The influence of emotions on investing

Emotions have a major influence on the result you achieve with trading. It doesn’t matter how good your analyses are when you don’t manage to control your emotions. However, you can also benefit from the presence of emotions on the trading floor.

Two powerful emotions are fear and greed. In this article, you will read everything you need to know about the influence of emotions on your investments.

(too much) fear is dangerous

Women are generally less self-confident and this can be seen in their investment behaviour. Women are often more cautious and make fewer transactions in a year. This can work out well since the transaction fees are lower in this case, which results in a higher return. Too much fear, however, can have a negative effect.

Many investors make the mistake of letting their emotions influence their trading behaviour too much. Loss aversion or the fear of losing play a role in this. People have a natural tendency to avoid losses and risks as much as possible. We see this everywhere: For example, the Dutch have more insurances than they need.

Prevent negative results due to anxiety

When you look at the investing behaviour of the individual, loss aversion often has a negative effect on the results. This is because traders want to avoid loss as much as possible. However, the consequence is that bad investments are not closed, with the hope that they will become profitable in the future. At the same time, investors close profitable investments too quickly because they are afraid of losing profit.

It is therefore important to always draw up a plan. Think in advance when you open or close an investment. It is important to be able to defend the investment with facts. If this is not the case, it is not wise to open the position. By drawing up a very rational plan, you will prevent yourself from going wrong at a later stage. That way the emotion fear does not affect you.

Finally, as a trader, it is more important to accept that winning is always impossible. Economic crises and downturns always occur, and it is important to deal with them wisely. Don’t let your fears and emotions guide you and only make a decision once you have thought about it.

Preventing anxiety

As an investor, fear is your greatest enemy. It is wise to avoid this emotion as much as possible. You do this by only investing with money you can spare. Do you immediately feel uncomfortable with your new position? Then you probably trade with too much money.

I only open investments that don’t wake me up at night. That way it stays fun.

Take advantage of the emotion fear

As an investor, it is also possible to profit from fear. During the economic crisis of 2008, many people dumped their shares at sharply reduced prices. The reason behind the decision to dump shares was rarely rational. Under the influence of the media, you could see that people anxiously sold everything because they assumed that the ship was going to sink.

Moments of mass hysteria like this can offer great oppertunities. When shares are dumped on a massive scale, you can look for bargains. Research yourself whether there is a rational reason behind extreme falls in share prices that you sometimes see. When there is no rational reason, you can sometimes achieve a return of 20% or more within a short time span.

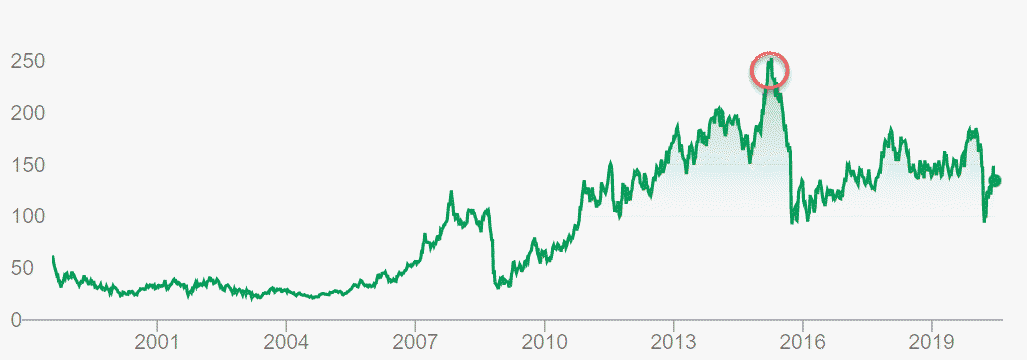

This works during an economic crisis, but also when a company is temporarily doing less well. This can happen, for example, when a scandal comes to light. For example, several car manufacturers have been accused of tampering with emissions. This led to substantial decreases in car shares, while the companies were still doing well. In the longer term, therefore, there was an upturn.

Volkswagen’s stock price after the company appeared to be tampering with emissions

Greed has two sides

Did you know that trading is still mainly a male sport? For every female investor, there are nine males, although this seems to be changing a bit lately. Men often have a higher degree of greed and without greed, there is no stock market. However, is greed the best friend or most feared enemy of the professional investor?

Let’s just say greed is a necessary evil. Without greed, one would not strive for the highest possible return and would simply start saving safely. However, it becomes dangerous when greed becomes so great that the investor takes huge risks.

Especially when you trade using leverage, it is important to keep a cool head and to take the additional risk of the investment into account.

