How can you invest in bonds?

Investing in bonds can be interesting for an investor looking for a relatively safe investment. In this article we discuss how you can make money with bonds. In this beginner’s guide to bond investing you learn everything you need to know to start!

What are bonds?

Bonds are loans issued by, for example, a company or government. When you buy a bond, you lend money to that organization. In return, you will usually receive interest. This interest is also called coupon rate.

How can you invest in bonds?

Are you considering an investment in bonds but don't know how to do it? You will feel right at home on this page. We briefly discuss the various ways in which you can invest in bonds.

How to buy bonds?

The most direct way to invest in bonds is by simply buying them. You can buy bonds by using an online broker. A broker is a party that can buy and sell financial securities for you. You can directly open an account with a reliable broker:

| Broker | Fees | Register |

|---|---|---|

| Invest in stocks without commissions! Other costs applicable. | |

| Speculate on price increases and decreases with a free demo! | |

| Invest in stocks & ETF's against low fees. | |

| Actively speculate in shares by using CFD's. 82% of retail CFD accounts lose money. | |

| Compare? | Compare the best brokers & open a free demo! |

Buying a bond through DEGIRO is easy. Via the search field you first select the bond you want to buy. After you found the bond you want to invest in, you can place a market order. With a market order, you buy the bond directly at the best available price. Do you only want to buy the bond at a certain price? Then you have to use a limit order.

Subscribing to bonds

Not all bonds are tradable through a broker. Many bonds are issued directly by an institution to raise money. For example, a property developer may issue bonds to raise enough money for a new construction project.

When this is the case you sign up for a new bond issue. When you do this, you will receive the number of bonds you want to buy at the offer price. Do additional research when you subscribe to an issue from an unknown party. When the body behind the bond goes bankrupt, you will lose all your money.

Investing in ETFs

Even with bonds it can be wise to diversify as much as possible. You can do this by buying ETFs or exchange-traded funds. These are funds that invest investors' money in a collection of bonds. This allows you to buy a selection of bonds directly with a relatively small amount of money. When you buy an ETF, it is important to investigate whether there is sufficient diversification across bonds. Not all ETFs buy various bonds.

The best broker to invest in ETFs is DEGIRO. At DEGIRO, you pay low transaction fees when you invest in ETF’s. This allows you to achieve a higher yield. Use the button below to directly open a free demo account:

In which European bond funds can you invest?

- iShares Core € Govt Bond UCITS ETF: This Fund tracks the yield on government bonds of countries within the Eurozone.

- De Think iBoxx Government Bond UCITS ETF (TGBT): This fund also tracks government bonds, 25 in total. The objective is to follow the Market iBoxx EUR Liquid Sovereign Diversified 1-10 Index.

- De Think iBoxx AAA-AA Government Bond UCITS ETF (TAT): This fund tracks government bonds with a minimum rating of AA and seeks to track the Markit iBoxx EUR Liquid Sovereign Capped AAA-AA 1-5 Index.

- De Think iBoxx AAA-AA Government Bond UCITS ETF (TAT): This ETF also tracks government bonds, but this time with at least an AA rating. The objective of the fund is to track the Markit iBoxx EUR Liquid Sovereign Capped AAA-AA 1-5 Index.

Funds investing in corporate bonds

- iShares € Aggregate Bond UCITS ETF (IEAG): this fund tracks government bonds & corporate bonds issued in euros that are relatively safe.

- De iShares Core € Corp Bond USCITS ETF (IEAA): this fund follows well rated corporate bonds issued in euros.

US bonds

De iShares $ Treasury Bond 1-3yr UCITS ETF (LBTE): this fund is denominated in dollars and includes U.S. government bonds with a duration of one to three years.

What do you want to know about bonds?

- Make money: how do you make money with bonds?

- Bonds background: how do bonds function?

- Interest: how is the interest on a bond determined?

- Bond price: how is the price of a bond determined?

- Risks: what are the risks of investing in bonds?

- Types: what types of bonds exist?

- Example: how does investing in bonds work?

- Advantages: what are the benefits of bonds?

- Wise investing: should you actually invest in bonds?

- Safety: how safe is investing in bonds?

- Differences: how are bonds different from shares?

How do you make money with bonds?

When you invest in bonds, you obviously want to achieve a positive return. There are two ways in which you can make money with bonds.

