Crypto credit cards comparison (2024): which one is the best?

With a crypto credit card, you can make payments directly by spending your cryptocurrency. Moreover, with a crypto credit card, you often receive attractive bonuses: think, for example, of cashback or special benefits. In this comparison, I will compare the most interesting crypto credit cards on the market.

What is the best crypto credit card?

Curious about the best crypto credit card? In the overview below, you will see my favourite providers:

| Provider | Benefit | Apply |

|---|---|---|

| Plutus | Receive up to 8% cashback + various benefits | |

| Crypto.com | Receive 5% cashback + free lounge access |

Compare Crypto Credit Cards

Crypto.com: Cashback & Various Benefits

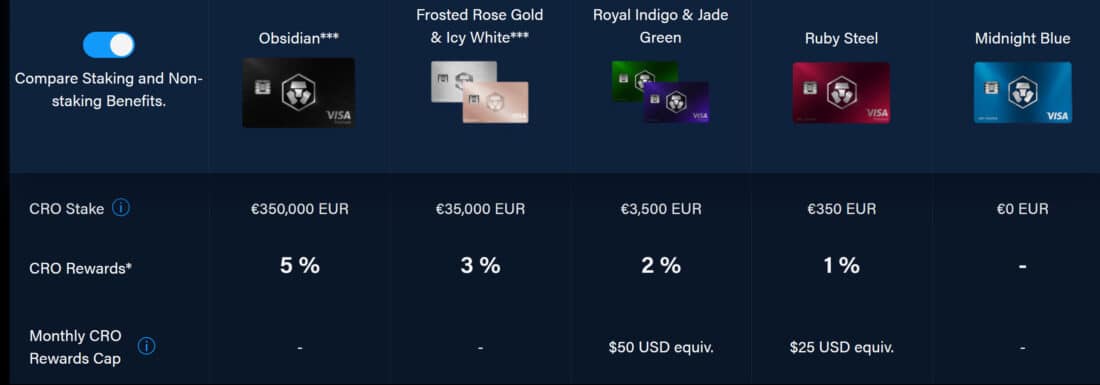

With Crypto.com cashback, you can enjoy various benefits & up to 5% cashback. You can only benefit from the advantages when you stake Crypto.com’s cryptocurrency (CRO). For the cheapest card, you must stake at least $350 worth of CRO, while for the most expensive card, you must stake a whopping $350,000! It is also possible to apply for a free crypto credit card, but you will not receive cashback on this.

I myself use the Indigo Green crypto credit card at Crypto.com. I receive 2% cashback and free lounge access at the airport. I find the latter benefit particularly attractive since I travel a lot.

The Crypto.com credit card is easy to use, and transaction fees are relatively low. This makes the crypto credit card from Crypto.com an attractive option if you want to use your cryptocurrencies to make purchases. Click here to apply for a Crypto.com credit card!

Plutus: High Cashback & Benefits

Plutus is a relatively new party that offers attractive benefits on the European market. Even with the free crypto credit card, you already receive 3% cashback on €250 and you receive a free perk. A perk can be, for example, a membership on Netflix or Spotify or a discount at Shell or Booking.com.

At Plutus, PLU is the used cryptocurrency: when you buy enough of it, you receive an increased cashback & various benefits. Personally, I have staked just under €5000 worth of PLU, and I receive 5% cashback and extra perks for this. Thanks to the Plutus crypto credit card, for example, I receive significant discounts, free taxi rides, free Spotify and Netflix, discounts on my vacations, and discounts on my gasoline.

Personally, I think that due to the attractive conditions of the free Plutus card, it is always worth applying for it. Moreover, as a new member, you will receive 10 PLU for free (worth about €10) when you open an account through this website. Click here to read my extensive Plutus credit card review first or click here to apply for your Plutus credit card directly!

Binance credit card: attractive cashback

The Binance credit card cannot miss from this comparison, as Binance is the world’s most famous crypto exchange and has introduced its own crypto credit card in recent years.

