How to buy Netflix shares (2024)? – invest in Netflix stocks

Do you want to know how to buy Netflix shares? Netflix is the largest paid provider of movies and series, with over 230 million users. In this article, you can read if it is wise to invest in Netflix stocks.

Are you wondering where to buy Netflix stocks? You need to open an account with a reliable broker to buy & sell Netflix shares:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Netflix without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Netflix! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Netflix with a free demo! |

What is the Netflix stock price?

Below, you can see the current stock price of Netflix. You can also use the buttons to open a new position on the stock.

Netflix Company Information

Below, you can see the most important company information of Netflix.

Netflix stock Analysis

Before deciding whether to buy or sell Netflix stocks, it is essential to analyse the stock first. In the overview below, you can see how Netflix has developed over the past period.

Stock prices of the last 5 days

In the table below, you can see the stock prices of Netflix for the last 5 days:

Why is the Netflix stock price plummeting?

In 2023, the stock price of Netflix has dropped significantly, by more than 60%! This is despite the fact that the stock performed very well during the pandemic. But why is the Netflix stock performing so poorly now, and can this improve in the future?

Reason 1: Uncertainty

Investors are now very fearful. High inflation and the war in Ukraine make many investors prefer to sell their stocks. This uncertainty also has a strong influence on the Netflix stock price. Interest rates have a significant impact on growth stocks like Netflix.

Reason 2: Decreasing user numbers

Netflix has lost users for the first time since its inception. Meanwhile, you can see that competition is growing. The company has lost many users in America, where it recently raised prices. Netflix also lost users in Europe, but this is mainly due to the loss of Russian subscribers.

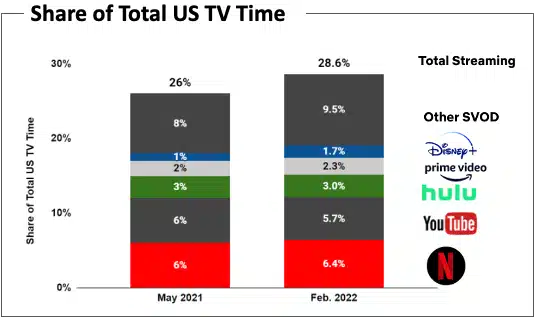

Market share of Netflix in America

Is it wise to buy Netflix stocks now?

The stock price of Netflix has dropped significantly. However, Netflix is not standing and has a plan to attract new users.

Plan 1: cracking down on account sharing

An estimated 100 million households are still using Netflix for free by sharing their accounts. This causes Netflix to miss out on a lot of revenue. The company is considering banning this practice or charging extra for it. If this does not lead to a mass loss of subscribers, the company can increase its revenue by cracking down on account sharing.

Plan 2: launch advertisements

Netflix is also considering launching a cheaper subscription plan with ads. This allows the company to attract a group of people with a smaller budget.

Plan 3: unique content

Netflix wants to further improve its service level and release even more quality content. If Netflix manages to release more popular series and movies, it can attract new members.

What do you think; are these measures enough to make buying Netflix stocks attractive again?

Reason 1: many users & market leader

Netflix can be an appealing investment. Currently, the company has over 200,000,000 paying customers spread across 190 countries. The company is exploring the possibility of entering the Chinese market. Within the Chinese market, there are now over 500,000,000 people using streaming services. If Netflix manages to become active in this market, it can greatly increase profitability.

Reason 2: strong bargaining position

Because Netflix has many users, the company can negotiate well with studios. This allows them to make good deals that can contribute to the profitability of the company.

Reason 3: strong content

Netflix has an extensive library of content that users can’t get enough of. The company is also good at releasing its own unique content. A good example of this is the successful Squid Games, which was watched for a whopping 1.65 billion hours!

With increasing competition, it will become increasingly important to create unique and attractive content. Netflix seems to be able to distinguish itself well with its Netflix Originals.

Reason 4: international presence

Netflix is active in many countries, which makes it possible to offset poor performance in one region by good performance in another region.

What are the risks of investing in Netflix stocks?

Risk 1: competition

However, there are also risks associated with investing in Netflix stocks. The biggest risk to Netflix’s survival is competition. In the past period, many similar services have been launched.

Amazon, Disney, and Apple have also launched their own streaming programs. Netflix will constantly have to fight for the best content. If they can no longer do this, there is a good chance that users will switch to another platform.

Risk 2: piracy

Piracy is also a risk to Netflix’s survival. Precisely because so many steaming services have been added, you can see that Netflix no longer always succeeds in buying the rights to new productions. People are then forced to subscribe to multiple services to watch all the new movies. If Netflix becomes less user-friendly than illegal alternatives, this could lead to a decrease in the number of customers for Netflix.

Risk 3: unique productions are expensive

The unique productions that Netflix produces are costly. In 2021, for example, the company invested $17 billion. Producing one episode of The Crown costs $13,000,000!

The series then has to become a great success to continue to achieve good results. Whether Netflix remains successful overall will strongly depend on what users think of the platform. If interest wanes or another streaming service becomes more popular, it may be wise to sell your Netflix stocks.

