How to buy Nextdoor stocks (2024) – invest in Nextdoor

The American networking site Nextdoor has grown significantly, which makes it potentially attractive to buy its shares. In this article, we discuss the best method to invest in Nextdoor.

Do you have confidence in Nextdoor’s future plans? Then it may be attractive to buy shares for the long term. In the table below, you can see where you can invest in Nextdoor shares:

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

What is the current stock price of Nextdoor?

Are you curious about the current stock price of Nextdoor’s? In the graph below, you can see how Nextdoor shares are performing. You can also use the buy & sell buttons to start trading Nextdoor shares directly:

Company information about Nextdoor

Below you can find the key company information about Nextdoor.

Analysis of Nextdoor

Before deciding whether to buy or sell Nextdoor shares, it is important to analyse the stock thoroughly. In the overview below, you can see how Nextdoor has performed over the past period.

Stock prices of the last 5 days

In the table below, you can see the stock prices of Nextdoor for the last 5 days:

What is the performance of Nextdoor’s stock in 2026?

Are you curious about what analysts think Nextdoor will do in 2026 and the years to come? We have combined the predictions of analysts with data from Alpha Vantage. Remember that this number is just a prediction of Nextdoor’s stock performance, and that this prediction may not come true.

- Growing market: the demand for local social networks is growing rapidly, and Nextdoor is well-positioned to take advantage of this.

- Large number of users: the number of Nextdoor users is growing, with more and more families using it to stay in touch with their local community.

- Advertising: advertisers can target specific neighbourhoods, which can be favourable for the company’s profitability.

- Innovation: Nextdoor regularly offers new features, such as local advertisements and updates on neighbourhood safety.

What are the risks of investing in Nextdoor stocks?

- Dependent on users: Nextdoor’s revenue is highly dependent on user behaviour on the website.

- Safety: Nextdoor is a social network that can experience problems when users misuse the network.

- Competition: Nextdoor has many competitors in the form of social networks. When users switch to other networks, Nextdoor’s stock price can fall significantly.

- Limited international presence: Nextdoor’s focus is mainly on the American market.

- Privacy: Privacy is becoming increasingly important in Europe. Nextdoor earns money by collecting data from its users.

What are the biggest competitors of Nextdoor?

- Facebook groups: some local communities use Facebook groups, which makes Facebook a direct competitor of Nextdoor.

- Meetup: Meetup.com is another competitor of Facebook, as users can easily organize events here.

- Alignable: this platform connects local entrepreneurs with larger parties.

