Start trading with a free demo!

With a free demo account, you can try your hand at trading without the monetary risk. It’s the perfect way to test your investing skills. On this page you can compare the best demo accounts to test trading in stocks & Forex for free!

Why should you try trading with a demo?

- Demo investing is 100% free.

- Get started in minutes.

- The results are real.

- You will learn how to trade.

In the overview below, you directly see the best free demo accounts available on the market:

| Brokers | Benefits | Register |

|---|---|---|

| Buy stocks without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of stocks! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of stocks with a free demo! |

Other trial accounts for you to try

In this section of the article you will find a list of the best sites to try trading with a risk-free demo. Later on, we will discuss what you can do with your demo account. Do you want to know which site is right for you? It is possible to open multiple trial accounts, so you can compare the trading platforms risk-free!

- eToro: social trading, follow investing trends.

- Plus500: active trading in CFD’s on all popular shares.

eToro demo

You can also try out the possibilities of trading 100% risk-free with a virtual demo at eToro. Your trial account will grant you access to the full range of trading options. While you will have the option to trade independently, it is also possible to track the activity of other traders. eToro’s social aspect is especially interesting for investors who have little time. Use the button below to open a free account today:

What are the benefits of trading at eToro?

- At eToro, you can buy stock & trade in shares by using CFD’s.

- At eToro, you can buy shares at no additional costs.

- You can trade socially: follow other traders completely free.

- Use the easy-to-use and multilingual software.

How do you open a demo account with eToro?

Opening a demo account with eToro is simple. On the home page, use the join now button.

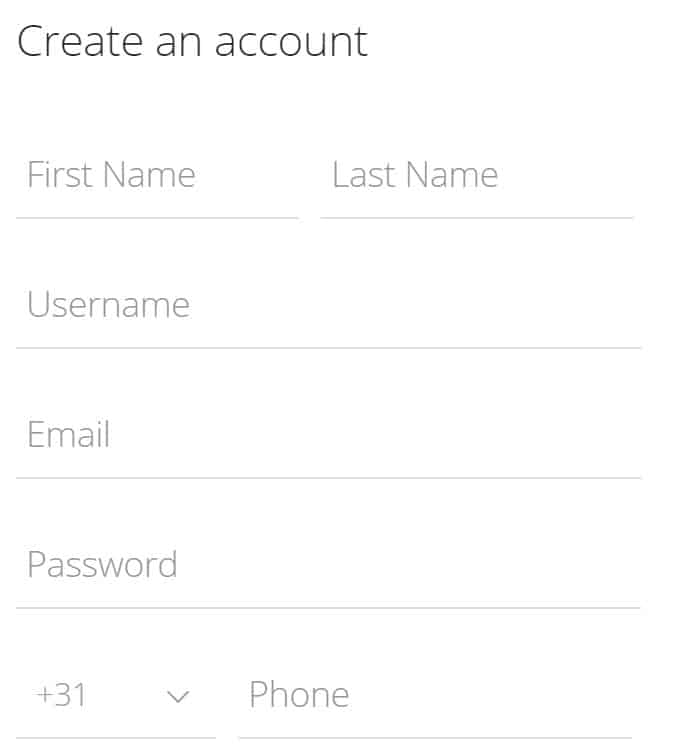

You will have to fill in some basic information. After you filled in the details, you can log into the eToro trial platform.

Within the eToro demo platform you can try your hand at investing with a demo account filled with $100.000.

Investing with real money

eToro has a minimum deposit starting at $50 for a new account. With this money you can choose to buy shares without any leverage. You can also actively speculate on the quotes by using CFD’s. After sufficient practice, this is the perfect way to explore the possibilities of investing even further!

Opening a demo with Plus500

At Plus500 you can trade in shares, Forex, cryptocurrencies and commodities by using CFD’s’. At Plus500, you will have the option to explore the world of trading with your free, unlimited trial account. Once you’re ready, you can easily deposit money into your account. Use the button below to open an account immediately:

What are the benefits of investing with Plus500?

- At Plus500 you pay 0% commission on all transactions.

- At Plus500 you can also trade with smaller amounts.

- You have the option to short a given stock & speculate on a decreasing price.

- All known international CFD shares are available to you at Plus500.

How do you open a demo account at Plus500?

You can easily create an account on the Plus500 website. At Plus500 you will receive $40,000 in virtual capital that you can use to make trades. Of course this capital is not monetary and holds no value whatsoever.

If you like the sound of Plus500, click the button below to begin your free trial!

