How to invest in gold? A guide for beginners

When uncertainty in the markets rises, many investors turn to gold. In this beginner’s guide to investing in gold, you will learn everything you need to know about investing in gold!

How to invest in gold?

A popular method to invest in gold is to buy stocks of gold mining companies. The costs of mining gold are generally fairly stable, which means the results of gold mining companies are closely linked to the price development of gold. It is important to also carefully research the company’s financial results, as not every company is equally well-managed.

Some well-known gold stocks you can invest in are:

- AngloGold Ashanti Ltd.

- Goldcorp Inc.

- Barrick Gold Corp.

- Newmont Mining Corp.

- Franco-Nevada Corp.

You can also trade in a combination of gold mining companies with an ETF. A suitable option for this is the Market Vectors Gold Minders ETF.

You can buy gold stocks with one of these reliable brokers:

| Brokers | Benefits | Register |

|---|---|---|

| Buy gold without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of gold! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of gold with a free demo! |

Option 2: Invest in gold with an ETF

There are various index funds or ETFs that track the price of gold. There are two types of gold ETFs:

- Bullion-Backed: these funds hold physical gold.

- Nonbullion-backed: these funds use financial securities as collateral.

Some examples of GOLD ETFs are:

- SPDR Gold Shares is a physical gold fund in dollars

- ETFS physical gold is a physical gold fund in euros

Note that funds charge an annual percentage fee to cover the administrative charges & the storage of the cold.

Option 3: Actively trade in the price of gold with CFDs

You can also actively speculate on the price movement of gold with CFDs. CFDs are suitable for speculating on price increases and decreases on the price of gold in the shorter term. With CFDs, you can use leverage, which makes it possible to invest in gold with smaller amounts of money. You can read more about investing in CFDs here.

You can try the possibilities of investing in gold for free with a demo at an online broker. Do you want to get started with a free demo account at a broker? Use the button below to open a free gold demo account:

Option 4: Gold options

With options, you have the opportunity (but not the obligation) to buy (call option) or sell (put option) a certain amount of gold. You pay a premium for an option, and it always has a certain duration. Within this time, you must exercise the option, or it becomes worthless.

Options can be used to set up fairly complex constructions. One big advantage of gold options is the fact that you are never obliged to exercise them. If you are eager to know more about investing in options, you can read our course about investing in options:

Option 5: Investing in other gold derivatives

Futures are binding agreements for the delivery of gold at a certain fixed price. Because of the leverage, futures can quickly lead to significant losses.

Warrants give you the right to buy a certain amount of gold in the future.

Option 6: Gold account

There are two types of gold accounts: the allocated account and the unallocated account. With a gold account you directly buy physical gold.

With an allocated account, the account holder fully owns the gold. The serial numbers of the gold bars are known, and the gold cannot be sold without your permission.

With an unallocated account, the account holder is not assigned specific gold bars and shares the gold with other account holders. The fees for unallocated accounts are lower, but it is harder to withdraw your gold. Especially in times of crisis, the account holder is dependent on the bank’s creditworthiness.

How to buy physical gold?

Investing in gold bars

Gold bars are available in different weights. The lightest gold bars weigh only one gram, while the heaviest weigh over a kilo. This allows you to invest in gold bars with both small and large amounts of money. The relative premium or production costs are relatively lower for higher weights, as it is cheaper to produce a larger gold bar.

Investing in gold coins

It is also possible to invest in gold coins. The weight of a coin is typically one Troy or approximately 31 grams. The value of a gold coin mainly depends on the purity of the gold. Some coins are reinforced with copper. When trading gold coins, the type of coin can also determine its value. Rare coins often have a higher value than more common gold coins.

Jewellery and other products with gold

You can also invest in jewellery and other products with gold. However, you generally receive a lower price for products with gold. Jewellery is typically not completely pure and must also be melted down.

What are the advantages of investing in gold?

Advantage 1: gold can protect you against inflation

Due to inflation, your money becomes worth less and less. By investing in gold, you can protect yourself against this currency devaluation. During inflation, you typically see that commodity prices rise.

Advantage 2: gold is scarce

Gold, like many other commodities you can invest in, is scarce. At the same time, prosperity is increasing worldwide, making more people interested in gold. It is therefore not unlikely that the price of gold will continue to rise in the future.

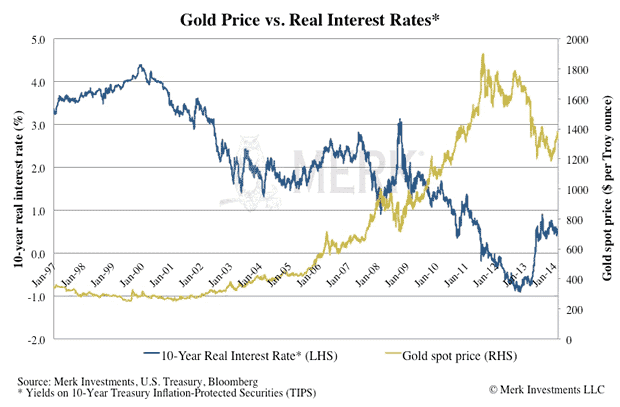

Advantage 3: good results at low-interest rates

Investing in gold is a good idea at low-interest rates, since the price of gold often rises when interest rates are low.

Advantage 4: risk diversification

You can also diversify risks with gold. Gold is an anti-cyclical investment product: when the economy performs poorly, gold typically performs well.

Advantage 5: good results with a weak dollar

When an important currency like the dollar loses value, it can be attractive to invest in gold. The price of gold is quoted in dollars, which means it can be cheaper to buy gold in your currency.

Advantage 6: high liquidity

Gold is highly liquid: you can sell the commodity anywhere at any time.

