How to invest in the AEX (2024)?

The AEX of Amsterdam Exchange Index is the largest Dutch stock market index. The index contains stocks from the 25 largest Dutch companies. The AEX is often used as a benchmark for the economic situation in the Netherlands. But how is the AEX composed and how can you invest in the AEX yourself?

How to invest in the AEX?

It is possible to invest in the AEX yourself. There are several ways in which you can invest in the AEX. These methods are briefly discussed below.

Invest in the AEX by tracking the index

If you want to invest in the entire AEX at once, you can buy an ETF. An ETF tries to closely track the price of an index. The fund often does this by buying the shares that are included in the index with investors’ money.

A big advantage of investing in the AEX through an ETF is that you often pay low fees. The transaction costs at the various brokers are low, as are the management fees. In the table below, you can see which brokers are the best fit for investing in the AEX:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 80% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

You can invest in the AEX with the following ETFs:

- iShares AEX UCITS ETF: 0.3% in annual costs

- VanEck Vectors AEX UCITS: 0.3% in annual costs

- VanEck Vectors AEX UCITS: 0.3% in annual costs

As you can see, the annual fees are very reasonable: you can therefore invest well in the average return of the AEX with these ETFs.

Buy individual AEX stocks

It is also possible to buy the individual AEX shares. You can choose to mainly buy the stocks with the heaviest weight. This way, the results of your investments are almost the same as the results of the AEX index. However, this way you retain more flexibility, as you can easily exit the position.

When you want to track the AEX by buying stocks, it is important to choose a broker with low transaction costs. Click here to compare the best brokers with each other.

Using options on the AEX

If you don’t mind taking bigger risks, you can choose to invest in options on the AEX. With options, you buy the right (but not the obligation) to buy (call option) or sell (put option) the AEX at a certain price. Do you want to know exactly how investing in options works? Then read our options investing guide:

Active trading on the AEX

You can also actively speculate on the price movements of the AEX. You do this by using a derivative such as a CFD. With a CFD, you can speculate on both rising and falling prices, allowing you to respond to changing market conditions. You do need some experience to be successful with active speculation. Do you want to try the possibilities? Then open a free demo:

Guide: Step-by-Step Plan for Investing in the AEX

When you want to invest in the AEX, it is important to have a good plan in place. Many people choose to invest in the AEX because it gives them a sense of security. When you invest in the AEX, you don’t have to think about your investments.

Step 1: Determine your available funds

First, determine how much money you can afford to invest at the end of each month. You should only invest money that you can afford to lose in the long term: this increases the chances of a positive result.

Step 2: Choose a broker

Compare the different brokers available and select a reliable one. It is wise to compare the costs of different brokers with each other. If you choose a broker with low transaction fees, you can ultimately achieve a much higher return.

Step 3: Determine your goal

Write down your investment goal. Do you, for example, want to save a certain amount for your retirement or do you save for a world trip? By determining what your goal is and what your time horizon is, you can decide whether this is realistic. You can use our tool to calculate the return you can achieve over a longer period of time.

Guide: buy and sell AEX Stocks

When you are ready to buy your first AEX share or ETF, you can log in to your broker account. You can then quickly find the stock you want to invest in by using the search function.

Within the order screen, you must provide at least the following information:

- Quantity: how many shares do you want to buy?

- Day order / continuous: do you want the order to remain or be closed after a day?

- Market order / limit order: do you want the order to be executed immediately or only at a certain price?

When you press “place order,” your order will be sent to the exchange immediately. Your AEX shares will then be bought or sold at the specified price.

What is the AEX?

The AEX, or Amsterdam Exchange Index, is the most well-known and important Dutch stock market index. The index reflects the price development of the 25 stocks with the largest market capitalization. The value of the index is calculated by taking the weighted average of the stocks.

What are the Benefits of Investing in the AEX?

- Diversification: by investing in the AEX, you invest in the 25 largest companies in the Netherlands all at once.

- Stable return: the average return on index investing is typically high due to the principle of compound interest. If you have enough time, your investments can increase in value significantly.

- Low effort: investing in the AEX can be almost entirely passive. You only need to deposit a fixed amount every month, and the rest happens automatically.

- Low costs: costs can put pressure on the returns on your investments. Investing in the AEX with ETFs can be cheap: the service costs are around 0.3% annually!

- Transparent: when you invest in the AEX, you know exactly what you are investing in. This is more difficult when you invest in a fund than when you invest in 1000+ different companies.

What are the disadvantages of investing in the AEX?

- No control: when you invest in the AEX, you have no influence over which stocks you buy or sell. The index determines what you invest in.

- No extremely high returns: when you speculate on your own, you can make a big profit. Investing in the AEX mainly yields an average return.

- Loss: just like with any other form of investment, you can also lose money with the AEX when stock prices fall.

- Weight: because there are only 25 companies in the AEX, a small group of companies determines most of the price development.

- Limited diversification: the diversification of the AEX may be disappointing: you invest in a handful of sectors with a focus on the Dutch region.

How is the AEX composed?

The AEX contains the 25 Dutch companies with the highest market capitalization. However, not every company has the same weight: the weight of a company is determined by the market capitalization of individual shares. Market capitalization consists of the number of shares multiplied by the value of an individual share. One stock may not have a higher weight than 15%, and the index is revalued every year.

