Invest with little money (2024) – 10 tips for better results

Do you want to invest with little money? You can! In this article, you will find 8 attractive stratgies you canuse toachieve good results with little money.

How to invest with little money?

Investing with little money is absolutely no problem nowadays! With many brokers, you don’t pay fixed transaction fees. This allows you to invest in stocks with 100 or less!

Below you can see an overview of my favorite brokers where you can invest with little money:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

Is it worth investing with little money?

Many investors do not believe that it is worth investing with little money. That is a shame: even with small amounts, you can build up a nice fortune. However, it is important that you have enough time. When you allow your investments to yield enough returns over a long period of time, the effect of compound interest can help you build a substantial amount.

Are you curious about how much an investment can yield over a longer period of time? With the tool below, you can see what return you would achieve if you keep reinvesting your returns:

The investment will be worth!Growth of the investment over time: Investing balance in year |

If you would start one year later with investing you would have less than if you would start today. |

|

|

Impressive, right? With a small investment, you can build up a substantial fortune. At an average annual return of 8%, your investment will grow to:

- $100 could grow to $ 1000

- $ 1000 could grow to $ 10,062

- $ 10,000 could grow to $ 100,626

These are one-time investments. If you manage to invest a small amount monthly, your return can increase even further. Remember that investing is always risky, and you can lose money. In the next part of the article, we will look at how you can invest with little money.

What can you invest in with little money?

There are several ways to invest smartly with little money. Below we discuss 9 proven methods that you can apply:

| Invest with little money in: | Possible from: |

|---|---|

| Buy stocks | $40 |

| Buy crypto | $5 |

| Buy ETF's | $100 |

| Daytrading | $40 |

| Options | $100 |

| Deposits | $100 |

| Bonds | $100 |

| Real estate | $100 |

As you can see, many investment options only require a small initial investment.

Method 1: invest in stocks with little money

You can choose to buy stocks. When the amount you invest is too small, the chances of success decrease significantly in most cases. This is because you pay transaction costs on every investment. Most brokers charge a minimum amount. When you invest with $100, you already pay a few percent in transaction fees. The stock must then rise several percent to achieve a positive return.

There are brokers who do not charge fixed commissions. You can then safely buy a few stocks. Your transaction costs are then 100% relative, so you can achieve a positive return even with a small amount.

In the overview you can see with which brokers you can invest in stocks with little money:

Method 2: invest in Crypto with Little Money

It can be interesting to invest in cryptocurrencies such as Bitcoin and Ethereum with little money. It is clear that you can achieve positive results even with a small amount. I recently spoke to someone who became a millionaire within a few weeks by investing 100 pounds in Safemoon (a relatively unknown crypto)!

Although it usually doesn’t happen that fast, it doesn’t mean that you cannot achieve good results with small investments in cryptocurrencies. Only invest money that you can truly afford to lose in cryptocurrencies, as the high volatility can result in losing your entire investment.

In the overview you can see which crypto brokers are best for investing with little money:

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

Method 3: invest in an ETF

Even when you pay low transaction fees, investing in stocks with little money can still be risky. This is because you have fewer opportunities to diversify your investments. By buying different types of stocks, you ensure that your total investments become less volatile. Poor results in one sector are then offset by good results in another sector.

A good method to apply diversification with a small amount is by investing in investment funds or ETFs. An ETF or exchange-traded fund is a fund that invests the money of all participants in a basket of stocks. This allows you to invest in a selection of stocks with a small amount.

You still have some influence when buying and selling ETFs. Some funds, for example, focus on a specific region or sector. If you have a lot of confidence in Asia, you could buy a special Asia fund.

Method 4: Day Trading with Little Money

With the advent of online brokers, it is now also possible to daytradewith little money. Day traders constantly follow the latest developments in the market and then speculate on rising or falling prices. You can read how to become a day trader in this article.

When day trading with little money, using leverage can allow you to open large positions with a small amount of capital. However, keep in mind that trading with leverage is riskier and your losses can accumulate quickly.

If you want to try day trading for yourself, many brokers offer a free demo:

Method 5: Invest in options with little money

If you want to invest with little money, you can also consider options. With options, you buy the right, but not the obligation, to buy or sell a certain stock at a certain price. Options on a stock are cheaper than the stock itself.

