How to Buy Bitcoin with Wells Fargo Bank in 2023: A 5-step Guide

Bitcoin is a digital currency that has been making waves in the world of finance since its inception in 2009. More and more people are interested to know how to buy bitcoin with Wells Fargo Bank. One popular way to buy Bitcoin and other cryptocurrencies is through a cryptocurrency exchange. However, buying Bitcoin through Wells Fargo Bank is possible for those who prefer to use their traditional bank account.

How to Buy Crypto with Wells Fargo Bank?

Wells Fargo Bank does not provide direct cryptocurrency trading services. This is due to the complex regulations and additional requirements of setting up a crypto exchange, which most banks avoid.

However, you can still purchase Bitcoin and other digital assets through cryptocurrency exchanges. Below is a table of several popular cryptocurrency exchanges compatible with Wells Fargo Bank.

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

You can buy crypto from your Wells Fargo Bank account using various payment options. These include PayPal, Skrill, Neteller, credit/debit cards, bank transfers, and ACH.

Once you have registered with an exchange, you can transfer funds from your Wells Fargo bank account to the exchange and trade them for the cryptocurrency of your choice.

Here is a simple guide to help you with investing through Wells Fargo today:

- Open an account with Wells Fargo Bank.

- Verify your account by providing personal information and documentation.

- Deposit funds into your Wells Fargo Bank account.

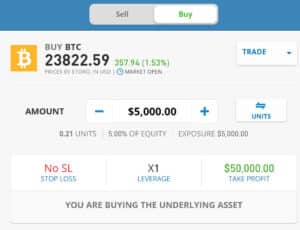

- Access the trading software and select Bitcoin as the cryptocurrency you want to buy.

- Fill in the amount of Bitcoin you wish to purchase and press “open position.”

Why Investing in Bitcoin with Wells Fargo Bank Can Be a Good Idea?

Wells Fargo Bank has a reputation for being a secure and reliable financial institution. By investing in Bitcoin through Wells Fargo Bank, customers can take advantage of the bank’s security features and ease of use. Additionally, Bitcoin is known for its growth potential. As an investor, you can take advantage of this opportunity by investing in Bitcoin through Wells Fargo Bank.

Risks to Look Out for When Investing in Crypto with Wells Fargo Bank

Although investing in Bitcoin with Wells Fargo Bank can be a good idea, investors must know the risks involved. One of the significant risks associated with Bitcoin is its volatility. The value of Bitcoin can fluctuate drastically in a short period, and investors should prepare for this. Additionally, the cryptocurrency market is relatively new, and there is a potential for scams. Wells Fargo Bank has taken measures to mitigate these risks, but investors should be cautious and stay informed on market trends.

What is Wells Fargo Bank’s crypto policy? Is Wells Fargo Bank friendly to crypto?

Although Wells Fargo Bank has not introduced cryptocurrency products or services on its platform, they are still considered friendly towards digital assets. Wells Fargo permits their customers to invest in cryptocurrencies.

However, Wells Fargo Bank advises customers to be cautious of crypto-related scams, as outlined in their website’s Scams and Cyber Threats section. Furthermore, the Wells Fargo Investment Institute has a section dedicated to crypto reports. They acknowledge that cryptocurrencies have become a viable portfolio option and offer guidance on understanding them better.

How to Buy Crypto Safely with Wells Fargo Bank:

Although cryptocurrency broker-dealers in the United States must register with FINRA and comply with anti-money laundering and customer identification regulations, the crypto assets are still unregulated.

Fortunately, you can protect yourself and your money when buying crypto. Here are some tips to follow:

- Research the cryptocurrency you are interested in and understand its risks.

- Only use a secure device for transactions, such as a personal computer with a VPN.

- Choose a reputable exchange licensed by regulators with a strong track record.

- Secure your account with two-factor authentication and a strong password.

- Store your cryptocurrency in a secure wallet, whether it’s a hot or cold wallet.

- Only invest money that you can afford to lose.

About Wells Fargo Bank:

Wells Fargo Bank is a well-known national bank headquartered in San Francisco, California. With over 8,700 locations, 12,500 ATMs, and an extensive online presence, the bank provides a broad range of products and services, including banking, investment, mortgage, and consumer and commercial finance.

Replica rolex Daytona present an accessible avenue for watch enthusiasts who yearn to bask in the aesthetics.

Federal and state agencies regulate Wells Fargo Bank. The bank also holds a license from the US government. New York Stock listed Wells Fargo Bank under the Wells Fargo & Company (WFC) ticker symbol. It is the fourth largest bank in the US in terms of assets and the second largest by market capitalization.

Conclusion: Can you Buy Bitcoin with Wells Fargo Bank?

Purchasing Bitcoin with Wells Fargo Bank is a simple process. Following the step-by-step guide outlined in this article, you can easily buy Bitcoin with your Wells Fargo Bank account.

Remember to do your research and invest wisely. Cryptocurrencies can be volatile and risky, so only invest what you can afford to lose. And always keep your cryptocurrency in a secure wallet to which you control the private keys.

Auteur

Over Ryan Donato

Ryan is a passionate writer with love for storytelling. He discovered his passion for writing at a young age and has been honing his skills ever since. Ryan is a sports enthusiast and enjoys following the latest developments in the world of sports. He also has a keen interest in finances and constantly learns about investments and personal finance.