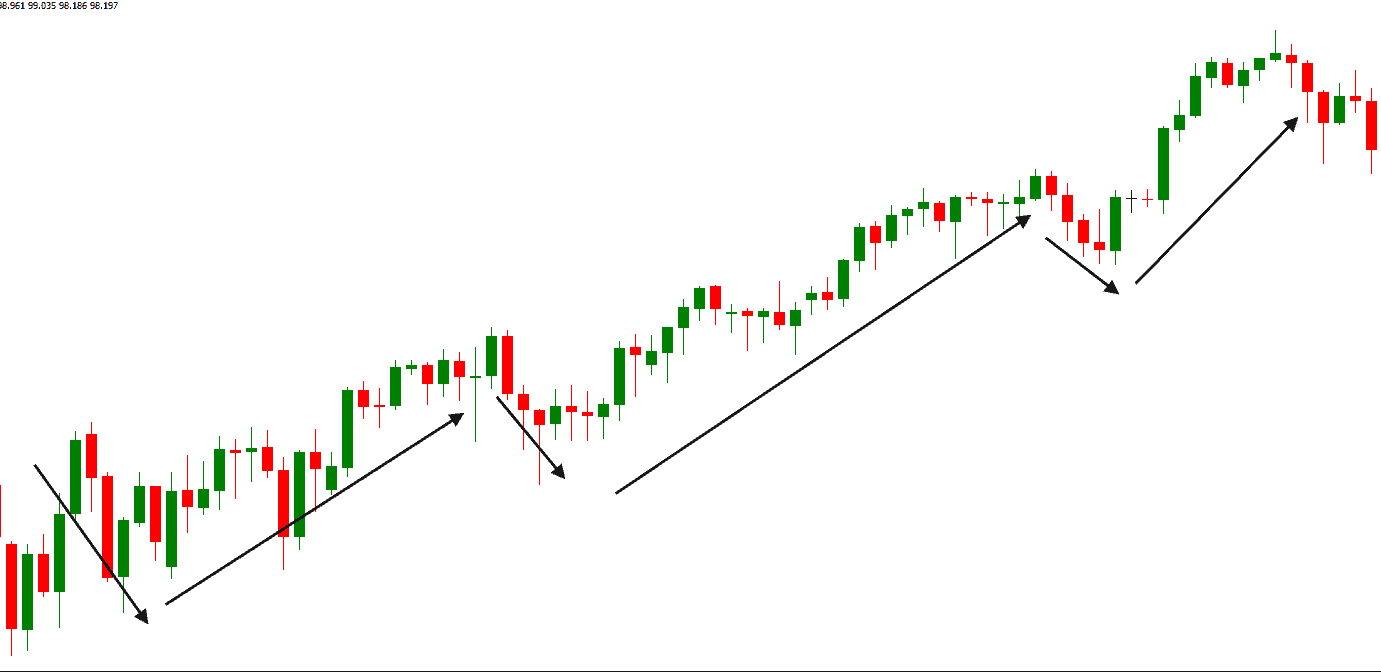

![]()

The spread is the difference between the buying and selling price. Illustrative prices.

Let’s have a look at these transaction costs at Plus500. The spread on EUR/USD is dynamic, which means that the spread can increase or decrease depending on market volume. At the time of writing, the spread on EUR/USD is only 0.6 pips, which equates to 0.00006 cents. This is much cheaper than the largest competitor, eToro. At the time of writing, eToro’s spread is 3 pips or 0.0003 cents (September 29, 2022 23:00).

The spread on the Dutch stock Philips is currently 5 cents at the time of writing. eToro is slightly cheaper with a spread of 4.7 cents. The difference here is marginal.

The spread on Google’s stock at Plus500 is $1.25 per share. At eToro, the spread is currently more than $3.

Above you can see the fixed spread for Google’s stock at Plus500. Illustrative prices.

Finally, let’s have a look at the spread on the AEX. Plus500 uses a dynamic spread, which is currently 28 cents at the time of writing. At eToro, the spread is over two euros.

Safety and reliability are naturally essential in the financial world. Based on my review, it appears that this is in good order at Plus500. This is because Plus500 has to follow strict rules set by regulators.

When you deposit money with Plus500, it is placed in segregated accounts. Plus500 will never speculate with client’s funds. Therefore, in the event that Plus500 were to go bankrupt, you would not lose the money in your account.

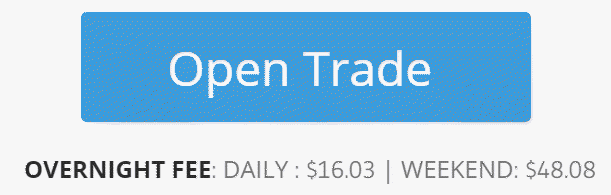

When trading CFDs, the broker temporarily loans you the money for the investment. The overnight funding per day is always clearly indicated for each security. You pay these costs every day. If you close your position before the end of the day, you will not pay overnight funding or financing fees.

Let’s compare the costs of Plus500 with the costs at eToro again. The overnight funding on EUR/USD is 0.0105% of your position at Plus500. At eToro, the financing fee is 0.009% (September 29, 2022, 23:00).

The financing rate on EUR/USD at Plus500. Illustrative prices.

At the time of writing, the financing rate for the Dutch stock Philips is 0.0232% at Plus500, while at eToro it is 0.0165%. For Google, the financing rate at Plus500 is 0.0288% and at eToro it is 0.0215%.

On some securities, you receive money when you take a short position. With a short position, you speculate on a decrease in price. If this is the case, you will see a positive figure under “overnight premium – sale.”

{q}How does leverage work at Plus500?{/q}

{a}Many investors make mistakes at Plus500 because they do not understand how leverage works. One advantage of investing with leverage is that you can take a larger position with a smaller amount of money. If you deposit $1000 and use a one-to-ten leverage, you can trade $10,000 in CFD shares. With leverage, both your profit and your loss move faster:

- With a one dollar increase, you gain a return of ten dollars.

- With a one dollar decrease, you lose ten dollars.

With a one-to-ten leverage, you lose your entire investment when the price drops by ten percent. When you no longer have enough money in your account, a margin call occurs: Your position is then automatically closed. Achieving poor investment results is not the broker’s fault. Fortunately, we can help you prevent such situations as much as possible. Apply the following tips to achieve better investment results with Plus500:

- Practice with a demo account until you understand how investing works.

- Read and understand how CFDs work.

- Be careful when applying leverage.

- Always use a stop-loss and possibly a take-profit.

- Use your common sense before opening a trading position.

At Plus500, the minimum deposit is $100. However, this does not mean that you can invest in everything with this amount. Each security within the Plus500 software has a minimum investment, which they call the unit amount. For example, at the time of writing, this is 0.02 contracts or 1/50th of the value of one Bitcoin for Bitcoin. For the ING stock, this is currently 50 shares.

50 ING shares currently cost around €250. However, you can apply a one-to-five leverage. This means that you need at least €50 to open a CFD investment in the ING stock.

Risk warning: 82% of retail investors lose money on CFD trading with this provider. You must consider whether you can afford the high risk of losing money.

BLOX review (2024): is this a reliable crypto broker?

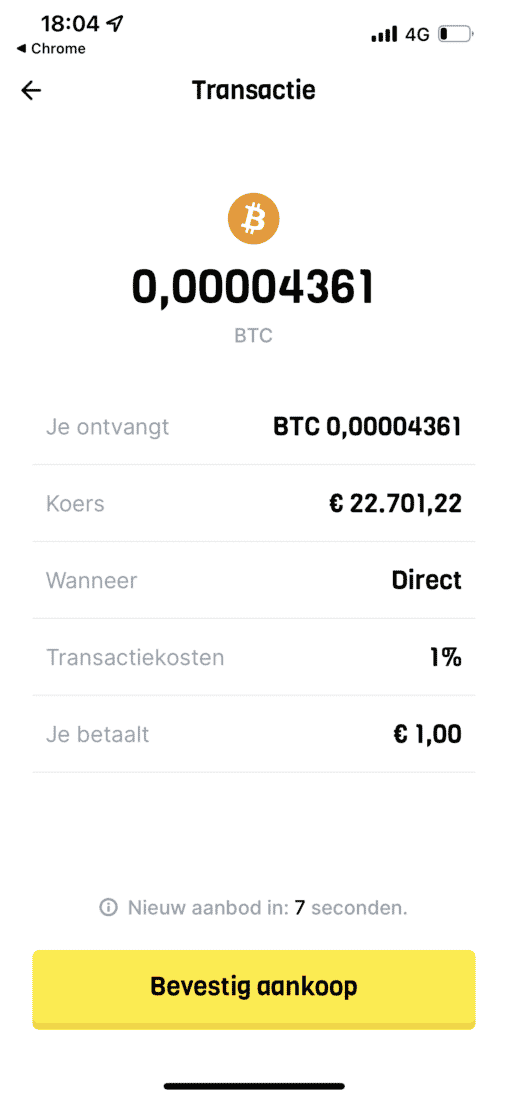

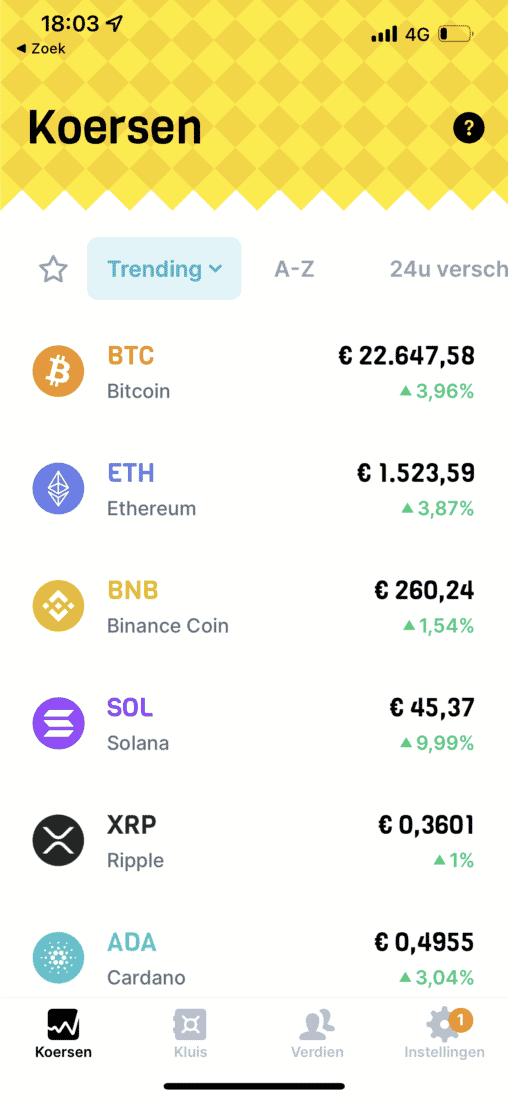

BLOX is a crypto application that allows you to trade in over 35 different cryptocurrencies. BLOX aims to make crypto trading as simple as possible. In this comprehensive review, I investigate whether BLOX has succeeded in making crypto accessible to the public.Note: BLOX is only available in the Netherland, Spain and Belgium. If you live in Europe you could try Bitvavo (which is a lot cheaper) or Binance (which offers more features).BLOX in brief

BLOX is a mobile application from the well-known BTC Direct, which has been around since 2013. BLOX stands out for its user-friendliness and allows you to quickly trade in the most well-known cryptocurrencies. With transaction fees of 1%, BLOX is pricier than Bitvavo (0.25%) and Binance (0.075%), but it does offer €10 in free cryptocurrency to every user. This makes it definitely worth opening an account with this provider. Use the button below to receive your free €10:Use code to receive €10 in free cryptocurrency!| Founded in: | 2018 |

| Minimum deposit: | €1 |

| iDEAL: | Yes |

| Fees: | 1% |

| Staking: | No |

| Regulator: | Dutch National Bank (DNB) |

| Deposit & withdraw crypto: | No |

| Platforms | Mobile platform |

How to open an account with BLOX?

