How to invest in the Euro (EUR/USD) (2024)?

Would you like to invest in the Euro? In this article, we will discuss how and where you can invest in the Euro (EUR/USD)!

How does trading in the Euro work?

Trading in the Euro is also called Forex trading. The abbreviation ‘Forex’ stands for Foreign Exchange and refers to the trade in foreign currencies. The Euro is not a foreign currency, but trading in the Euro falls under Forex trading because trading in the Euro always involves a foreign exchange rate. You can read more about this in the next paragraph.

How does Forex trading work?

When you trade in the Euro, you speculate on a rise or fall in value compared to another currency. For example, you predict that the Euro’s value compared to the US dollar will rise or fall. Trading in the Euro always involves another currency. This can be the US dollar, but it can also be the British pound or the Japanese yen.

To trade in the Euro, you need to find a currency pair in which the Euro is included. The most popular pair is the EUR/USD, with the US dollar. The EUR/USD pair indicates how many dollars you need to get one Euro. If you go short on this rate, you indicate that you expect the Euro to decrease in value compared to the US dollar.

However, if you decide to go long, you expect the Euro to increase in value compared to the US dollar. If you are right, you make a profit. If you are wrong, you make a loss.

Where can you invest in Euro/dollar?

You can trade CFDs in the Euro online with a professional and reliable broker. Are you curious which Forex brokers allow you to trade in the Euro exchange rate? Check out the list below:

Which Euro pairs can you trade?

The Euro is usually traded in combination with another currency. This way, you express the value of the Euro in another currency.

When you look at EUR/USD and the price is 1.1, you receive €1.1 for every dollar you sell.

Famous EUR pairs that you can trade include:

- EUR/USD

- EUR/GBP

- EUR/AUD

- EUR/NZD

- EUR/CAD

What to consider when investing in the euro?

Economic & Political Climate

When investing in the euro, you need to take a global view. The euro is used as a means of payment in most European countries. The economic and political climate is therefore largely responsible for the euro’s exchange rate against other currencies. When things go well within the eurozone, the demand for the currency generally increases, which can lead to an increase in value.

Interest Rates

Of course, you also need to pay attention to interest rates. You can look at the interest rates provided by the Central Bank on euros and the interest rates given by the Federal Reserve of America. When the average interest rate on the euro is higher than the interest rate on the dollar, this can lead to an increase in the eur price.

You can remember the following:

- If interest rates are raised in the eurozone, the value of the euro will likely rise

- If interest rates are lowered in the eurozone, the value of the euro will likely fall

Demand & Supply

Finally, it is important to remember that the exchange rate is determined by the interplay of demand and supply. The exchange rate can therefore fluctuate due to news or under the influence of certain patterns on the chart.

Strategies for Forex trading in the euro

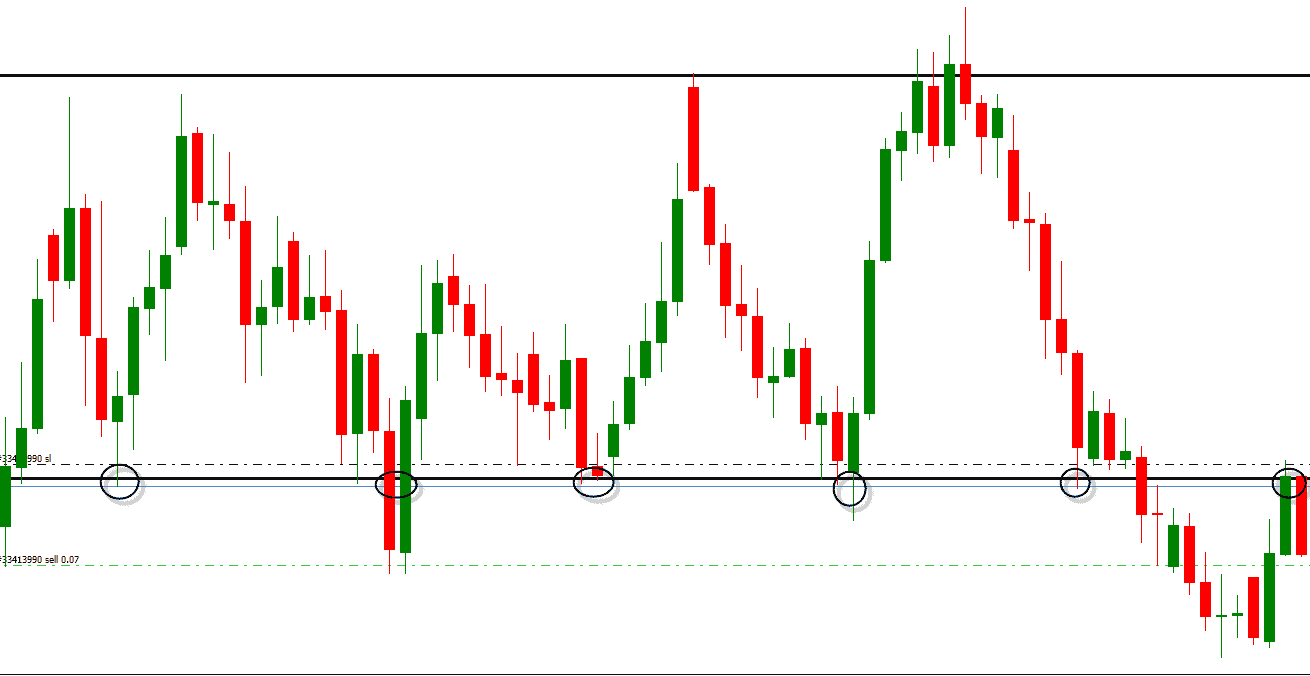

When you start trading the euro, it is essential to apply a good strategy. Look for clear patterns on the chart.

For example, you often see horizontal levels that the exchange rate responds to. When the exchange rate breaks through a horizontal level, this level is often retested. This can be a good time to open a position.

If you want to read more details on how to open Forex positions on the euro, read my article on technical analysis.

What are the advantages of investing in the euro?

- Relatively Stable: as the euro is the second-largest currency after the dollar, the exchange rate moves relatively stable.

- Diversification: by trading in currencies, you can add diversification to your investment portfolio.

- Trading Hours: the Forex market is open 24/7, so you can invest in the euro almost all the time.

- Relatively Low Costs: due to high liquidity, the spread on euro trading is low.

What are the disadvantages of trading in the Euro?

- Uncertain future: The Eurozone consists of many individual countries. Weaker, southern European members can bring the exchange rate down.

- New members: When the European Union admits new members, this can have a negative impact on the Euro exchange rate.

- Exchange rate losses: If you enter at the wrong time, you can make losses with investments in the Euro.

Practice with a demo account

Trading in the Euro may sound easy, but it’s more challenging than you might think. This is because it’s difficult to predict what the value of a currency will do. The fact that you have to compare the value against the value of another currency makes it even more difficult.

Since forex trading is not easy, we recommend that you practice first. You can do this by creating a demo account. With this account, you don’t speculate with real money, but with a fictional amount. If this goes well, you can start trading in the Euro. Use the button below to open a free demo immediately:

Frequently Asked Questions about Trading Euros

EUR/USD is a currency pair that indicates the relationship between the most traded currencies in the world. EUR/USD indicates how many dollars you need to buy one euro.

To predict the Euro exchange rate against, for example, the dollar, you can apply both technical and fundamental analysis. With fundamental analysis, you look at the situation within the Eurozone, while with technical analysis, you try to recognize patterns on the chart.