What are the best stocks to invest in for 2021?

After what seemed like ages, 2020 is finally over. For all those who survived, congratulations. The worst might already be behind us.

All of us faced several trials in one way or another, be it personal, professional, financial and while things might not be OK on all fronts, lessons were definitely learnt. One such lesson that a lot of us experienced was the need for investments. Investments into assets that will help generate income as well as appreciate in value to help tide us over the tough times. We here at trading.info have got just the recommendations for you to begin your investment journey in 2021. Here is a list of the best shares of 2021

Before you start buying the best shares of 2021, you might be interested to know the best broker for buying & selling shares in 2021. When you press the button, you can immediately compare the best brokers for buying & selling shares:

Qudian (Ticker: QD)

We begin the list with what some believe is the source of all happiness and for others the root cause of all evil: Money. The holiday season has just passed us by. Time of giving and gifting. Often one finds themselves short on cash while buying gifts. Credit cards to tend to be maxed out around this time. This pinch was felt harder this year as compared to the rest.

Banks and financial institutions take too long or are often unwilling to extend credit often due to credit report issues or small loan size. Let me introduce you to a little known company called Qudian (Ticker: QD). Qudian aims to fill the gap by offering credit on the go. It is a Chinese microfinance app found in 2014 that provides small size loans from 150-215 USD[1].

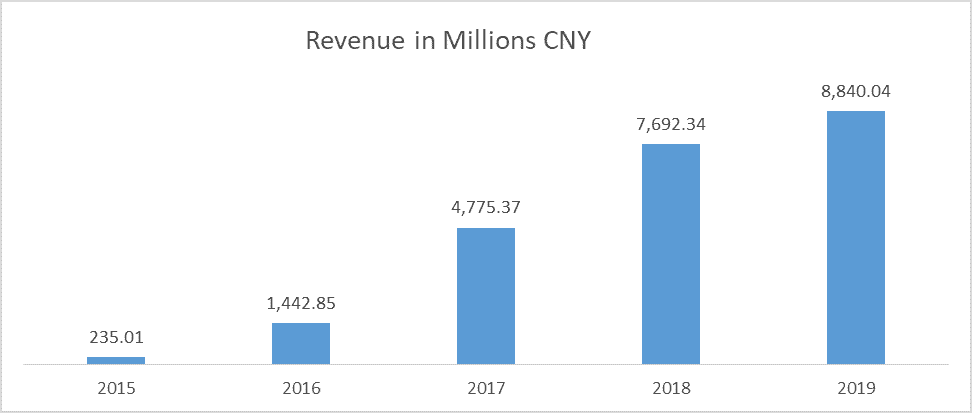

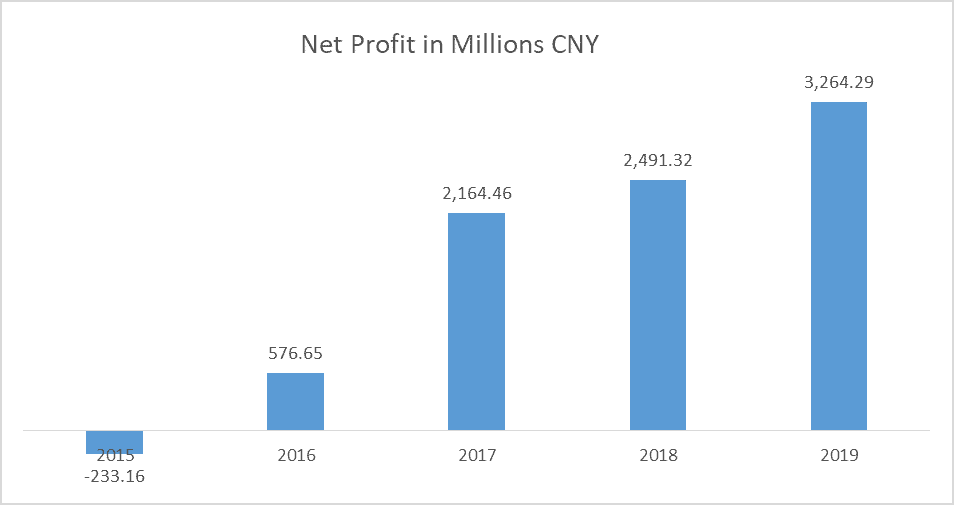

It has displayed strong revenue growth with stellar profits and continuously strong profit margins (32%-45%)[2].

