What is investing with insider knowledge or insider trading?

Investing with prior knowledge or insider trading is illegal in many cases. In this article, I explain what trading with prior knowledge exactly means.

What is investing with prior knowledge?

Investing with prior knowledge is also called insider trading. If you invest with prior knowledge, you use information that has not been made public. You can do this to gain profits, but also to avoid losses. Trading with prior knowledge is prohibited in most countries. You are not allowed to (attempt to) trade based on non-public information. If you do, you can be punished for it.

You are also not allowed to pass on the information you use to others. For example, if you discover a secret document, you are not allowed to forward it to other investors. All investors on the stock market must have the same information.

It is important to constantly ask yourself whether the information you use as an investor is public for other investors. If this is not the case, you are not allowed to use this information. If you do, you may face the consequences of trading with prior knowledge.

Is investing with prior knowledge always illegal?

Insiders, like everyone else, are allowed to buy and sell shares. When insiders report their investments on time within a company, this is legal. Directors and major shareholders must always publish their transactions.

However, it is not legal to buy or sell shares just before a major announcement. Insiders are only allowed to shell these shares after this knowledge has been made publicly available.

The consequences of investing with prior knowledge

Financial supervisors can not only penalize companies for trading with prior knowledge, but can also impose a penalty on private investors. If you invest with prior knowledge, you can, for example, receive a fine. This fine can be very high, even for private investors. The financial supervisor can also take other measures in this case.

For example, the financial supervisor can take a so-called trading measure in the case of insider trading. This happens if this is in the interest of investors or if it is necessary for orderly trading. The supervisor can stop trading in a particular share, for example, before the stock market opens or during a trading day.

Only when everyone has had the opportunity to receive certain information, will the supervisor restart trading. To share the information with all investors, the supervisor can publish a press release. After the publication of this press release, trading resumes.

When you manipulate markets on a large scale, you can even get up to four years in prison within the European Union!

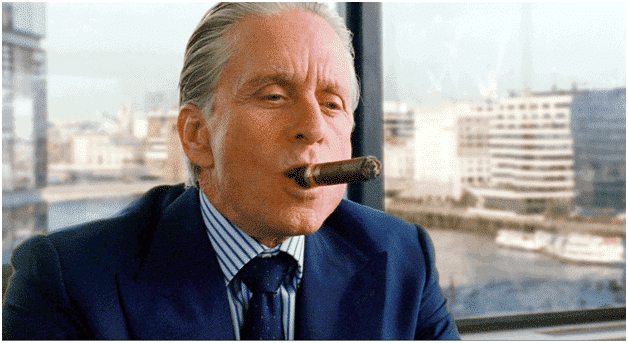

Gordon Gekko in the film Wall Street experienced the consequences of insider trading.

Should trading with prior knowledge be legalized?

Some investors believe that investing with prior knowledge should be legalized in all cases. By allowing this, the markets would operate more efficiently since information would be processed faster in the market.

You could also see an investment based on prior knowledge as a fair transaction: at that moment, both the buyer and the seller are willing to conduct business.

Additionally, limiting investing with prior knowledge would block freedom of speech.

Example of investing with prior knowledge: Martha Stewart

Martha Stewart was convicted of insider trading in America. She sold 4000 shares of the biotech company ImClone in 2001 based on a tip from broker Peter Bacanovic. Peter Bacanovic gave this tip just after the CEO sold all of his shares.

Ultimately, it turned out that an important ImClone drug had been rejected by the FDA. After the trial, Martha Stewart was sentenced to five months in prison.

Reporting investing with prior knowledge

The financial supervisor constantly monitors the financial markets. If an organization or investor is suspected of trading with prior knowledge, an investigation is immediately launched. If insider trading took place, immediate action is taken.

In addition, the supervisor responds to reports from other investors. Do you suspect that a company or private investor is trading with prior knowledge or at least trying to? Then you can report this to the local supervisor.