What are the disadvantages of investing in Bitcoins?

Before investing in Bitcoins, you must also understand the disadvantages. In this article, we discuss the biggest risks and dangers of investing in Bitcoin. This allows you to make an informed decision and determine whether it is wise to buy Bitcoins NOW.

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

Unpredictable prices

Investing in Bitcoin is not for uncertain types: the price can easily drop several percents in a day. Therefore, you must be able to handle risks well and possess nerves of steel. This prevents you from losing a substantial amount with your investment in Bitcoin.

Do you want to limit the volatility of your investment somewhat? Then it may be wise to apply dollar cost averaging. With this technique, you buy Bitcoins at different times. You buy them at both lower and higher prices, which allows you to benefit from an average return on Bitcoin.

Political uncertainty

There is still a fair amount of uncertainty surrounding the political situation & Bitcoins. You see that some countries ban cryptocurrencies while others embrace them. Due to the decentralized nature, the government can never completely ban a crypto, but it can become much more difficult to buy or use cryptocurrencies. Political actions can therefore put significant pressure on the Bitcoin price.

A good example of this was seen in 2021 when China announced it was going to ban mining. After this news, the price of Bitcoin dropped significantly and even reached a new low. This shows that despite the lack of a central party, governments can still exert a lot of influence on the price development of Bitcoin.

Crypto exchanges can also be subjected to limitations. For example, you see that Binance no longer offers futures in many European markets in 2021 to comply with government guidelines. The unpredictable attitude of governments is therefore a risk for investments in Bitcoin.

Lack of sustainability

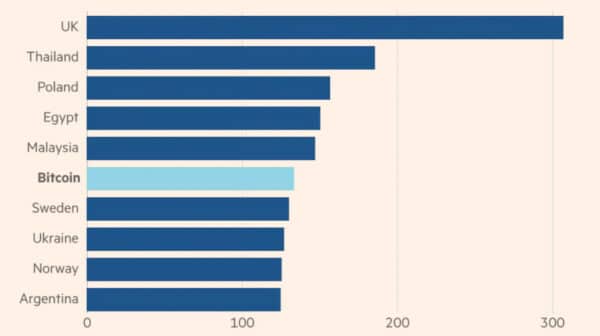

Bitcoin is anything but sustainable, since mining Bitcoins requires a lot of computing power. Currently, all miners together consume as much electricity as the entire country of Argentina. In Iran, they sometimes even turn off the power of a city to mine Bitcoins.

In a world where sustainability is becoming an increasingly important theme, an energy-consuming crypto can be difficult to break through. The chances are, therefore, high that a more energy-efficient crypto will eventually take over from Bitcoin.

Mining Bitcoin consumes a lot of computing power and electricity. Source: ft.com

Limited scalability

Another major disadvantage of Bitcoin is its limited scalability. Only a few transactions can be executed on the network per second, while Visa can easily process thousands per second. Validating a block for a transaction takes a lot of time.

Therefore, Bitcoin is not a realistic replacement for normal currencies such as the euro or the dollar. No one wants to wait 15 minutes in a supermarket for a transaction to be processed. A faster and more scalable crypto could therefore eventually replace Bitcoin.

Transaction Fees

The transaction fees for executing a Bitcoin transaction are also increasing. Other cryptocurrencies make it possible to execute transactions without paying transaction fees, which is obviously much more attractive.

Too Much Centralized Power

Bitcoin is built as a decentralized system. In practice, however, Bitcoin is not as decentralized as it seems. Most mining activities, take place in China. If the government decides to shut down mining facilities, the Bitcoin network can suddenly be brought to a halt.

Furthermore, the largest amounts of Bitcoins are held by some parties. This can allow them to manipulate the price, which does not contribute to the decentralized nature of Bitcoin. It is important to consider these factors when considering an investment in Bitcoin.

Hacks & Other Security Issues

The security of cryptocurrencies such as Bitcoin is also a tricky problem and a big risk. Research has shown that 99 percent of exchanges will eventually be hacked. When using a traditional bank account, you can be sure that your money will not simply disappear. Because there is no oversight of Bitcoin, if you are robbed, you cannot be compensated.

Therefore, it is advisable to secure your Bitcoin exchange account well. You can secure your account by choosing a strong password and enabling 2FA protection. You can also store some of your Bitcoins in a cold wallet: these are not connected to the internet, which makes it harder to steel your coins.

Do you want to know how to safely invest in Bitcoins yourself? In our special, we cover in detail how to prevent your Bitcoins from being stolen:

No Influence in Times of Crisis

The lack of influence from the government is seen as a plus for Bitcoin by many suspicious people. However, this can also be a disadvantage; in times of crisis, the government can solve the situation somewhat by, for example, printing money. This is not possible with Bitcoin, which means governments are unlikely to use this cryptocurrency as a general currency.

Embracing Bitcoin as a valid payment method can give the price a considerable boost.

No Replacement for Gold

Many doomsday peppers strongly believe that Bitcoins are the perfect investment to protect yourself against the downfall of the world. They believe that Bitcoin is the new digital gold. However, in practice, this is not entirely true: Bitcoins are not physical, and you cannot access your Bitcoins when the internet is down. When the world comes to an end or there is a war, the chance is high that this type of infrastructure will no longer exist. Gold remains the only true safe haven.

As you can see, there are enough negative points associated with investing in Bitcoins. Therefore, it is important to realize that Bitcoin is far from perfect. Therefore, never invest all your money in Bitcoins!

Loss of Access

Another risk of investing in Bitcoins is that you can lose access to your wallet. On the internet, there are enough stories of people losing millions of dollars worth of Bitcoins because they lost their password.

As a Bitcoin investor, you are 100% responsible for the security of your own cryptocurrencies. With a normal bank account, there are still ways to retrieve your password so that you can access your funds again.

Irreversible Transactions

Another disadvantage of Bitcoin is that you cannot easily undo transactions. When you make a mistake, you are entirely at the mercy of the recipient of the Bitcoins. The recipient can only undo a transaction by sending the money back, which makes Bitcoin particularly vulnerable to fraud.

Money Disappears from the Real Economy

Another long-term risk is that too much money disappears from the real economy due to Bitcoin and other cryptocurrencies. With Bitcoins, it is easier to hide a large fortune, which makes it easier to avoid taxation.

However, taxes are necessary to pay for healthcare and infrastructure in a country. When an increasing number of people convert their money into digital currency, the government must take steps to ensure the security of the system.

Can you reduce the risks of investing in Bitcoins?

As you have read in this article, there are many disadvantages and risks associated with investing in Bitcoin. If you decide to invest in Bitcoin anyway, it is advisable to limit the risks as much as possible by taking these steps:

- Secure your Bitcoin account with a strong password and 2FA

- Store large amounts of Bitcoins in a cold wallet

- Diversify your investments: Bitcoin is very volatile

- Only invest money in Bitcoin that you can afford to lose

Good preparation is half the battle: therefore, compare the advantages and disadvantages of Bitcoins carefully before opening an investment! In the article the advantages of Bitcoins, you can read in detail why it can be attractive to invest your savings in Bitcoins.