1: exchange rate gain

The prices of bonds are constantly fluctuating. Most bonds are freely tradable and the game of supply and demand creates a price. If you buy the bond at the right time, you can achieve a positive return by selling it for a higher price.

2: interest payments

On most bonds you will receive interest payments. Periodically, you will receive a fixed amount of interest. When you invest money in bonds, you can thus build up a fixed and fairly certain income from your investments. Alternatively, you can do this by investing in stocks that pay out substantial dividends.

How do bonds work?

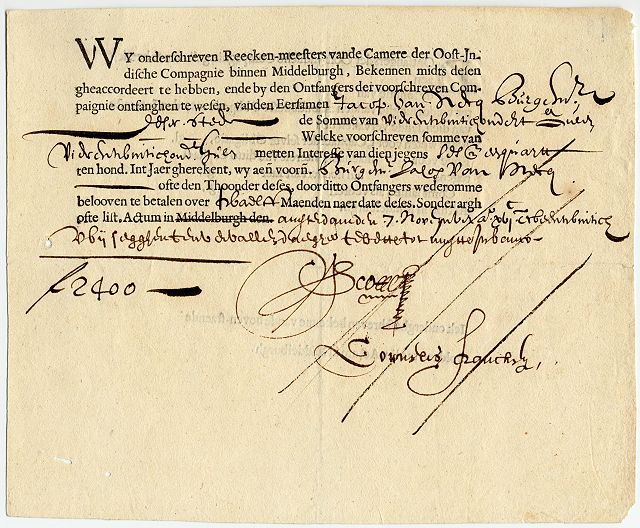

Bonds are a smart way for companies and governments to raise money. As early as 1624, the Dutch water board issued the first bond with a value of 1,200 Dutch guilders. Even now, holders of this perpetual bond still regularly receive an amount of interest. The basic principle of the bond has changed little over the years.

When a company wants to raise money, they write out a bond. Bonds can be issued over different periods of time. The duration indicates after how many years the amount of the loan will be repaid. If the term is 10 years, you will get the total amount lent back at the end of those 10 years.

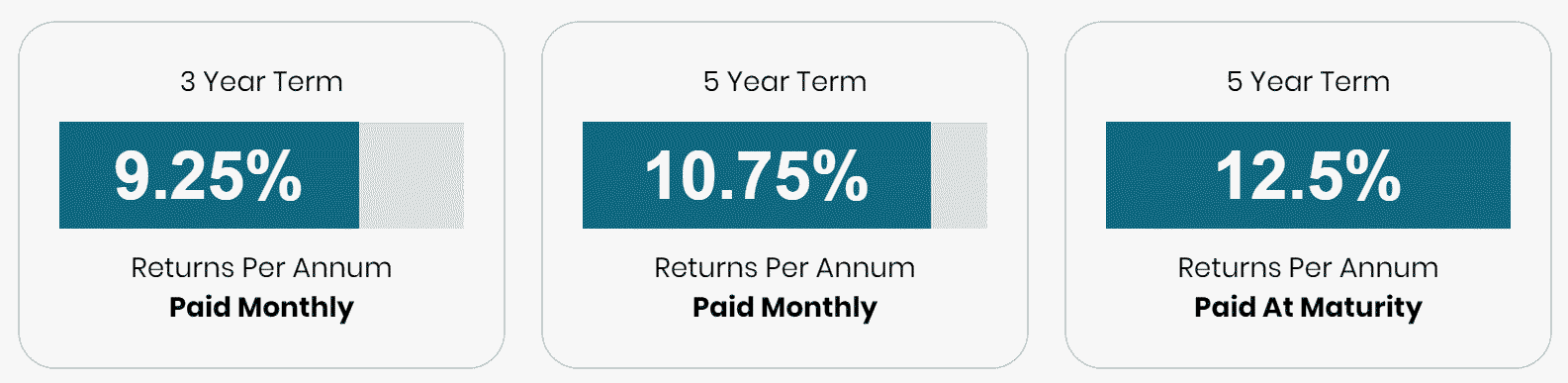

Interest rates can differ widely. Not every bond will pay the same percentage of interest. The moments at which interest is paid also differ. Finally, the issuer determines the market value of the bond. This does not always happen at the nominal value of the bond. The nominal value is the amount redeemed at the end of the term. The options are:

- At par: at 100% of the nominal value

- Under par: issued for less than 100% of the nominal value

- Over par: issued for more than 100% of the nominal value

How high is the interest rate on a bond?

