Is bitcoin a bubble? – everything you need to know

You only have to tell people that you would like to start investing in cryptocurrency, and they will immediately tell you that it is a big bubble. Often, these are people who are completely unaware of how an investment bubble works or what the characteristics of a bubble are. To help you get started, we will show you if Bitcoin is a bubble or if it is a wise choice to invest in.

What is a bubble anyway?

First, let’s look at the phenomenon behind the bubble. What is a bubble, you may ask? An economic bubble or asset bubble is the situation where asset prices appear to be based on unlikely or inconsistent expectations about the future. It can also be described as trading in an asset at a price that greatly exceeds the asset’s intrinsic value.

In normal language, it means that the prices are far too high compared to the underlying value. When bread is sold for $600 a piece, you know that something is wrong. This is also sometimes the case with shares, bonds and other types of assets. They call it a bubble because the prices keep rising (the bubble is inflating) and then all of a sudden, they are worth nothing (the bubble bursts).

Phases of an investment bubble

Now that you know a bit more about what an investment bubble is, it is important to look at the phases that we can distinguish in a bubble. What is special about the phases is that they are the same for every bubble, whether it is stocks or possibly Bitcoin. To make things easier, we have listed the main phases of a bubble below:

Phase 1: Displacement

Displacement occurs when investors are very interested in a particular type of asset, such as a new technology like blockchain. A classic example of crowding out is the fall in the federal funds rate from 6.5% in July 2000 to 1.2% in June 2003. During this three-year period, interest rates on 30-year fixed-rate mortgages fell by 2.5 percentage points to an all-time low of 5.23%. This led to many people wanting to start investing. As a result, there was interest from the public.

Phase 2: Boom

The next phase of the bubble is the so-called boom phase. The prices rise slowly at first, but then rise much faster as more and more investors join who are also keen to make money from the rising price. During this phase, the asset in question gets a lot of media attention. The fear of missing out on a unique opportunity leads to more speculation. As a result, more and more investors and traders will enter the market, causing the price to rise again. It is a kind of self-fulfilling prophecy that comes true.

Phase 3: euphoria

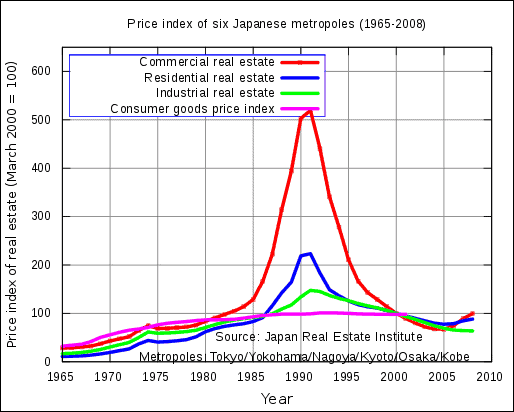

The next phase in a bubble is the euphoria phase. During this phase the prices really shoot up. The prices reach extreme levels during this phase. People think that the price can only go up and that there will always be buyers for their stocks, for example. At the peak of the Japanese property bubble in 1989, property in Tokyo sold for 139,000 dollars per square metre. This is more than 350 times the value of property in Manhattan.

This shows that prices are no longer realistic at all. People just do not want to see this because they only think that the price will go up even further. For example, at the height of the Internet bubble in March 2000, the combined value of all technology stocks on the Nasdaq was higher than the GDP of most countries.

Phase 4: Sale of assets

In this phase, the first profits are recorded. This usually takes place at the moment when the first warning signals are given that the growth of the previous phase cannot continue for so long. Estimating the exact moment when a bubble will burst is not easy. The famous economist Jan Maynard Keynes said this as follows: ‘The markets can stay irrational longer than you can stay solvent.

In August 2007, for example, the French bank BNP Paribas stopped the withdrawal of three investment funds with significant exposure to US subprime mortgages because it could not determine the value of their holdings. While this development did cause quite a stir, it took much longer for the bubble to burst. The people who get their money out of the market at this stage are, of course, the big winners. They can make a huge profit on their investment.

