What is short selling and how does it work?

Short selling enables you to speculate on decliningstock prices. But what is short selling and how does it work? In this article, I explain how you can open a short position.

What does short selling mean?

When you go short, you speculate on a declining stock price. When the price subsequently falls, you make a profit, while you lose money when the price rises. There are various methods in which you can go short. In this article, we explain how you can open a short position yourself.

Where can you go short?

It is not possible for private investors to go short everywhere. Therefore, you will need to open an account with a reliable broker that offers support for this. Below you will find my favorite brokers for opening short positions:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

How can you go short on the stock market?

Do you want to speculate on a falling stock price? Then you can go short! Below we discuss three methods you can use to go short on the stock market.

Method 1: go short directly on a stock

At some brokers, you can go short directly on a stock. You do this by selling shares that you do not currently own. You will then receive the money from the sale in your investment account.

When the stock price subsequently falls, you can buy the shares back at a lower price. You can then pocket the price difference. However, if the stock price rises, you can also lose a lot of money.

Method 2: go short with a put option

You can also choose to go short with options. You can speculate on a falling stock price with a put option. A put option gives you the option to sell a share at the current price. When the price subsequently falls, you can buy the security at a lower price and make a profit.

A put option is always limited in validity. You pay a so-called premium to buy a put option. If the price rises, your loss will never be higher than the premium. This makes options an attractive method to go short.

Do you want to learn how to invest in options? Then read our comprehensive options guide:

Method 3: CFDs or contracts for difference

Another popular way to go short is with CFDs. With CFDs, you can speculate on a falling price of, for example, a share. You will never become the owner of the product you invest in; you only invest in the price difference.

Are you curious about how to invest in CFDs? Then read our extensive CFD guide:

Short selling example

With a simple example, we will demonstrate how short selling works in practice. Suppose there is a stock available for 100 dollars. You decide to take a short position on this stock. The stock price then drops by 10 dollar. You decide to close the position, which means you make a profit of 10 dollar.

The opposite can also happen. If you open a short position at 100 dollarsand the price rises by 10 dollar, you will lose 10 dollars on each position.

What can you short sell?

You can short sell different securities:

- Stocks

- Cryptocurrencies

- Indexes like the S&P500

- Commodities

What are the benefits of short selling?

Short selling has several advantages. Below, we discuss the most significant benefits of short selling.

Flexibility

Short selling increases the flexibility of your investments. When you only buy stocks, you can only perform well in a rising market. With short selling, you can speculate on a falling price during economic challenging times.

Hedging

Short selling can also be used for hedging. By hedging, you can mitigate certain risks. For example, if you believe that stock prices will decline, it may be expensive to sell all of your shares and buy them back later. You can then hedge your risk by taking a short position on, for example, the S&P500.

Return

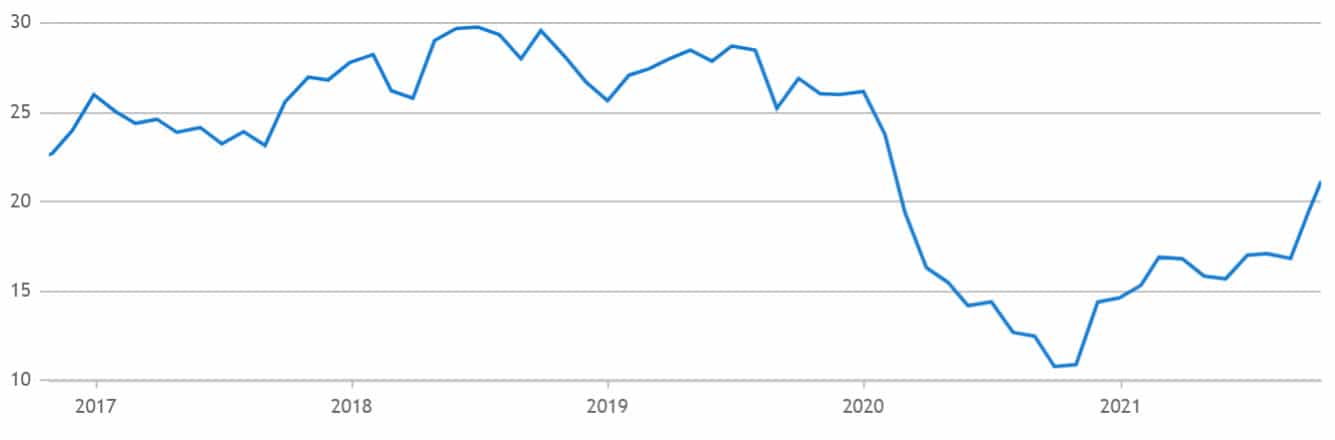

When investors panic, stock prices often drop rapidly. By short selling, you can achieve a significant return in a short amount of time. Below you can see, for example, the price trend of Shell during the 2020 coronavirus crisis:

If you had opened a short position at the right time, you could have achieved a good result. However, remember that timing the market is challenging.

What are the disadvantages of short selling?

There are also some disadvantages to short selling. Below, we discuss the potential risks of short selling.

You can lose unlimited amounts of money

When you buy a stock, you cannot lose more money than the value of the stock. When a share costs 10 dollars, you cannot lose more than 10 dollars. With a short position, every dollar increase costs you money. The stock can theoretically rise to 100 or even 1,000 dollars. Your potential loss is, therefore, unlimited.