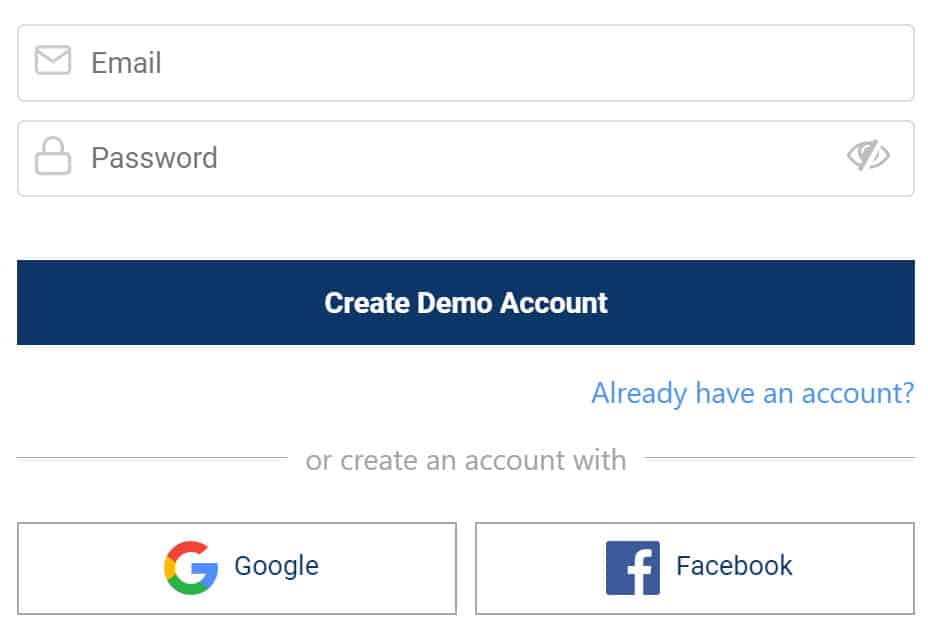

You will have the option of logging in to an existing account, or creating a new one. It is also possible to link your account to your Google or Facebook account.

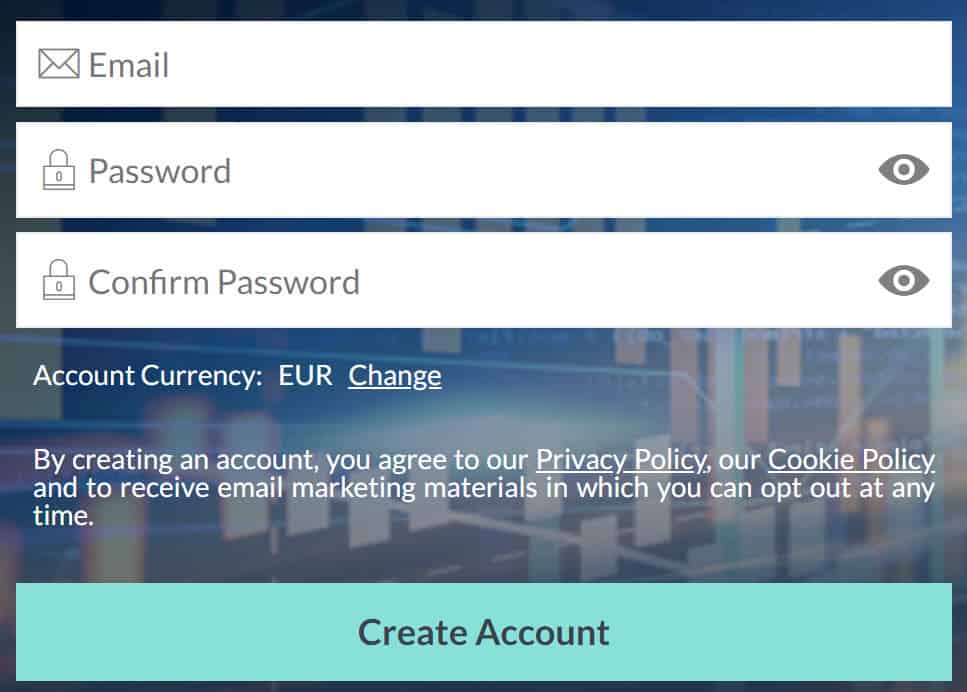

To create your free demo account, you only need an email address and password. If you want to trade with real money, you will need to add some more personal details.

Trading with real money

At Plus500 you can trade with real money stating from $100. Before you can start trading with real money, you must convert your account from a trial account to a cash account. To do so, there will be a test to verify your identity. According to the law, it is not allowed to open an investment account anonymously. You must confirm your identity by uploading a copy of your passport.

Open demo at Marketsx

Marketsx is an established, reliable site where you can try trading using their risk-free demo. Use the button below to open a free demo account now:

What are the benefits of investing with Marketsx?

- At Marketsx you benefit from very low transaction costs.

- You can use advanced analytical tools.

- You can invest in more than 2200 stocks.

- Receive expert advice within the platform.

How do you open a trial account with Marketsx?

On the Marketsx website you can easily create an account by entering an email address and password. The investment software is completely web-based, so you don’t need to download anything.