Certain companies are quite dominant within the AEX. Think, for example, of Royal Dutch Shell, Unilever, and ASML, which together account for more than 40% of the index’s weight. When investing in the AEX, it is important to keep an eye on the shares with a strong weight.

Where can you invest in the AEX?

Investing in the AEX is accessible to everyone. At most brokers, the AEX is simply tradable as a contract, which allows you to speculate on both rising and falling AEX prices. If the price rises, you can buy the fund, and if you think the AEX price will decline, you can choose to go short.

If you want to know which brokers offer the most advantageous AEX investment opportunities, take a look at our overview of the best brokers:

How is the AEX calculated?

Before investing in the AEX, it is important to understand how the index is calculated. The AEX consists of the 25 stocks with the highest trading volume: this volume is calculated by multiplying the average stock price by the traded volume.

The weighting is then determined by looking at market capitalization. Only the free float shares, which are the freely tradable shares, are taken into account. No single company can have a weighting of more than 15% to prevent any one stock from having too much influence on the index price.

The index is recalculated twice a year: if a different company has earned a spot in the index, it will replace another company. With each revision, the weighting factor is re-determined, which means the value of the index should not change. The index is 1/100th of the value of the basket of shares in euros.

During a recalculation, funds that track the AEX often have to sell and buy certain stocks. This often has an impact on the stock prices of these shares. As an investor, you can take advantage of these recalculations.

Criticism of the AEX index

The AEX is not infallible, and its importance is decreasing. In fact, the index is no longer an accurate benchmark of the Dutch economy. The distribution of funds within the index is quite uneven, and some companies in the index have little connection to the Netherlands. A good example of this is ArcelorMittal.

Due to the increasing international operations of the business world, there is a growing interest in international indices such as the Euro Stoxx 50. However, due to its name recognition, the AEX is still frequently mentioned in the news.

What other indexes are there in the Netherlands?

In addition to the AEX, the Netherlands also has the AMX and AScX indexes. The AMX Index (Amsterdam Midkap Index) contains the 25 mid-sized stocks that just miss out on the are to small for the AEX. The AScX Index (Amsterdam Small Cap Index) is the third index and contains numbers 51-75. These indexes may be more interesting if you want to invest in smaller companies.

Invest in AEX futures

It is also possible to invest in the AEX with a futures contract. An index future is always 200 times the size of the index. If the index is at 600 and rises to 610, your profit would be 10 x 200 = € 2000. As you can see, profits and losses can quickly add up with futures. Therefore, investing in AEX futures is only recommended if you have sufficient experience and funds.

AEX price fluctuations

Compared to, for example, the Dow Jones or S&P 500, the AEX is a relatively small index. As a result, the index can sometimes make lage jumps. Big parties can manipulate the price to some extent and at least temporarily push it up. This is often seen during lunchtime or 5 minutes after closing when professionals can still place orders.

It is also important to note that paid-out dividends are not included in the stock chart. The AEX price therefore drops when dividends are paid out, while the value of your investment result can still rise.

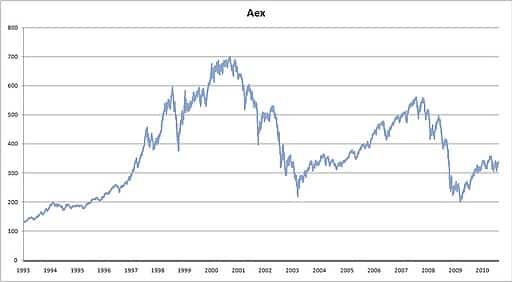

AEX price fluctuations between 1993 and 2010

The role of world news

The AEX price is mainly influenced by world news. Interestingly, news related to the Dutch economy has little influence on the AEX price fluctuations. This is because the large multinational companies included in the index mainly operate internationally. Many foreign parties also invest in the AEX index. Therefore, the price of the AEX typically moves along with the stock market development of the S&P 500.

The importance of a few companies

When investing in the AEX, it is important to remember that only a handful of companies really influence the price. Shell, ASM, and Unilever are so large that many other smaller funds only have a minimal impact on the AEX price. Therefore, pay close attention to the large parties within the index: they ultimately make the difference!

How to achieve better results with investments in the AEX?

You probably want to invest in the AEX to achieve good results! With these tips, you can ensure that you achieve the highest possible return on your investment in the AEX.

Analyze the index

The composition of the AEX index can change regularly. During the dot-com crisis, for example, the index consisted of many overvalued internet companies. At that time, if you bought an ETF on the AEX, you mainly invested in internet companies. Just before the credit crisis, things were very different: the index mainly consisted of banks.

Because the composition keeps changing, you are also investing in different sectors. Therefore, keep an eye on whether the index is still sufficiently diversified across different sectors.

Track the news

If you actively speculate on the trend of the index, it is important to keep an eye on world news. The largest Dutch companies are heavily dependent on economic developments worldwide. When the global economy is performing well, the AEX will likely also show good results.

Also consider other options

Buying an ETF on the AEX is certainly not a bad investment strategy. However, it is important to invest money in other markets as well. The AEX by itself does not offer enough diversification to achieve lasting stable results.

Buy Dutch stocks

Buying individual AEX stocks can be profitable, provided you select the best stocks. We have a special page on Trading.info with all the interesting Dutch stocks. Want to know how to invest in Dutch AEX stocks? Then visit our special:

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.