Opening an account with BLOX is easy:- Click here to directly download the BLOX mobile application

- Use code <X> to receive €10 in free cryptocurrency

- Enter your personal information; your name, email address, and password

- Indicate how much experience you have with investing

- Confirm the source of your deposits (e.g. your income)

How does the BLOX platform work? Quick guide

A positive point within my BLOX review is the user-friendliness of the application. You can find all the functions you need in 4 different tabs.Prices

Under the prices tab, you can buy and sell cryptocurrencies. Select the cryptocurrency whose current price you want to consult, and you will immediately see how the price has developed. You can buy a cryptocurrency for as little as €1 with BLOX.Buying cryptocurrencies with BLOX is simple:- Click on the cryptocurrency you would like to buy

- Then press the Buy button

- Enter the amount for which you would like to buy crypto and press Continue

- Then Confirm the purchase

Vault

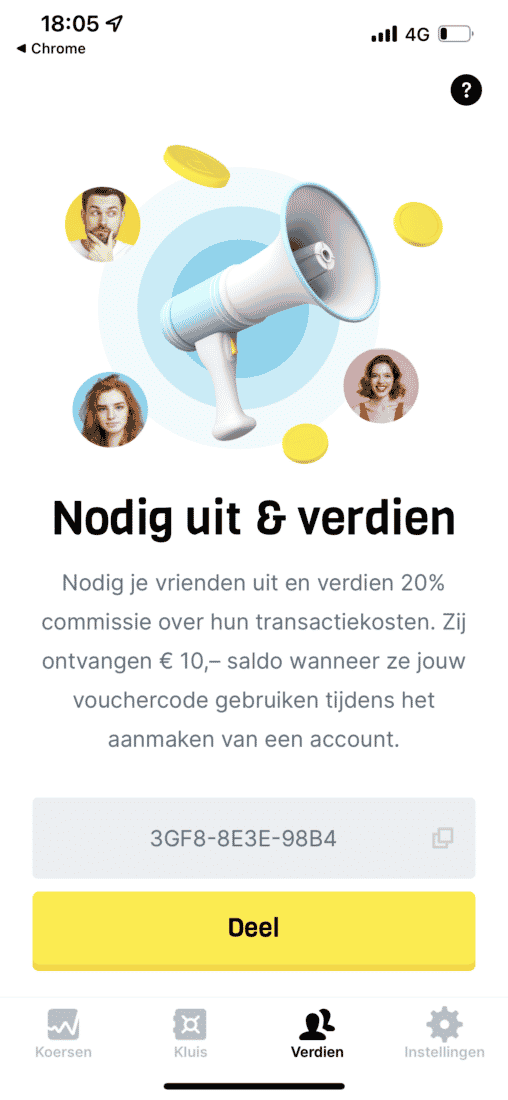

Curious about how your crypto investments are performing? In the vault, you can immediately see whether you make a profit or a loss.Earn

Do you know any friends who are interested in crypto? You can give them €10 worth of crypto for free! In addition, you will receive 20% of all trading fees they make.

Settings

Under the last tab, you can change your password and contact customer service.Deposit money at BLOX

You can deposit money at BLOX using all the usual payment methods, such as:- iDEAL

- Bank transfer

- Bancontact for Belgium

- Credit card (Visa and Mastercard)

Offer of cryptocurrencies

You can also see from the selection that BLOX focuses primarily on the novice investor. At BLOX, you can only invest in the most well-known cryptocurrencies. At the time of writing, you can trade 37 different cryptocurrencies at BLOX. Examples of cryptocurrencies that you can buy and sell at BLOX are: Bitcoin, Ethereum, Binance Coin, Solana, and Ripple.I find the selection of cryptocurrencies a bit limited, but this is because I also like to invest in lesser-known altcoins. If a large selection is important to you, Binance can be a good choice.Don’t expect any special extra features. At BLOX, you cannot speculate on falling prices or follow other investors as you can at eToro. It is also not possible to earn extra returns through staking. It’s safer, but less interesting.

What are the costs at BLOX?

Your return is largely determined by the costs you pay: at BLOX, you pay a standard cost percentage of 1% on your transactions. This cost percentage is lower than some other Dutch providers, but certainly not the lowest on the market.For example, at Bitvavo, you pay a maximum of 0.25%, and at Binance, around 0.125%! If costs are critical to you, it’s better to choose another provider.The Bitcoin price can also differ from broker to broker. Keep in mind that this can cause your costs to be higher or lower than expected.How reliable is BLOX?

Registration & regulation

BLOX is registered under the brand name BTC Direct with the Dutch Central Bank. This is a good sign: BLOX complies with Dutch rules and regulations.Another positive sign for the reliability of BLOX is that the parent company has been around since 2013. This means that the broker has been active for almost 10 years without any unpleasant hacks.The BLOX wallet

BLOX stores all cryptocurrencies in a central wallet. Unlike some other brokers, you cannot deposit or withdraw cryptocurrencies. This offers the advantage that you do not have to protect a wallet yourself. A clear disadvantage is the lack of control, as BLOX is technically the owner of the cryptocurrencies.When it comes to security, BLOX seems to be doing well. Most of the cryptocurrencies are stored on so-called cold wallets. Cold wallets are not connected to the internet, which makes them more difficult to hack. Moreover, there are sufficient security protocols to prevent the cryptocurrencies from being stolen.However, for crypto investors who consider control to be crucial, BLOX is not an option. You remain fully dependent on the company’s security.Stability & outages

Recently, BLOX has not always built up a good reputation for stability. They have had several outages, resulting in users losing money. As a user, it is important to be able to sell your cryptocurrencies quickly, especially when strong market movements occur. It seems that BLOX has improved its stability & accessibility in 2023.

Conclusion: Is BLOX a good crypto exchange?

BLOX is not the best crypto exchange, but I don’t think BLOX is trying to be the best either. This crypto app mainly focuses on novice investors who want to invest in Bitcoins and other cryptocurrencies with little knowledge. BLOX does little wrong for this target group, and with the free €10 in crypto, it can be attractive to open an account:Use code to receive free €10 in crypto!Frequently Asked Questions about BLOX

Personally, I would never consider investing in crypto to be safe, as drops in value of tens of percent occur regularly. Fortunately, BLOX promises to protect your funds as much as possible. They do this by storing your cryptocurrencies offline. Additionally, BLOX is registered with DNB, which is normally a positive sign for safety.

BLOX is currently only available as a mobile application. If you want to invest in cryptocurrencies on your desktop, you can try the software from the parent company BTC Direct.

Creating an account with BLOX is completely free. As a new user, you even receive €10 in free crypto from this crypto exchange! Trading cryptocurrencies on BLOX is not free: you pay 1% in transaction fees.

There are no difficult conditions to receive €10 in free crypto: you only need to open an account, and that’s it! However, you can only use the promotion once, and you must enter the code when creating an account.

The BLOX application is currently available in Dutch, English, and Spanish. Users from all over Europe can open an account with BLOX.

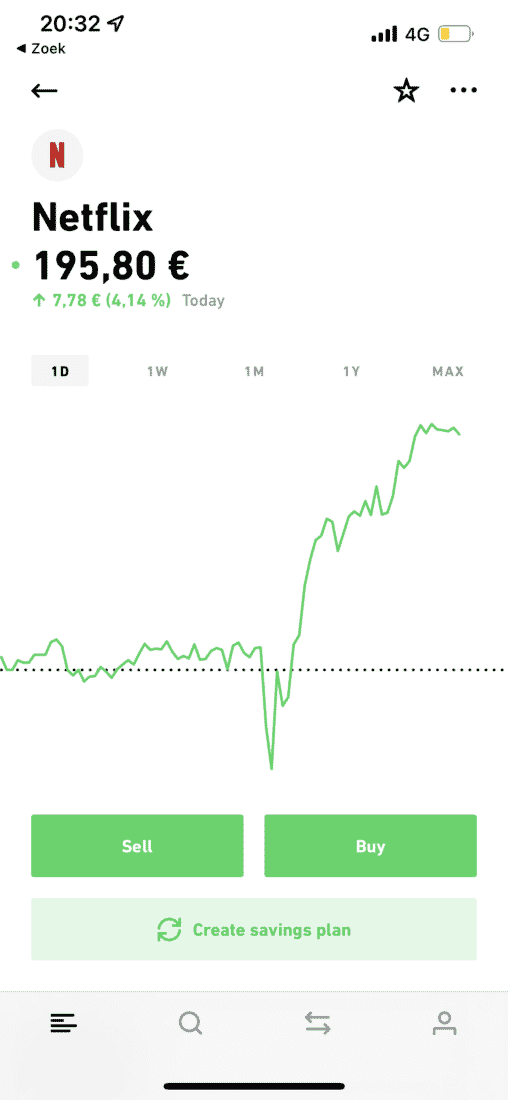

Trade Republic review (2024): advantages and disadvantages of the platform

The German Trade Republic is now available in the Netherlands! Trade Republic allows you to invest in thousands of stocks & ETFs with your mobile phone. It’s also convenient that with this broker, you can automatically invest in shares & ETFs on a regular basis. In this review, I will share my experiences with Trade Republic.About Trade Republic

Trade Republic was launched in Germany in 2005, but is now also active in Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain. Despite the fact that the broker only offers an app, you can invest in an extensive range of stocks and ETFs. The low transaction fees (maximum of €1) make the application an attractive alternative to many traditional brokers.If you want to try Trade Republic for yourself, you can open an account directly with the button below:| Year of foundation: | 2015 |

| Products: | Stocks & ETF's |

| Costs: | Maximum €1 per order |

| Minimum deposit: | €1 |

| Payment methods: | Bank transfer & credit card |

Advantages of Trade Republic

- You pay a maximum of €1 in transaction costs per order

- You can invest in over 7500 products

- Trade Republic is regulated by the German BaFin

- The savings program is an interesting feature

- You can trade outside of regular trading hours

Disadvantages of Trade Republic

- The application is only available in English

- It is not possible to deposit with iDEAL yet

- Your orders are sold to the Hamburg stock exchange

- The customer service is only available by email

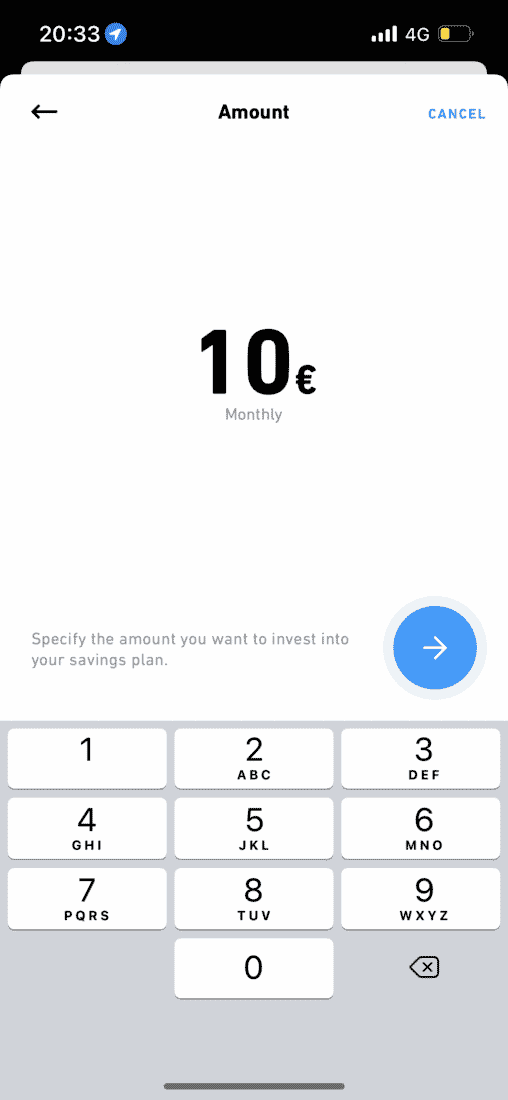

Unique feature: savings plan

I am a big fan of the savings plan which is offered by Trade Republic.With a savings plan, you can invest a fixed amount periodically (e.g., every month) in a selection of stocks and ETFs. Not all products are available in the savings plan: you can choose from 1,000+ ETFs and 2,500+ stocks.You then only pay one euro in transaction fees for your entire transaction. This means that you can also invest a small amount in stocks like Amazon and Alphabet shares. Within Trade Republic, you can also buy fractional shares, which allows you to buy part of a bigger stock.You can, for example, invest €100 each month in Amazon, €100 in an ETF of your choice, and €100 in Philip shares. By creating your own savings plan, you retain complete control.By investing periodically, you can take advantage of dollar-cost averaging, which allows you to achieve an average return on your investment. By consistently investing a fixed amount, you can build up a large sum over a longer period. With this tool, you can see for yourself what the effect of periodic investments can be.

Unique feature: longer trading hours

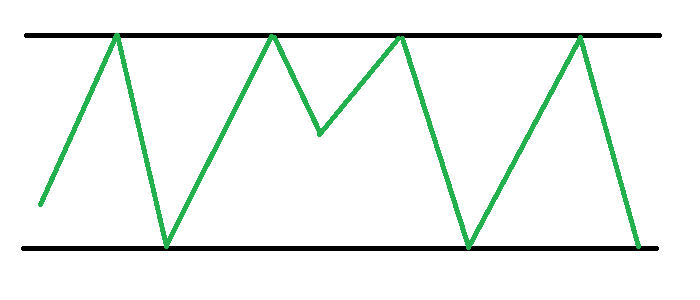

Another advantage of Trade Republic is that you can also invest outside of regular trading hours. Because you can still trade stocks after the market closes, you can also react to events outside the trading hours.There is a disadvantage to this: outside of normal trading hours, the spread increases. The spread is the difference between the buy and sell price of a stock. Outside regular hours, there are fewer active traders, which makes it difficult to find buyers and sellers. This makes it important to be extra careful when investing with Trade Republic in the late hours!Trading options with Trade Republic

The trading options at Trade Republic are excellent, especially for a mobile application. You can invest in thousands of different stocks from the United States, China, Germany, and the United Kingdom, among others.It is also possible to invest in ETFs at Trade Republic: with over 400 products, there is plenty of choice. If you like, you can also trade more than 500 bonds from companies and governments.You can also invest in commodities to a limited extent at Trade Republic; in gold, silver, and oil. For Forex traders, Trade Republic is less interesting since you can only trade the euro versus the dollar.How does investing with Trade Republic work? The application

The Trade Republic application is just as user-friendly as BUX’s. The company’s target audience is therefore mainly younger, less experienced investors.In my opinion, a big disadvantage of web applications is the lack of extensive analysis capabilities. You can quickly place and execute orders within Trade Republic, but don’t expect many other options.You can use the following order types at Trade Republic:- Market order: with a market order, you open the investment immediately at the prevailing price.

