Investing in Bitcoins (2024): The Complete Guide for Beginners

Do you want to start investing in Bitcoins? In this beginner’s guide, we will teach you everything you need to know to make your first investment in Bitcoins. By following three simple steps, you can make your first investment right away.

Investing in Bitcoins in 3 steps

Step 1 – Choose a crypto exchange: At a crypto exchange, you can buy Bitcoins directly. You can buy Bitcoins with one of these reliable cypto exchanges:

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

Step 2 – Deposit money: You can deposit money directly with creditcard or bank transfer.

Step 3 – Buy Bitcoins: You can then exchange your money for Bitcoins.

How does investing in Bitcoins work?

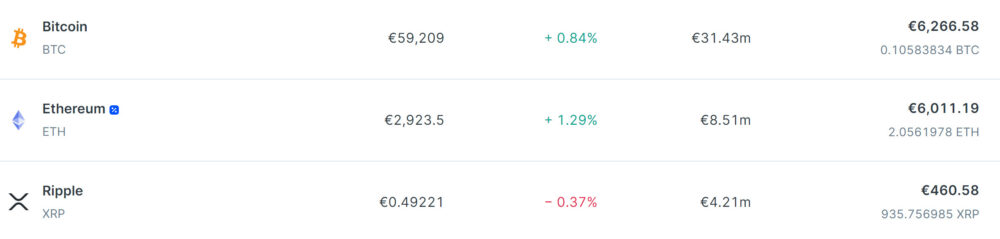

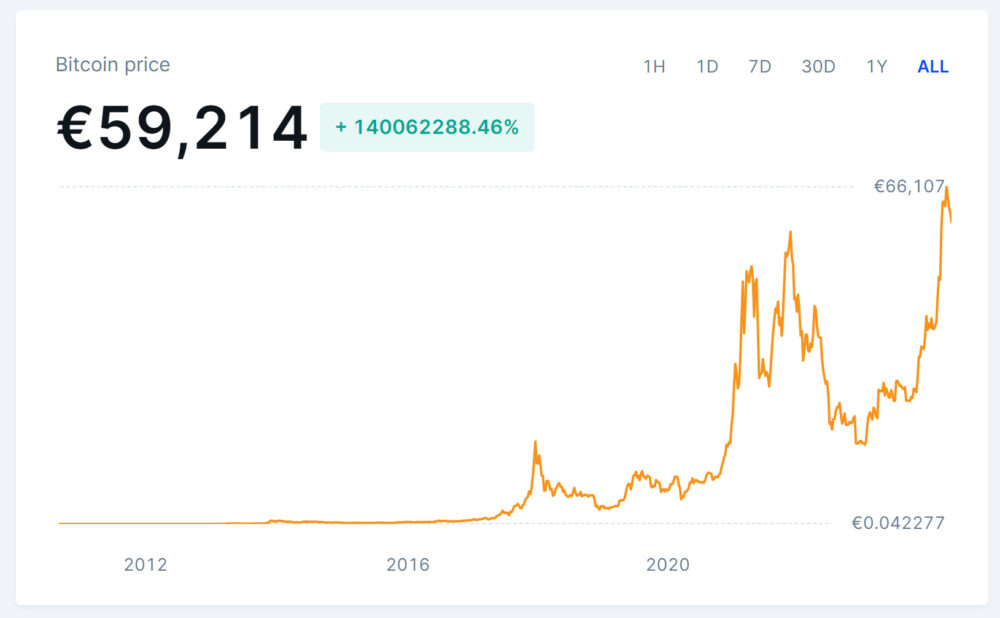

Bitcoins are extremely popular: thanks to Bitcoin, many people worldwide have become millionaires. If you had invested €100 at the launch of the cryptocurrency, you would have had over €600 million at the peak in 2024! There are still plenty of opportunities: an investment of €100 in 2020 increased to €1000 in 2021.

But what do you actually do when you invest in Bitcoins? When you buy Bitcoins, you invest in a digital cryptocurrency. Some people believe that Bitcoin is the currency of the future and that everyone will pay via the internet in the future.

Since there are fluctuations in the demand for Bitcoins, the price can move strongly. As an investor, you can take advantage of this: by buying and selling Bitcoin at the right time, you can achieve a positive return.

