Investing with high returns

Of course, we only invest with one goal in mind: achieving the highest possible return. But how can you actually achieve the highest possible return on your savings? In this article we discuss which investment methods you can use to achieve the highest return.

How can you achieve a high return from investing?

You can certainly achieve a high return with investments. However, return and risk are inextricably linked: a higher return therefore entails a higher risk. We start the article by discussing the investment products & strategies with which you can achieve a very high return. Determine for yourself whether you can bear the risks of losing money.

Many people are convinced that investing in shares involves a lot of risk. This picture has arisen because some investors have lost savings in the past by trading on the stock market. However, if you apply a good strategy, you can achieve a high return on stock investments in the long term.

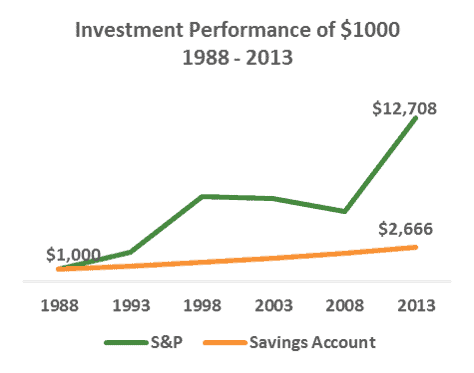

Over the last 80 years, statistics have shown that investing in shares gives a higher return than all other forms of investment. However, many novice investors are impatient and hope to make large profits within one or two years. However, this is a very unrealistic expectation: it is therefore important to invest in shares with patience.

Shares usually perform better than savings

Shares usually perform better than savings

You can achieve a high return with shares by betting on price gains. If this is the plan, it is important to spread your chances. Patience is a virtue, as the stock market will not always move up.

It is also possible to achieve a good return with shares that pay out a high dividend. Some stocks pay out several percent in dividends a year. When you buy a stable dividend stock in an all-time low you obtain a fixed high return on a monthly basis!

If you really want to achieve an extremely high return, you can invest in more exotic stocks. Growth stocks in start-ups can sometimes increase in value by tens or even hundreds of percents. There is a chance that the company will go bankrupt, as a result of which you will lose the entire investment. It is therefore important to investigate the company behind the share well.

You can also achieve a high return on shares by investing in penny stocks. Penny stocks are shares worth a few cents: this allows the smallest price fluctuations to yield a 100% return. When you invest in these types of risky shares, you are also more likely to lose your investment.

A high return with trading in CFDs

With CFDs, you can speculate on short-term price fluctuations on, for example, shares and currency pairs. In the short term, the prices of shares move strongly up and down: by reacting smartly to this, you can achieve a positive return under all market conditions.

What makes CFDs unique is the leverage effect: by applying leverage you can achieve a higher return in the short term. The risk is also higher with CFDs, which makes it important to apply a stop loss order.

With a stop loss order, your position is automatically closed in the event of a certain loss. This protects you against possible losses and allows you to achieve a good investment result with CFDs.

Investing in exotic ETFs

ETFs or index funds are better known for their stable returns rather than their high returns. With an index fund, you can automatically invest in a basket of shares: most people use this way of investing to track an index like the FTSE. However, ETFs also allow you to achieve a high return, at least if you are prepared to take a higher risk.

There are ETFs on more risky investment products: think for example of an ETF on cryptocurrencies or an ETF on cannabis stocks. An advantage of using an ETF is that even with these types of risky products, you still apply some diversification: this reduces the chance of losing all your money at once when a company goes bankrupt.

Do you want to invest in ETFs yourself? A good broker for investing in ETF’s is DEGIRO. At DEGIRO you do not pay transaction costs when you buy funds from the core selection. This allows you to achieve a higher return without taking bigger risks. Use the button below to open an account with DEGIRO:

Investing in high-yield bonds

High-interest rate bonds are issued by companies with a weak financial position. These bonds are popularly known as junk bonds. The interest rate on these bonds is often high: 7-9% is not uncommon. The party releasing the bonds has to pay a higher interest to attract investors. However, there is a chance that the company behind the bond will go bankrupt, as a result of which you could lose the full amount of your investment.

If you still want to achieve a higher return with bonds, but prefer not to buy bonds yourself, then you can also choose to invest in an ETF that buys bonds with a high-interest rate.

Speculate in options

You can also achieve a high return with options. With an option, you buy the possibility, but not the obligation, to buy a certain security at a certain price. For example, you can buy an option for $2 that allows you to buy a certain share for $10. If the share price subsequently rises to $12 or more, you can achieve a positive return.

When the price moves in the right direction, you can achieve an enormous return: at a share price of only €14, your return is already 100% on your initial investment of $2 per option. At the same time, you can also lose your entire investment with options. Options expire at a certain moment and when the option is worthless at the end of the term, you lose the full deposit.

You can further increase your return on your existing investments by issuing options. You will receive a premium for writing an option. If you make the wrong decisions, you can also lose a great deal of money by writing options. Would you like to know how you can achieve a high return by investing in options? Then read our guide on investing in options:

Investing in real estate

You can also achieve a high return with investments in real estate. Of course, you can buy shares in companies that are active in the real estate sector. There are also many real estate funds with which you can, for example, co-finance a large office building. When investing in real estate, it is important to carefully analyse the underlying party: if the company behind the project is not reliable, you can simply lose the full amount of your investment.

