What are the benefits of investing in Bitcoins?

Before you invest in Bitcoin, you probably want to know why it can be attractive. In this article, we discuss the benefits of investing in Bitcoin.

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

Bitcoin may not be the best cryptocurrency, but it was the first successful one. In the crypto market, many speculators are active who do not understand the technology behind cryptocurrencies. This automatically leads many people to invest their money in Bitcoin when they want to invest in cryptocurrencies.

Moreover, due to its dominant position, exchanges use this crypto to exchange for other cryptocurrencies which further contributes to the strong position of Bitcoin.

It will take a long time before another cryptocurrency can overtake the dominant position of Bitcoin. Therefore, Bitcoin is likely to remain the most successful cryptocurrency for the foreseeable future. This can be a good reason to invest in Bitcoin.

Bitcoin dominance according to bitcoindominance.com

High potential returns

Let’s be honest, the main reason many people speculate in Bitcoin are the extremely high potential returns. If you had invested $100 in Bitcoin in 2010, you would have possessed over $600 million in 2021!

With Bitcoin, a similar return is no longer possible. However, if you had invested $100 in 2020, you would have had over $ 1000 worth of Bitcoin in mid-2021. Compared to the average return on shares(between 6 and 8 percent), this is enormous!

You do have to be willing to take greater risks if you want to invest in Bitcoin: the chance of losing a considerable amount with an investment in Bitcoin is also high. People who bought Bitcoin at the top in 2017 lost almost 70% of their investment within a few months!

Fully decentralized

Another advantage of Bitcoin as a concept is that it is fully decentralized. When you use regular money, there is always a central bank that oversees your transactions, such as your bank. In the case of Bitcoin, such a party does not exist.

As a result, transactions are carried out completely independently of governments and central banks. These types of parties cannot easily influence the functionality of the money. Therefore, Bitcoin is actually the first type of “democratic money“.

The blockchain is revolutionary

The Bitcoin as digital currency is interesting, but the underlying technology is revolutionary. One major advantage of Bitcoin as a means of payment is the blockchain. Many experts believe that the blockchain is still in its infancy, as the current state of the blockchain is equivalent to the internet in the 90s.

If this is true and the blockchain is increasingly embraced, the Bitcoin price could rise even further. This is good news for you as a Bitcoin investor! Do you want to know how the blockchain works? Then read our article how does the blockchain work?

Faster transactions are possible

Bitcoin and other cryptocurrencies make it possible to send money to other countries faster. When you transfer money from your bank account to a foreign account, it normally takes a long time for the money to arrive.

This is not the case with Bitcoins: sending money to a local town costs as much as sending money to Bangladesh. This can make Bitcoin even more attractive to people who send a lot of money abroad. If Bitcoin is embraced more for this purpose, it can become an even more attractive investment.

Privacy

The anonymous nature of Bitcoin is also an advantage. When you transfer money with your bank account, your transaction is always monitored. In the past, I have been called by the bank with questions about transactions they considered suspicious.

Since there is no central party with Bitcoin, this is unlikely to happen. However, Bitcoin is not completely anonymous: if someone knows your Bitcoin address, they can trace your transactions. In this article, we discuss which cryptocurrencies are completely anonymous.

No bank fees

Banks can sometimes charge high fees for sending money. This is especially true when you send money to more exotic regions. Fortunately, this is a thing of the past with Bitcoin: since there is no central party, you do not pay fixed bank fees when using Bitcoin.

This is why you see that the cryptocurrency is also widely used by migrant workers who want to send money home. When the functionalities of Bitcoin increase, this can only be beneficial for the price.

Protection against inflation

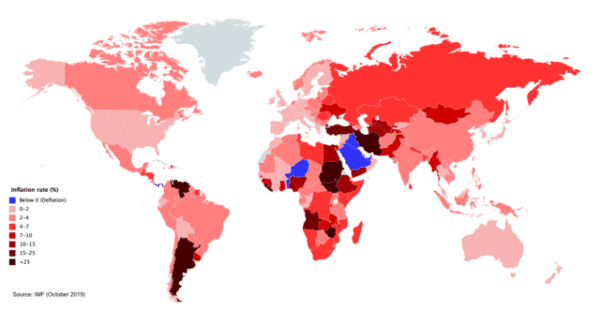

A major disadvantage of traditional money is inflation. Inflation is the process by which you can buy fewer products with the same amount of money every year. This happens because Central Banks print money, which increases the supply of hard currency.

This risk does not exist with Bitcoin: there is a fixed, limited number of Bitcoins available. Because the supply is finite, the price can only go up with equal demand which is good news for Bitcoin investors.

Inflation is certainly a big problem in some areas. Is Bitcoin the solution?

Why should you invest in Bitcoin?

As you can read in this article, there are plenty of reasons why investing in Bitcoin can be interesting. In addition to the high returns that can be achieved, the technology is also promising. With Bitcoins, you can take control of your transactions yourself and there is no third party that can influence them.

It is certainly advisable to weigh the pros and cons carefully before investing in Bitcoin. In the article on the disadvantages of Bitcoin you can read about the weaknesses of Bitcoin.

If you’re interested in investing in Bitcoin, our beginner’s guide can be a good place to start: