How to Buy Bitcoin with Barclays Bank: Safe and Easy Method

Are you looking to buy Bitcoin or other cryptocurrencies and are you wondering if you can do it with Barclays Bank? The good news is that it is possible! In this article, we will show you how to buy Bitcoin with Barclays Bank and provide you with some essential information on crypto trading with this bank.

How to Buy Bitcoin with Barclays Bank?

Barclays Bank does not currently facilitate cryptocurrency trading services for its customers. However, by connecting your Barclays bank account to a crypto exchange, you can still buy Bitcoin with your account at Barclays Bank.

Here is a table that provides an overview of some of the crypto exchanges that Barclays Bank currently supports:

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

Once you have connected your crypto account with Barclays Bank, you can follow these steps to buy Bitcoin:

- Open an account with the crypto exchange supported by Barclays Bank.

- Verify your account with the crypto exchange by providing your personal information.

- Deposit funds into your crypto exchange account.

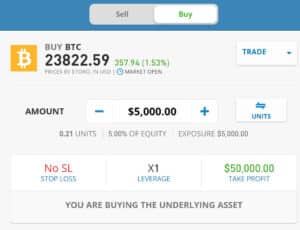

- Select Bitcoin or any other cryptocurrency you want to buy in the trading software provided by the exchange.

- Fill in the amount you would like to buy and press the “open position” button.

Barclays Bank’s Crypto Policy

Barclays Bank does not currently provide any products or services related to cryptocurrencies. However, the bank’s crypto policy lets customers freely deposit and withdraw funds from regulated exchanges. Barclays remains committed to prioritizing its customers’ needs and interests, and will continue to review its policy as the crypto market evolves.

To protect customers from fraud, Barclays has provided advice on its website in the Fraud and Scams section. However, customers can still transfer funds using their Barclays bank account on investment platforms if the transfers are limited to crypto exchanges solely trading digital assets.

Moreover, Barclays is involved in the blockchain technology space and has hosted the annual Barclays Crypto and Blockchain Summit, where the bank provides updates on developments in the blockchain sector to its institutional clients.

Cryptocurrency Storage: Hot Wallets vs. Cold Wallets

Hot wallets involve the storage of personal and private keys online, usually with a crypto exchange, in a password-protected account. This makes them vulnerable to hacking attempts, as hackers can access users’ assets by acquiring their personal and private keys.

Although hot wallet providers have responded to security breaches with heightened security measures, hackers persistently attempt to bypass these measures, forcing them to improve their security protocols continuously. However, hot wallets offer convenience as you can access them from anywhere. Users can handle losing access since the provider can help with crucial recovery using identity verification.

On the other hand, cold wallets offer a more secure method of cryptocurrency storage. They are not connected to the internet and, therefore, immune to online hacking attempts. Cold wallets are thumb drives requiring a “seed phrase” to unlock. This phrase is a long, randomly generated sequence of words difficult to crack.

However, connecting a cold wallet to a web-connected device removes its air-gap security and makes it vulnerable to hacking attempts. Additionally, recovering a forgotten seed phrase is much more difficult with cold wallets than with hot wallets. Furthermore, you must purchase cold wallets, while hot wallets are often provided for free.

Hot wallets offer convenience, while cold wallets provide enhanced security but require more effort and expense to acquire and maintain.

How to buy Crypto Safely with Barclays Bank

As the crypto market is still relatively new and untested, investing in digital assets can be riskier than investing in traditional stocks. Unfortunately, many individuals have been deterred from investing in crypto due to the prevalence of scams and cybercrime that target both inexperienced and seasoned investors.

To ensure safe crypto investment, it is crucial to take appropriate measures. Here are a few tips for investing in digital assets and safeguarding your money:

- Conduct thorough research: Before investing, understand the cryptocurrency you want to buy, including its functionality and risks.

- Choose a reputable exchange: Verify that the exchange is licensed by the appropriate regulators in your country and has a reliable track record.

- Secure your account: Employ two-factor authentication and a strong password to secure your account.

- Use secure devices: Avoid public computers and Wi-Fi networks. Instead, use a personal computer with a Virtual Private Network (VPN) to establish a secure connection and protect sensitive information.

- Utilize a secure wallet: Store your cryptocurrency in a safe wallet to shield it from cyber-attacks. Choose between a hot (online) or cold (offline) wallet based on your preferences, and read our in-depth guide on crypto wallets to determine the right fit.

- Monitor your investments: Keep track of market changes and fluctuations in the cryptocurrency price you’ve invested in.

- Avoid investing more than you can afford to lose: Due to the volatility of the crypto market, it’s essential to be conservative with investments, especially when beginning.

By implementing these measures, you can protect yourself and your investment from potential threats and make informed decisions about buying crypto.

Shop around for the best replica watches with free shipping and 70% off on replica watches.

We Provide A Wide Range Of The Latest And Top Quality Rolex Day Date Replica Watches, 1 Year Warranty.

About Barclays Bank

Barclays Bank is a renowned British multinational bank in London, England. It operates through two primary divisions, Barclays International and Barclays UK, which Barclays Execution Services, a service company, supports. The bank’s rich history of corporate acquisitions has played a vital role in expanding its reach and services. Some notable additions include Mercantile Credit in 1975, Woolwich in 2000, and the North American operations of Lehman Brothers in 2008.

Barclays Bank was identified as the most powerful transnational corporation. It concerns ownership and corporate control over global financial stability and market competition, outpacing Axa and State Street Corporation in second and third positions. The bank operates in over 40 countries worldwide and has over 80,000 employees. Based on total assets, Barclays Bank ranks as the fifth-largest bank in Europe.

Final Thoughts: Buying Crypto with Barclays Bank

Buying Bitcoin and other cryptocurrencies with Barclays Bank is a straightforward process that you can do by connecting your crypto exchange account with your bank account. Barclays Bank is a crypto-friendly bank that supports several reputable crypto exchanges, making buying crypto easier.

However, it is essential to remember that investing in cryptocurrencies is risky and comes with challenges. It is necessary to research, take precautions, and invest wisely.

Auteur

Over Ryan Donato

Ryan is a passionate writer with love for storytelling. He discovered his passion for writing at a young age and has been honing his skills ever since. Ryan is a sports enthusiast and enjoys following the latest developments in the world of sports. He also has a keen interest in finances and constantly learns about investments and personal finance.