The world facing an economic recession has proved to be a boon for the company as people need that small credit to pay the bills and run their house. Its margins have not been impacted throughout the pandemic.

Its share price has seen a significant hit due to the fears surrounding the Chinese governments crack down on micro lending firms but that has been overhyped and stretched too far. The governments stance has been clear about cracking down on unlicensed firms and licensed firms shall not be affected. Qudian which was backed by Alibaba’s Ant Financial faces no such qualms and had even announced a buyback[3].

This recent regulatory scare, however, has reinforced the need for Qudian to diversify its business. While its earlier ventures of car purchase financing and e-learning might not have been very successful, its new venture Wanlimu launched in tie up with Secoo (Asia’s largest online integrated upscale products and services platform)[4] is set to become a roaring success.

Wanlimu is a luxury e-tailer app catering to luxury products and services for both men and women. It offers a wide selection of brands from Versace, Gucci, and Burberry to Prada and Michael Kors among others with its product lines including perfumes, apparels, fashion accessories and bags. A combination of a shopping app along with in built credit offering has a synergy to it that resonates across the board.

At its current price, Qudian trades at a Price/Sales of 0.2 and P/E of 0.7x 2019 earnings and 2.5x and 3.7x of Sep 2020 Quarter earnings respectively which is rock bottom as compared to global peers who trade at P/E between 5x-38x. With the crackdown out of the way, revenue while down but having faced no long term significant damage, world economies coming back to track and a diversification in business which is set to experience rocket growth, not to mention the unleashing of pent-up demand among consumers that will see a rise in demand for small credit as well, an earnings as well as multiples expansion cannot be ruled out.

All these ingredients combined in synergy with an improving global scenario have resulted in an opportunity for a lucrative investment.

Tattooed Chef (Ticker: TTCF)

We all love our meat (I know what you are thinking you naughty boy, but I am referring to actual consumable meat) but if there is one thing we learnt in 2020, it is that all it took to shut the world down was one little unknown person in some remote corner of the world eating meat that he/she was not supposed to.

There is an increasing awareness across the world about the health effects of meat consumption and that coupled with a growing rise of veganism means the world has begun to move away from meat consumption. Although no one is saying that meat consumption will stop and one had better walk away from those that spout this lest one gets considered to be a part of that tribe, meat consumption will decrease as those that cannot consume it for health or lifestyle reason will migrate to plant-based alternatives

Additionally, there is just not enough livestock to feed a growing population which is expected to get to 10 billion by 2050. Veganism is also on the rise in the USA and although initially catering only to the elite and upper middle class, technology advancements and increased competition among suppliers in this segment, one can see prices coming down as well which would increase its appeal among the masses as well. One such player striving to make its product cost-effective and comparable to its traditional meat counterparts is Tattooed Chef.

Tattooed Chef manufactures, distributes and retails plant-based alternatives to traditional meals all in a frozen ready to cook variety. It grows its own raw material in Italy, imports them to its plant in California where it processes them and manufactures and packages frozen meals with plant-based alternatives, for e.g. cauliflower pizza, Mexican style street corn, veggie hemp bowl, zucchini spirals with basil pesto (pasta alternative), organic acai bowl etc., all priced at competitive prices to traditional alternatives and accessible at retail stores like Walmart.

Given a choice between a healthy meal and not so healthy one at the same price and people are likely to choose the healthier option as the most common excuse for not choosing healthy foods is their high prices.

Revenue has grown from 2.1 million USD in 2009 to 148 million USD in 2020[5]. The company operates in the frozen food segment. The global frozen plant-based food segment currently valued at 2.8 billion USD and the US market for the same at 914 million USD is poised to experience a strong growth with more and more families having both spouses working and a frozen alternative to traditional meal makes it easy and quick to cook.