Too much greed is dangerous

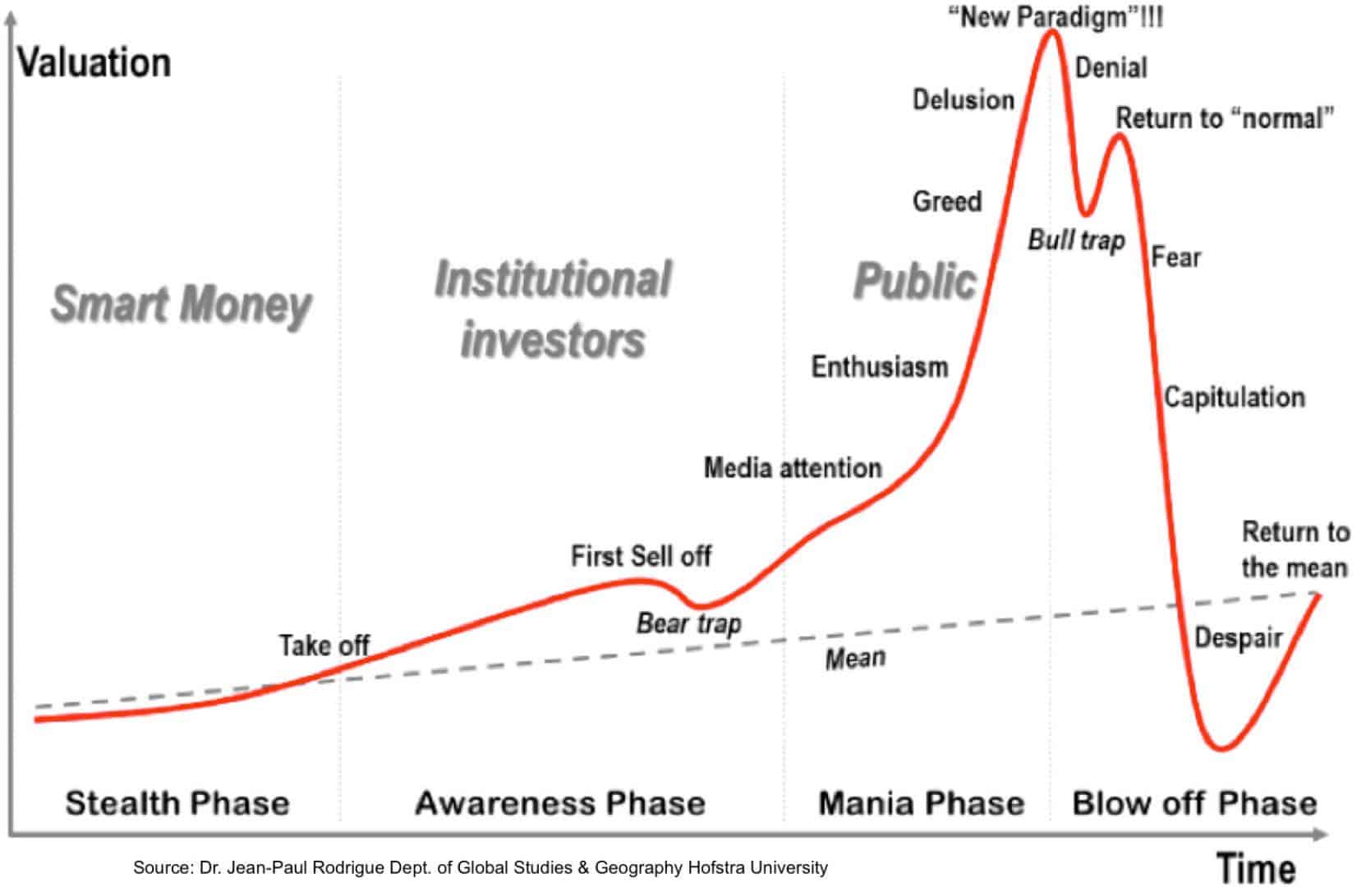

Too much greed, however, is always disadvantageous. High levels of greed can even cause a so-called bubble. A good example of this is the enormous rise of the Bitcoin in 2017 and 2018 followed by a huge crash. When people urge each other too strongly to invest in something, greed can lead to strong market movements.

When this happens, the actual value of an investment can be much lower than the price. People then simply buy something because they expect it to continue to rise tremendously. When the underlying investment turns out to be worth nothing, the house of cards collapses. As a result of the fear described earlier, the price can then suddenly drop significantly.

Don’t get carried away

It is therefore important not to get carried away by the emotions of the mass. When the postman and the milkman all indicate that you have to make a great new investment, it is better not to do it. Always ask yourself whether there is a good reason to invest in a share. Is there no good reason to do so? Then there is probably an economic bubble.