Companies and governments can determine how much interest they give on a bond. However, if they provide an unattractive interest rate, no one will buy the bond. The interest rate will therefore always depend on the situation of the market. Below, we discuss three factors that influence the interest rate on bonds.

The market interest rate

The central banks determine the market interest rate at which banks can borrow money. This interest rate then indirectly determines how much interest people receive on their savings account. When the market interest rate is high, the interest rate on a bond will have to be even higher. After all, bonds are investment products with some risk. If, on the other hand, the interest rate is low, then the interest rate on bonds will also be lower.

Duration of the loan

When you go to the bank and want to borrow money, the interest rate increases when you want to do this for a longer period of time. After all, there is a greater chance that the interest rate will rise in the meantime and then the lender has a disadvantage. The same principle applies to bonds. When the term is longer, you'll receive a higher amount of interest. Only in the exceptional situation of a reverse interest curve, this is not the case.

Credit rating

A final important factor in determining the interest rate on a bond is its creditworthiness. There is always a small chance that the counterparty will not be able to repay the amount of the loan. With some bonds, this risk is minuscule: think for example of bonds issued by the government. Corporate bonds, on the other hand, are more risky. Bonds with a lower credit rating have a higher interest rate. In this way, you are compensated for the higher risk.

How is the price of a bond determined?

Bonds are traded on the stock exchange at market price. This price is different from the price at which the bonds were originally issued. The attractiveness of a bond depends strongly on the market interest rate.

When the market interest rate rises, the prices of the outstanding bonds fall. The new bonds that are issued are then more attractive because the interest rate on them is higher.

If, on the other hand, the market interest rate falls, the prices of the outstanding bonds rise. The current bonds then pay more interest than the bonds that are currently being issued. You will then receive a higher annual interest payment than the market rate.

The term to maturity also has a role in how strongly the prices of bonds fluctuate. If the term is longer, the price of the bond will move more when the market interest rate changes. After all, the influence of the interest rate change is stronger in that case. With a longer term to maturity, a higher or lower amount of interest is paid periodically for a longer period of time.

What are the risks of investing in bonds?

Investing in bonds involves the necessary risks. The most important risks of investing in a bond are the interest rate risk, the debtor risk and the market risk. Let's take a brief look at what these types of risks are.

Interest risk

Interest rate risk is the risk that market interest rates rise. The interest rate on a bond remains the same throughout its term. When the market interest rate rises, the bond becomes less attractive. As a result, the price of the bond will fall. The return on your investment then decreases.

Debtor risk

The debtor or counterparty risk relates to the creditworthiness of the issuer of the bond. In the unlikely event that the counterparty goes bankrupt, you may lose the full amount of your deposit. Fortunately, this seldom happens, especially with the safer bonds.

Market risk

Depending on the market situation, the demand for bonds may decline. This happens, for example, when other investment products yield a much higher return on average. When there is less demand for bonds, the price will fall.

What categories of bonds exist?

There are different types of bonds. Not every type of bond is equally risky. We can split bonds into:

- Government bonds: these bonds are issued by a country.

- Corporate bonds: these bonds are issued by a company.

- High-yield bonds: bonds of uncreditworthy companies at high-interest rates.

- Emerging market debt: bonds of companies & governments from emerging countries.

Government bonds carry little or no risk, while emerging market debt carries high risks. The differences in the interest you receive are therefore large. On the safest bonds you sometimes have to pay interest, while on the most dangerous bonds you sometimes receive as much as 9 or 10 percent interest per year.

You can read the creditworthiness of a bond by looking at its rating. The rating indicates how creditworthy a bond is. Companies such as Standard & Poor's and Fitch indicate with letters how creditworthy a bond is. Bonds with a rating of AAA are the safest and bonds with a rating of D are very risky. Before investing in a bond, it is wise to check the creditworthiness of the bond.

What types of bonds are there?

Most people invest in fixed yield bonds. With this type of bond, you periodically receive fixed interest payments. However, bonds come in all shapes and sizes. Let's look at some other types of bonds you can invest in.