There are apprehensions as is in all new things regarding frozen foods, but as history has shown, convenience always trumps apprehensions and at the end, this will be no different. Tattooed Chef, however, is not content with only prepared and meat based frozen foods but is also eyeing the traditional dessert market where it seeks to compete with traditional egg based as well as frozen desserts.

As the world population balloons and the demand for alternate food sources emerge, the world will turn to a plant-based diet. It is possible and is practised by India today where 40% of the population (one of the largest in the world) follows a vegetarian only diet[6]. Disruptions are a norm in today’s fast-moving world and the livestock industry is no exception. Protein alternatives especially when made to proper taste have the potential to disrupt a major economic sector. While originally confined to high and upper middle income class countries and groups, efforts by companies like Tattooed Chef and others have ensured that even the masses can access it.

Government favour and intervention and improved technology can accelerate the change. After all, if a traditional macaroni and a healthy macaroni both cost the same and taste the same, who will eat the traditional one?

Phillips 66 (Ticker: PSX)

The best investments are often found when they are down in the dump. The best shares that one can ever find will be among the filth, one just needs the fortitude to wade through it and the ability to take the risk for it. One whole sector that has taken a massive beating so far this year has been Energy, especially oil. The recent Wonder Woman film WW64 while had its fair share of criticism, but what it did bring to light is the oil boom of the 1980s. Black Gold was the theme of the first part. While all sheen is now lost from the black gold as energy stocks hit all-time lows, it now seems to have hit rock bottom. After all there is a limit to which oil will go down, it will obviously not come for free.

Most of the beating of low demand for oil due to COVID-19 has been borne by the exploration and upstream companies (i.e. oil producers). However, just by the virtue of their association with the oil sector, a lot of midstream and downstream companies (i.e. refining, pipelines, oil marketing and petrochemicals) have taken a beating as well. What investors often don’t understand that these companies often have the luxury of price rise pass through. It means that any rise in crude oil prices are passed right along to the end customer without affecting their margins. One such company down in the dumps is Phillips 66.

You must have seen the iconic Phillips 66 gas stations along the route. The company deals in midstream, refining, pipelines, petrochemicals and marketing specialities. With the energy sector, especially crude taking a beating due to low demand, PSX has also taken one (down 37% for the year) alongside its oil producing counterparts like Chevron. However what has escaped notice is that copper prices are hitting a 7-year high on unprecedented demand[7]. This is looking to be the beginning of a commodity super cycle and the next to follow will be steel and crude. It means that we are looking at the bottom of a cycle, one where one should be accumulating and waiting for the super cycle to begin. Phillips 66 might not only be able to maintain its margins, it will be able to raise them as well once the demand of crude shoots up and prices begin to go up.

The company has already begun preparations to participate in this anticipated demand. It has begun buyback of its shares and taking on long-term debt to finance its capital expenditure. This is known as gearing and the company is taking on leverage to improve its operational efficiency which will come to fruition when the prices begin to rise[8]. With the stock down as it is, it is a perfect time to begin accumulating. Like a coiled spring storing potential energy on suppression, ready to unleash it when the pressure is let go, the stock will explode upwards once the selling pressure is gone and the crude demand sees a rise along with the price.

Roblox

The next best share to invest in 2021 that we have has not yet become public but is planning to do so this year. While many companies and industries suffered during the pandemic, one industry went from success to success expanding and even hiring new people. That is gaming. With people cut off from physical contact and an enforced lockdown, online multiplayer games picked up steam. One such gaming company is Roblox Corporation.

