Investing in cryptocurrencies

Cryptocurrencies are booming. This is not surprising when you consider that with cryptocurrencies you can sometimes achieve hundreds or thousands of percent in return in a short time. But how can you start trading cryptocurrencies? And which cryptocurrencies can be a smart investment? In this article you will read everything you need to know about investing in cryptocurrencies.

How can you invest in cryptocurrencies?

You can choose to actively trade cryptocurrencies. This way, you are more readily able to benefit from market fluctuations as well as invest in cryptocurrencies on a long-term basis. It is also possible to invest in cryptocurrencies for the long term.

Active cryptocurrency trading

Cryptocurrencies such as the Bitcoin and Ethereum are highly volatile. This means that the price can fluctuate a lot in a day. You can benefit from this as an investor. It is possible to take advantage of both the down and up movements. To achieve this, you need an account with a broker that supports cryptocurrencies.

One of the best cryptocurrency brokers is Plus500 (Availability subject to regulation). With Plus500 you can trade in all known CFD cryptocurrencies without having to pay a fixed commission. In addition, it is possible to practice as much as you like with this provider using a free demo account. Plus500 is a great broker to actively trade popular CFD cryptocurrencies like the Bitcoin and Ethereum.

- Practice risk-free with an unlimited free demo

- Pay no commissions on your trades.

- Profit from downward market movements

Would you like to try active investing? Use the button below to open a free demo account with Plus500:

Investing in cryptocurrencies

Do you have a lot of faith in certain cryptocurrencies? Then you can also choose to buy certain cryptocurrencies for the long term. A great broker to invest in cryptocurrencies is Stormgain. You can trade in all known cryptocurrencies using the Binance platform. If you would like to explore the possibilities of Binance, use the button below.

What are cryptocurrencies?

Before you start investing in cryptocurrencies, it is important to understand what they are. Cryptocurrency stands for encrypted money. You can see it as a digital form of payment where there is no central party that manages the currency. Cryptocurrencies can therefore eliminate the drawbacks of traditional money because they are completely traded via the internet. It is not possible to receive physical crypto coins or bills.

What is unique about cryptocurrencies is their special functionality. The Bitcoin, for example, is a completely decentralized currency. This means that there is no bank or other third party involved in a transaction. When you transfer money to another person, this will be transferred directly without any interference. Because a third party is no longer needed for transactions, the costs of transactions can be reduced and the of transactions speed can be increased. This is of course very advantageous.

Some advantages of cryptocurrencies

- Cryptocurrencies are fully decentralized

- Transactions can be made faster and cheaper

- Transactions are often difficult to trace or even untraceable

- Cryptocurrencies are increasingly used as a valid method of payment

In which cryptocurrencies can you invest?

On trading.info you can find information about all major cryptocurrencies. In this article you can read briefly what each cryptocurrency is exactly. If you click through you can find more information about the specific cryptocurrency. You can then also view the current price and start investing in the relevant currency.

Why should you invest in cryptocurrencies?

