How to invest in oil & oil shares (2024)?

Oil is also known as black gold because it is one of the most important commodities in the world. Oil reserves become increasingly depleted, which means the battle for oil will intensify. But how can you, as a private investor, get involved? In this article, we explore how to invest in oil for beginners!

How to Invest in Oil?

Option 1: Invest in Oil Stocks

You can invest in oil stocks such as Shell or BP. When you invest in oil stocks, it is not just the price of oil that determines your results.

For example, the BP oil spill in 2010 in the Gulf of Mexico caused a lot of social unrest, which caused the share price of BP to plummet. When the price of oil rises, the share price of an oil company may still fall. Therefore, when investing in an oil company’s stock, it is essential to study the company’s financial results carefully.

You can buy oil shares with these reliable brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy oil without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of oil! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of oil with a free demo! |

Option 2: trade in the price of oil barrels

You can choose to directly trade in the price movement of oil barrels. Crude oil is more difficult to store than, say, gold. You cannot directly buy oil barrels and store them in your backyard. Fortunately, you can speculate on the price movement of oil with derivatives. You can speculate on the price of oil using CFDs, futures, or options.

speculate on Oil with CFDs

With CFDs, you can speculate on the short-term price movement of oil. You can speculate on both rising and falling prices with CFDs. With a short position, you can speculate on a decline of the oil price.

Do you want to try trading oil without risk? Then consider opening a demo with a reliable CFD broker:

Oil Futures

With futures, you apply a multiplier of 1000. One future contract applies to the value of 1000 barrels. This can cause your profits and losses on a contract to fluctuate greatly. Furthermore, with futures, you have the obligation to take delivery of the oil barrels at the end of the term.

This obligation led to a massive oil price crash in April 2020, where the oil price even became negative. Because nobody actually wanted to receive the oil during the corona pandemic, the price crashed enormously. At one point, you even received money when you bought an oil future!

The most well-known futures are on Crude Oil (CL) and Brent Oil (CL).

Oil options

You can also choose to invest in oil by using options. With an option, you have the possibility, but not the obligation, to buy or sell oil at a fixed price. With a call option, you buy the possibility to buy oil at a certain price, and with a put option, you buy the option to sell at a certain price.

Each option has an expiration date. If the option does not yield a profit by the time it expires, you lose the entire investment. Do you want to know more about investing in options? Then read this article.

Option 3: invest in an oil fund or ETF

Equity funds

Equity funds track a fixed basket of stocks from companies that are involved in oil. Examples of European ETFs are Lyxor ETF STOXX EUROPE 600 OIL and GAS and iSHARES STOXX 600 OIL & Gas UCITS EFT DE. If you want to invest in the global market, you can invest in the SPDR MSCI World Energy UCITS ETF.

Oil funds

Oil fundstrack the price trend of oil, often by buying oil futures.

Examples of funds that track the oil price are UCO and USO. The disadvantage of these funds is that they constantly have to roll over futures to the next month. The new futures are almost always pricier, because few people actually want to receive the oil. As a result, you can only benefit from these types of funds when the price of oil rises rapidly.

What is oil and what types of oil are there?

There are more than 150 types of oil, but when we talk about investing in oil, we always refer to the two most well-known types of oil in the world:

- Light Sweet Crude Oil (WTI): This type of oil is the most traded in the world and is particularly well-known in America.

- Brent Crude Oil (BZ): Brent oil is mainly used as a benchmark for oil prices in Europe, Africa, and the Middle East.

Note that these two types of oil are traded at different prices!