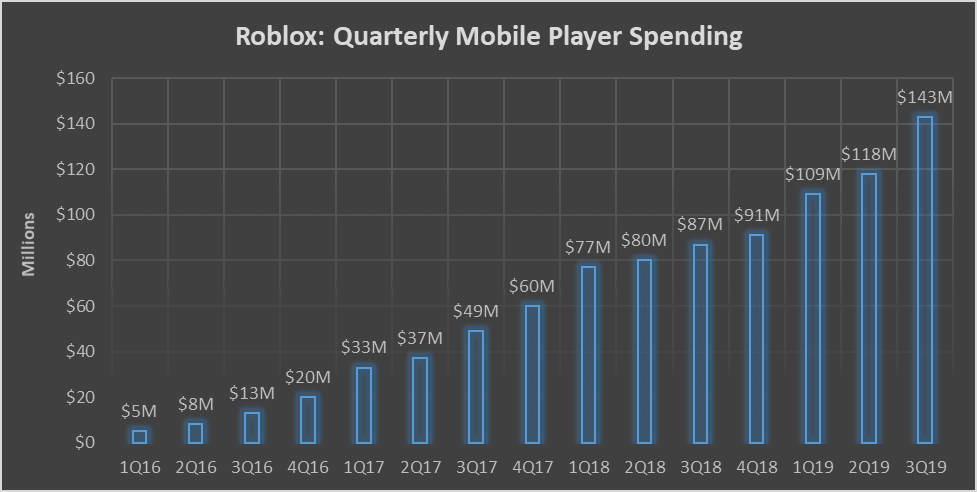

Roblox is an online game platform and game creation system where users can play games created by other users. The creators get a cut of the in game money spent by players. Real currency is converted to in game currency and then used to purchase skins, weapons and stuff for gameplay improvement. So while the games are free to play, to make progress one needs to pay and this forms the revenue of the company[9]

The amount of money being spent by users has kept on increasing and while the figures for 2020 are not out yet due to it being a private company, the company has announced a developer payout of $250 million USD which at a 25% cut projects its revenue to $1 billion USD[10]. The nature of the platform is such that anyone can create games and publish and anyone can play them free thus leading to hundreds of thousands of games. One can come online each day to find a different game to play. This element of never-ending discovery entices users for repeated visits thus ensuring stickiness of customers.

With the pandemic raging on and newer strains emerging, the kids if not the world will definitely be spending more time inside and with the desire to meet and hang out with friends, what better place to do so than an online gaming platform with an endless supply of games.

Tech Sector

The next investment we have for you is not a conventional one. It is more of a short play and should only be undertaken by those who can understand and absorb the risk. Warning: The potential for loss is unlimited in shorting stocks and only experienced investors and traders should pursue this.