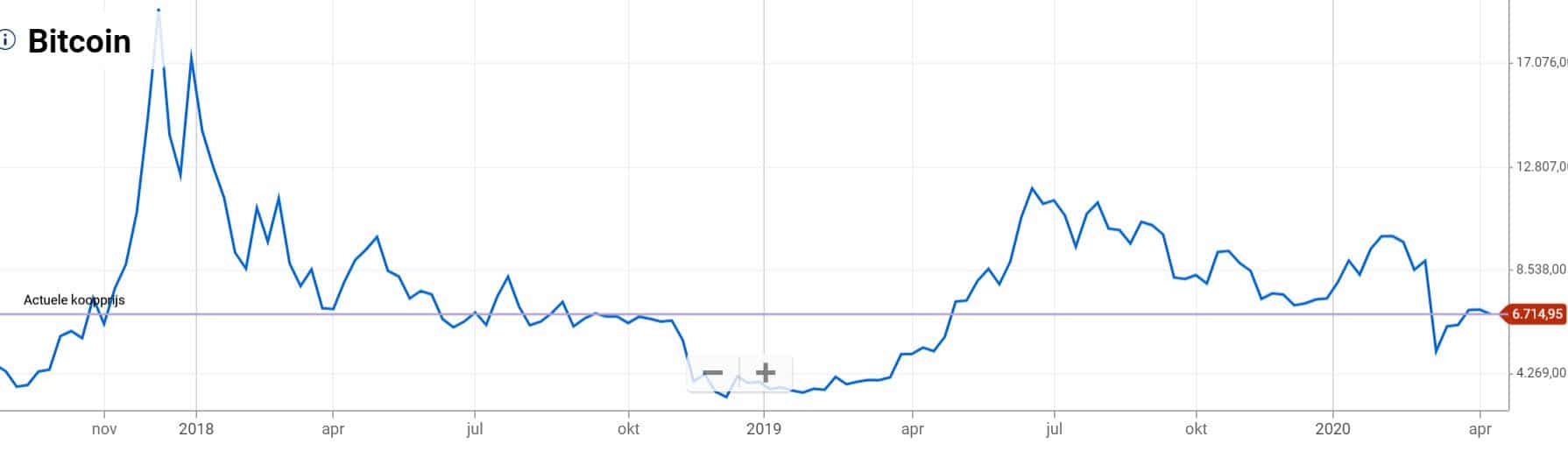

Cryptocurrency investments can be particularly lucrative due to market volatility. Below you will find a graph demonstrating the price evolution of bitcoin over time.

As you can see, high peaks are regularly interspersed with low valleys. In 2018, a peak of more than $18,000 was recorded. In 2019, there was a low of around $4,000. However, within a few months, the price rose again to $10,000 and then dropped again to $4,000. Thus, the aforementioned volatility is clear to see.

This price evolution will deter many prospective investors. For those who are willing to take a little risk, cryptocurrency trading can prove to be a worthwhile endeavour. After all, if you buy and sell regularly, you can achieve regular, respectable returns.

Investing in cryptocurrencies is not suitable for everyone. You have to be willing to accept the risk associated with high market volatility. You must be prepared to suffer losses along the way. If this all sounds acceptable to you, cryptocurrency investments may be suitable for you!

Successful investments in cryptocurrencies

Do you want to achieve good results with your cryptocurrency investments? With these tips, you can ensure you achieve better results.

Do your research

Many people have ventured in to the world of cryptocurrencies without doing research. Many of these people ended up losing them money and potentially leaving them disillusioned with the world of investing.

Avoid losing a lot of money with your investment in cryptocurrencies and use your wits. When you start investing in stocks, you simply cannot pick your stocks at random. With this in mind, make sure you thoroughly research the stocks you are looking to invest in. This is especially important when looking to invest on a long-term basis.

Join the hype

The trend can be your best friend! Many people will blindly follow overwhelming trends in cryptocurrencies and start buying when the prices skyrocket. Naturally, what other people do is not necessarily what you should do. Bearing this in mind, you can take advantage of the hype surrounding certain cryptocurrencies by investing smartly.

If you want to invest successfully in cryptocurrencies, you should spend some time researching what general investments are being made by the majority of the market. Many people who invest in cryptocurrencies have little understanding of investing in general. Many investors often act on emotion rather than letting research determine their investments.

This means that cryptocurrency values can react strongly to media and news stories, especially to adverse news. During times of adversity, investments opportunities often present themselves. Successful crypto traders realize the need to understand mass psychology to produce consistent results.

Spreading your investments

Every investor understands that, by spreading your investments, you reduce your risks. Strangely enough, this principle is sometimes forgotten when investing in cryptocurrencies. Many people buy one or two cryptocurrencies and leave it at that. However, it is generally accepted that by researching multiple cryptocurrencies and investing in them accordingly, you will improve your chances of returns.

By investing this way, you prevent losing a substantial amount of your capital because the price of the cryptocurrency you bought tanks. Moreover, you increase your chances of buying a cryptocurrency that suddenly raises significantly. The most volatile cryptocurrencies often yield the highest potential returns.