Demand and Supply in the Oil Market in 2021 & 2023

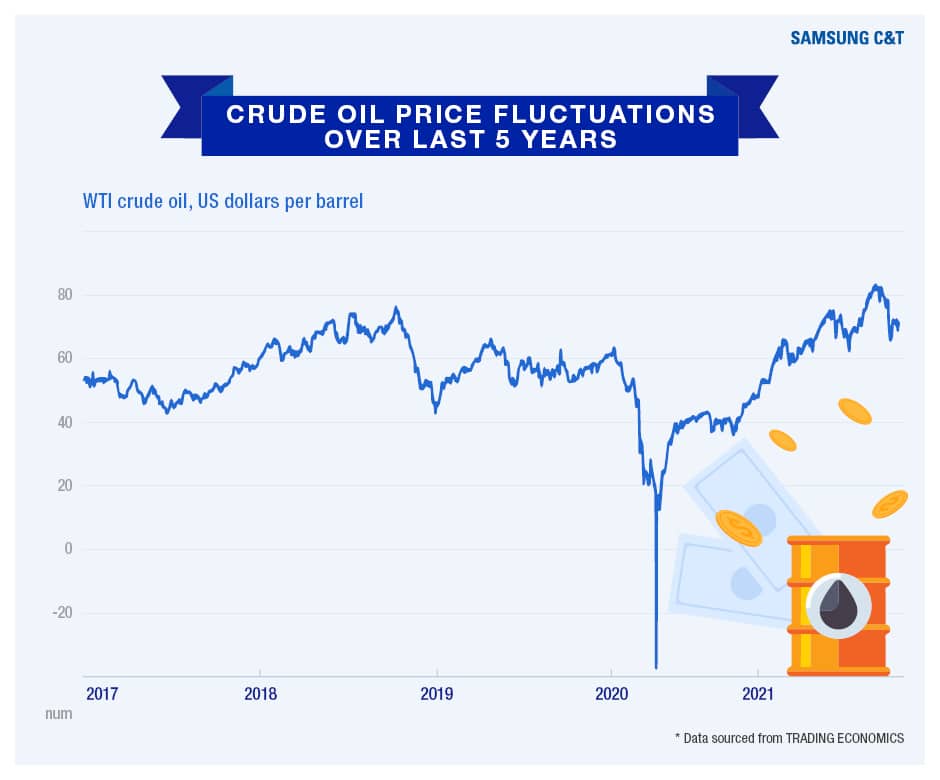

In 2021, we faced a bizarre situation in the oil market. Due to the pandemic, the demand for oil dropped so drastically that future prices temporarily turned negative. In this time, you would be paid money for buying barrels of oil.

Times quickly changed in 2023: the oil price skyrocketed due to the invasion of Ukraine by Russia. The pandemic was over, which led to a rise in demand for oil. At the same time, there was a lot of uncertainty about the supply of oil & natural gas as Russia is using commodities as a weapon.

Due to high demand and a uncertain supply, it is expected that oil prices will remain high in 2024 and 2025. Whether the oil price will rise further depends heavily on the development of the conflict in Ukraine.

The oil price as a rollercoaster. Source: http://news.samsungcnt.com/wp-content/uploads/2023/12/DEC-NO2-InfographicCRUDE-OIL8.jpg

How is the price of oil determined?

- World Economy: When the economy performs well, the demand for oil increases. This can drive the price of oil up.

- Demand & Supply: Emerging economies require increasing levels of oil. Uncertainty about the supply of oil from large producing countries can drive the price up.

- Dollar: When the dollar is relatively cheap, the price of oil often rises, since oil becomes more affordable for countries who use other currencies.

What are the benefits of investing in oil?

- Scarce: Oil reserves are finite. It will become increasingly difficult (and therefore more expensive) to find new oil reserves.

- Diversification: By investing in commodities like oil, you add more diversification to your portfolio.

- Inflation protection: You can protect your portfolio against inflation by investing in oil.

- High demand: Oil is essential to the economy. China and India are growing rapidly and will likely need more oil in the future.

What are the risks of investing in oil?

- Sustainability: especially in the West, there is an increasing focus on sustainable alternatives.

- Dollar risk: Oil is listed in dollars, which makes you dependent on the exchange rate of the dollar.

- Volatility: The price of oil can fluctuate strongly, which can lead to significant short-term losses.

How to select a strong oil stock?

When investing in oil, you naturally prefer to choose the best oil stock of 2024. When selecting an oil stock, you can consider the following factors:

- Sustainability: Does the oil company have a vision for the future? In 10, 30, or 50 years, the world will look different, and oil may even be banned in many countries.

- Balance: Is the company’s balance sheet strong? The company should be able to survive during times of low oil prices.

- Dividend: If you invest for income, you can select oil companies that pay a high dividend.

Which oil stocks can you invest in?