For example, you can buy an option to buy a stock for $10 for $2. If the stock price then rises, you can make a profit. If the stock price rises to $15 and you can buy the stock with the option for $2, you will make a profit of $3.

Options are complex investment products. If you know how to handle them, you can achieve substantial returns. However, there is a real risk of losing your entire investment, thus it is important to educate yourself before investing in options. Our options course teaches you everything you need to know about this investment product:

Method 6: Savings account or deposit

Some people are looking for a safe way to invest their money with a favorable return. A savings account or a deposit may seem like attractive options, but in practice, this is not always the case.

Interest rates on these types of savings products are very low nowadays, which means that the absolute return is already disappointing. At the same time, your money becomes worth even less due to inflation and capital gains tax. Therefore, I would not recommend considering a deposit as an investment.

However, it is important to keep some of your money in a savings account. It is important to always have enough money available for unexpected expenses. If you suddenly have to take out a loan, you will be even further away from your goal, as the interest on consumer loans is high. Therefore, make sure to only invest money that you can afford to miss in the coming period!

Method 7: Lending little money

Method 7: Lending little money

You can also choose to lend a small amount of money. The most well-known way to do this is by buying bonds. A bond is a loan issued by a company or government. You will receive a fixed periodic interest payment on the debt instrument.

Bonds are a relatively safe investment. It is especially interesting to invest in bonds if you have a short time horizon. However, do not expect high returns when investing in bonds. In the long run, this often turns out to be disappointing, especially compared to stocks.

If you want to learn more about bonds, read our comprehensive guide to investing in bonds:

Method 8: Buying and selling

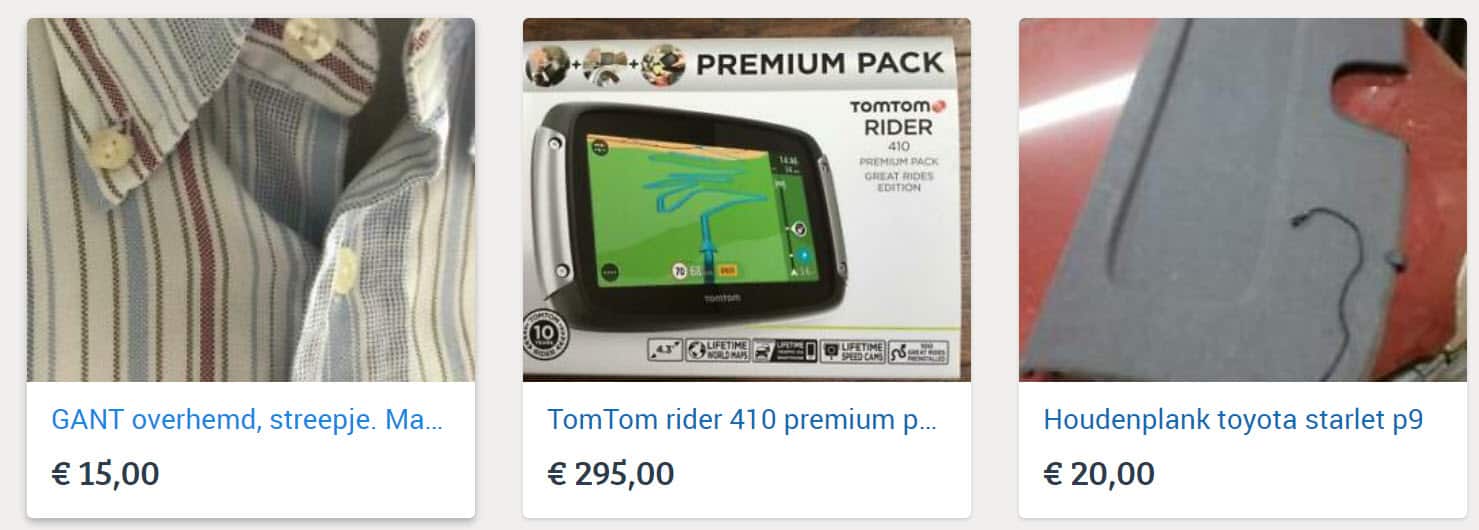

When you have a lot of time, you can also earn money by smartly investing in things. You can search for bargains on eBay and then sell them for more money.