Convertible Bonds

This type of bond is issued by a company. With a convertible bond, you as an investor will not receive your money back at the end of the term. Instead, you receive a fixed number of shares per bond. It is especially interesting to invest in convertible bonds when you have a lot of confidence in the share price of the company.

Zero coupon bond

This type of bond does not pay interest. The price for this type of bond is therefore lower than the amount you receive at the end of the term. The return then consists of the difference between the purchase price of the bond and the amount you receive on the expiration date.

Subordinated bond

Subordinated bonds are riskier than 'normal bonds'. With a subordinated bond, you only receive your money in the event of a company's bankruptcy after all normal bondholders have received their money. For this higher risk, you usually receive a higher interest rate.

Indexed bonds

With this type of bond, the interest rate moves with inflation. As a result, the risk for the investor is somewhat lower. However, as an investor you are paid to take risks. The return will therefore be lower with this type of bond.

Floating interest rate bond

The interest rate is not fixed for this type of bond. For example, the interest rate can move with the market rate. Pay close attention when you buy this type of bond and examine whether it is likely that the interest rate will move in the right direction. If this is not the case, it is better to buy another bond.

Speculating with bonds

Bonds often have a safe image. This certainly does not have to be the case. For the more adventurous investor, there are the high-yield bonds or junk bonds. With an assessment below BBB, the risk of bankruptcy is much higher. As an investor, you will receive a much higher interest percentage for these riskier types of bonds.

Before investing in these types of risky bonds, it is important to research the company carefully. After all, when the business goes bankrupt, you can lose the full amount of your investment.

Why do people buy bonds with a negative yield?

Nowadays, bonds with a negative return also exist. You have to pay money to hold a bond.

Investors are still buying this bond because they expect the interest rate to fall even further. The price of these bonds will then increase, making it still possible to achieve a positive return.

However, I would never invest in anything that requires me to pay money. I would rather invest my money in some riskier shares instead.

Example of bond market developments

By using an example, we show how investing on the bond market works. In the first example, we want to buy a bond of a fictitious company. The interest rate is 5%. We buy the bond and receive an interest payment of 5% each month. After we buy the bond some negative news is published: the company appears to be almost bankrupt. People sell their bonds en masse because they are afraid to lose their entire investment.

Despite the fact that people are selling the bonds, we still receive the 5% interest every month. In the end, the company manages to recover and at the end of the term we receive back the amount we originally invested.

In the second example, we buy bonds during the corona crisis. We decide to invest in government bonds, as there is a lot of uncertainty. The central banks lower the interest rate, so you would expect the interest rate on the bonds to drop. However, this turns out differently. People are afraid of the outcome of the crisis, which causes the interest rate on the bonds to rise sharply. We buy governmental bonds with a higher interest rate, and we hope to achieve a good return on this in the future.

As you can see, there are many factors that play a role when investing in bonds. The price of a bond is certainly not the only factor that is important. The interest you receive on the bond can also be an important consideration. When the interest rate is high, you can use bonds to build up a nice fixed income.

Ensure sufficient diversification

An important tip when investing in bonds is to ensure sufficient diversification. When you buy bonds from companies, it is wise to do this in different sectors. A rising oil price, for example, can be beneficial for a company like Shell and disastrous for a company like Air France-KLM. The prices of bonds on Shell may rise while those of a company like Air France-KLM fall.

It is also advisable to diversify between different investment products. When bonds do well, shares often perform worse. This also applies the other way around. By investing in both shares and bonds, you ensure a more stable and secure return. Would you like to know more about investing in shares? Read our article on this subject:

What are the advantages of investing in bonds?

Investing in bonds can be advantageous for several reasons. Let's see what the biggest advantages of bonds are:

It's relatively safe

Bonds are a relatively safe investment. The price of a bond often moves less strongly than the price of a share. Moreover, even if the price is lower, you will still receive the same amount of interest.

You receive an income

On bonds, you will receive a periodic payment in interest. This allows you to build up an extra income with which you can do nice things again.

Diversification

By investing in bonds, you can spread the risks of your entire investment portfolio. Shares perform better in the long term. However, this certainly does not have to be the case in the short term. By also investing in bonds, you reduce the volatility of your total portfolio.

Is it sensible to invest in bonds?