Shell

Formerly known as Royal Dutch Shell, Shell left the Netherlands in 2023. It might be interesting to buy Shell shares, since the company focuses on sustainability. Shell also pays a stable dividend, which makes it an ideal stock for investors who value a steady income.

ExxonMobil

In my opinion, ExxonMobil is also one of the best oil stocks. The company is one of the largest oil companies in the world. Prior to the pandemic, ExxonMobil performed poorly, but during the pandemic, the company implemented cost savings that seem to have had a positive effect.

Chevron

Chevron is a large American oil company that is active in both the upstream and downstream sectors of the oil industry. A positive aspect of Chevron is that they are involved in diversification: for example, the company has invested in renewable fuels and hydrogen.

Saudi Aramco

You can also choose to invest in the world’s largest company: Saudi Aramco. This giant is the state oil company of Saudi Arabia, which is also a disadvantage. The government of this country has a lot of influence, which makes it difficult for the company to keep up with the latest developments.

Gazprom

Another oil company that has been in the news a lot is Gazprom. Due to the blockade of Russian companies on European and American stock exchanges, the stock is no longer tradable in the West. However, the company still makes large profits due to the increased oil prices. In the future, you could consider investing in Gazprom stocks.

How to predict the oil price?

Short-term oil price

In the short term, the price of oil can fluctuate strongly. There are many parties that influence the price of oil. The price of oil is ultimately determined by the balance between supply and demand.

For example, when OPEC decides to export more oil, the oil price will fall due to the increase in supply. However, a conflict in a country that exports oil can drive up prices. People then become nervous about future oil deliveries.

On the short term, the price of oil is therefore difficult to predict. Although there is usually a clear direction in the trend, this trend can suddenly be broken due to an important event somewhere in the world. Oil is therefore a popular asset for day traders, investors who actively trade every day.

It is advisable to keep a close eye on the news. Consider with each news item what effect it will have on the average investor. Examples are:

- A news item about the US deciding to drill for oil in their reserves (1).

- A news item that consumers increasingly using their car (2).

- There is a war going on in an important oil-producing region (3).

In general, news items where the supply of oil increases lead to a decrease in price (item 1). When demand seems to be increasing, the price usually rises (item 2). Finally, a decrease in supply can also lead to a rising price (item 3).

Important events have a big impact on the oil stock price

Oil price in the long run

Oil is clearly becoming scarcer: with the rise of new powers such as China, oil consumption is expected to continue to increase in the coming years. According to recent predictions, it will only take forty years before oil is truly depleted. Currently, oil seems like a good investment. As the reserves continue to decrease and consumption continues to increase, it is not unrealistic to assume that the price will continue to rise.

However, it is also important to keep an eye on alternative energy sources. Oil and other fossil fuels lose popularity due to the pollution they cause. Various companies are therefore looking for alternative fuels.

What should you look out for when investing in oil stocks?

Many people invest in oil stocks because of their stable nature. In the short term, the price of oil can fluctuate significantly. However, the economy relies on oil and the price always reaches new highs. But what should you actually look out for when selecting and buying oil stocks?

Step 1: Open an account with a reliable broker

If you want to achieve good results with your oil investments, it is important to open an account with a reliable broker. Click on the button below to compare different brokers:

Step 2: Decide which sector you want to invest in

Everyone knows the classics like Shell and Total. However, there are many more companies involved in the oil production process. When investing in oil, you can invest in three main sectors: upstream, midstream, and downstream.

Upstream

The upstream sector is mainly involved in the exploration and production of oil. Companies in this sector extract oil from the ground. For example, a company like Fugro finds suitable locations to drill for oil. Other companies are involved in producing material or providing labour.

Midstream

The midstream sector transports and stores oil. This sector is the link between the upstream and downstream sectors. Examples of companies that are active in this sector are Vopak and Scorpio. A company that is involved in the storage of oil can also perform well at a low oil price. In this case, there is often overproduction. These companies make money in this situation by storing the oil.

Downstream sector

The last sector involved in oil is the downstream sector. This sector refines crude oil and processes it into a usable raw material. Crude oil still needs to be converted into, for example, petrol for your car, asphalt, or kerosene. Companies involved in this step in the production process include Marathon Petroleum and ExxonMobil.