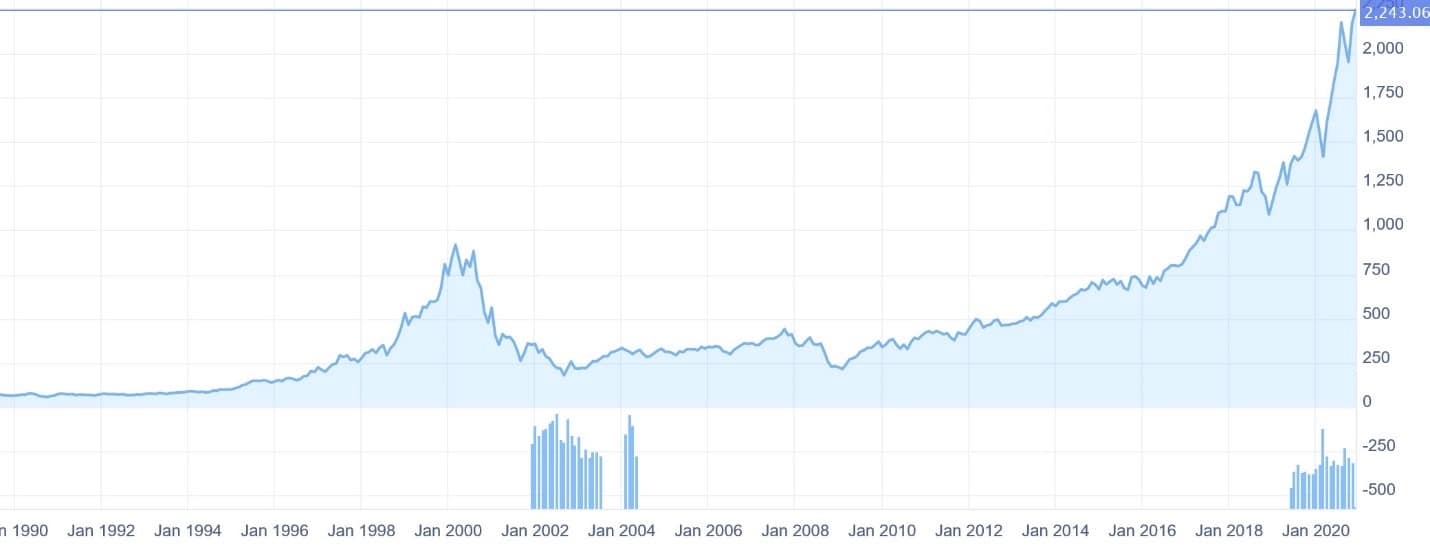

One of the biggest beneficiaries of this pandemic were the tech companies. The ability to work unhindered during the lockdown and the increased demand for remote connectivity and other work from home solutions has seen the fortunes of tech companies soaring. The S&P 500 IT Index has reached an all-time high[11]

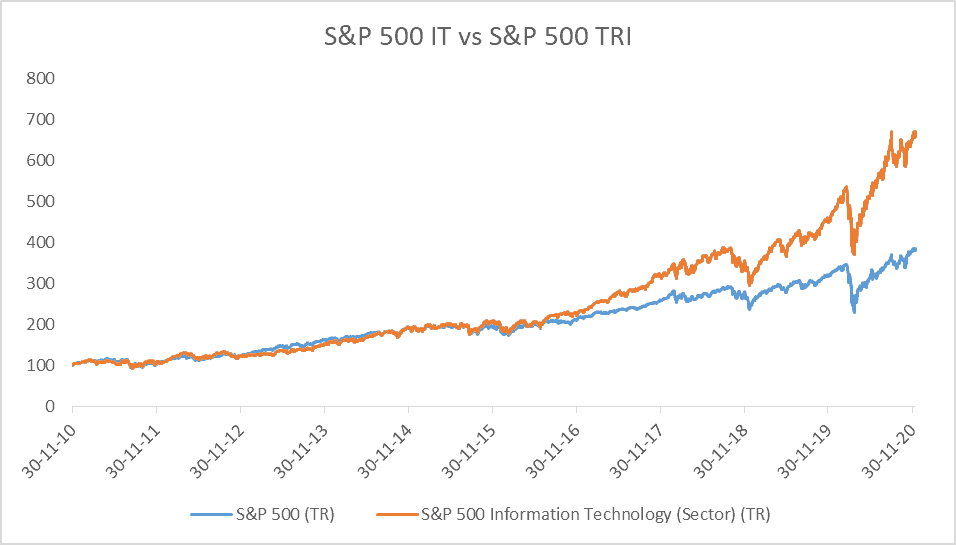

It has even outshone its well-known parent index the S&P 500[12].