Understanding the principle of scarcity

The price or value of a cryptocurrency doesn't tell you much. What is more important is the market capitalization of the currency. The market capitalization is the total value of all outstanding cryptocurrencies. The Ripple is a coin that is only worth about twenty cents. However, the market capitalization is more than eight billion dollars, and thus it is one of the largest cryptocurrencies that exists.

Many cryptocurrencies are scarce. For example, bitcoin is known to never exceed 21 million. When demand increases and no new bitcoins are added, it is not unlikely that the price will rise. Therefore, be sure to research a given cryptocurrency’s supply as part of your pre-investment research. By doing so, you will be better able to predict the cryptocurrency’s development.

Decide what you can lose

Before you invest in cryptocurrencies it is important to consider what you are willing to lose. Cryptocurrencies are hugely volatile and you must be able to hold your nerve. It is therefore important to determine how much money you are willing to lose. That's the only way you're going to avoid leaving yourself in a difficult financial situation.

In which cryptocurrencies can you invest?

You can find information about all major cryptocurrencies on trading.info. In this article you can read briefly what each cryptocurrency entails. When you click through, you can find more information about the specific cryptocurrency. You can view the current exchange rate of every individual cryptocurrency, and you can start investing directly!

Investing in Bitcoins

The largest and most well-known cryptocurrency is still the Bitcoin. The Bitcoin has already achieved many records and the price has risen to thousands of pounds. The Bitcoin is also increasingly accepted as a payment option. These developments make the Bitcoin an interesting investment option.

Trading In Ethereum

Another big cryptocurrency is the Ethereum. Unique to the Ethereum is that the coin can also be used to execute smart contracts. It is precisely these unique possibilities that give the Ethereum high potential. It can therefore be interesting to invest in the cryptocurrency Ethereum.

Investing in Litecoin

Another currency is the Litecoin. The Litecoin is also a highly volatile currency. As an investor, you can benefit from these huge fluctuations by selling or buying at the right time. It may therefore be interesting to also trade in the Litecoin. Of course, we have also published an article about the Litecoin.

Investing in Dash

Dash is also a cryptocurrency that is slightly different from the Bitcoin. An advantage of Dash is that transactions are confirmed directly. In addition, the Dash offers greater privacy and there is a common pot that is used for the development of special projects. These features make the Dash an interesting investment opportunity.

Getting started with Ripple

The Ripple has some unique characteristics for a cryptocurrency: the currency is not entirely decentralized. There is a central party that determines how many Ripple coins are released on the market. The focal point of the Ripple is reducing the transaction costs for transactions to other countries. Of course there is a great demand for this and this makes investing in Ripple interesting.

Investing in NEO

NEO may sound like an interesting film name. However, it is also a cryptocurrency. With the NEO, as with Ethereum, contracts in which computer logic can be applied are the focal point. The NEO, however, focuses more on Asia as a target group, which can contribute to the further growth of this currency. Investing in the NEO can therefore be profitable.

Monero as an investment

Monero is a new digital currency with which it is possible to perform 100% anonymous transactions. This is possible because no information about the sender or recipient is sent with the transaction. Whether you are a criminal or a good citizen: anonymity is ultimately a great thing. Monero can therefore be an interesting investment.

Bitcoin Cash as fork

Bitcoin Cash is the first fork of the Bitcoin. A fork is an event where an original crypto coin is split up. This happens when people cannot agree on a particular functionality of the currency. The Bitcoin Cash has already gained popularity and it can therefore be interesting to invest in it.

Bitcoin Gold as fork

Bitcoin Gold is also a fork of the original Bitcoin. The key point of Bitcoin Gold is that the mining of the currency must be decentralized again. Obtaining a Bitcoin under the current system would require too much computational power. Bitcoin Gold focuses on making the system fair again.

Be careful with investments in cryptocurrencies

When you decide to invest in cryptocurrencies, it is important to stay sharp. Do not just go along with the hype and do not buy all sorts of coins en masse just because the crowd is doing this. In the long term, some coins are likely to crash, and it is detrimental to lose a lot of money in the event of a crash. Do enough research on the different coins and only invest with money that you can really afford to lose.