What are Netflix’s biggest competitors?

- Amazon: with Amazon Prime Video, Amazon is a formidable competitor of Netflix.

- Apple: Apple has also launched its streaming service under the name Apple TV+.

- Walt Disney: Disney is also competing with Netflix through its service Disney+.

- AT&T: this company competes with Netflix through the popular HBO Max.

Step 1: Research Netflix stocks

Before buying Netflix shares, it is important to go through some steps. Before investing in Netflix, it is critical to do research. Determine with your analysis whether you think there is a lot of growth potential behind the company. If this is the case, you can consider buying Netflix shares.

It is essential to determine for yourself whether Netflix shares fit well within your investment plan. Netflix is a technology stock with relatively high risk and potential high growth. When adding Netflix shares to your portfolio, it is essential to consider whether this type of stock suits you.

For example, would you mind losing a large portion of your investment? And do you have enough time to wait for the stock to perform well when the market is not performing well?

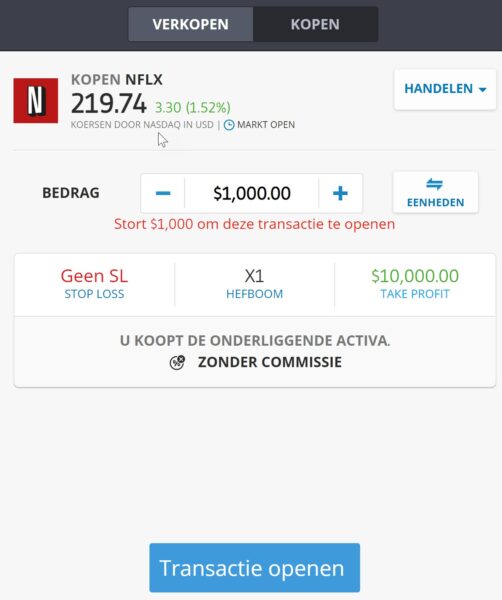

Step 2: Open an account with a broker

When you are certain that you want to buy Netflix shares, you need to open an account with an online broker. A stockbroker is a party that makes it possible for individual investors to trade in stocks. It is recommended to choose a broker with low transaction costs for the US market.

When placing an order, you must consider how many shares you want to buy. The answer to this question strongly depends on the total amount you would like to invest. It is always advisable to diversify your investments as much as possible. This prevents you from losing a large portion of your money on your investment in Netflix stocks.

With a market order, you buy the share directly, and with a limit order, you can set a price at which you want to buy the stock.

What will be the stock price of Netflix in 2025?

Are you curious about what analysts think Netflix will do in 2025 and the years to come? We have combined analysts’ predictions using data from Alpha Vantage. Keep in mind that this figure is only a prediction of Netflix’s stock performance, and this prediction does not necessarily have to come true.

The price development of Netflix in 2025 will depend, among other things, on:

- The number of new paying members within Netflix

- The development of Netflix compared to its competitors

- The development of inflation and interest rates

How did Netflix originate?

Netflix was founded in 1997 and has been around for quite some time. Unlike popular applications like Popcorn Time, Netflix is 100% legal. The company buys licences to show series and movies in different countries. Although the company initially mainly focused on the American market, Netflix is nowadays conquering the rest of the world.

The international expansion was initiated by Netflix in 2013. During this period, the Netflix stock price rose sharply. The European market is large, and internet speeds are improving. This means that the market for Netflix is still growing.

Of course, a company also has to make a profit. Netflix makes a profit by making users pay a fixed monthly contribution. This seems to work better than the business models of other streaming services, where you have to pay per movie.

Netflix shares have performed very well in the long term. The company has attracted many users and is the market leader in video streaming. An investment in Netflix stocks may therefore be interesting for investors with a high risk tolerance.

However, it is important to keep an eye on the competition. If many users switch to competitors, the Netflix stock price may come under pressure.

It is difficult to determine whether the price of Netflix will continue to rise indefinitely. When investing in Netflix, you should keep a close eye on developments. The earnings per share are low, and the content of Netflix needs to be continuously updated, which can be expensive.

However, there are also innovations at the company that can lead to better results. For example, Netflix is increasingly producing its own series and movies, which can reduce costs. In addition, this is a good motivation to become a member of Netflix, as certain films and series are only accessible through Netflix. Furthermore, more and more films and series are becoming available in higher 4K definition.

To make a profit with investments in Netflix, you should mainly follow the general trend. Many people know the company Netflix, so many people buy a few shares of Netflix, and these people are not necessarily professional investors. Therefore, small news reports can quickly have a big impact on the share price.

Therefore, try to estimate the effect of news on the Netflix stock price. If you do this well and time your investments correctly, you can achieve good results with investments in Netflix. But never forget that investing in stocks is risky, and you can lose your investment.

You can buy a Netflix share for [stock symb="NFLX" curr="USD" curr_symb="$"]. Keep in mind that the stock price of Netflix fluctuates constantly.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.

2 Comments

I am interested on investing with Netflix

i want to try… bt i dont know how.. do i have to read a piles of books to know this? 😅😅😅