- Limit order: with a limit order, you set a price at which you open an investment

- Stop order: with a stop order, you can automatically close a trading position at a certain loss

- Periodic order: this allows you to place a savings plan order, you can read more about this earlier in the review.

What are the costs of Trade Republic?

A positive point within the review is the low costs: at Trade Republic, you pay a standard fee of €1 for each order.In the article free investing, I investigated various ‘free brokers’ and they were found to regularly charge additional fees. This is not the case with Trade Republic, and there are no hidden costs. With Trade Republic, you do not pay custody fees and depositing and withdrawing money is entirely free of charge.An additional advantage is that Trade Republic does not charge conversion or currency exchange fees. With many brokers, you pay a markup for exchanging euros for dollars, e.g. 0,25%. When you buy US stocks, you almost always need to exchange euros for dollars. By not charging conversion fees, Trade Republic can save you a lot of money.Is Trade Republic trustworthy?

Before opening an account with Trade Republic and starting to invest, you probably want to know if it is a trustworthy party. In this part of the review, I will discuss if this is the case!Regulation

Trade Republic is supervised by BaFin, which is a German financial watchdog. This is a good sign: Trade Republic must comply with German and European laws and regulations, which means your money is protected.Trade Republic is also registered with the Deutsche Bundesbank (the German central bank), which guarantees the balances in your account up to €100,000. This is higher than some other brokers offer: a reassuring thought!Sale of orders

Trade Republic states that they do not earn money from transaction fees. However, the broker does make money in another way: by reselling all orders to the Lang & Schwarz Exchange in exchange for a commission.This practice is not allowed in every country, since it can, in theory, work against the interests of customers. If exchange A sells shares at a higher price but charges a higher commission, orders could be executed on the less attractive exchange.This doesn’t seem to be the case with Trade Republic. According to this study (which they conducted themselves), Trade Republic is almost always as cheap as the usual exchange and sometimes even cheaper. I have examined some random examples myself and came to the same conclusion. Therefore, it seems that reselling orders is not a problem with Trade Republic.Securities lending

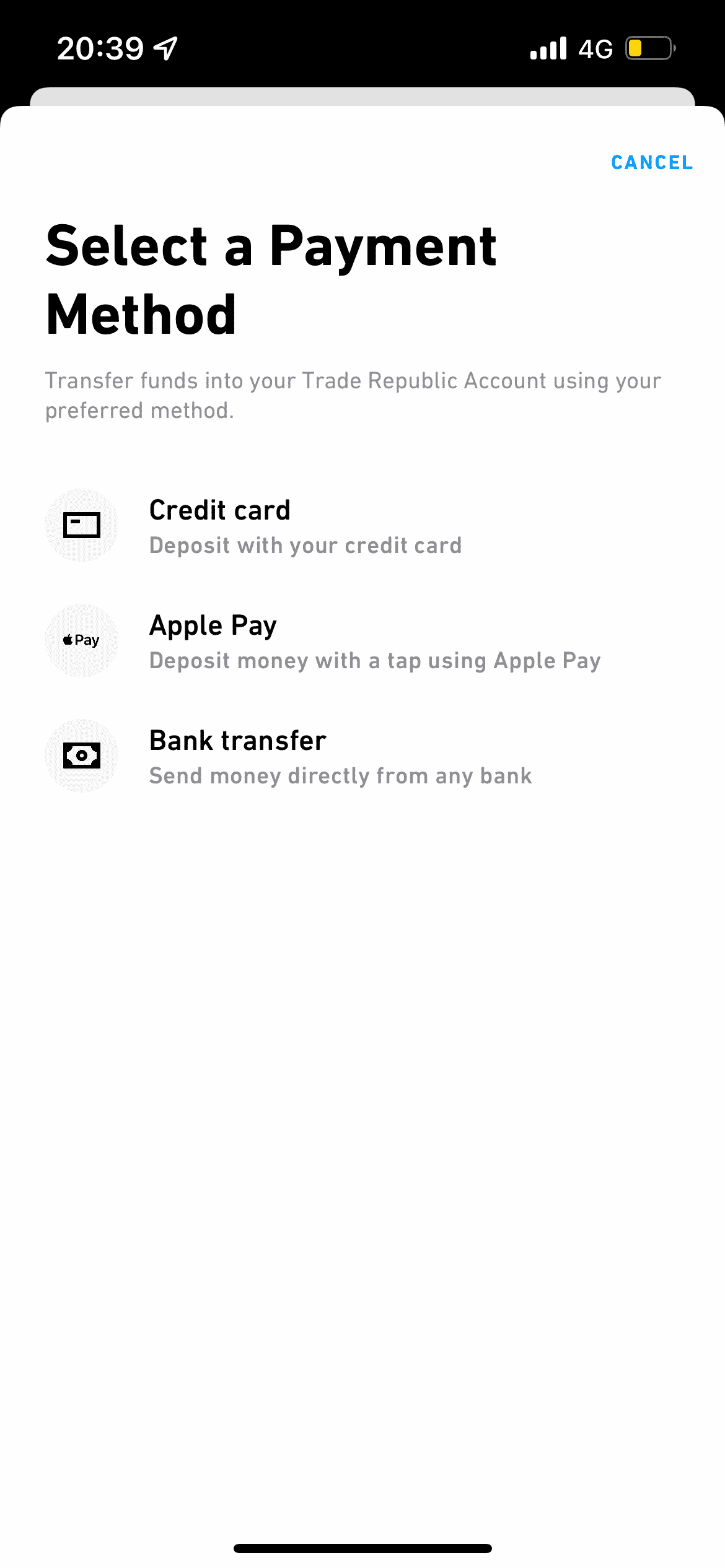

The second method Trade Republic uses to make money, is by lending out your securities. This may sound scary, but it is very common.The risk is minimal, because the parties borrowing the securities must provide collateral. This collateral typically consists of high-quality government bonds. If the other party is unable to repay the securities, the collateral can be sold.If you object to securities lending, you can open a special custody account. You will then pay higher transaction costs, but your securities will not be lent out.Depositing & withdrawing money

You can deposit money with Trade Republic using the following methods:- Bank transfer (can take up to 3 days)

- Credit card

- Apple Pay

- Google Pay

Trade Republic customer service

Trade Republic’s customer service is disappointing. Unlike some other brokers, you cannot call or use live chat. The only way to request support from Trade Republic is via email and in English, which is a major disadvantage of this broker.Conclusion review: investing with Trade Republic

I am a fan of Trade Republic: I definitely think that this new broker can compete with existing parties in Europes. With the savings plan, investors can also invest in interesting stocks with a small amount of money. If you don’t mind your orders being resold, then Trade Republic is a good choice!Frequently Asked Questions about Trade Republic

Trade Republic earns money from your investments in two ways. The first way Trade Republic earns money is by reselling the orders. The exchange pays Trade Republic a small commission for this.

The second way Trade Republic earns money is by lending out your securities. This is also common practice among brokers and carries a limited risk.

Investing is never completely safe: you can always lose your investment. However, Trade Republic is a reliable party with registration with the German regulator and the German Central Bank. This ensures that Trade Republic must adhere to strict rules.

I find Trade Republic to be cheap: you never pay more than €1 in transaction fees at this broker. Some brokers offer free trading, but then you often face additional costs. Trade Republic is very transparent and does not charge fees for exchanging currencies such as euros to dollars. Compared to the competition, Trade Republic is a cheap company.

What are the best mobile stock investment apps (2024)?

Are you curious about the best investing apps of 2023? In this article, I will discuss my favourite trading apps that allow you to invest online in assets such as stocks, ETFs, and cryptocurrencies. In my top 10 list, you will find the best trading apps you can use to buy & sell stocks.What are the best mobile investment apps of 2023?

In the overview below, you can see my favourite mobile apps of 2023. In the rest of this article, you can read more about the features of the different mobile applications.| Brokers | Benefits | Register |

|---|---|---|

| Buy shares without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of shares! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of shares with a free demo! |

