Investing in options for beginners: how to invest in options?

Do you want to invest in options? Then you have come to the right place with this short beginner's guide to investing in options! By following the steps in this guide, you can open your first option investment right away.

Note: options are risky investment instruments. Consider whether you are willing to take this high risk.

What is an option?

Before discussing how to invest in options, it is important that you understand what options are. Options are financial derivatives that you can trade on the stock exchange. With an option, you buy the possibility, but not the obligation, to buy or sell a security. An option can relate to, for example, a:

- Stock

- Commodity

- Index

- Currency pair

You can invest in two types of options:

- With a call option, you buy the possibility to buy an underlying security at a fixed price

- With a put option, you buy the possibility to sell an underlying security at a fixed price.

For example, with a call option on the S&P500, you buy the option to buy an index on the S&P500 at a fixed price. The option becomes more valuable when the AEX price rises. In this case, you can buy the underlying asset cheaper and sell it again at a higher price.

Do you want to read more about what options are? Then read the article what is an option?.

Where can you invest in options?

You can invest in options with an online broker. You need an account with a broker to trade options:

How does investing in options work?

When you invest in options, you will see that they are listed as follows:

ABC CALL SEPTEMBER 20, 2023 €100

- Underlying value (ABC): indicates which asset the option relates to.

- Option type (CALL/PUT): indicates whether you have the right to buy (call) or sell (put) the asset.

- Expiration date (20 SEPTEMBER 2023): the option is valid until this date. If you do not exercise the option by this time, it will expire and you will lose the premium you paid.

- Exercise price (€100): this is the price at which you can buy or sell the underlying value.

An option contract always relates to 100 underlying values. An option also has a certain price, for example, $2. When you buy one option, you pay €$200 in this case. Only if you make more profit on the sale of the option than $200, you will achieve a positive result.

If the ABC share is worth $110 before the expiration date, you would achieve the following result:

- Your costs amount to $200 in premiums.

- You buy 200 shares for $100 = $20,000

- You sell 200 shares for $110 = $22,000

- Your profit is: $22,000 - $200 = $21,800

Active trading in the value of an option

It is possible to actively invest in the value of options. Many people engage in active option trading and never exercise them. But how can you successfully invest in the value of an option?

It is important to make a prediction about the price of the underlying value:

- Do you expect it to rise? Then it is best to buy a call option.

- Do you expect it to fall? Then it is best to buy a put option.

You can also decide to buy an option when you expect more volatility in the future. When the underlying asset becomes more volatile, the chance that the price will exceed the exercise price is higher.

How to buy an option?

When you buy a share, the price is always fixed. However, you can buy different options on the same share at different prices. This is because the exercise price, expiration time, and premium to be paid are different. At any given time, there are different options available, some examples:

Philips share with a current value of $18.00

- Call option with an exercise price of $20.00 and an expiration time of three months

- Put option with an exercise price of $30.00 and an expiration time of two years

- Call option with an exercise price of $16.00 and an expiration time of two weeks

The price of an option is naturally determined by its attractiveness to the buyer. A call option with a strike price below the current market price yields an immediate profit and is therefore very favorable. A similar option will therefore be traded at a higher price. There are three possibilities for call options:

- In the money: the strike price is below the current market price, which makes it immediately valuable.

- At the money: the strike price is equal to the current market price.

- Out of the money: the strike price is higher than the current market price and is worthless.

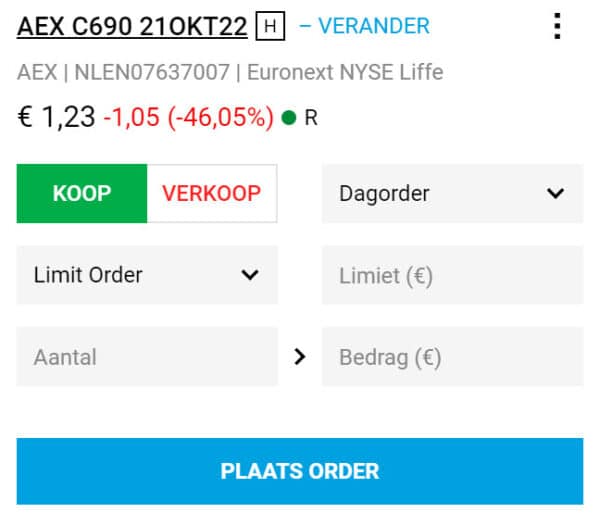

When placing an order on an option, you can use two types of orders:

- Limit order: you only buy the option at a predetermined price.

- Market order: you buy the option at the available price.

How is the value of an option determined?

The value of an option is determined by the intrinsic value plus the expectation value.

The intrinsic value is the actual value of an option. For example, if you have a call option that gives you the right to buy a stock that currently costs $30.00 for $25.00, you immediately make $5.00 profit per share. The intrinsic value is then $5.00.

As an investor, the expectation value is especially relevant. The expectation value is higher when:

- There is high volatility.

- The expiration date is far in the future.

- The price is close to the strike price.

The price of an option can fluctuate strongly due to these developments. For example, if volatility increases or the price of the underlying asset moves in the right direction, the option can become more valuable. At the same time, the option will become less valuable over time, as there are fewer days left to move in the favorable direction.