Dividend payment

When you short sell a stock, you must pay the dividend. In practice, this is not a significant problem: the stock price drops by the same amount as the value of the dividend paid out.

Short squeeze

A major risk of short selling is a short squeeze. A short squeeze occurs when the price of a stock rises sharply due to many open short orders. When the price increases, many stop loss orders are triggered for those who have shorted the stock. They are then obligated to buy the shares, causing the price to rise further. This can result in significant losses with a short position.

Want to read more about short squeezes? Check out this article!

Against the trend

On the long term, stock markets tend to rise. When you go short, you take a position against the overall trend. You need to be very attentive to the market to achieve good results with a short position.

Financing costs

With many financial products, you pay financing costs for your short position. For example, with CFDs, you pay a daily premium. When you short with options, you don’t pay financing costs. However, you run the risk that your option will become entirely worthless at the end of the term.

How does short selling work?

Short selling literally means selling shares that you do not own. I understand that this may sound confusing. That’s why we’ll take a closer look at how short selling actually works. I have to warn you, though: the underlying theory is not simple and is quite abstract! If you have any questions, feel free to ask them at the bottom of the article.

When you go short, you sell shares that you don’t own. To sell these shares, you must borrow them. These shares are typically borrowed from a party that holds many shares for the long term. This can be a bank, insurance company, or pension fund..

The investor is then required to cover the underlying value of the shares so that the stocks can be bought back at any time. The lending party wants to be sure that the investor can pay for the borrowed shares when necessary.

You must always have enough money in your investment account. If you don’t have enough money, you may face a margin call, which could result in losing the entire amount in your account.

How to profit from a short position?

If the price falls, the investor can buy the shares back at the lower price and return them to the party who lent the shares. This allows you to benefit from a falling stock price. The difference between the current price and the price at which the shares are repurchased determines the profit.

You pay interest to the party from whom you borrow the shares. This percentage is also known as financing costs.

Three short selling strategies

Speculate on the price

Day traders constantly try to profit from small upward and downward price movements. By going short, you can speculate on a falling price.

Hedging risks

Do you think the prices of your stocks will significantly decrease in value? Then you can hedge this risk by going short through, for example, a put option. You pay a small premium for this. If the prices fall, you won’t lose money. If the prices rise, you will only lose your premium.

Arbitrage

Some stocks are traded on different exchanges. For example, Unilever is listed on both the Dutch and English stock exchanges.

Sometimes there are minuscule differences in the price of the stock on both exchanges. By going short on the stock with the higher price, you can speculate on this. This methodof investing is not possible for individual investors since it requires extremly fast computers.

How much does it cost to go short?

You pay transaction costs on your short position. The amount of transaction costs depends on the broker. Most brokers charge a spread. This is the difference between the buying and selling price and is charged when you open a position.

You also pay financing costs on your short position. This is a daily fee on the total amount of your investment. Be aware of your daily financing costs. With most brokers, you’ll pay 4 to 5 percent per year, which makes short positions unsuitable for long-term investments.

When are good times to go short?

Good timing is important in investing. But when is the best time to apply a short selling strategy? We discuss three moments when going short can be an attractive option.

Going short during an economic crisis

Shorting can work well during an economic crisis. When traders panic, stock prices often plummet. By taking a short position, you are one of the few investors who benefits from the situation.

Going short due to poor company results

The publication of poor results can also be a good time to go short. For example, investors expect a certain profit. If the company delivers remarkably worse results, this can be a good time to go short.

Going short on bad news

Bad news is also a good reason to go short. For example, emissions scandals caused the stock prices of various car manufacturers to plummet. Smart investors can take advantage of this.

The emissions scandal caused Volkswagen’s stock price to plummet between 2015 and 2016

Ethics and going short

Short selling is seen as something negative by some organizations. Companies that are already under pressure due to poor results can be further in trouble due to people going short on the stock. For example, customers of a bank may withdraw their deposits en masse when they see the stock price drop further. This could ultimately cause a bank to collapse.

However, the ability to go short is generally not the central reason for the decline in stock prices. Short selling is usually tightly controlled by most governments. When the market performs poorly, it is often temporarily prohibited to short sell.

In the Netherlands, for example, the ability to short sell in SNS, AEGON, and BinckBank was temporarily banned to give the stock prices time to recover. Additionally, the ability to short sell contributes to the pricing of securities and can promote market liquidity.

The ability to short sell also keeps companies honest. When something is not right, companies are severely punished for it. For instance, the stock of Luckin Coffee dropped significantly after it was revealed that the company had committed accounting fraud. A company that shorted the stock uncovered this.

For whom is short selling suitable?

Short selling is not suitable for novice investors. The risks of short positions are higher because you can lose more than your initial investment. It is also often difficult for novice investors to understand the financing costs. Since you pay a percentage on your position, you cannot make long-term investments with a short position.

Frequently asked questions about short selling

Naked short selling is the act of taking a short position without being able to deliver the underlying shares. This is not possible with most brokers. To engage in naked short selling, you need a lot of collateral at the very least.

You normally go short when you expect the underlying asset’s price to fall. By taking a short position, you speculate on a declining price. Short selling is not only advantageous for active speculation; you can also protect your investments by opening a short position.

You make money with short selling when the price falls. By taking a short position, you speculate on a declining price.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.