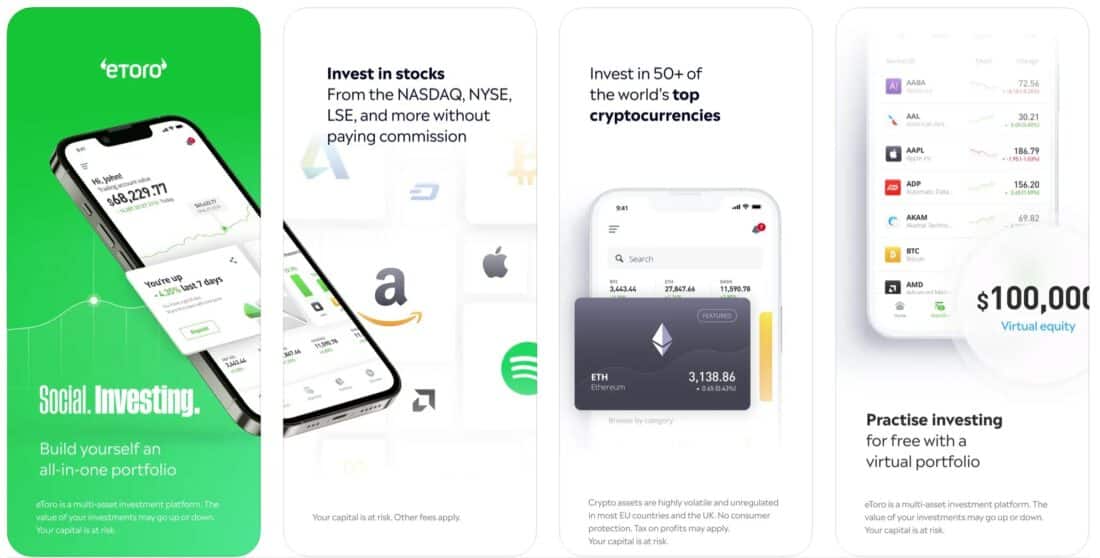

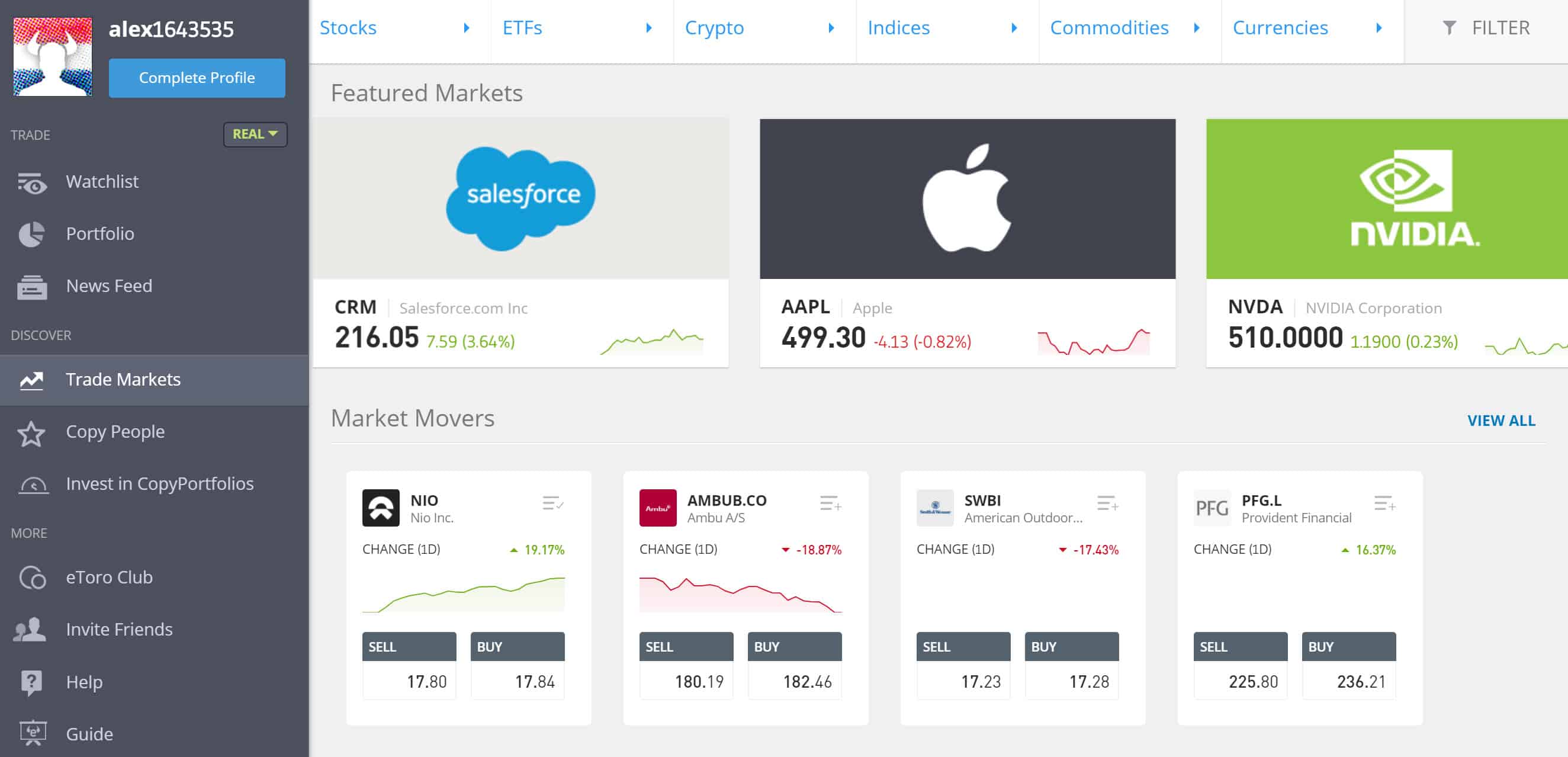

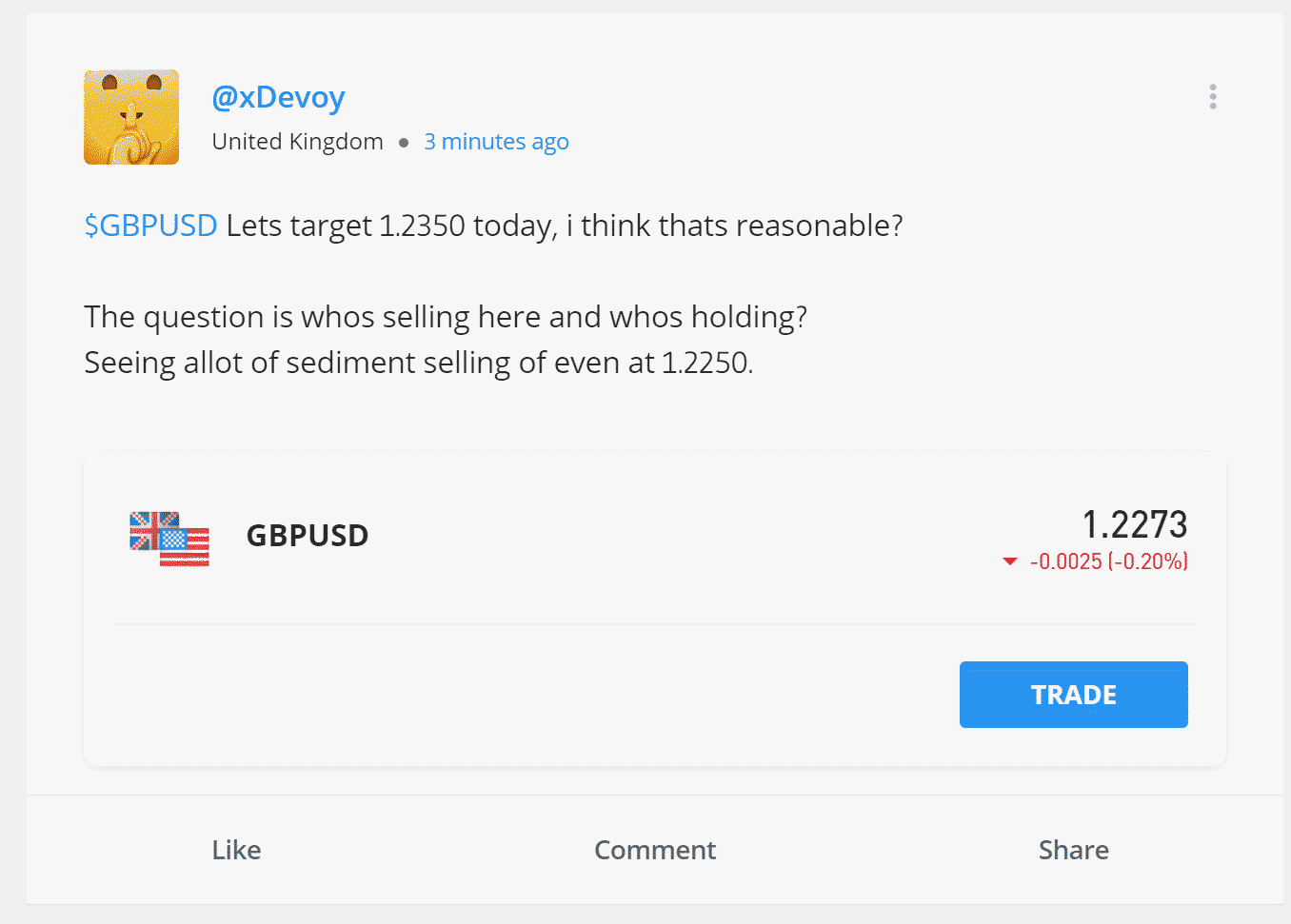

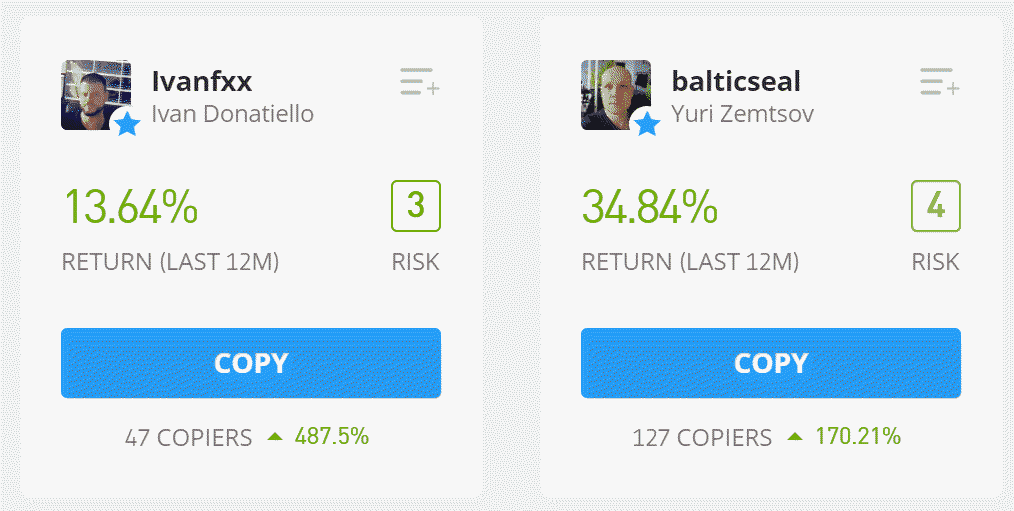

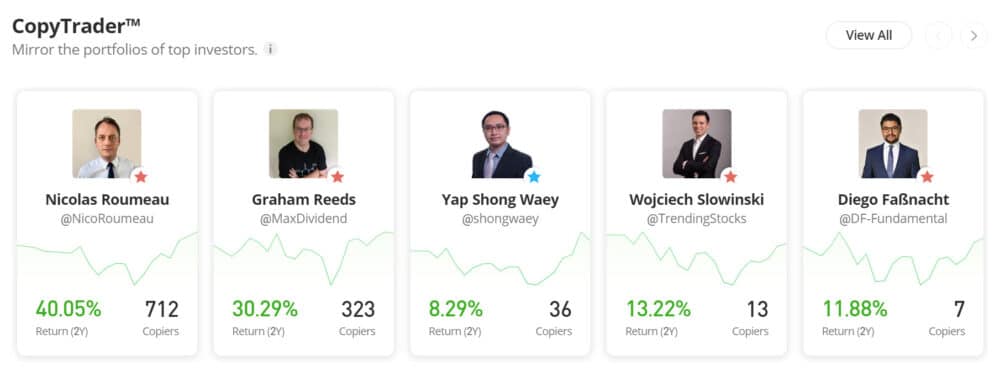

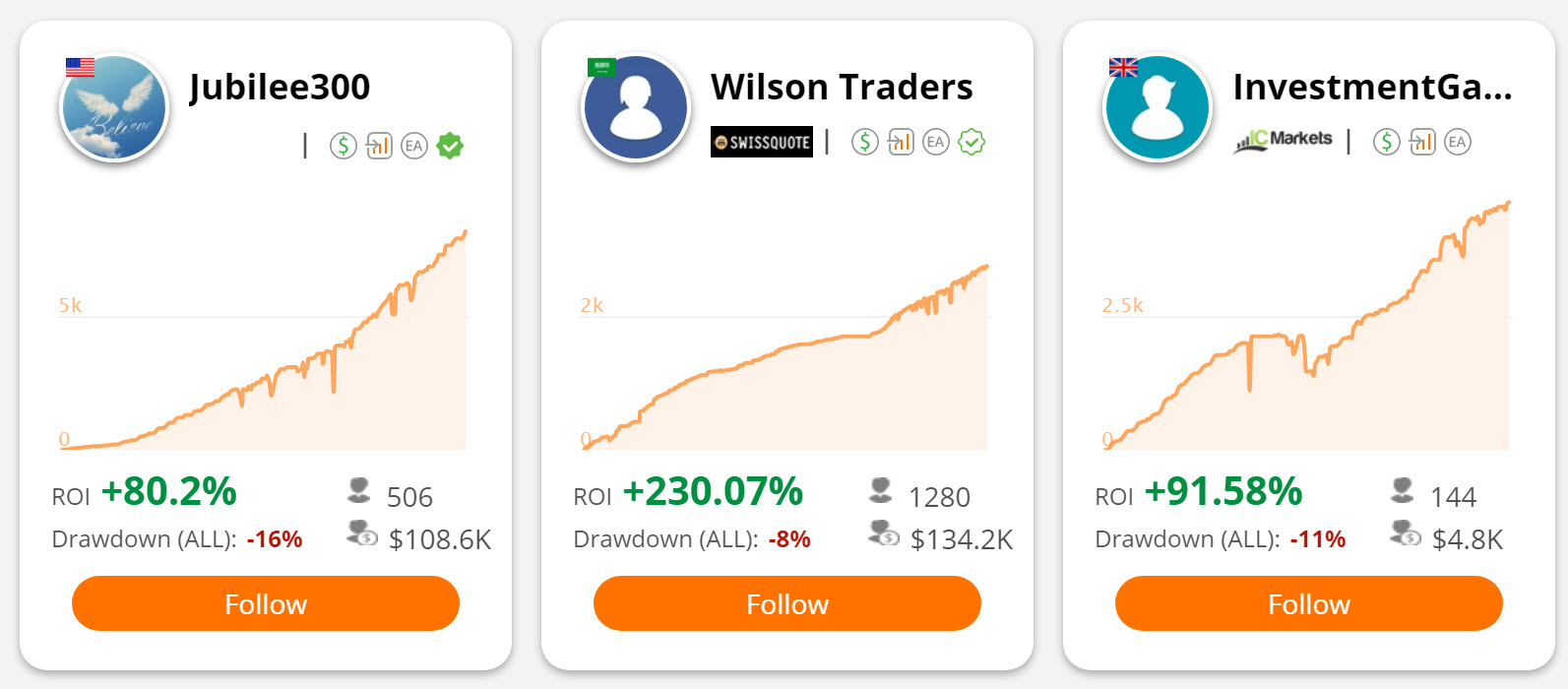

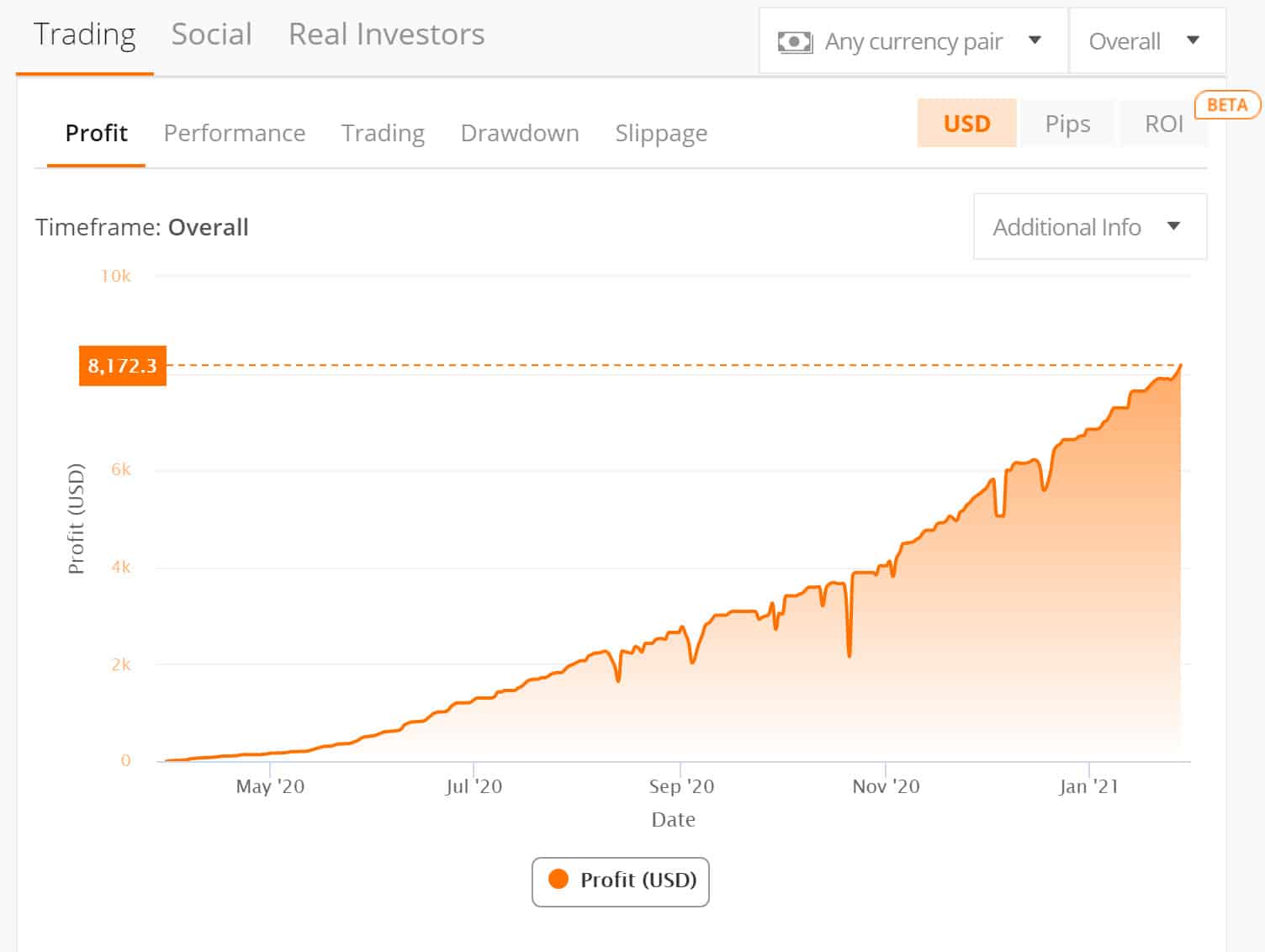

1. eToro – One of the best social investing application

eToro is my favourite all-around investment app. You can invest in 3000+ different stocks, ETFs, and cryptocurrencies on eToro. Moreover, it is possible to actively speculate on price increases and decreases with derivatives. New users can also try the possibilities for free with an unlimited demo.I’m also a big fan of the Copy Trading feature, which allows you to copy other successful traders within your account. However, there are also some downsides to the eToro application: you can only open a dollar account, and you will pay $5 in transaction fees when you withdraw money. Do you want to know more about eToro? Click here to read the review or open an account directly! (76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.)