Do you have a little more capital of your own? In that case, you can also achieve a high return by buying a property yourself. For example, a while ago I bought a small flat in Amsterdam than I am renting out now. The great thing about this construction is that you only have to put in a small part of the money yourself which allows you to benefit from a leverage. Over my deposit of €50,000 I receive €18,000 annually in rental income.

However, you do need to pay close attention when investing in real estate yourself. After all, you are taking on debt and if you select the wrong property, you can lose everything. Would you like to know more about investing in real estate? Read our guide on the different investment methods you can use:

Investing in cryptocurrencies

Another way in which you can achieve a very high yield is by investing in cryptocurrencies. Some people actively trade the price of crypto’s: one day a cryptocurrency like the Bitcoin can go up or down by as much as ten percent. If you keep a close eye on the market you can achieve a high daily return.

When the price of a promising crypto is at a low point, it may also be wise to buy it for the long term. After 2018, for example, cryptocurrencies decreased sharply in value: at the low point you could buy a Bitcoin for around $4000. Two years later, in 2020, the price reached yet another new record which would have allowed you to achieve a return of almost 500% in two years.

Before investing in cryptocurrencies, it is important to remember that they are highly speculative & new investment products. It is therefore uncertain which currency will be widely used in the future. Cryptocurrency investments are therefore only suitable for people with a high-risk appetite.

Investing in loans

Nowadays, there are also platforms where you can invest in loans. This way of investing money is also called P2P borrowing. People or companies that need money can take out a loan on the site. On many platforms, the loans are merged, so you can reduce the risk a little. However, these types of P2P loans are very volatile and there are plenty of stories of platforms that did not pay out in the end. That’s why it’s important to be careful when you lend money to others.

Investing in an IPO

An IPO or initial public offering is the introduction of a new company to the stock market. By buying shares during an IPO, you can achieve a very high return. This is certainly the case with promising (technology) shares.

I can still remember how I believed Facebook was overvalued during the IPO in 2012. In the short term, I was right: the price halved fairly quickly. In the meantime, however, the price has risen to ten times its value. In 8 years you could have achieved a return of about 1000%.

Of course, you have to be careful with an IPO: not every IPO is equally successful. You often see that new shares are introduced to the stock exchange relatively cheaply. Companies want to prevent shares from collapsing on the first trading day. That is why it is certainly worth investigating whether any interesting IPOs are coming up.

Investing in start-ups

Another way to achieve a high return is by investing in start-ups. You can find all kinds of websites on the internet where you can invest in a start-up. This strategy is a bit of a hit & miss: when you invest in a mediocre start-up you lose everything, while when you select the right company you can achieve an enormous return. Companies like Facebook and Microsoft were once small start-ups that were run from a garage.

It is even better to invest money in your own business. When you have a good idea, and you can turn it into a good plan, you can make a lot of money with it. However, entrepreneurship is not for everyone, but the theoretical return on an investment in your own company is unlimited.

Your money in a high-yield savings account

If you ask me, it is in any case unwise to park too much money in a savings account. Savings interest rates are low and inflation and taxes are only reducing your assets in a savings account. Some people therefore choose to put their money in a high-yield savings account.

With some foreign savings accounts you still receive one or two percent interest. However, it is important to examine the risks carefully: for example, research what happens when the bank collapses. Also pay attention to the currency used for the bank account: if you use the account in another currency, you also run a currency risk.

Storing money abroad produces a slightly higher return, but the risks are also much higher. If you are planning to take higher risks anyway, it is better to go for an option with which you can achieve a higher return.

Currency trading

You can also achieve a high return by trading currencies or Forex. Currencies such as the euro, dollar and pound sterling fluctuate constantly in value. You can exchange one currency into another via an online broker. If you do this right, you can make a profit because the currency you buy increases in value.

Currency trading is normally done via derivatives. As a result, you do not have to exchange your money yourself at the bank. By actively analysing the markets, you can then predict whether a currency will rise in value in the next few hours. Investing in Forex is especially suitable for the active investor who does not mind spending time learning a new skill.

Do you want to know how investing in currencies works? In our comprehensive guide, we discuss how you can invest in Forex yourself:

High-risk alternative investments

Nowadays, you can invest in anything and everything: by investing smartly in collectibles such as art, wine and antiques you can achieve a high return. For this type of alternative investment you often need specialized knowledge (or luck).

You sometimes read a story in the newspaper about someone who knows how to buy a Picasso for a tenner. An inspiration, but also exceptional. After all, you don’t read in the newspaper about all the people who buy worthless paintings every day. If you want to get rich by a stroke of luck you can also try the local lottery.

How do you determine your own risk tolerance?

Before investing in a high-risk investment product, it is important to first determine your risk tolerance. Only when you won’t lose sleep over your investments, is it worth investing for a high return.

Do you have a hard time when losing money? In that case, it is better to opt for a more stable and safe method of investing. Think, for example, of shares in stable companies or ETFs that follow a well-known index. Never start investing before you have a good plan.

How do you maximize your returns?

It is always wise to quantify your risks as much as possible. Determine what (temporary) loss you can live with. In this way you can determine the maximum risk you are willing to take.

In the long term, the more aggressive, offensive investment products are often more profitable. However, you do need sufficient time, as you can also make a much higher loss in the short term. Therefore, determine what percentage of your investments you can put into risky products; in this way, you optimize the maximum achievable return.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.