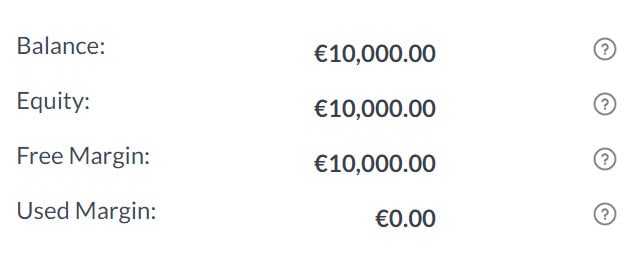

Within the online software you can easily switch to the free demo. Using your trial account, you can try out the possibilities of investing in stocks with a demo amount of $10,000.

Whenever you’re ready, you can easily switch to a real money account. To do this, you will, of course, have to enter some more personal information. After all, opening an investment account is similar to opening a bank account.

Frequently asked questions about trading with a demo account:

In this section we answer the most frequently asked questions about investing with a demo account:

- How can you use your demo account?

- When & how can you invest with real money?

- What is a demo trading account exactly?

- What can you do with a trial trading account?

- Is a demo always free?

- What is the difference between a trading simulator and a demo account?

- What can you invest in with a demo account?

- What are the functionalities of a demo account?

- Why do brokers provide free demo accounts to clients?

- Can you lose more money than you deposit?

How can you use your demo account?

It is sensible to use your demo account properly and treat it like a real trading account. At first, you can use a trial account to learn how the trading software works. You can try to open your first trades on the platform. Once you have a thorough understanding of how the software works, you can start making investments.

When you practice, it is important to keep a good track of what works and what doesn’t work. It may sound childish, but it is wise to keep a diary. You can use the diary to keep track of the investments you make. By doing so you can analyse whether you have made a good or bad trading decision. By keeping track of what you have learnt from your trading activities, you can move forward and grow as an investor.

When & how do you use real money?

It is important to only trade with real money once you have fully understood how the software works. It is also important that you have a good understanding of how the financial markets operate. Once you have these bases covered, you can consider making your first deposit. It is wise to start with a small amount first, so that you can get used to the risk and tension associated with investing.

Converting the demo account to a real account takes about ten minutes. This process requires you to fill in some personal data (required by the European Union to combat money laundering). The broker also makes sure that you have enough financial knowledge to invest. Once your account is activated, you can easily deposit money via bank transfer, credit card or PayPal. Trading with real money ultimately works the same as trading with a demo account.

What is a demo account?

A demo account allows you to experience a simulation of the market. The simulation tracks the share prices of the real market. However, on your demo account you invest using fictitious amounts. This makes a trial account the ideal method to get used to trading the financial markets.

What can you do with a trial account?

A trial account has the same functionality as a real account, only with no real monetary gains or losses. With a demo you can test all the possibilities of the platform. A trial is also suitable for testing various investment methods. Even for advanced investors, creating a trial account can be useful.

Can you use a demo for free?

Practising with a demo is always free. There’s no risk attached to investing with a trial account. Only when you deposit money you risk losing money.

What is the difference between a trading simulator and a demo account?

There is no difference! A demo account may sometimes have a different name at different providers. Some parties call a demo a simulation or a trial.

What can you invest in with a demo account?

This depends on the broker. With most brokers, you can invest in the following securities:

• Shares

• Index funds

What are the functionalities of a demo account?

The functionalities may differ considerably. Some brokers only allow you to trade actively in shares by using leverage. Leverage allows you to open a larger position with a small amount. When you apply leverage you can for example open a position of $1000 with an initial investment of only $100. When you use leverage both your potential gains and losses increase.

You can also short stocks with many brokers. When you short a stock, youspeculate on a decrasing price.

Most brokers also offer the possibility to use orders. Orders allow you to automatically open or close a position at a certain value.

Why do brokers offer free demo accounts?

Brokers don’t offer demo accounts because they are feeling generous. Naturally, the brokers aim to excite you and to entice you to deposit real money. Brokers naturally want to attract as many customers as possible. The chances of attracting prospective users only increases when you can try their software for free.

Can I lose more money than I deposit?

No, you never lose more money than your deposit. As soon as your losses increase too much, the position will automatically close. If the broker fails to close your position in time, they have to pay for the additional losses. Therefore, you can never lose more than the amount in your account.

Demo trading: the advantages

For people who have never invested before, it is always recommended opening a free trial account first. Within the demo account you will learn to deal directly with the software and the various tools available. Opening positions at different times will teach you what is sensible and what is not, so you will achieve better results when you start trading with real money.

A demo account can also be useful for the advanced investor. You can test new strategies and investment methods before applying them with real money. By doing so you can reduce the risks and achieve the highest possible return!

How do you get started with a trial account as a beginner?

You must thoroughly research the stocks you plan to invest in before you open a position. In our free course ‘learn how to trade’ we teach you the essentials. After you take the course you are fully ready to start trading!

Wait before you make your first deposit! Your first deposit can quickly disappear if you make a wrong move. It is wiser to practice first with a demo account with fictitious money so you better understand the features and capabilities of the demo. When you are ready to trade with real money, you can make your first deposit.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.