After the enormous greed comes the inevitable fall. Cryptocurrencies in 2017-2018.

What other emotions do you have to watch out for?

In addition to fear and greed, there are other emotions you should be aware of when trading. Below we discuss how you can deal with these feelings.

Hope

They sometimes say that hope lives. Many investors who buy a share expect it will rise. However, hope alone is not enough. Therefore, check regularly whether the company behind the share is still performing well and make sure that all your investments are supported by hard figures.

Even for active traders, hope can lead to bad results. They keep a loss-making position open for too long, even though it should have been closed a long time ago. As a result, a small loss can lead to a huge loss. You should therefore always use a stop loss as an active trader so that your positions are automatically closed.

Frustration

When you feel that you are doing everything right and the results are still disappointing, you can become frustrated. It can also be very frustrating when you constantly break your rules. Frustration is always a dangerous emotion. Irritation can cause you to make irresponsible decisions and open positions you shouldn’t have opened.

When you are frustrated, it is therefore important to seek distraction. Only when you can look at your trades objectively you should return to your computer screen.

Boredom

We live in a society full of constant stimuli and entertainment. Waiting months or even years for a share to rise can therefore become boring. Yet patience when investing is a virtue. It is important to always stick to your plan. Are you looking for some excitement? Take a ride on a roller coaster and leave your trades alone.

Isn’t holding shares in the long term interesting enough? Then you might as well consider becoming a day trader. As a day trader, you can take action every day. For this way of trading you need much more time.

How do you trade without emotions?

Research has shown time and time again that especially novice investors often buy at the top and sell in a dip. If you want to achieve good results, you have to do just the opposite. But how do you ensure that emotions play a smaller role in your trading activities?

Automate your investments

The first way to get emotions out of your investments decisions is to automate them as much as possible. In any case, it is important to always draw up a plan for this. In the plan, you can then determine when and especially why you want to buy and sell a share. By doing so, you avoid making the wrong decision during exceptional market circumstances.

For many investors it is then wise to leave your investment account alone. Make sure you have set the value at which you take your losses and profits. By not logging in all the time you avoid getting stressed when the market collapses and your plan will automatically be executed correctly.

Dollar cost averaging

Of course, as an investor, you want to avoid getting in on top and selling in the dip. A good way to prevent this is by applying dollar-cost averaging. This is an investment strategy in which you do not invest all your money in one share at once. So, you don’t buy Apple shares for $10,000 in one go. Instead, for example, buy $1,000 worth of Apple stock each year.

One year you may receive 5 shares and the other year 6 shares. By applying this method you buy the shares at an average price, and thus you’ll achieve an average return. For most people this is the best way to invest: hardly anyone succeeds in timing the market correctly.

Spread investment

Finally, it is smart to invest as spread out as possible. Investors often panic when their investments suddenly fall sharply. It rarely happens that all sectors perform poorly at the same time. By spreading your investments across different sectors, you reduce the risk of a drop in all your combined investments.

For investors with a smaller portfolio, it can be smart to trade in an index fund or ETF. By using these investment products, you can easily spread your money over different investment products. By depositing money in the fund on a monthly basis, you immediately apply the technique of dollar-cost averaging.

How do you control your emotions?

All decisions we make are at least partially based on emotions. In a well-known psychology study it was discovered that when the brain part responsible for our emotions no longer works, we can no longer make decisions at all. In fact, our brains are so cleverly built that, in retrospect, they often rationalize our emotional decisions.

For example, you break up with your love partner because you no longer experience enough positive emotions. After the breakup you rationalize this decision by drawing up a whole list of things that were wrong with him or her. In daily life, it is not essential to be aware of this. When you are going to trade, however, it is important.

It is then advisable to actively seek out emotional impulses. Think about what certain feelings aroused in you and see how it influenced your investment behaviour. For example, have you opened dozens of trades out of boredom? Then it is important to acknowledge the ineffectiveness of this emotion and to devise a strategy to prevent this from happening again in the future.

Only through regular evaluation will you learn how your emotions influence your behaviour and you can steer them better.

Greed is good, fear is…

Let me close this article with one of my favourite film quotes: ‘greed is good’ from the film Wall Street. A healthy degree of greed combined with some fear makes you an emotionally strong investor. However, make sure that both emotions remain well-balanced so that you can invest responsibly and successfully.

After all, too much greed leads to too high risks and therefore a lower or negative return. Fear, on the other hand, leads to uncertainty in which investments are often not made at all. Investing leads to a higher return in the long term than saving. Do you want to learn how to invest yourself? Then take a look at the three-step plan to start trading!

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.