Example of investing in options

Below are two examples of how investments in call and put options turn out.

Investment in call option example

Suppose you buy a call option on a stock for $1. The exercise price of the stock is $10. In this case, you pay a total of 100 times $1 for the option contract, so the premium is $100. Depending on the stock price, you achieve the following result:

| Stock price | Paid premium | Value on expiration date | Total result |

|---|---|---|---|

| $8 | -$100 | $0 | -$100 |

| $9 | -$100 | $0 | -$100 |

| $10 | -$100 | $0 | -$100 |

| $11 | -$100 | $100 | $0 |

| $12 | -$100 | $200 | $100 |

| $13 | -$100 | $300 | $200 |

| $14 | -$100 | $400 | $300 |

The maximum loss in an investment in a call option is thus the paid premium, which is $100 in this case. However, your potential profit is unlimited.

Investment in put option example

In this example, we buy a put option on a stock for $1. The underlying stock has an exercise price of $10 again. In this case, you also pay 100 times $1 for the option contract, so the premium is $100. Depending on the stock price, you achieve the following result:

| Stock price | Paid premium | Value on expiration date | Total result |

|---|---|---|---|

| $6 | -$100 | $400 | $300 |

| $7 | -$100 | $300 | $200 |

| $8 | -$100 | $200 | $100 |

| $9 | -$100 | $100 | $0 |

| $10 | -$100 | $0 | -$100 |

| $11 | -$100 | $0 | -$100 |

| $12 | -$100 | $0 | -$100 |

The maximum loss in a put option is thus the paid premium, which is $100 in this case. Your potential profit is the result you achieve when the stock value is $0. In this case, the profit would be $900.

Writing options

You can also choose to write options. When you write an option, you receive a premium for it. When writing an option, you usually hope that the option will not be exercised. If this is the case, you do not lose any money and can pocket the premium. Writing options can be a lot riskier.

Example of writing a call option

In this example, we write a call option on a stock. We receive a premium of $1, and since option contracts are traded in units of 100, we receive $100. Depending on the stock price, you achieve the following result:

| Stock | Received premium | Total result |

|---|---|---|

| $8 | $100 | $100 |

| $9 | $100 | $100 |

| $10 | $100 | $100 |

| $11 | $100 | $0 |

| $12 | $100 | -$100 |

| $13 | $100 | -$200 |

| $14 | $100 | -$300 |

When you write a call option, your potential loss is unlimited. However, you can hedge your position by purchasing the stocks. That way, you can deliver the stocks and do not have the risk of having to suddenly buy the stocks for a much higher amount.

Example of writing a put option

In this example, we write a put option on a stock. We receive a premium of $1, and since option contracts are traded in units of 100, we receive $100. Depending on the stock price, you achieve the following result:

| Stock | Received premium | Total result |

|---|---|---|

| $6 | $100 | -$300 |

| $7 | $100 | -$200 |

| $8 | $100 | -$100 |

| $9 | $100 | $0 |

| $10 | $100 | $100 |

| $11 | $100 | $200 |

| $12 | $100 | $300 |

When you write a put option, your potential loss is equal to the amount you lose when the stock is worth $0. As you can see, your losses can increase significantly when writing options, especially when you write them uncovered.

Investing in Options & Leverage

Investing in options can be interesting because of the leverage. It is possible to invest in a larger quantity of shares with a much smaller amount of money.

For example, with a call option on a $10 stock, you pay only $100 to take an option on 100 shares. Normally, for this amount, you could only buy 10 shares.

If the price then rises to $12, you make a profit of $100. On an investment of $100, this is a return of 100%.

If you had physically bought the shares, you would have only made a profit of 20%. This is because with $100, you could only buy 10 shares that have each increased in value by $2.

Leverage thus makes it possible to achieve much larger results with a smaller amount of money. However, this comes with a risk, since you can also lose the entire amount when investing in options.

What are the advantages of trading options?

By buying options, you can protect yourself against price drops. With a put option, you can sell the underlying asset at a fixed price. If the stock price drops, you can still sell the stock you own at a high price. Put options can be used as insurance in uncertain times.

You can also use options to earn extra return on the stocks you already own by writing call options. This is especially useful when you were already planning to sell the stocks. You receive extra return on your stocks, and if the price rises, you receive the selling price and the premium.

The presence of leverage can make investing in options even more attractive. This allows you to achieve a higher potential return with a smaller amount of money. However, it is important to be careful, as using leverage incorrectly can also result in losing a lot of money.

What are the disadvantages of investing in options?

One major risk of investing in options is that you can lose your entire investment. 75% of options never become in the money and are therefore never executed. When an option expires worthless, you lose the entire premium, and you can quickly lose 100% of your investment.

When you write call and put options, your losses can be (almost) unlimited. If the stock price suddenly rises or falls significantly, you can lose many times your initial investment. Options are therefore not suitable for novice investors, but rather for investors who already have some experience with stock trading.

Be aware of the difference between American and European options!

Both American and European options exist. American options can be executed at any time during the term, while European options can only be executed at the end. Since options are traded on the stock exchange, you can always sell them in between.