Crypto.com credit card review (2024): receive up to 8% cashback!

With the Crypto.com credit card, you can enjoy benefits such as 8% cashback and free access to airport lounges! In this comprehensive Crypto.com credit card review, I will research whether the credit card is worth it.

Do you also want to apply for a Crypto.com credit card? Click here and receive your first crypto credit card for free!

| Card type | Visa |

| Fees | Free |

| Deposit money | Wire transfer or crypto |

| Supported crypto | CRO |

| Cashback | 1% - 5% |

| Physical card | Yes |

| Online card | Yes |

| Availability | EU, UK & USA |

What are the biggest advantages of the Crypto.com credit card?

- Application: You can use the virtual Crypto.com credit card immediately.

- Cashback: Receive up to 5% cashback on all your purchases.

- Free lounges: Use the lounge at the airport for free.

- Costs: The crypto.com credit card costs are low.

- Reliable: Crypto.com is a well-known and large brand with a solid reputation.

What are the biggest disadvantages of the Crypto.com credit card?

- High staking: The best card requires a very high staking amount.

- Netflix & Spotify: You only receive 6 months for free with the lower tier cards.

- Charging: Charging with a credit card costs 1%.

Applying for a Crypto.com credit card

Applying for a Crypto.com credit card is easy! Click here to receive your own Crypto.com credit card right away.

It can take a long time to receive the physical Crypto.com credit card: I waited almost 2 months for it. Fortunately, you can use the Crypto.com credit card immediately online after submitting the application. This allows you to immediately take advantage of cashback and special benefits on online transactions.

How does the Crypto.com credit card work?

The Crypto.com credit card is actually a debit card: this means that you have to preload it yourself each time. You can easily deposit money on the Crypto.com credit card by transferring money to Crypto.com’s bank account number. Transactions are processed quickly: often, the money is already on your credit card within an hour. Then, within the Crypto.com application, you can add money to your credit card.

Staking & different benefits

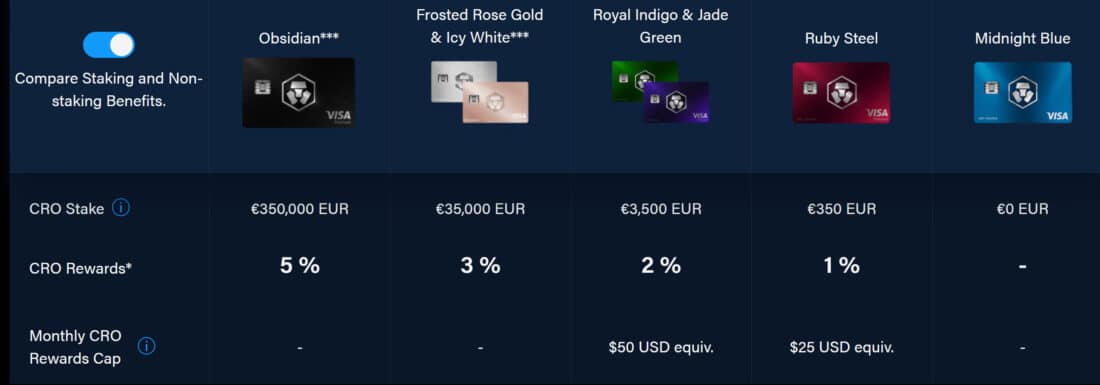

The Crypto.com credit card offers benefits in the form of CRO, which is Crypto.com’s cryptocurrency. At Crypto.com, you have different card levels, where the amount of CRO you stake determines which level card you receive. If you want to receive a better card, you must buy a certain amount of CRO and lock it up for six months.

Cashback and Other Benefits of Crypto.com Credit Cards

With the Ruby Steel credit card, the maximum monthly cashback is €25 (for spending over €2,500), while with the Royal Indigo & Jade Green card, the maximum monthly cashback is €50 (for spending over €2,500).

In Europe, cashback is particularly attractive because it is not typically offered by European credit cards. However, to receive this benefit with Crypto.com credit cards, you must speculate on the price of CRO, which is a cryptocurrency that is tied up for a longer period. This means you can either make a profit or experience a loss on your investment.

Free Spotify

With the Ruby Steel and Royal Indigo & Jade Green credit cards, you can receive free Spotify for the first 6 months (with a maximum refund of €14 in CRO). With the higher-tier cards, you can continue to enjoy free Spotify even after the initial 6 months.

Free Netflix

With the Royal Indigo & Jade Green credit card, you can receive free Netflix for the first 6 months (up to a maximum of €14). With the higher-tier cards, you can continue to enjoy free Netflix even after the initial 6 months.

Lounge Access

One of my favourite benefits of the Crypto.com credit card is the free lounge access at airports. With the Royal Indigo & Jade Green card, you can enjoy unlimited free lounge access, even after you stop staking CRO.

With the Frosted Rose Gold & Icy White card, you can also bring a guest with you to the lounge for free. This means you can even enjoy free food and relaxation in a luxury airport lounge on a cheap Ryanair flight.

Amazon Prime

With the Frosted Rose Gold & Icy White card, you can also receive free Amazon Prime up to a maximum of €14.99 per month.

Expedia

With the Frosted Rose Gold & Icy White card, you can receive 10% cashback on your Expedia spending up to a maximum of €50 per month.

Airbnb

With the most expensive Obsidian credit card, you can receive 10% cashback on your Airbnb spending up to a maximum of €100 per month.

Conclusion

Personally, I am a fan of the cashback and lounge access benefits. I chose the Royal Indigo credit card for its 2% cashback and free lounge access at the airport. I also see it as a speculation on the price of CRO, hoping that the coin will be worth more at the end of the staking period.

Costs of the Crypto.com Credit Card

One positive aspect of the Crypto.com credit card is the low costs. Even the free Midnight Blue credit card can be used for free. Additionally, Crypto.com charges lower fees than competing crypto credit cards. In the table below, you can compare the costs of the different Crypto.com credit cards:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

You can also add money directly to your credit card at Crypto.com with another credit card, but you will pay a 1% fee for this. Depositing money onto your credit card with a bank transfer is completely free.

Starting from December 2023, Crypto.com will charge fees for exchanging euros to other currencies. These fees are 0.2% within the EU and 2% outside the EU.

If you need to request a replacement card, Crypto.com will charge you €50. If you withdraw more money than your limit, you will pay 2% on the amount. Make sure to use your card at least once a year, or you will be charged €4.99 per month.

The costs of the Crypto.com credit card are quite attractive. However, it will be less attractive to use the credit card abroad from December 2023 onwards. For example, if you receive a 2% cashback, it may not be worth it as you will then lose the same amount in transaction fees.

Conclusion on the Crypto.com Credit Card

The Crypto.com credit card is one of the most attractive crypto credit cards on the market. With a cashback of up to 5% and various interesting benefits, it may be worthwhile to stake CRO. However, the benefits of the credit card are slowly being phased out, which may allow other crypto credit cards to dethrone this card in the future. For instance, with the Plutus credit card, you can receive up to 8% cashback for a lower stake.