What is a short squeeze? Profit from shorters!

In 2021, Gamestop was without a doubt the most well-known short squeeze. In this article, we discuss what a short squeeze is and how it takes place. After reading this article, you will know what a short squeeze means and how to profit from it.

What is shorting?

A short squeeze can only occur when many people short a stock. You go short on a stock when you speculate on a decreasing price. You then sell shares that you do not own, hoping to buy them back at a lower price later on.

If you want to read more details about shorting, you can read this article:

What is a short squeeze?

When you open a short position, you borrow shares from another party. At some point, you will have to buy back these shares. Shorters hope to buy these shares at a lower price.

However, this does not always work out; the price can also rise. When many people own short positions, this can lead to a domino effect. A positive news article can give a boost to the stock price, after which shorters begin to close their positions. A short position is closed by buying the shares, which further increases demand for the stock.

With a short squeeze, the shorters are squeezed like a lemon: the stock price can suddenly rise sharply.

The 6 steps of a short squeeze

- A company does not perform well, which leads to many people shorting it.

- The company reports better-than-expected results, causing the price to rise.

- Some shorters panic and close their positions, forcing them to buy the stock.

- This creates a chain reaction causing more investors to close their short positions.

- Due to the large increase in demand for the stock, the price rises explosively.

- The short squeeze is a fact, the rocket goes up, but often crashes back down quickly.

Gamestop: A well-known example of a short squeeze

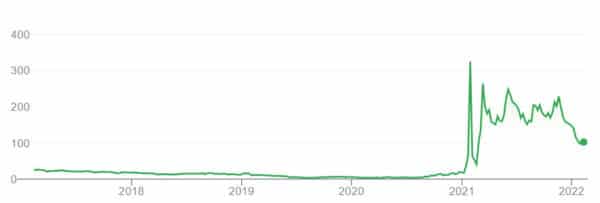

Perhaps the most well-known example of a short squeeze occurred in 2021. The Gamestop stock rose from a few dollars to over 300 dollars.

Gamestop is a simple physical gaming store, not the type of modern company that attracts substantial stock price increases. However, at one point, there were more short positions than Gamestop shares, which makes the likelihood of a short squeeze very high.

A large group of retail investors on Reddit noticed this and decided to buy the stock massively. As a result, the stock price skyrocketed to enormous heights within a week, and a group of “ordinary people” defeated several large hedge funds.

How to benefit from a short squeeze?

As an investor, you can benefit from a short squeeze. It is essential to find shares with a high chance of a short squeeze:

- Stocks with a low market capitalization (i.e., a low total value) have a greater chance of a short squeeze (<$1 billion)

- Stocks with a good news expectation. The good news then gives the initial boost to the stock price.

- Stocks with relatively high short positions compared to the number of available shares have a greater chance of a short squeeze.

For the last point, look at the short interest ratio. This ratio indicates how many shares are shorted percentage-wise. When there are 100 shares, and 10 shares are shorted, this percentage is 10%. It doesn’t matter how many absolute short positions there are; it’s entirely about the number of relative short positions.

When positive news is released, the chances of a short squeeze occurring are higher. However, keep in mind that the stock market is difficult to predict: there is certainly no guarantee of a short squeeze.

What is the biggest short squeeze?

The biggest short squeeze ever occurred on Volkswagen/Porsche shares in 2008. This story demonstrates the power of a short squeeze, as the company was temporarily the largest in the world.

In 2018, the company’s stock initially dropped significantly, almost 50%. This attracted many shorters, as you can make money with a short position when the stock price falls. However, Porsche announced that they bought a large part of the company, causing shorters to close their positions. In an acquisition, you often see a significant increase in stock price, since a premium above the asking price is paid.

This led to a massive chain reaction, causing the stock price to increase fivefold within a few days!

What are the risks of a short squeeze?

Short squeezes are not entirely without risk. Short squeezes don’t always occur; if the stock price continues to drop, you can lose money on your investment position.

Even investors who enter at the right time frequently still lose money in a short squeeze. They are greedy and do not exit in time. A short squeeze is always temporary by definition: it typically only lasts a few days. This was also the case with Gamestop: after the peak of $300 was reached, the stock price fell back to $40.

How can you protect yourself against a short squeeze?

When you open a short position yourself, you can encounter a short squeeze. Your loss can then be enormous: when the stock price increases several times, you can lose the entire amount in your investment account.

It is therefore advisable to always use a stop loss. With a stop loss, you set an amount at which you automatically take your loss. However, a stop loss cannot always be executed in fast-moving markets. With some brokers, you can use a guaranteed stop loss, which is attractive when you expect a lot of volatility.

What is a gamma squeeze?

Options played an important role in the strong price development of Gamestop. When you buy options, the counterparty is at risk when they do so without owning the collateral. A naked call can become costly, especially when the price rises sharply.

The counterparty can also be moved to buy more shares when many call options are taken. This can increase the chance of a significant increase in stock price for investors who buy options, which is also called a gamma squeeze.