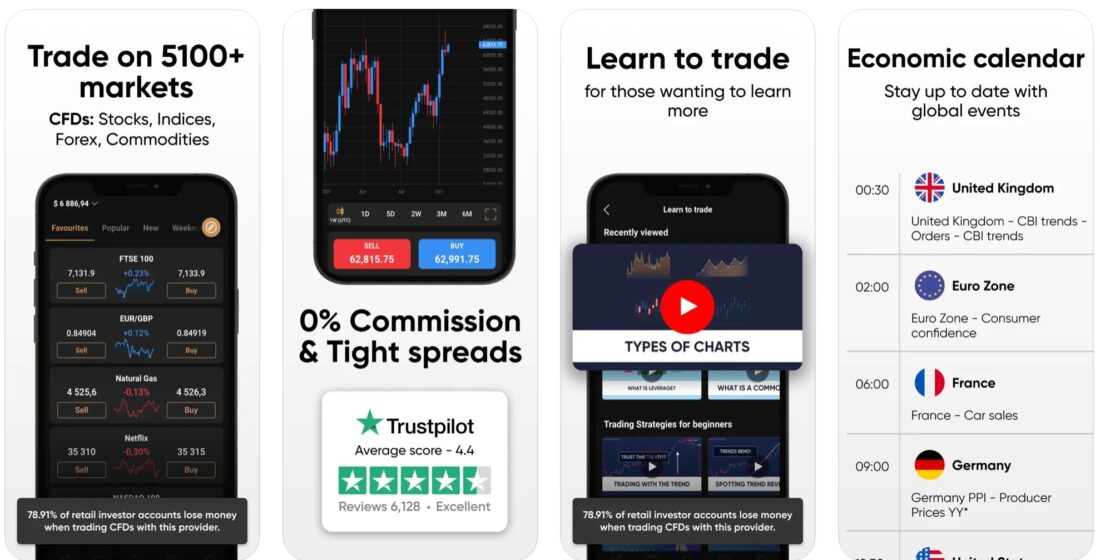

2. Plus500 – best trading app

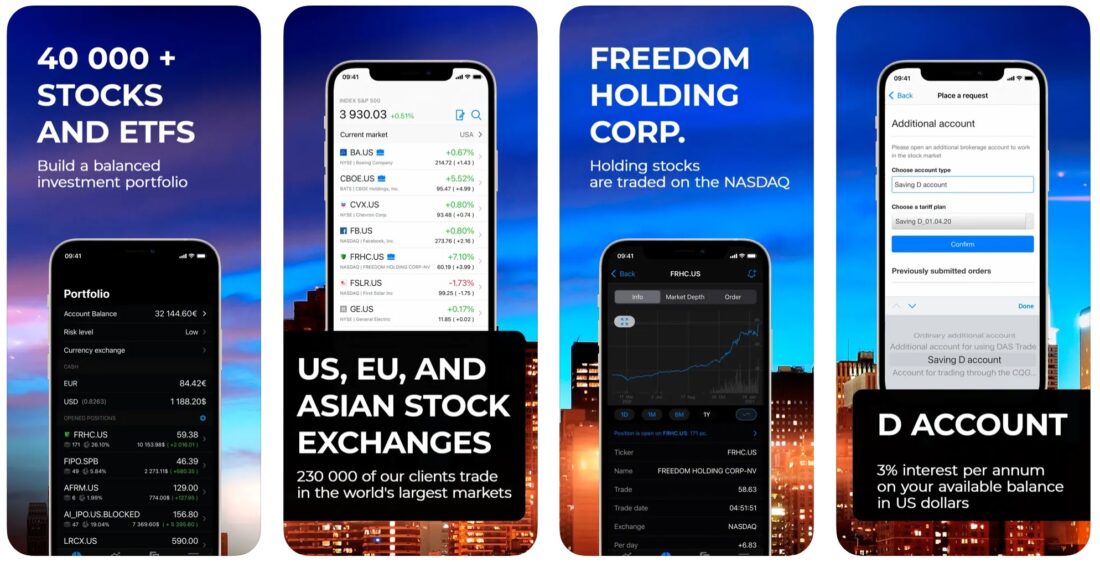

In my opinion, Plus500 is the best CFD trading application. With CFDs, you can speculate on price increases and decreases of, for example, stocks, commodities, currency pairs, index funds, and cryptocurrencies. By using leverage, you can open a large position with a small amount of money. Plus500 also allows you to speculate on a declining price: this is called short selling.Plus500 is especially suitable for the more advanced investor who enjoys actively engaging with the stock market. In my review, you can read more about Plus500. Before you begin, it is recommended to first try the possibilities for free with a demo:3. Freedom24 – invest in IPOs with this mobile app

The investment application of Freedom24 cannot be left out from this list. Unique to Freedom24 is that you receive interest (3%) on money you deposit into your account. It is also appealing that as an investor at Freedom24, you can participate in IPOs. An IPO is an initial public offering, which is the moment a stock gets listed on the exchange. This makes investing with Freedom24 particularly interesting if you are interested in participating in the stock market launch of large companies.Click here to read my review of this platform or open an account with Freedom24.

4. Trade Republic – application which a free stock

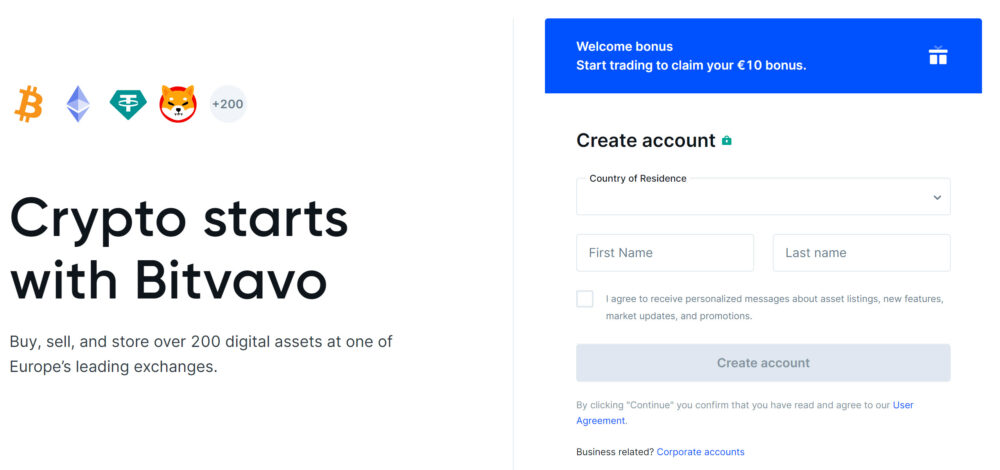

With Trade Republic’s investment app, you can invest in more than 8,000 different stocks, ETFs, and cryptocurrencies. The Trade Republic application is user-friendly, and as a new member, you receive a free share immediately.I am particularly a fan of the savings plan they offer: with this plan, you can invest in a selection of stocks for only €1 per month. With €100, you can already invest in 10 stocks, which makes it easy to apply diversification. Furthermore, It is beneficial that you can invest outside normal trading hours. Click here to read my review or open an account directly.5. Bitvavo – best crypto application