How to buy Bitcoin with a crypto exchange?

Especially as a beginner, it can be a bit complicated to open your first investment in Bitcoin. That’s why I’m happy to help you get started with this guide. To open an account, you only need to leave your email address and password at first.

After you have opened an account, you still need to deposit money into your account. Fortunately, this is very easy: you can add money to your account with, for example, bank transfer or your credit card.

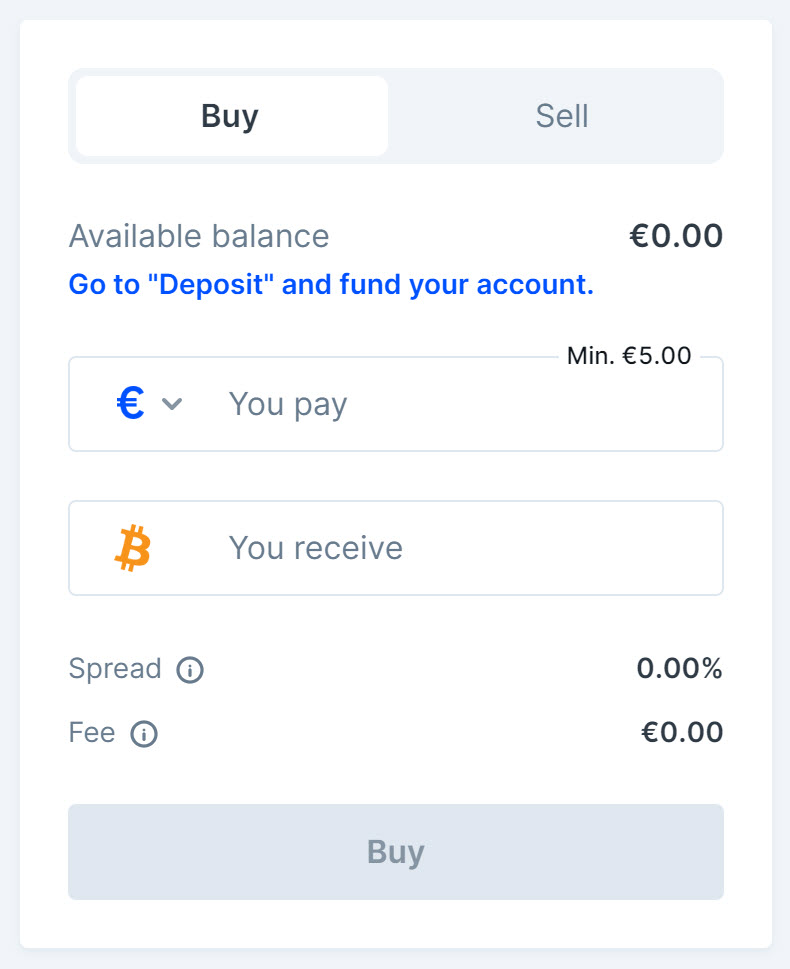

After you added money, you can open your first investment. Navigate to Bitcoin for this and press the cryptocurrency to open the order screen directly.

Within the order screen, you can then indicate for what amount you want to buy bitcoins. Fortunately, you can also buy bitcoins for very small amounts of money: for example, you can add 1/1000th of a Bitcoin to your account.

Example of buying Bitcoin with Bitvavo, the process is similari with other crypto exchanges.

Then press the buy button to add the Bitcoins to your account. Within a few seconds, you can then find the Bitcoins in your account. When you think that Bitcoin will no longer rise, you can sell them by pressing sell instead of buy.

Do you want to withdraw the money from your investment account? Fortunately, you can do this at any time! After selling the Bitcoins, you can withdraw the money into your bank account.

What is the best strategy to start with Bitcoin?

As an investor, you can choose from different investment strategies. Not every strategy is equally suitable for every investor. Some investors prefer a hold strategy: you hold onto the Bitcoin for a longer period of time. Do you enjoy actively following the news around Bitcoin? Then you can consider active speculation.

Why invest in Bitcoin?

