How to make profits with bonds? Yield explained

Investing in bonds can be an attractive choice if you do not want to run too much risk. In this article we will discuss how bond investing works. How is the price of a bond actually established, and how can you determine the profit you make with your bond?

What are bonds?

Bonds are debt securities. When you buy a bond from a company or the government, you are entitled to periodic interest payments. With a bond, these different characteristics are important:

- Coupon rate: the amount of interest you receive when you buy the bond.

- Maturity date: the last day of the bond’s validity.

- Denominations: the value in which you can purchase the bond.

- Currency of issue: the exchange rate can determine your return.

- Issue price: the price at which the bond is issued.

In the article what is a bond you can read in more detail what bonds are and how they work. You can also read more about the different types of bonds.

How can you invest in bonds?

You can easily invest in bonds at an online broker. Bonds are generally traded freely. The price of a bond need not be the same as the issue price. The price of a bond can change due to the influence of supply and demand. Click here to see at which brokers you can invest in bonds.

A good broker for trading bonds is DEGIRO. At DEGIRO you can buy and sell bonds at favourable rates. Use the button to open an account at DEGIRO:

Some bonds are not freely tradable. For example, some companies allow you to subscribe to bonds. Be aware of the risks: not all bonds always pay out.

What is the return on a bond investment?

The return that you achieve on your bond investment depends very much on your investment strategy. Of course, you can choose to buy a bond when the price is low and then sell it at a profit. When you choose this option, your profit consists of the price gain.

Interest payments

Most people who invest in bonds focus mainly on the interest payments. The interest percentage you receive on a bond is also called the yield. When the yield is 5 percent, you will receive an annual return of 5 percent over your bond. If the bond has a value of $1000, you will receive $50 annually for your investment.

It is important to distinguish between your nominal and real return. If inflation is 2 percent, you can buy 2 percent less products with the same $1000 over a year. Your real return on your bond is then 3 percent.

Alternatives

It is also smart to compare your bond investment with other investment products. When interest rates on bonds rise, you might have achieved a 7 percent return with a new bond. In this case, you do make a profit in absolute terms, but in relative terms you would have been better off making another investment.

Premium

Finally, you must also take into account the purchase price of a bond. When a bond pays out a high yield, the price can rise above the nominal value. For example, if you have to pay 105% of the value, you pay a premium of 5%. At the end of the term, you will only receive the original purchase price of 100% back. Your return is then, despite the high-interest payments, immediately much lower.

Relatively safe investment in bonds

The price of a bond can change continuously. Yet, this does not have to be a problem. You can choose to buy bonds and hold them during the term. At the end of the term you will receive the full amount back. In this way, the price of the bond does not affect your return.

However, it is also possible to actively trade bonds. This way you can make price gains. But before you do this, you must understand the factors that can influence the price of a bond.

What determines the price of a bond?

The nominal value is the value at which the bond was originally issued. The price of the bond may subsequently rise above or fall below the nominal value. The value of a bond is determined by, among other things, the market interest rate, credit rating and the remaining term to maturity.

The effect of market interest rates on the price

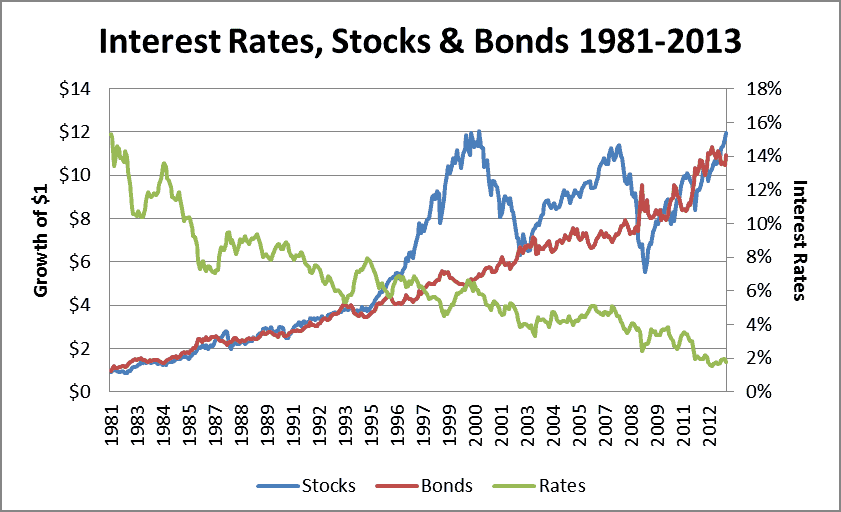

The market interest rate has the greatest influence on the price of a bond. The interest on a bond is fixed. If you bought a thirty-year bond some time ago with an interest rate of eight per cent, you will always receive this eight per cent. However, the European Bank regularly adjusts the interest rate to stimulate the economy. A lower interest rate will counteract saving behaviour and will stimulate spending.