Whether it is wise to invest in bonds strongly depends on your personal situation. Bonds are a relatively safe and defensive investment product. Bonds are therefore more popular for older investors. When your retirement is approaching and your time horizon is shorter, you want to have a fixed amount of money at your disposal. By investing in bonds, you are almost certain that you will get a certain amount back at the end of the term.

However, share prices fluctuate sharply. It is therefore not at all certain that you will have the amount of your investment back in a few years’ time. Therefore, shares are more suitable for investors who have time. Over a longer period of time, shares yield a lot better than bonds.

That's why you should consider for yourself to what extent you're willing to take risks. If you have more time, and you want to take more risks, then you can invest a larger part of your money in shares.

Strategy: a bond ladder

When you decide to invest in bonds, it can be interesting to build up a bond ladder. You then invest your money in bonds with different maturities. You can invest part of your money in a bond that expires over 5 years and another part in a bond that expires over 10 years.

When the market interest rate rises, this prevents all your money from being trapped in the same bond for a longer period of time. After 5 years, you can invest part of your money somewhere else.

How can you safely invest in bonds?

Of course, investing is never completely safe. After all, as an investor, you get paid to take risks. Nevertheless, if you take a smart approach, you can invest much more safely in bonds.

It is important to first choose a good party to buy bonds. Do not invest with rogue companies: if you do this, there is a chance that you will lose the entire amount of your investment to a crook. In our brokers comparison overview, you can immediately see where you can invest reliably.

It is also important to investigate the creditworthiness of the company properly. If a company has a good score, this is already a good indication for a safe investment. However, dig a little deeper and investigate what the party behind the bond is doing. Rating companies sometimes get it wrong too. A good example of this are their positive ratings for the mortgage bonds that ultimately caused the 2008 credit crisis.

Which bonds are interesting?

This is a question we cannot answer directly. If you are willing to take large risks, then an investment in a high-yield bond can be interesting. If you are looking for a very safe investment, you may consider investing in a government bond.

In any case, it is wise to perform proper research into the market situation. First predict what you think will happen to the market interest rate. After all, the market interest rate has a strong influence on the prices of bonds.

When you think that the market interest rate is going to fall, it is even more interesting to buy bonds. If you think that the market interest rate is going to rise, then it might be better to wait awhile before you buy bonds.

What are the differences between bonds and shares?

Bonds and shares are the best-known investment products out there. Not everyone understands the difference between a bond and a stock. When you buy a share, you immediately become co-owner of the company. You can take part in the shareholders' meeting, and you have the right to receive part of the profits in the form of dividends.

When you buy a bond, you are not a co-owner of the company. Therefore, you are not welcome at the company's meeting, and you do not receive any dividends. You are only entitled to interest payments and at the end of the term your bond expires automatically. However, in the event of bankruptcy, you are entitled to money before the shareholders receive it. This makes a bond less risky.

How to buy bonds and make money from them?

Are you curious about the best method for buying bonds? In this article we will discuss the best method to invest in bonds. This way you will immediately discover the various ways in which you can make money with bonds. What are bonds? Bonds are debt securities issued by a company (corporate bond) or government … [Lees meer]

How to make profits with bonds? Yield explained

Investing in bonds can be an attractive choice if you do not want to run too much risk. In this article we will discuss how bond investing works. How is the price of a bond actually established, and how can you determine the profit you make with your bond? What are bonds? Bonds are debt … [Lees meer]

What are bonds?

Are you wondering what bonds are? Then you have arrived at the right place! In this article we describe the meaning of a bond in detail. What are bonds? A bond is a loan issued by the government or by a company. Bonds are debt securities. When you buy a bond, you usually receive a … [Lees meer]

What are the risks of bonds?

As an investor, you are of course always looking for a form of investment that gives a high return, but which is also safe. An example of a relatively safe investment is the bond. For a long time, many investors thought investing in government bonds was a safe haven. But do bonds and government bonds … [Lees meer]

Zero bonds or zero coupon bonds meaning: what is it?

In this article, we discuss the meaning of a zerobond or zero-coupon bond. What is a zerobond or zero-coupon bond? A zerobond (zero-coupon bond) is a bond that does not pay interest. Zerobonds are sold at a discount, and you earn your return at the end of the term when you receive the face value. … [Lees meer]