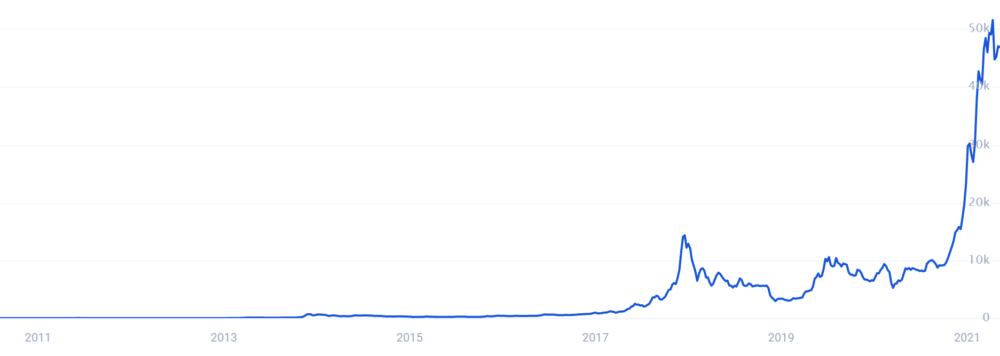

Of course, many people invest in Bitcoin because they hope to get rich. The return on Bitcoin can indeed be enormous. In the chart below, for example, you can see how the price of Bitcoin increased by more than ten times in one year in 2020-2021, which translates to a return of 1000%! When you consider that the average return on stocks and ETFs is only 8 percent, this is of course a great result.

At the same time, this is of course not always the case: for example, below you can see how the price of Bitcoin dropped enormously after the peak in 2018. If you enter at the wrong time, you can also incur a substantial loss. Fortunantly, after this a new peak was reached in 2024!

However, there are also other reasons to invest in Bitcoin: for example, many people have a lot of confidence in the future of the cryptocurrency. If these high expectations are met and more and more companies accept Bitcoin as a means of payment, the price of the cryptocurrency can further rise. Are you curious whether you too can become rich by investing in Bitcoin? Then read this article.

What are the advantages of investing in Bitcoin?

- Dominant position: Bitcoin is the first successful cryptocurrency.

- High potential return: a return of 1000% was achieved in the period 2020-2021.

- Privacy: Bitcoins offer more privacy than regular currencies.

- Control: there is no central party that can influence Bitcoin.

- Volatility: Bitcoin prices moves strongly, allowing you to trade actively.

- Long-term return: the return has been very high in the long term.

- Revolution: Bitcoin is a revolutionary technology that is still in its infancy.

What are the disadvantages of Bitcoins?

- Volatility: buying at the wrong time can lead to significant losses.

- Political situation: politics do not always embrace Bitcoin.

- Sustainability: Bitcoin consumes a lot of energy and is not sustainable.

- Scalability: Bitcoin can only handle a limited number of transactions per second.

- Centralized power: a few large Bitcoin holders dominate the price trend.

- Hacks: hackers can jeopardize the future of Bitcoin.

- No gold: Bitcoin is not stable enough to replace gold.

- No underlying value: it is nothing more than code.

- Complex: Bitcoin is difficult for many people to understand.

If you want to read more about the disadvantages and risks of investing in Bitcoins, then read the article the disadvantages of Bitcoins.

How to invest in Bitcoins safely?

Bitcoins do not have the reputation of being a safe payment method. By taking the necessary precautions, you can avoid losing a significant amount of money when trading Bitcoins:

- Reliable party: only use reliable crypto exchanges.

- Diversify: spread your investments over time and over different cryptocurrencies.

- Secure your account: use 2FA security.

- Offline wallet: store your Bitcoins offline and keep hackers out.

- Scams: always watch out for scammers.

If you want to invest safely in Bitcoins, read the following articles and discover how to prevent losing money to scams:

How can I invest in Bitcoin without owning the coin?

Do you want to invest in the Bitcoin price trend without owning the coin yourself? That is also possible! Below, we briefly discuss the possibilities.

Option 1: speculating with CFDs

By using CFDs, you can actively speculate on the Bitcoin price trend. A CFD is a derivative product, which means that you never own the Bitcoin itself. Instead, you speculate on price increases and decreases of the cryptocurrency.