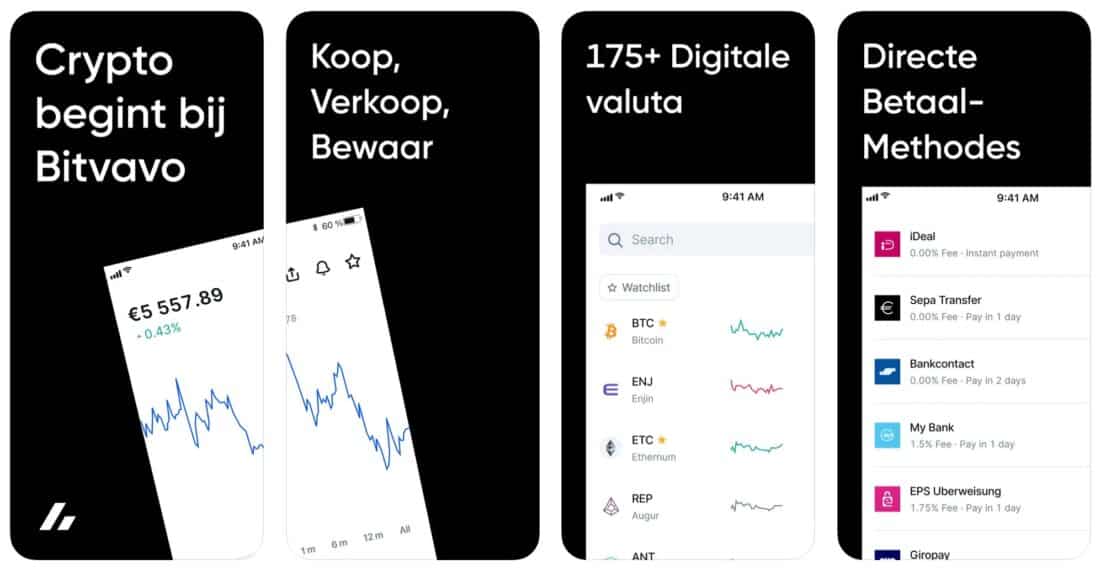

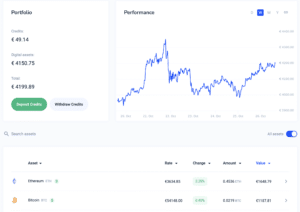

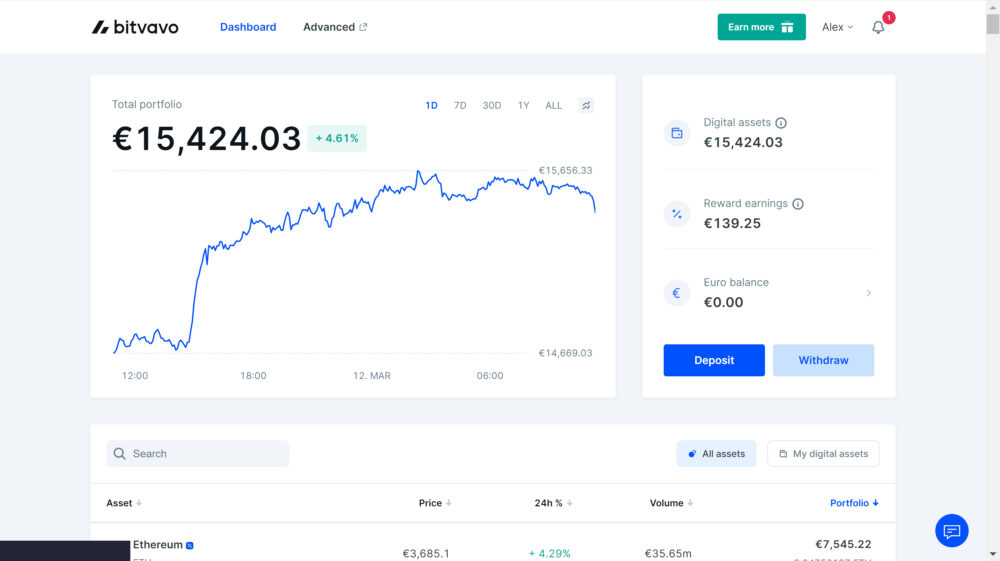

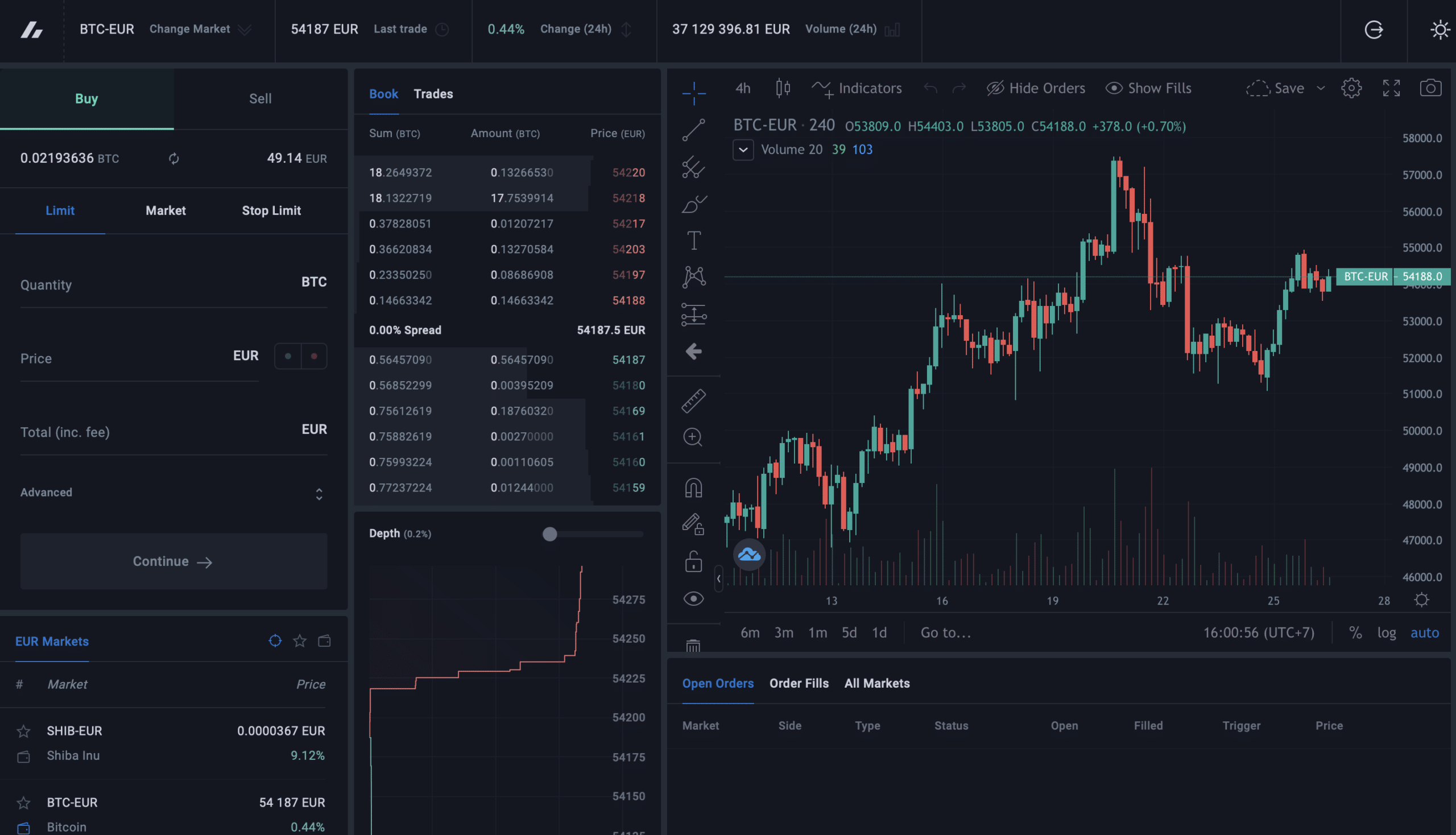

I use the Bitvavo crypto application to buy and sell Bitcoins & Ethereum. A big advantage of this crypto app is its high level of user-friendliness. You can buy and sell cryptocurrencies in no time. Moreover, at Bitvavo, you can trade in over 175 different cryptocurrencies, which meants there is plenty of choice.Bitvavo is one of the cheapest European crypto applications: you never pay more than 0.25% in transaction fees. In 2023, Bitvavo has introduced a new scheme in which your balances are protected up to €100,000 under certain conditions in case of theft. Do you want to know more about Bitvavo? Click here to read the extensive review or click here to open an account & pay no transaction fees on your first €1000 in trades.

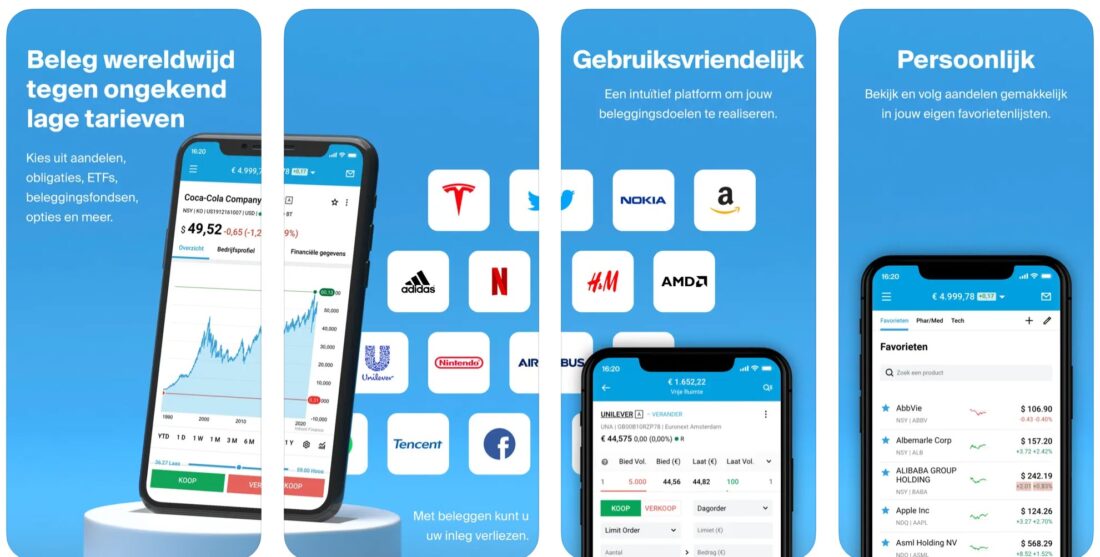

6. DEGIRO – best stocks & ETF application

DEGIRO is perhaps one of the most well-known brokers: this is not surprising given that they come up in dozens of studies as one of the best brokers to invest with. DEGIRO also keeps up with the times and has introduced a modern investment app. With the application, you can track the latest price developments and place orders directly on the stock exchange.Unfortunately, at DEGIRO, you cannot invest in stocks without commissions: for example, you pay €3 for European shares. However, under certain conditions, you can invest in ETFs from the core selection without transaction costs. In my review you can read more about DEGIRO, and by clicking here you can open an account directly.

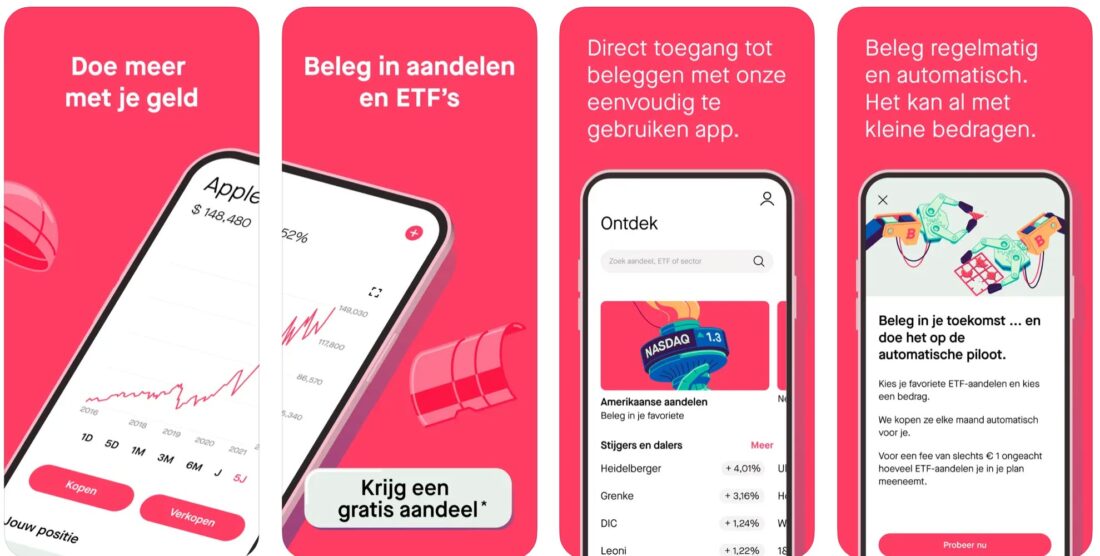

7. BUX Zero – best ‘free’ mobile investing app

BUX Zero aims to make investing as accessible as possible for beginners. In my opinion, they have succeeded: the BUX Zero application is user-friendly and allows you to trade in familiar stocks and ETFs. The total selection of investment options is somewhat limited compared to some other brokers, but for many investors, the options at BUX will be sufficient.Click here to read about my experiences with BUX Zero or open an account directly & receive a free share after depositing!

8. Peaks – investing with your spare change

Peaks is an application that allows you to automatically invest your spare change. You can link the application to your bank account and then automatically invest small amounts. When you make a payment of, for example, $1.20, Peaks rounds this amount up. It then automatically invests $0.80 in an index fund.Although I am a fan of the concept, the high costs of investing with your spare change at Peaks make it less attractive. With small amounts, you pay $1 per month. A better alternative would be to invest a fixed, monthly amount in an ETF; discover here how this works.

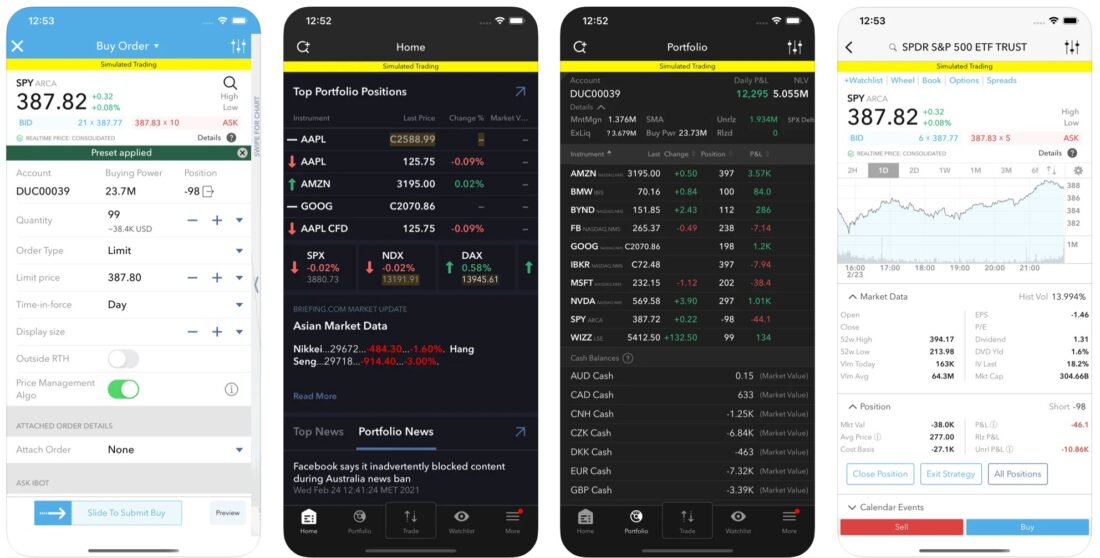

9. MEXEM – a high-quality investment app

Another investment app you can use is the stock application from MEXEM. MEXEM uses the well-known Traders Workstation, which is globally recognized as one of the best investment programs in the world. The software itself is of high quality, and you can perform complex analyses with the extensive tools.MEXEM is also a relatively affordable broker: for example, when buying and selling Dutch shares, you pay a minimum of $1.80. This means that MEXEM can be slightly more affordable than DEGIRO.

10. Capital.com – application with the most extensive offering

Capital.com has a trading application that is interesting for the active trader. At Capital.com, you can trade in thousands of different securities with CFDs. Since 2023, it is also possible to invest in stocks without paying commissions in Europe.An advantage of Capital.com is that you can trade in hard-to-reach markets. Within the application, for example, you can speculate on the price movements of the Russian rubble or the developments of Russian stocks. Capital.com can therefore be a good choice for the serious trader: read my detailed review here or open a free (demo) account directly.

What should you look for when selecting a stock trading application?

- Reliability: not all investment applications on the market are equally reliable. There are many scams: therefore, research well whether the party behind the investment application can be trusted.

- Costs: in addition to transaction fees, also investigate hidden costs well. In my article on free investing, I show how some ‘free’ brokers still charge hidden costs.

- Features: for novice investors, a simple investment application may be sufficient. More demanding investors may want to invest in ‘exotic’ markets. Therefore, research whether the app offers enough opportunities for your needs.

- Features: some applications offer only one function, which is buying and selling stocks. With other stock trading applications, you can perform complex analyses or follow other investors.

Is mobile investing the future?