When the interest rate falls, and you own a bond with a higher interest rate than the market rate, the value of the bond will rise. The return on your bond in relation to the return on a savings account will then increase.

If you have a bond with a return of 8 percent and the market interest rate is 3 percent, this means that for every $1000 you earn $50 extra with your bond on an annual basis. You can then decide to sell the bond with a price profit or to keep the bond.

A rising interest rate will actually have a negative impact on the value of a bond. When the market interest rate rises, the interest on your bond is relatively lower. It is therefore important to estimate the future interest when you start investing in bonds. When you estimate the future interest correctly, you can make a nice profit with your investment in bonds!

Market interest rates and bond prices move in opposite directions

The creditworthiness

The creditworthiness of the institution behind the bond also plays a role in the price development. When you buy a bond, you run the risk of bankruptcy of the institution behind the bond. If this is the case, you lose your entire investment. When the company or the government behind the bond is seen as less risky, the price of the bond rises.

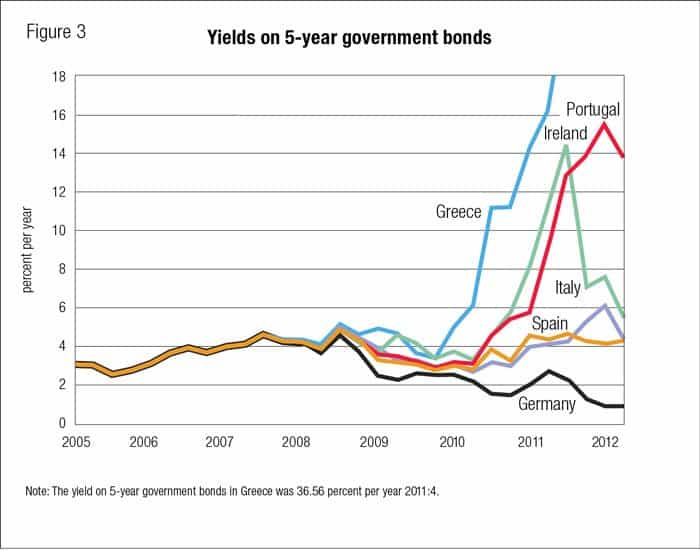

This was clearly reflected in the debt crisis in Greece, for example. The financial markets wondered whether Greece could still pay off its debts. Under the influence of these concerns about its creditworthiness, the value of Greek bonds fell sharply.

When you start investing in bonds, you can try to estimate the creditworthiness of countries and companies. In case of panic, the price of a bond sometimes drops quite extremely. This can be a good moment to buy!

Be extra careful when investing in bonds of parties who are not creditworthy. If the institution behind the bond goes bankrupt, you could lose the entire investment. Naturally, you will receive a higher interest rate on loans with a higher risk.

Residual term

The remaining term also influences the price of a bond. For example, a bond with a higher interest rate and a longer term may have a higher price than a bond with a higher interest rate and a shorter term. This is because as a bondholder, you will probably benefit longer from the higher interest payments.

Should you invest in government bonds or corporate bonds?

When investing in bonds, you can choose between government bonds and corporate bonds. But what is the best investment? And what exactly is the difference?

Government bonds

Government bonds are generally seen as less risky. Governments are large and almost always manage to repay their debts in full. Certainly in large, stable economies such as Germany or the United States, the risk of not receiving your money back is almost zero.

Government bonds have little correlation or association with equities. Sometimes there is even an opposite relationship. When share prices rise, the prices of government bonds can decrease. Government bonds can therefore be a good investment to reduce the volatility of your portfolio. In bad economic times, you can still achieve a nice return.

Sovereign bond yields rose sharply as worries about sovereign debt repayment increased.

Corporate bonds

Corporate bonds are riskier, but tend to perform better over the long term. They also have a stronger correlation with the stock markets. When the economy performs badly, the prices of corporate bonds fall. When stock prices are performing well, the prices of corporate bonds rise.

This is because with corporate bonds, there is more concern about whether the lent amount will be repaid. After all, companies often go bankrupt and when this happens, you lose your entire investment. With corporate bonds, it is therefore even more important to check carefully whether the company behind the bond is performing well.

Bond investing: ensure diversification

As with any form of investment, it is also important with bonds to ensure sufficient diversification if you want to make a profit. Certainly, when you buy corporate bonds, this is important. When things go badly in one sector, it does not have to be bad in another sector. The correlation between bonds of companies in different sectors is therefore limited.

Ultimately, investing in bonds can be a good alternative to saving. After all, the return on savings is lower. A deposit could then be an alternative, but deposits do not have the flexibility that bonds have. However, never forget to do sufficient research. Bonds are less risky, but certainly not risk-free.

In our article Making Money Buying Bonds, we look at examples of how to get good results buying and selling bonds.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.