What are the risks of investing in gold?

Risk 1: You do not receive dividends on gold

When you invest money in stocks or bonds, you receive dividends or interest. With gold investments, you can only make a profit when the price rises. In the long term, an investment in gold can therefore disappoint, especially in relation to (gold) stocks.

Risk 2: Poor return in a good economy

Gold performs well in times of economic uncertainty. When the economy performs well, alternative investments often perform better.

Risk 3: The gold market is volatile

The price of gold is highly volatile. However, gold usually performs better in the long term. It is also possible to take advantage of volatility by opening a short position. With a short position, you speculate on a declining gold price.

Risk 4: Poor results at high-interest rates

Gold performs relatively well at low-interest rates. However, when interest rates rise, gold typically loses its lustre. Safe alternatives such as bonds or even a savings account than become more attractive.

What determines the price of gold?

- Market interest rate: When interest rates rise, you typically see the price of gold fall. Other investments that yield interest or dividends then become more attractive.

- Inflation: Inflation causes the prices of many products to rise. The price of gold regularly also rises when there is inflation.

- Dollar exchange rate: With a strong dollar, the price of gold falls. It becomes pricier for investors in other countries to invest in gold.

- Stability: When there is a lot of political uncertainty, the price of gold typically rises. Gold is still seen by many investors as a safe haven.

- Demand and supply: When central banks decide to sell part of their gold, this can put pressure on the price.

How does investing in gold work in practice?

With two examples, we will discuss how investing in gold works in practice.

A crisis!

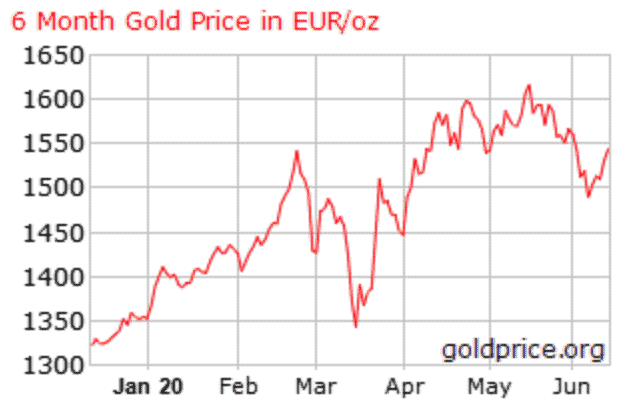

It’s the end of February 2020, and you realize that the coronavirus crisis is having an increasing impact on the stock markets. The markets are plummeting and investors are selling their stocks. You are seeking an interesting alternative to shares, and after some research, you ultimately decide to buy gold.

You decide to speculate on the gold price with a CFD. You buy gold for an amount of $1400. Initially, the price drops a bit more, but eventually, the price rises sharply. You sell the gold for a price of $1550, which results in a positive return of $150 per gold bar, which is a yield of about 10%.

With a derivative, you can also choose to apply leverage. If you had applied a 1:3 leverage in this case, you would have even achieved a return of $450 or 30% per gold bar. However, when applying leverage, your losses can also increase significantly.

Keep in mind that past results are not a guarantee for future success: you could also have suffered losses!

A new gold mine

You have received a small inheritance, and you decide to invest a small part of it in a gold mine by buying shares in a gold mine at eToro. A few weeks later, you look at the news.

Unexpectedly, a huge gold reserve has been found somewhere in Africa. The global gold reserves are suddenly much larger than expected. Due to the increased supply, the value of gold decreases. As a result, people sell the gold mine shares, which results in a significant loss on your investment.

Is it smart to invest in gold?

Whether investing in gold is a wise choice depends heavily on your personal situation. It is important to remember that gold is a risky investment by definition. Therefore, only invest in gold with money that you can miss for the long term.

It is also essential to time your gold investment properly. It is not wise to invest in gold when there is a strong bull market. A good example of a great moment to buy gold is during a crisis. During the coronavirus crisis of 2020, for example, the gold price rose sharply.

Investing in gold can be appealing. The precious metal is no longer directly linked to the dollar. However, gold still acts as a safe haven. Therefore, you can see gold as an insurance policy against downward markets and inflation. As a result, it can be attractive to invest in gold for both in the short and long term.

Frequently Asked Questions About Investing in Gold

It is important to use a reliable broker, both for trading securities in gold and for trading physical gold. You can verify whether the broker has a licence from a regulatory authority.

It is also critical to ensure that the gold is safe at home. Not every household insurance policy covers gold bars, so it is advisable to check whether it is wiser to store your gold in a safe deposit box at a bank.

Gold and silver are often mentioned together in one sentence. This is not surprising, as they are both precious metals. Silver is typically considered the little brother of gold, but it is questionable whether this is justified.

Silver seems to perform better than gold in bull markets, probably because there are more applications for silver. Silver is widely used in technological products, and as our society becomes more digitalized, the demand for such products is increasing.

An investment in silver may therefore be more interesting. Silver is still considered a safe haven, but it can also perform well in times of economic prosperity. The supply of silver is decreasing while the industrial demand is increasing.

Gold was long known as the safe haven. Nowadays, however, a new player has arrived: Bitcoin. Like with gold, there is no direct counterparty with Bitcoin. When people are concerned about inflation or the state of the economy, you can see that the price of Bitcoin often increases. Investing in Bitcoins can therefore be interesting in uncertain times. Click here to learn more about Bitcoins.

Personally, I do not see Bitcoin as the ‘new gold’. Unlike gold, Bitcoin is completely digital. Moreover, Bitcoin does not offer a strong hedge against inflation. In fact, when inflation rose sharply in 2023, the price of Bitcoin declined by over 82%.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.