Phase 5: Panic

The final phase of the bubble is the panic phase. If a bubble really bursts, it will burst immediately and many shares or other types of assets will become almost worthless in one day. In the panic phase, asset prices reverse course and fall as fast as they rose. Investors see their money disappear into thin air. As supply overwhelms demand, asset prices fall sharply. A good example of this phase is the bankruptcy of Lehman Brothers. The S&P 500 plummeted nearly 17% that month, the ninth worst monthly performance. The bank’s own shares became worthless.

Bitcoin – top 4 reasons why it is not a bubble

If you have read the above, you already know how to recognize a bubble. With this knowledge, it is easy to see if Bitcoin is a bubble or not. Below, we have listed the top 4 reasons why specialists and economists say Bitcoin is not a bubble:

Bitcoin is increasingly used as legal tender

The main reason that Bitcoin cannot be seen as a bubble is the fact that it is increasingly being used as a real legal tender. One of the biggest challenges that Bitcoin has faced so far has been its acceptance by legislators and financial regulators to be used as a real currency. This was mainly due to its decentralized nature and association with criminal activity over the Internet.

Fortunately, this has changed. There are more and more countries and governments that are very positive towards cryptocurrencies. This growing adoption means that Bitcoin’s price is rising and that its use is increasing significantly.

In April 2017, Japan announced that it would officially accept Bitcoin as a legal payment method. In the Philippines, citizens are increasingly using Bitcoin to send and receive cheap money transfers. This has not gone unnoticed by the country’s Central Bank. In fact, they said in February 2017 that they will regulate Bitcoin. As a result, Bitcoin can be used as an official currency, giving it full legal status. Countries like Australia and Russia have recently made similar statements that could lead to Bitcoin becoming a fully accepted medium of exchange in their respective countries. It is likely that many more countries will do so as well.

Bitcoin used by more businesses

Besides the fact that Bitcoin is increasingly used or regulated by governments, many more businesses are choosing to use Bitcoin. Several leading technology companies and e-commerce platforms accept Bitcoin as a means of payment. Microsoft, Rakuten, and Overstock are three of the largest companies that accept Bitcoin payments.

Increased media coverage and new acceptance in countries such as Japan is driving more and more businesses to join them. Bitcoin offers many advantages to sellers and businesses. For example, it costs much less than credit card payments. Bitcoin can also make it easier for people from foreign countries to make transactions without the interference of banks.

Bitcoin is used as a digital store of value

Another reason why Bitcoin is not considered a bubble is that it is used as a store of value in countries that are struggling financially. For example, in countries like Venezuela, Bolivia, and Zimbabwe, Bitcoin is a storage of value and an alternative means of payment. This is mainly due to the fact that local currencies are losing value.

This can be seen by the increasing volumes of bitcoin traded, which are negatively correlated with the performance of local currencies and economic growth in distressed regions. Bitcoin also allows citizens to put their money aside and buy things with it. This is much more convenient than regular currency as Bitcoin is not prone to inflation.

Bitcoin supply is limited

Another important reason why Bitcoin is not a bubble is the fact that the supply is limited. The way Bitcoin is created, there can never be more than 21 million coins. On top of that, the rate at which new coins are created will slow down over time. So, this really ensures that the supply is finite, unlike, say, normal currencies. Due to the finite character, it is not possible for the price to develop in the same way as that of a real bubble. So as an investor you don’t really have to worry about this.

Is Bitcoin a Bubble?

With the reasons mentioned above, we can conclude that Bitcoin is not just a bubble. This means that it can certainly be a good option to invest in Bitcoin. It is quite different from the Tulip bubble or the Dot Com bubble.

Bitcoin is likely to continue to grow and use the blockchain much more in the coming years. Of course, this does not mean that Bitcoin will not experience significant declines. It is just that Bitcoin cannot be seen as a bubble. Those who say it is, should read this article to learn more about how a bubble works.

However, it is important to remember that blockchain and Bitcoin are still very new. As more and more businesses accept crypto money, you can see that the case for it is growing. However, given Bitcoin’s limitations, it is questionable whether Bitcoin will remain the dominant player; it could be taken over by another cryptocurrency. Therefore, be vigilant with investments and cryptocurrencies and consider investing in other altcoins.

Want to buy bitcoins?

Are you convinced that Bitcoin is not a bubble? Then it might be smart to buy the cryptocurrency. You can do this with a reliable crypto exchange:

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.