How much does it cost to invest in a mutual fund?

The cost structure of an investment fund is very important. In this article we will look at the influence of costs on the return that you will achieve with an investment fund. The costs play a more important role than most people think! How much does it actually cost to invest in a mutual fund?

Do not underestimate the impact of costs

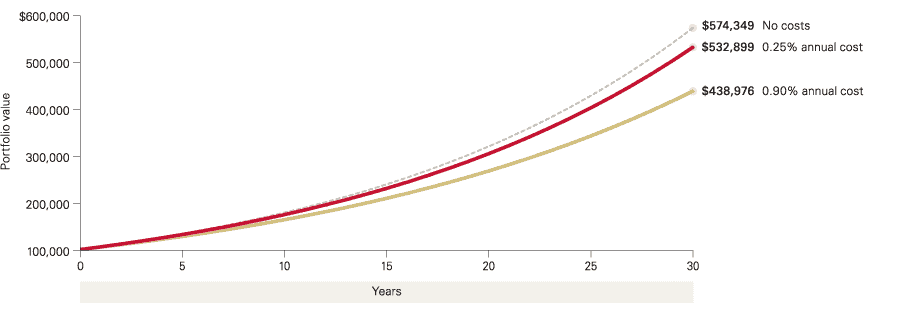

When selecting an investment fund, many people mainly look at the return, while the costs should certainly not be underestimated! Costs have a strong effect on the final result of the fund. For an investment of $100,000, a difference of 0.65% in costs can mean almost a $100,000 lower return within a period of 30 years!

Therefore, when selecting a good investment fund, always pay attention to the costs! Every percentage point of costs that you have to pay within the investment fund is not a return! For example, if you have to pay one percent, the return must be one percent higher than that of another fund to achieve the same result.

The effect of compounding only increases the effect of costs in the long run. By paying attention to the costs, you can therefore immediately improve your investment result.

Where can you invest in funds cheaply?

When you invest in a fund, you normally pay a purchase fee. The amount of these costs differs per fund and per broker: on average, you can count on a few pounds to 0.5% in entry costs.

It is also possible to invest in funds without paying purchase and sales charges. This is possible at DEGIRO: at DEGIRO you don’t pay purchase and sales costs when you trade funds noted in their core selection. Use the button below to open a free account at DEGIRO:

Which type of investment fund is the cheapest?

There are two broad categories of investment funds: passive funds and active funds. A passive fund follows the market by, for example, buying shares quoted on the FTSE or S&P500. A passive fund does not try to beat the market and therefore no expensive analysts are needed.

An active fund does hire analysts who try to beat the market. In practice, funds rarely succeed in beating the market (consistently). However, as an investor you do pay higher costs for a participation in an actively managed fund. Therefore, research whether an actively managed fund is worth your money.

Fixed costs & performance fee

It goes without saying that an investment fund incurs costs: in addition to the mark-up for profit, staff must be paid, the building must be rented and paper must be purchased. The fact is that an investment fund never invests for free.

With a fund, you actually always pay a fixed percentage fee. This percentage is often somewhere between 0.5% and 2%. Before investing in a fund, always research how high the fee is. If the percentage is high, it is important to find out if it is justified.

There are also funds where you pay a performance fee. This is often the case with hedge funds where there is very active trading. You then pay, for example, 20% of the profit to the fund when a profit is made. Be careful whether this is worth it: consider that a fund with high risks can easily achieve good results for a few years and then lose your money. The fund has then taken 20% of your positive results each time.

Exchange rate charges

If you invest in a fund that does a lot of investing abroad, you may also lose money through exchange rate charges. The exchange of currencies costs money anyway. Moreover, foreign currencies can become relatively more expensive, as a result of which you will get less for your investment. Keep this in mind if you want to invest a lot abroad.

Transaction costs

Remember that fund managers actively manage funds: they buy and sell shares regularly. The turnover factor or portfolio turnover ratio indicates how often a fund trades shares. Also, a fund pays transaction costs when they buy and sell shares; when all this active trading does not contribute positively to your return, all this extra trading only costs you money. Therefore, research whether a fund that is very active in trading actually achieves better results.

Spread

When you buy funds (ETFs) yourself from a broker, you also have to deal with a spread. The spread is the difference between the buy and sell price of a fund and are relative transaction costs that are charged to the broker. Is the spread very high? In that case, it may be wise to wait awhile before buying the ETF. The spread is often between 0.3 and 0.5 percent.

The size of the spread depends on the trading volume. When a fund is widely traded, the spread decreases. The price formation on the stock exchange can then take place more efficiently. You therefore see that funds in emerging regions and economies often have a higher spread than funds that focus on American shares, for example.

It pays to hold on to funds for a longer period of time. The buying and selling costs on an annual basis then decrease considerably. You can also compare whether an ETF with multiple listings is cheaper on a specific stock exchange. Research has shown that costs can vary widely between stock exchanges.

How do you know how much a fund costs?

It is often immediately clear how much it costs to buy or sell an investment fund. Your broker or fund often clearly states the percentage or amount you pay for your order. The costs you pay for the management are sometimes less clear. Read the documents with information on costs carefully: that way you will not be confronted by unpleasant surprises.

Don’t forget dividend leakage

Another ‘cost item’ is the so-called dividend leakage. In the Netherlands, the dividend tax rate is 15%, while in America, for example, it is 30%.

When a fund buys shares in America, 30% tax is paid on this dividend. The Netherlands has treaties with many countries through which overpaid dividend tax can be recovered. When investing in a fund, leakage occurs when these ratios are not applied properly. Many ETFs have a dividend percentage of 0.3%.

If you invest in shares yourself, and you do not live in America, you must fill in the W8-BEN form. This form prevents you from being taxed twice for the dividend you receive.

Do you want to invest yourself?

Do you have enough time? In that case, it can be attractive to invest in shares yourself. Before you start buying shares, you must of course understand what you are doing. As a beginning investor, it is attractive to try investing by means of a demo, this way you can test whether you can achieve a higher return by investing yourself.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.