About Nextdoor

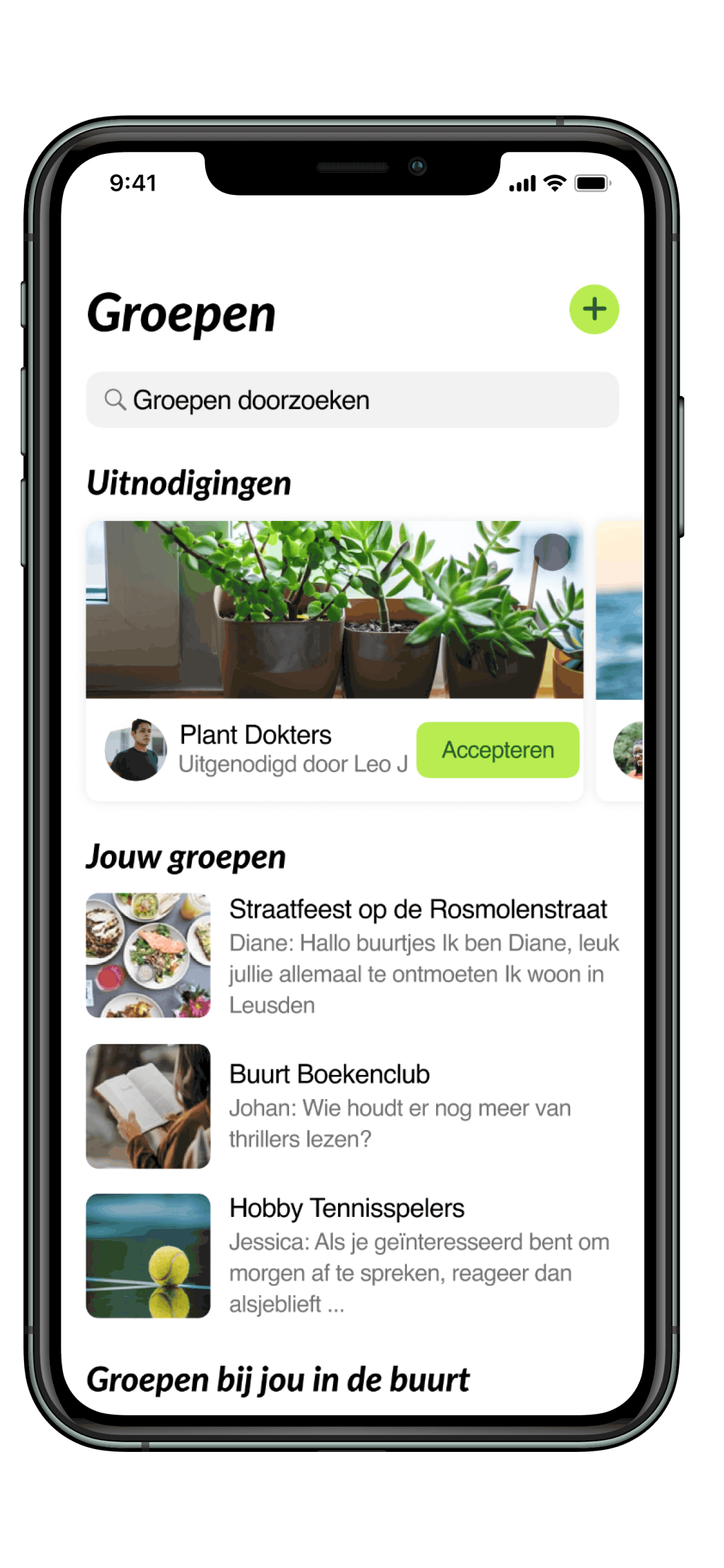

Nextdoor is an American social networking site that focuses on building connections between neighbours. The company was founded in 2014 and went public in 2021. Nextdoor is active not only in the United States and Canada but also in European countries such as Germany, Denmark, and even the Netherlands.

Better cohesion in neighbourhoods

Nextdoor is a social networking site designed for neighbours. Founder Nirav Tolia noticed a lack of cohesion in his San Francisco neighbourhood and wanted to improve relationships with his neighbours.

International expansion

Tolia’s idea was a massive success, and he quickly expanded Nextdoor beyond US borders.

Nextdoor is active in the United States, Canada, the Netherlands, the United Kingdom, France, Germany, Spain, Italy, Denmark, Sweden, and Australia. Altogether, the app represents 265,000 neighbourhoods around the world, with a membership of approximately 50 million users.

Technology can help us in our daily lives. In many large cities, people have grown apart, and people miss social contacts. This makes an investment in Nextdoor interesting: the company is tapping into a current trend that can be beneficial for investments.

You can invest in Nextdoor shares through a stockbroker. It is important to activate your investment account first by uploading a copy of your passport and address. After these documents have been processed, you can start trading Nextdoor shares directly.

Do thorough research into the fundamental figures behind the company. This way, you can determine if an investment can be appealing.

Nextdoor is growing rapidly and aims to expand further. The IPO did not come as a surprise to professionals.

There are certainly good arguments for buying Nextdoor shares. For example, the company is growing strongly and is active in different regions. Research indicates that people are feeling increasingly lonely: a company that enables connections with neighbours certainly has a reason to exist.

However, there is a catch with Nextdoor, and that is that the company works with a cookie wall. To use Nextdoor, you are required to accept all types of cookies, including those that can transmit your data to commercial companies.

These types of cookies are important for Nextdoor since they use them to make money from their users. Therefore, it is indispensable to follow the latest developments when considering an investment in Nextdoor.