For example, you can look for products offered by people who have no idea how to market something. Products sold with vague, grainy photos often don’t sell well. However, the product can be of excellent quality. Therefore, invest in a good camera and make sure you highlight the things you sell well.

You can easily buy and sell things on eBay

You can easily buy and sell things on eBay

Method 9: Invest Little Money in Real Estate

Investing in property is also very interesting. Most people think it’s not possible to invest in real estate with little money. Of course, you can’t buy a whole house with an amount of $500 or $1000. However, there are good methods to invest in real estate with little money.

You can do this by investing in a fund. There are various real estate funds that invest in apartments or office buildings, for example. When you buy a participation in a fund, you share in the profits that are made. However, you always pay management fees for your participation in the fund, which will reduce your returns. Investing directly in real estate can therefore be more profitable, but you need a larger capital for this.

Method 10: Invest Little Money in Commodities

More and more people invest small amounts of money in precious metals such as gold and silver. Gold and silver are strong hedges against inflation and uncertain times. Investments in these commodities can therefore protect your portfolio well against price drops.

However, the possibilities do not stop there: did you know that you can also speculate on the price movements of commodities such as sugar, oil, and even pork with little money? Do you want to read more about this? Then check out our guide on investing in commodities:

Why is it riskier to invest with little money?

Investing with little money carries extra risks. With a larger amount, you have a greater margin for errors. It is advisable to risk only a limited amount of your assets on one investment. When you invest with little money, this is often not possible. You then a larger proportion of your money on one single investment.

This gives you much less room for errors. Investing with little money is not for the faint-hearted. When investing with little money, you must be willing to lose it all.

Since there is much less room for errors, it is certainly advisable to try out the possibilities with a demo. This way, you can discover whether investing is right for you completely free of charge. Use the button below to compare the different demo accounts:

Investing with little money can be wise!

Many people think it is unwise to invest with little money: this is not necessarily the case! It is often more unwise to invest with little time.When you have enough time, your return grows faster.

For example, by investing 10 pounds every month for decades, you can build up a nice fortune. This is due to the effect of compound interest: you receive interest on your return as well.

Moreover,by taking your time, you also have more time to wait for recovery when the stock market is not performing well. By investing periodically with little money, you can achieve an average return over a longer period.

Curious about how your return grows faster over a longer period? Then use the tool below! With this, tool you can see how you can build up an increasingly higher return over a longer period:

What is the minimum investment to start investing?

Most brokers have a minimum investment of one hundred. This means that you only need to have one hundred available to invest.

There are even brokers where you can invest from $1. Investing with little money is more accessible than ever!

Curious about where you can invest from one hundred pounds? We have compiled an overview of brokers where you can trade in, for example, shares with small amounts:

Set clear goals, especially with little money!

If you want to invest with little money, this requires a different preparation than if you were to invest with a lot of money. When we talk about little money, we are talking about amounts of around one hundred pounds or a multiple of that, not the thousands of pounds sometimes used in investing.

Before you start investing with little money, it is important that you make your goals clear to yourself. The stock market tends to fluctuate, so it is important that you determine how you want to respond to this.

Therefore, think carefully about your plan: what do you want to invest in, with what amount, and how much time do you have? This way, you can determine whether it is realistic to achieve your goals.

The minimum amount to invest is $5, which can be used to purchase cryptocurrencies. If you prefer to invest in stocks, you will need a minimum of $40.

You don’t have to be rich to invest! You can certainly invest with little money. Nowadays, you only need $40 to invest in stocks and you can buy cryptocurrencies for as little as $5!

It is often wise to invest, as long as you can afford to invest a small amount of money. Even with little money, it can be smart to invest. It is important to create a good plan, consider your goals, and decide which risks you are willing to take. By investing a fixed amount in stocks periodically, you can build a solid portfolio in the long run.

Unfortunately, there is no crystal ball that tells us whether investments will be profitable. However, I believe in the power of evidence: when you look at the past, you see that investments have performed much better in the long run than, for example, savings accounts.By investing small amounts of money periodically, you increase the chances of achieving a positive result. The fact is that without investing, your wealth will only decrease in value due to inflation and taxes.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.