I, personally, believe 100% that mobile investing is the future. I already see that almost 80% of visitors to this website use a mobile device. It is therefore not surprising that more and more people use their mobile phones to trade in, for example, stocks. I think that in the future, the majority of investments will be executed using a mobile device.Do you also want to be able to invest everywhere and always? Then open an account with your favourite app today! Can’t decide? It is always possible to open an account with multiple brokers.Frequently asked questions about investing with an app

Unfortunately, there is no one objectively best mobile investing application. Everyone who invests has different priorities. Therefore, it is recommended to make a list of what you find important: by doing so, you can discover which investment application suits you best. Personally, I use Bitvavo for crypto and DEGIRO for buying and selling stocks.

Investing with a mobile application has several advantages. You can trade at any time of the day, which allows you to react to the latest price developments. Additionally, you can receive notifications immediately after price developments.

However, there are also pitfalls; according to research, people who trade infrequently often achieve the best results. A mobile application actually invites investors to be constantly trade, which can lead to psychological pitfalls, especially for beginners. Therefore, invest responsibly and remember that you can lose money!

If you want to start investing as an absolute beginner, an application like Trade Republic can be helpful. Trade Republic is user-friendly, and the options are limited.

Nowadays, you can examine the latest stock market prices with almost any investment app. Personally, I use the eToro application to check examine the latest stock prices. eToro is easy to use due to its user-friendly interface.

Capital.com review & experiences (2024): is this a reliable broker?

Capital.com is an interesting broker for anyone who wants to actively trade in CFD stocks, commodities, cryptos & ETFs! Capital.com was founded in 2016 but has grown tremendously since its inception and now has over 300,000 active customers. In this extensive review, we investigate whether it is appealing to trade with Capital.com.Capital.com summary

Capital.com is a reliable broker where you can actively trade thousands of different stocks. You can only trade in CFDs at Capital.com, which makes the broker unsuitable for novice traders. Capital.com is suitable for the active trader who wishes to speculate on rising and falling prices with an user-friendly platform.Do you want to try the possibilities of Capital.com for free? Then use the button below to open a demo immediately:| License: | FCA, CySEC, ASIC & NBRB |

| Founded in: | 2016 |

| Minimum deposit: | $20 |

| Broker type: | CFD-broker |

| Products: | Stocks, crypto, forex, ETFs & commodities |

| Free demo: | Yes |

What are the pros of Capital.com?

- No hidden costs: commission-free trading & low spreads

- Over 5000 stocks to trade

- You can trade in exotic trading products

- MetaTrader4 is also available

- You can already deposit money from $20 with credit card

- Customer service by telephone

What are the cons of Capital.com?

- You can only trade in CFDs at Capital.com

- The software is decent, but not extensive

How does trading at Capital.com work?

We start the Capital.com review with a small guide so that you immediately understand how to start trading with this broker.Step 1: Open an account

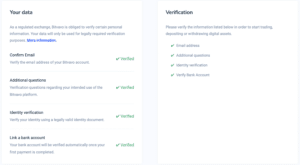

Before you can trade with Capital.com, you must first open an account. Opening an account at Capital.com is easy: you can open an account with your Facebook or Apple account. After you have opened an account, you can immediately get started with the demo mode. With the demo, you can test strategies and discover if Capital.com is right for you. If you want to trade with real money, you still have to go through a few verification steps:

After you have opened an account, you can immediately get started with the demo mode. With the demo, you can test strategies and discover if Capital.com is right for you. If you want to trade with real money, you still have to go through a few verification steps:- You must upload a copy of your ID

- You must upload proof of your address

Step 2: deposit money at Capital.com

After your account has been approved, you can deposit money directly into your Capital.com account. Depositing money is a positive point within this review: you can start trading from $ 20 with this broker. In addition, all known payment methods are available, such as:- Credit card

- Apple Pay

- PayPal

- Bank transfer

- Instant Bank Payment

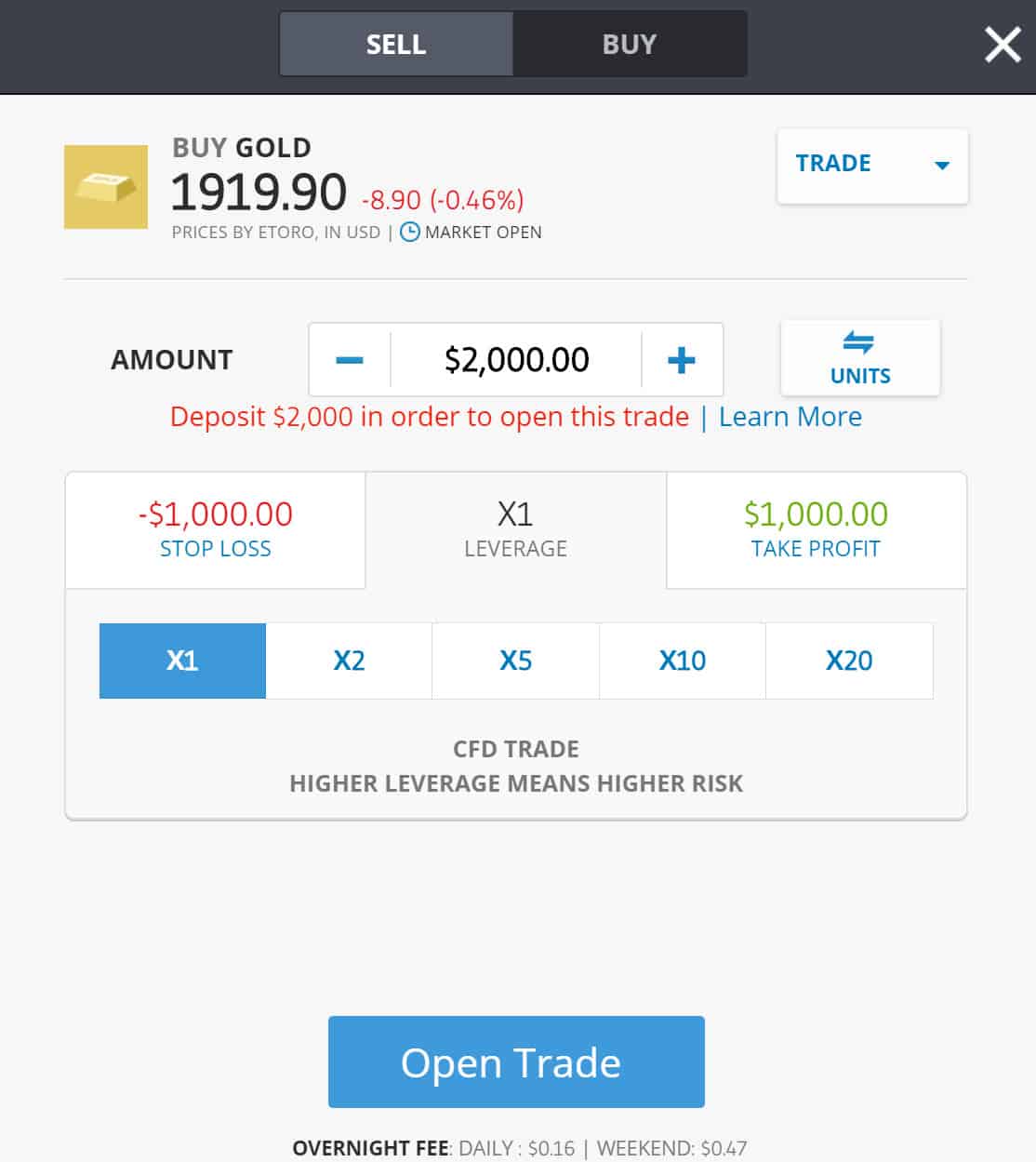

How does CFD trading work?

After opening an account, you can start speculating at Capital.com. Some traders do not understand what CFD trading is; that is why I would like to explain CFD trading in this part of the article.With CFDs, you do not trade directly in the underlying security. You don’t buy a share; instead, you buy a contract on a share. The price development then determines whether you make a profit or loss.When trading CFDs, you can use two unique options:- Short selling: you speculate on falling prices

- Leverage: you can open a larger position with a small amount

How reliable is Capital.com?

Capital.com is regulated by several parties. Within Europe, the broker is supervised by CySEC which is the Cypriot financial regulator. Capital.com must therefore adhere to the high standards of the European Union, which is a good sign for its reliability.As with many other brokers, your funds at Capital.com are also stored separately. This prevents you from losing all your money if Capital.com goes bankrupt.Capital.com is also affiliated with the Investor Compensation Scheme, which means that if something goes wrong, you do not lose all the money in your account. At the time of writing, this guarantee amounts to €20,000.What can you trade in at Capital.com?

I am enthusiastic about the range of CFD trading products at Capital.com. You can actively speculate on a wide range of trading products.Stocks

You can of course trade in British and American shares at Capital.com. With this broker, however, it is also possible to trade in more exotic stocks. It is for example possible to trade in CFD stocks listed on the Russian or Japanese stock exchange. I didn’t count them manually, but you can trade over 5000 stocks at Capital.com!This also allows you to speculate on the price movements of smaller companies, which can be interesting.Forex

Capital.com started as a Forex broker, and you notice this immediately: the fees on Forex trading are low and you can trade in some unique currencies. At Capital.com you can, for example, speculate on the price development of the Russian Ruble or the Turkish Lira. These currencies sometimes make significant jumps, which you can capitalize on by using leverage.Cryptocurrency

You can also speculate in a handful of cryptos at Capital.com. Personally, I am not a big fan of CFDs on cryptos: the leverage is limited, and the costs are often relatively high. If you want to trade in cryptos, you can also consider Bitvavo. At Bitvavo you never pay more than 0.25% in fees, and you can hold the cryptos for a longer period.ETFs & indices

With Capital.com you can also speculate on the price movements of the well-known indices: for example, the S&P 500 and the NASDAQ. What is unique is that you can also trade in thematic indices such as a crypto index or the corona antivirus index. It is wise to research carefully which stocks are included in these indices before you open a position.The thematic indices are interesting as they respond to current trends. For example, during the war between Russia and Ukraine, Capital.com introduced a special oil portfolio.

Commodities

At Capital.com you can also trade in various commodities like gold, silver and oil. Capital.com also offers a few unique commodities like aluminium or orange juice. The leverage for trading in commodities is 1:10, allowing you to take a large position with a small amount of money.What are the costs at Capital.com?

I have of course also extensively researched the costs for this review. Capital.com doesn’t charge annoying, hidden fees. For example, I didn’t find any costs for:- Depositing and withdrawing money

- Opening an account

- Not using an account (inactivity fee)

- Converting currencies

The spread

Capital.com makes money by building in a difference between the buy and sell price of a security. Most spreads at Capital.com are dynamic: this means that the transaction costs are not fixed. When there is a high volume, the spread is usually lower than when there are, for example, too few buyers.In general, Capital.com offers attractive spreads. On April 14, 2022, at 6:00 PM local time in Bogota Colombia, the following charges were calculated:- On a barrel of oil, the spread was $0.04

- On a Philips share, the spread was $0.08

- Over EUR/USD pair, the spread was $0.00007

- On Bitcoin/USD, the spread was $110

Financing costs

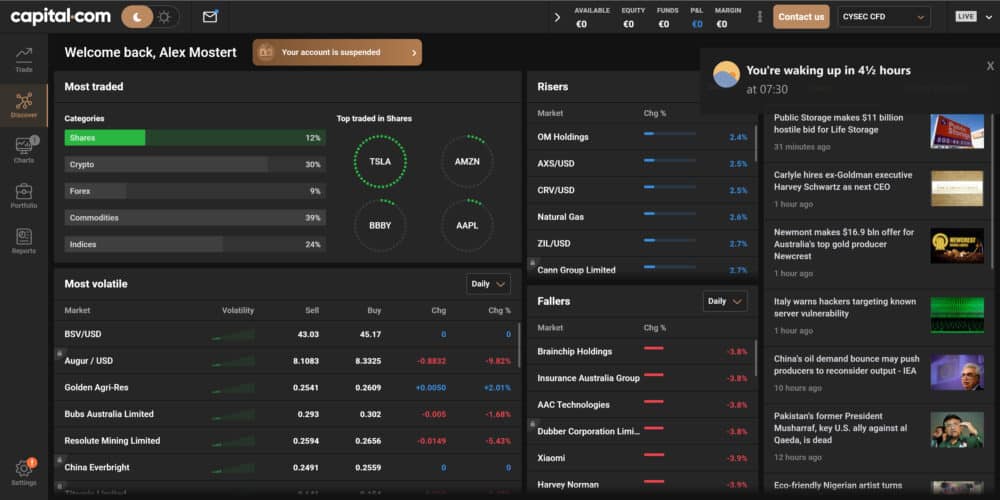

When you use CFDs, part of the position is financed by the broker. If you decide to keep the position open overnight, financing costs are often charged. This is not always the case, sometimes the broker pays you a fee for holding a position.Financing costs at Capital.com are at an attractive level. An extra positive thing is that at Capital.com you only pay financing costs over the leveraged part of your position and not on the part of the position you finance with your money.On crypto, the leverage is 1:2 for example. When you open a position with €1000, you only pay financing costs over €500.Although financing costs are reasonable at Capital.com, it is important to keep a close eye on them. Due to the financing fees, Capital.com is especially suited for short-term trading and certainly not for long-term investing.The trading platform reviewed

Most traders will use Capital.com’s online platform. Within the platform, you can immediately follow the latest trends with the discover option. You can see what other Capital.com users are trading in, and you can also consult the latest news. If you want to trade in a specific security, you can press trade. Here, you can quickly find a specific share or other trading product using the search function. You can then use the chart to perform extensive analyses: at Capital.com you can use a wide range of technical indicators.