Many larger oil companies are involved in various parts of the oil production process. Research under which market conditions the company you want to invest in performs well. Some stocks may be less dependent on the price of oil than other stocks.

Step 3: Ensure adequate diversification

Even when investing in oil by buying stocks, it is important to diversify sufficiently. It is unwise to put all your money into one oil stock. Even with a high oil price, a company can still go bankrupt. Mismanagement or fraud can turn a company from a top performer into a total flop in a day.

Therefore, it is important to conduct sufficient research when investing in oil stocks. Examine how the company earns its profits. Furthermore, ensure sufficient diversification across other sectors by not just investing in energy-related stocks.

Step 4: Create a plan

Randomly buying and selling oil stocks during a crisis is not a good strategy. It is important to create a plan. First, determine why you want to buy stocks. Do you want to build income by buying stocks that pay high dividends? Or do you want to gain high capital gains? Every goal requires a different type of strategy.

Determine your goal and write your target price down. This prevents you to trade based on emotion.

Step 5: keep the fees in mind

When investing in stocks, it is essential to select a low-cost broker. In this overview, you can discover which brokers offer investing against low commissions:

How can you make money with falling oil prices?

It is also possible to make money with falling oil prices by going short on the price of oil. When you go short, you speculate on a falling oil price. With a short position:

- You lose money when the oil price rises.

- You make money when the oil price falls.

Frequently asked questions about investing in oil

When you actively invest in oil, you take a position on a rising or falling price. The price movement determines whether you make a profit or loss. Trading in oil is usually done through a derivative: these are risky investment products with leverage.

As a trader, you can react to strong price movements. Therefore, when markets are volatile, it is most interesting to actively trade the price movements of oil. If you invest in Brent oil, the price is most volatile during European trading hours, and if you invest in WTI, the market is most volatile during American trading hours.

Oil is an important commodity and is constantly traded. Therefore, most brokers allow you to trade in this commodity 24 hours a day and 5 to 7 days a week.

Brent and WTI are the most well-known types of oil in the world. Brent Crude oil is the main benchmark in the world and comes from oil fields in the North Sea.

WTI is the main benchmark in America. The composition of WTI also differs slightly from Brent Crude oil.

Brent and WTI oil are not the only types of oil that exist. For example, Dubai or Oman crude oil is used as a benchmark in the Middle East.

- iShares Oil & Gas Exploration & Production UCITS USD (Acc) (EUR) | IS0D

- Xtrackers Stoxx Europe 600 Oil & Gas Swap UCITS 1C (EUR) | XSER

- Lyxor Index Fund – Lyxor Stoxx Europe 600 Oil & Gas UCITS Acc | OIL

- Invesco STOXX Europe 600 Optimised Oil & Gas UCITS | SC0V

The OPEC, or the Organization of the Petroleum Exporting Countries, has multiple members who export oil together. The member countries form a cartel, and they make decisions about the price and export quantities.

In general, when production increases, the price of oil will decrease with a constant demand. Therefore, when you want to buy oil barrels, do not forget to also examine the supply side carefully.

When you buy oil, the dollar holds a key role. This is the case because the price of oil is noted in dollars. For example, when the value of the euro increases with a constant oil price, you can buy more oil for the same amount of euros.

Conflicts, especially in oil-producing countries, also drive up prices. When civil wars break out in a large oil-producing country, this can raise the price of oil because production is threatened. Therefore, keep a close eye on the international political situation.

New oil reserves can bring the price down again. Oil is a finite resource, so as it becomes scarce, the price will increase significantly. However, when a large new oil reserve is discovered, it can decrease the price as the supply increased.

The answer is a resounding yes! By buying and selling oil at the right time, you can make significant amounts of money in a short period. However, any profit can just as easily turn into a loss. Therefore, manage your risks wisely and only invest money in commodities such as oil that you can afford to lose.

You might think that these types of oil should always have similar prices. However, this is not the case because they refer to different regions. For example, in 2010, you saw WTI oil (also known as American oil) fall because the supply increased, while the supply of Brent decreased. This caused Brent oil to become much pricier than WTI.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.