The great thing about CFDs is that you can also speculate on falling Bitcoin prices. In addition, with leverage, you can take a larger position with a small amount of money. Do you want to try speculating in Bitcoins for free with a demo? Then take a look at the best crypto exchange demos:

Option 2: Investing in Bitcoin Stocks

A major disadvantage of investing in Bitcoins is that there is no underlying value. By investing in companies that are involved with Bitcoin, you can benefit from the profits generated by these activities. Examples of these companies include those involved in Bitcoin mining, crypto exchanges, or producers of hardware used for Bitcoin mining. If you want to learn more about Bitcoin stocks, read our special:

Option 3: Invest in Bitcoin Futures

With Bitcoin futures, you can speculate on the price of Bitcoin without actually owning it. Futures are risky investment products that can sometimes result in losses greater than your initial investment. Therefore, futures are not recommended for novice crypto investors.

Option 4: Invest in Bitcoin ETFs

An ETF is a fund that automatically tracks the price of an underlying security. By purchasing a participation in a Bitcoin ETF, you can track the price of Bitcoin without owning it yourself. One advantage of this is that you do not have to worry about the security of your account. One disadvantage is that you often pay management fees.

When is the best time to invest in Bitcoin?

The best time to buy Bitcoins was in hindsight, at the launch. Unfortunately, many people did not yet see the potential of the crypto currency at that time: there is even someone who bought a pizza with 10,000 Bitcoins!

You can never be sure beforehand what the best time is to invest in Bitcoins. It is recommended, however, not to blindly follow the crowd: when even the mailman buys Bitcoins, you may want to wait a bit.

What is Bitcoin?

Bitcoin and blockchain are often believed to be the same, yet they are very different. The Bitcoin is a cryptocurrency that uses blockchain. Bitcoin is completely digital and decentralized, which makes it difficult for other parties to influence its value.

What is Blockchain?

This currency operates on blockchain technology. This means that the data containing all transactions is distributed across thousands of computers. These computers then verify and process the transactions.

Is it wise to invest in Bitcoins now?

All in all, bitcoins are a very interesting but also speculative investment opportunity. It can be fun to play with these types of financial instruments, but we do not recommend putting too much money into trading bitcoins. For example, I invest a maximum of 1% of my wealth in cryptocurrencies such as Bitcoin. Of course, I only invest with money that I can really afford to lose.

Because don’t forget: cryptos are extremely speculative and you can lose your entire investment. Therefore, only invest in Bitcoins and other cryptocurrencies with money that you can really afford to lose.

Frequently asked questions about Bitcoin

In this final part of the article, we will discuss some frequently asked questions about investing in Bitcoins.

Investing in Bitcoins is never 100% safe. You can always lose a large part of your investment due to fluctuating prices. You should also be careful of hackers and scammers. When you choose a reliable party, you reduce the chance of losing money with your investments in Bitcoins. Read more here >>

You can invest in Bitcoins at an online crypto exchange. A crypto exchange makes it easy to buy and sell Bitcoins.

Investing in Bitcoin is not without risk. Hackers are always lurking and trying to steal your Bitcoins and other cryptocurrencies. The price is also extremely volatile, so you can lose a lot of money in a short time. Discover in this article what the biggest risks are of investing in Bitcoins and learn how to prevent them as much as possible.

Bitcoin is scarce: there will never be more than 21 million Bitcoins on the market. If there continues to be demand, the price can rise significantly. After all, the supply is limited. However, there is certainly a chance that other cryptocurrencies will take over from Bitcoin.

New Bitcoins are brought to market through mining. Transactions on the network must be approved and this process requires a lot of computing power. Miners receive Bitcoins as a reward for this process.

The price of Bitcoin can fall to 0 when no one wants to own the cryptocurrency. Given Bitcoin’s dominant position, this is unlikely to happen. However, the cryptocurrency can drop significantly in value when trust in Bitcoin decreases. Read more here >>

Even in the year 2140, the last Bitcoin will be mined. Fortunately, this does not mean that the network will collapse afterwards: miners will then still earn their money by calculating transaction fees. In 2140, the Bitcoin price could have risen significantly, which would make it still lucrative enough for miners to continue working.

You can certainly become rich by investing in Bitcoins. However, for every Bitcoin millionaire, there are hundreds of stories of novice investors who have lost a lot of savings by investing in Bitcoins. Therefore, make sure to study how investing in Bitcoins works and create a plan. Restrain yourself and don’t blindly invest all your savings at once: that is a guaranteed recipe for disaster!

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.