If you want to trade in a specific security, you can press trade. Here, you can quickly find a specific share or other trading product using the search function. You can then use the chart to perform extensive analyses: at Capital.com you can use a wide range of technical indicators. When you would like to open an order, simply press the buy (speculate on a rising price) or sell (speculate on a falling price) button. You can then use some useful functions within the user-friendly order screen:

When you would like to open an order, simply press the buy (speculate on a rising price) or sell (speculate on a falling price) button. You can then use some useful functions within the user-friendly order screen:- Buy at price: set a price at which you open a position.

- Close at loss: close your position automatically at a certain loss.

- Close at profit: close your position automatically at a certain profit.

The Capital.com software does what you would expect: the web trader is user-friendly, and you can quickly find the securities you want to trade in. However, Capital.com is not the most comprehensive trading product: copy trading and physical stock investing are not available.

The Capital.com software does what you would expect: the web trader is user-friendly, and you can quickly find the securities you want to trade in. However, Capital.com is not the most comprehensive trading product: copy trading and physical stock investing are not available.MetaTrader 4

More professional traders often prefer the MetaTrader platform. A big advantage of Capital.com is that you can get started with the MetaTrader. Within MetaTrader, you can put multiple screens next to each other and perform more complex analyses. You have to physically download MetaTrader, and this software is definitely not suitable for the novice trader.Mobile application

You can also use the excellent mobile application at Capital.com. The mobile application allows you to open and manage positions in a user-friendly way.Interestingly, you can also use the Investmate application with your Capital.com account. Investmate is designed for novice traders and teaches you useful information that you can use for your trades.

Investmate

Customer service Capital.com

Another advantage of Capital.com is that you can reach customer service in English at +44 20 8089 7893. This ensures that your problems can be solved quickly.Experiences other users

Capital.com scores well on Trustpilot with an average score of 4.3. This is a good sign: most users are satisfied with the services offered by the broker.

Capital.com review conclusion

Capital.com is a fairly new party that can certainly be interesting for the new trader. I find Capital.com especially intriguing because you can trade in markets that are often difficult to access. For example, you can speculate on a fall of the Turkish Lira or Russian Ruble and since you can use leverage, this can lead to significant gains (or losses!).Do you want to test the options without risk? Open a free demo at Capital.com:However, Capital.com is a bit limited, since you can only actively trade with CFDs. If you prefer to physically buy stocks and ETFs, DEGIRO or BUX might be a better choice.Frequently Asked Questions about Capital.com

Some brokers charge extra costs if you do not trade for a while. Fortunately, this is not the case with Capital.com: you can decide not to use your account for years without it costing you a cent.

You can easily & quickly withdraw the money in your account by pressing withdraw money within your account. You can enter the amount you want to withdraw into your bank account. Kindly note that you can only withdraw the money in your account to a bank account under your name.

Capital.com processes withdrawal requests quickly: funds are normally sent within 24 hours. It then depends on your bank how long it takes for the money to arrive.

Capital.com’s main office is located in London. However, Capital.com is an international company and has offices in 9 different countries.

Capital.com is a 100% legal broker. Capital.com is supervised by various parties, which means that the company has to meet strict requirements.

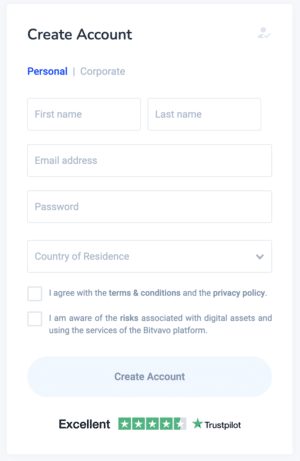

Can Bitvavo be trusted? Bitvavo safety

On the news, you constantly read reports of people losing their crypto assets due to scams or theft. Therefore you might be wondering whether Bitvavo can be trusted. In this article we will discuss the security & safety of the crypto exchange Bitvavo. We will also explain how you can protect your account at Bitvavo.Tip: try Bitvavo for free

Do you want to test Bitvavo for yourself? Then it might be smart to open a free account with this crypto exchange. Our research showed that Bitvavo is a reliable crypto exchange. Moreover, you do not pay any transaction fees over the first € 1000 when you open an account through this link:Our research: is Bitvavo reliable

I have been using Bitvavo for trading cryptos for a long time. In those years, I have not had any unpleasant experiences with Bitvavo. However, this is not enough to state with certainty that Bitvavo can be trusted.Therefore, I visited Bitvavo’s head office in Amsterdam and talked to its employees. I also researched whether the company is completely legitimate.In the end, I came to the conclusion that Bitvavo can be trusted. In the rest of the article, I will discuss how I came to this conclusion.Can Bitvavo be hacked?

A big fear of many people using an exchange is of course hacks. This is for a good reason: in the past, entire exchanges have gone bankrupt because all their Bitcoin were stolen. Even the well-known exchange Binance had to deal with a major hack where a large number of Bitcoin was stolen.So yes, like any exchange, Bitvavo can be hacked. Fortunately, they do everything they can to minimize losses in such an event.Cold wallets

You can store crypto coins such as Bitcoins and Ethereum in both cold wallets and hot wallets. Cold wallets are not connected to the internet, so they cannot be hacked easily. Most of the cryptocurrencies managed by Bitvavo are therefore stored offline and in secure locations, which is a lot safer.Only the part needed for active trading is stored on a hot wallet. These wallets are connected to the internet, which guarantees that the funds are quickly accessible. Bitvavo uses complicated models on a daily basis to calculate how many cryptos will likely be traded. In the unlikely event that more crypto are needed, they move cryptos from the cold wallets to the hot wallets. When this happens, someone has to physically move and connect the cryptos in a well-secured vault.Because Bitvavo has such strict security protocols, you can rest assured that your funds are managed reliably.Custody providers

Bitvavo uses multiple custody providers to manage the cryptocurrencies: these are parties that store most of the digital currency in cold wallets.A big advantage of this is that the assets are insured up to an amount of €250 million. In the unlikely event that something does go wrong, at least not all the money is gone. Multiple signatures are also required for transactions, so a lone wolf cannot suddenly empty Bitvavo’s entire vault.Headquarters located in the Netherlands

It is also good to know that Bitvavo’s head office is located in the Netherlands. If you want to, you can visit the Bitvavo office at Herengracht 450 in Amsterdam. They rent several mansions there, which they need to accommodate their rapid growth.Since they operate from Amsterdam, they must also comply with the AVG (General Data Protection Regulation) which is active in the EU. Therefore, your private data cannot be sold or shared with another party.Bitvavo also adheres to the fifth anti-money laundering guideline (AMLD5) is a positive sign for the trustworthiness of Bitvavo. Bitvavo also possesses all the necessary licences: for example, they are supervised by the Dutch bank.What happens if Bitvavo goes bankrupt?

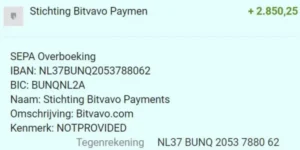

Bitvavo is doing very well: cryptos are more popular than ever, and the chances of the company going bankrupt are not very high. However, it is good to know that in case of bankruptcy, you won’t suddenly lose all your cryptos.This seems to be settled; if Bitvavo goes bankrupt, nothing will happen to your money. Bitvavo has set up the Bitvavo Payments Foundation to safeguard user funds in case of bankruptcy. As you can see, Bitvavo is doing well: they serve many customers all over Europe!

As you can see, Bitvavo is doing well: they serve many customers all over Europe!Improve your account security

Even though Bitvavo is completely reliable, there is still the risk of individual hacks. Therefore, it is recommended to apply the following steps to secure & protect your account:Enable two-factor authentication (2FA)

By applying two-factor authentication (2FA), you make it a lot harder for hackers to steal your cryptos. Within Bitvavo, you can easily set up 2FA. After you set up 2FA, you receive an access code via your phone.Device and IP management

I travel a lot, so I often notice they use IP and location-based account protection. Bitvavo increases security by keeping track of where you often log in from. When you log in with a new device or from a new IP address, you have to confirm this by email. This prevents a smart hacker abroad from quickly withdrawing your funds.Antiphishing protection

Phishing is a type of scam where a criminal tries to fool you into believing that the email is from Bitvavo when it is not. If you click on the link and provide your details, they know how to log in.Within the settings of Bitvavo, you can set a unique code with which the official mails from Bitvavo will be signed. This allows you to confirm that the emails are sent by Bitvavo and not a third party.Protection against withdrawal of funds

In the unlikely event that a third-party gains access to your account, they cannot simply steal your funds. The bank account number where you send the money must be in your name. If you want to change this, you need to contact Bitvavo directly.If despite all measures, something goes wrong, Bitvavo has a dedicated team to assist you in case of fraud.Does Bitvavo experience downtime?

Of course, a website can never be 100% protected against downtime. However, Bitvavo does everything they can to minimize downtime.They want to guarantee reliable and uninterrupted access by hosting their systems in zones. If one zone fails due to an outage, traffic is diverted to a backup server.Conclusion: is Bitvavo reliable?

Yes, Bitvavo is absolutely reliable! Of all the crypto exchanges I have tested, I have the best feeling about Bitvavo. This is because the exchange is based in The Netherlands, and they clearly do everything to protect their assets as much as possible.However, when you invest large amounts of money, it can be wise to store your crypto’s in a cold wallet yourself. This way, you will keep full control over your cryptocurrencies.Do you want to read more about Bitvavo?

- In the Bitvavo review you can read everything about this crypto exchange

- In the Bitvavo manual we teach you everything you need to know about crypto investing

What are the advantages of Bitvavo?

Are you considering buying bitcoins and other cryptocurrencies at Bitvavo? In this article we will discuss the biggest advantages of Bitvavo’s trading platform. Are you also curious about the disadvantages of Bitvavo? Then read this article.Don’t have an account with Bitvavo yet? Open an account now for free & pay no transaction fees on your first €1000 of transactions:Advantage 1: low transaction fees

A big advantage of buying & selling Bitcoins and other cryptocurrencies at Bitvavo is the low transaction fees. At Bitvavo, you will never pay more than 0.25% in fees, and this percentage can go down even more when you trade high volumes.Are you curious about Bitvavo’s fee structure? Then read this article & discover how the fee structure at Bitvavo works.Advantage 2: trade from as little as 5 euros

Cryptos are accessible to everyone at Bitvavo. It is possible to buy bitcoins for an amount of €5. This allows you to buy cryptos periodically (e.g. every month) for a small amount.Advantage 3: reliable exchange

Bitvavo does everything in their power to keep your crypto assets safe. For example, Bitvavo’s wallets are insured up to an amount of 255 million euros. Because you are trading with a Dutch company that is registered with the Dutch bank, you can be sure that the company has to meet strict requirements. In our article about the reliability of Bitvavo we will discuss this in more details.Advantage 4: usability

Another major advantage of Bitvavo is the user-friendliness of the platform. Some crypto exchanges make the buying and selling of bitcoins unnecessarily complicated. At Bitvavo, you can actually buy bitcoins with just a few clicks.

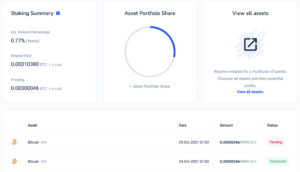

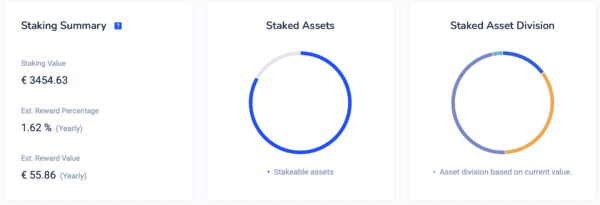

Advantage 5: earning money with staking

Another advantage of Bitvavo is that it allows you to earn money by staking. With staking you periodically receive interest over your cryptos. At Bitvavo, this staking can yield up to 10.Advantage 6: professional support

Another advantage of Bitvavo is their reachability. You can reach the support team of Bitvavo by means of their live chat and email. Their support is available in multiple languages such as English, Dutch, French and German.Do you want to read more about Bitvavo?

In this Bitvavo review, you can read everything you need to know about trading cryptos with Bitvavo. You can also read the Bitvavo manual: there, we discuss in detail how buying & selling cryptos works.What are the disadvantages of Bitvavo?

Although the Bitvavo exchange has many advantages, there are also a few disadvantages. In this article, we will discuss the biggest disadvantages of trading in cryptos at Bitvavo.Disadvantage 1: limited possibilities

A major advantage of Bitvavo is the user-friendliness of the platform. On the other hand, the number of possibilities is more limited in comparison with, for example, Binance. At Bitvavo, you cannot trade in leveraged products or speculate on decreasing prices.The advanced trader does offer more possibilities for the active trader. However, people who are professionally involved in trading are better off choosing Binance. Click here to open an account with this crypto exchange.Disadvantage 2: it is hard to get an overview of your results

At Bitvavo, you can monitor the development of your portfolio and your purchases and sales per crypto. However, it is not possible to track your total profit or loss in one clear overview.Therefore, when using Bitvavo, you need to keep track of your results in a smart way. When you don’t do this, it is easy to lose track.

You can see your purchases and sales at Bitvavo, but not your results in a clear overview

Disadvantage 3: limited supply of cryptos