The Binance credit card offers little extra services: the only benefit you receive with the credit card is cashback. This cashback can go up to 8%, but you will need to buy a lot of BNB. Fortunately, the cashback percentage of 2% is easy for everyone to achieve.

A disadvantage of the Binance crypto credit card is the fact that its user-friendliness leaves something to be desired. For example, because Binance does not have an official licence, it is difficult to deposit money into your account.

When you open an account through trading.info, you will receive a permanent 20% discount on your transaction fees. Click here to read my detailed review of the Binance credit card or click here to open an account directly with this provider!

How does a crypto credit card work?

A crypto credit card works the same as a normal credit card. Most crypto credit cards are actually regular Visa credit cards that you can use to make payments on websites and in stores.

With most providers, you can deposit money into the credit card. You do this by transferring money to the credit card provider. Then, the money for each transaction is automatically deducted from the card after you make a payment. You will automatically receive the promised cashback percentage back into your account.

What to consider when comparing crypto credit cards?

Rewards

Most people choose a crypto credit card because of the attractive rewards. For example, many providers offer high cashback and various benefits. Therefore, it pays to compare the different credit cards with each other: this way, you can determine which rewards are the most attractive to you.

Costs

When you plan to use the credit card frequently, costs are also an important factor to consider. For example, withdrawing money at an ATM or making foreign transactions can cost a lot of extra money. Therefore, make a list of the places where you want to use the credit card to determine if the crypto credit card is right for you.

User-friendliness

The user-friendliness of the crypto credit card is also essential. With some credit cards, you can easily and quickly deposit and withdraw money, while with other credit cards, it can be a cumbersome process. By comparing the applications of the different providers, you can discover which credit card suits you best.

Safety & reliability

Crypto is not always known for its high safety/reliability. Therefore, research what measures the provider has taken to secure your funds. Large providers such as Crypto.com and Binance have a good reputation, which contributes to the reliability of the brand. With new and unknown brands, it is more important to conduct extensive research.

The crypto

Finally, many people apply for a crypto credit card because they are interested in investing in crypto. It is, of course, a bonus when the crypto on your credit card increases significantly in value: you can make a profit that way. If you plan to stake a large amount of crypto, it is wise to investigate how the cryptocurrency is developing.

What are the risks of crypto credit cards?

Crypto and risks go hand in hand: this also applies to crypto credit cards. To benefit from rewards, you often have to buy a certain amount of crypto. Cryptocurrencies are very volatile, so your investment can decrease in value. In extreme cases, you can even lose the entire amount of crypto: for example, if the underlying exchange goes bankrupt.

You should also pay extra attention to the security of your account. Hackers are always on the lookout to steal your funds. Crypto exchanges that issue crypto credit cards are typically (less) regulated, which means you can really lose your funds in the event of a hack. A regular credit card is therefore much safer!

Conclusion: are crypto credit cards worth it?

I am a big fan of crypto credit cards myself! Especially for Europeans, crypto credit cards offer unique benefits. With cashback, you can save money on every purchase! Moreover, crypto credit cards are easy to use these days, which makes the market more accessible than ever!

Frequently Asked Questions about Crypto Credit Cards

You can use crypto credit cards to pay at any provider that accepts credit cards. If your crypto credit card is not accepted somewhere, you can also try Curve: with Curve, you can turn any credit card into a Mastercard.

With most providers, you do not have to pay for applying or using the credit card. However, credit cards often charge transaction fees for transactions in foreign currencies. By thoroughly researching what fees a crypto credit card charges, you can avoid unpleasant surprises.

Personally, I believe crypto credit cards are definitely worth it! In practice, when you use a crypto credit card, you are actually paying with fiat currency. You deposit regular euros onto the credit card, which you can then spend. The difference with a ‘regular’ credit card is that you receive a nice cashback and can take advantage of various benefits.

In terms of use, crypto credit cards are often just as safe as normal credit cards. However, to receive the various benefits, you often have to stake a larger amount of crypto. This is risky; cryptocurrencies fluctuate strongly, and their value can decrease significantly. When you stake crypto, it is therefore important that you understand and accept these risks.