How to Buy Bitcoin with U.S. Bank (2024)

Are you a U.S. Bank customer, and do you wonder if it is possible to buy Bitcoin? This article will show you what you need to know about buying Bitcoin with your bank account at U.S. Bank.

How to Buy Bitcoin with U.S. Bank (2024)

Step 1: Create an account with a crypto exchange

U.S. Bank customers are not offered an online banking platform that supports the direct purchase of Bitcoin or any other digital assets. In order for you to buy Bitcoin with U.S. Bank, you will need to connect your bank account to a licensed cryptocurrency exchange.

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

The crypto exchange platforms listed above offer you the best environment to conveniently buy Bitcoin (BTC) or any other digital asset you plan to invest in. Choosing a licensed crypto exchange platform gives you a perfect head start to buy Bitcoin with U.S. Bank. Licensed platforms provide you better security for your funds and minimizes the risk of falling into a fraudulent scheme.

Step 2: Complete all your verifications (personal or company).

You will be required to carry out all the necessary verifications as needed by the crypto exchange platform. You would be asked to provide the following information:

- Passport: upload a copy of your pasport.

- Address: You will be asked to upload a document that proofs your current location e.g. utility bills.

- Experience: Provide answers to questions about your experience with cryptocurrency trading.

- Finance: Give an overview of your financial portfolio, for example your annual income.

It is mandated for crypto exchange platforms to verify it users. This helps them prevent cases of fraud and other criminal activities.

Step 3: Deposit funds from your U.S. bank account.

You can now go ahead and make deposits to your account once the exchange platform has approved your account. Go to the crypto exchange platform and navigate to the deposit button, click and enter the amount of your chosen fiat currency.

To prevent any mistakes, it’s also crucial to ensure that the name on your crypto exchange account and the one on your U.S. Bank account is a match.

Step 4: Select crypto on the trading platform.

Bitcoin is one of the most widely used cryptocurrencies which tries to create a decentralized peer-to-peer financial system. Despite early scepticism, Bitcoin has become a financial model for the creation of many other cryptocurrencies with differing use cases.

To make better investment decisions, it is important to study the market value, volatility, and Whitepaper of a cryptocurrency, as this will enable you to better understand the kind of project you are investing in.

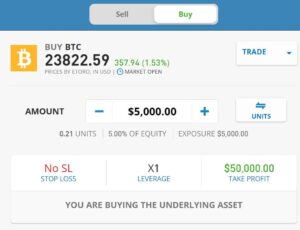

Step 5: Open a crypto position

- Amount: Decide the number of Bitcoin you would like to purchase

- Order: Once you have decided on the amount of Bitcoin to purchase, the next thing for you to do is to place an order. Here you should choose an order price that is suitable for you based on your market assessment. This will serve as your entry price.

- Stop loss: With a stop loss you can limit your losses.

- Take profit: With a take profit you can automatically take your profit.

What are the risks of buying crypto with U.S. Bank?

- Regulatory risk: The regulatory status of cryptocurrencies is uncertain. A crypto user faces an uncertain economic situation, given the possibility of stifling crypto regulations. For instance, if a regulation that stifles cryptocurrency adoption becomes law, it becomes difficult to make transactions and can cause a crash in the crypto economy.

- Counterparty risk: Many investors and business people depend on third-party exchange platforms to store their crypto. This comes with the risk of loosing your investments if the third-party exchange shuts down or liquidates. In the past, users of crypto exchanges lost their holdings due to hacks.

- Market manipulation: Market manipulation is still a massive problem in the crypto world. This is a result of influential people, organizations, exchanges acting unethically.

Is U.S. Bank Crypto friendly?

U.S. Bank on its own cannot provide you a platform to buy, sell or store cryptocurrency. You can only buy Bitcoin with U.S. Bank by connecting your bank account to a licensed crypto exchange platform. Luckily, U.S. Bank in general does not block transactions to crypto trading platforms.

About U.S. Bank

U.S. Bank is the fifth-largest commercial bank in the country. The bank offers financial services to individuals, businesses, governments, and other financial institutions, including banking, investment, mortgage, trust, and payment products. Its 3,133 domestic offices and 5,860 ATMs are located all over the United States which serves more than 20 million customers.

U.S. Bank is a subsidiary of U.S. Bancorp, with $750 billion in assets as of January 31, 2023. The company operates 3,106 banking offices in 25 states and 4,842 ATMs. It also provides services such as investment management, mortgage banking, insurance, and capital markets products.

Conclusion: can you buy Bitcoin with U.S. Bank?

In conclusion, U.S. Bank does not allow you to directly buy digital assets like Bitcoin on its online banking platform. To buy crypto, U.S. Bank customers have to register on a crypto exchange platforms that accept ACH transfers and credit or debit card deposits from U.S. Bank accounts.