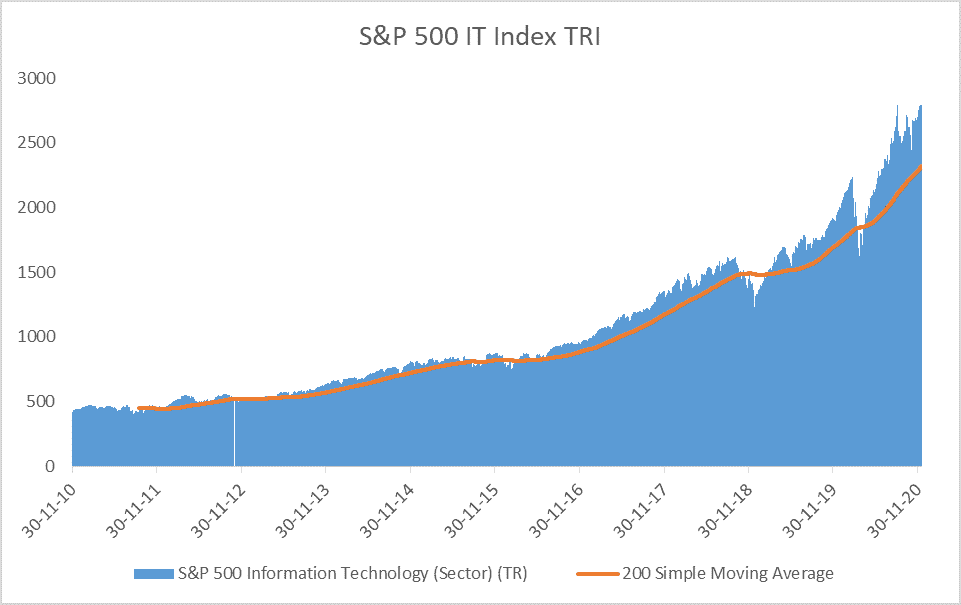

This has now reached dangerous proportions. In market as in life, all things tend to reverse to the mean. This phenomenon is known as mean reversion and markets are no different.

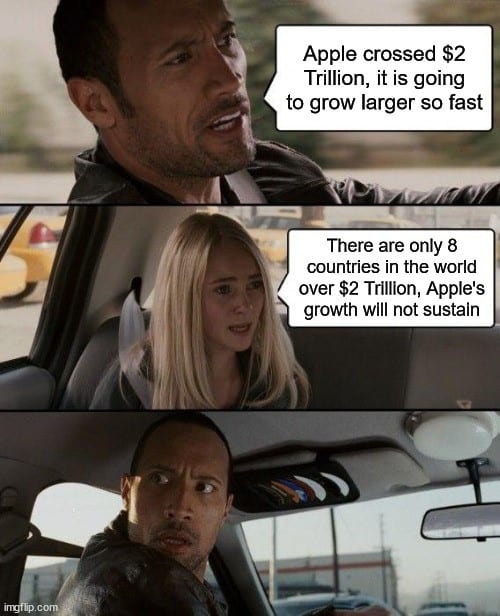

The S&P 500 IT Index is 20% above its 200-day moving average. That is the potential distance it has to go for mean reversion. The whole sector is levitating at dangerous heights. If we were to drill down a bit, let us look at Apple. It is now larger than 96% of all countries in the world (GDP size) and at such a large size, it is just not possible to grow at the rates that the market expects. Not only that, the top 4 companies leading the tech revolution are all larger than 92% of the countries in the world. This serves to highlight the excessive valuations accorded to the tech sector on the basis of projected growth rates unrealistic to achieve[13].

As much as the case is made for shorting, in shorting timing is the most crucial part. As John Maynard Keynes stated “markets can remain irrational for longer than you can stay solvent”. It is difficult to accurately predict when the tech sector will correct. But correct it must and hence it is advisable to deploy strategies that can be put on and can stay valid for a longer-term period to take advantage of the correction in that period. One such method is through purchase of LEAPS (Long Term Equity Anticipation Security). They are like options but with longer time to expiration. This gives one an advantage of fixed downside and unlimited upside. The Disadvantage is if the correction does not materialize before the LEAPS expire, the money paid for purchasing the LEAPS is lost.

Conclude: If there is one thing that this year has taught us, it is to gain control of one’s finances and manage it well. The above recommendations may help you achieve some portion of that control as well as build the wealth that will serve as a cushion

DISCLAIMER: your capital is at risk. This article is not meant as an investment advice, but merely as a commentary on the markets. Always conduct your own research and only invest with money that you can afford to lose.

References

[3] China crackdown on micro finance

[5] Company Analyst Presentation

[6] Plant Based Meat Market 2020 by Arizton Advisory & Intelligence

[8] Phillips 66 Company Presentation

[9] Roblox revenue and mobile spending

[10] Roblox will pay out 250 million to developers in 2020

[11] S&P 500 IT Index Price Chart

[12] S&P 500 IT Index outshines S&P 500 index

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.