How can you invest passively?

Many people have the idea that investing is hard work: you constantly have to select the right stocks to optimize your returns. Funnily enough, in many cases passive investing can actually deliver the highest returns. You do not have to make investment decisions all the time. In this article, we discuss the best ways to invest passively.

What is passive investing?

There are tens of thousands of stocks to invest in around the world. For many people, it can be difficult to select the best shares. By investing passively, you do not have to make difficult decisions yourself. This is because with passive investing, you invest in a set of shares that are purchased by an investment fund. The aim of passive investing is not to beat the market but to follow the market. By investing passively, you also build up a good, average return.

How can you invest passively?

You can invest passively with a broker by buying an ETF there. An ETF is a freely tradable fund. There are many ETFs nowadays. ETFs usually follow a particular market, region or index. With an ETF, you can invest in the price of an index like the FTSE or S&P500.

A good broker for passive investing is DEGIRO. At DEGIRO, you pay no purchase or sales charges on the funds included in the core selection. This enables you to achieve a higher return with passive investing. Use the button below to open an account at DEGIRO:

What are the advantages of passive investing?

Passive investing has its advantages. One major advantage of passive investing is its relatively low costs. Because passive funds do not have to carry out complicated analyses, the management costs are often low. Moreover, the orders to buy and sell shares are merged, as a result of which you pay lower transaction costs.

Therefore, in most cases, the return is higher when you invest passively. This is because many investors are not experts in predicting the market. As a result, few investors actually manage to achieve a higher return. When you have little financial knowledge, passive investing usually provides the highest return.

Another advantage of passive investing with a fund is that the strategy is often very transparent. You see immediately what the fund is investing in. Since the fund simply copies a certain market, you always know where you stand. Active investment funds can sometimes have not so clear rules for buying and selling shares.

What are the disadvantages of passive investing?

Even with passive investing, you can lose money. Share prices rise and fall and when things go wrong, your return can be disappointing. A passive fund can hardly compensate for bad times, as they do not actively trade. They will not suddenly come up with investments that do well during a bad economic situation. Therefore, the flexibility is limited when you do passive investing.

Another reason why people often dislike passive investing is that it can be dull. When you start investing yourself, it can be very exciting. Actively trying to beat the stock market and buying and selling shares is a fun activity for many people. If you don’t mind a lower return, then active investing can be more attractive.

Another disadvantage is that you have no influence. When you buy shares, you can attend the shareholders’ meeting. This gives you a direct voice on the future policy of the company. When you buy units in passive funds, you do not have this luxury. Of course, you do have some influence over what you invest in by selecting funds: if sustainability is important to you, you can buy a passive sustainability fund, for example.

Things to think about

Before you start blindly investing passively, it is wise to ask yourself certain things. When you passively invest in an index, your risk diversification may still be disappointing. This is because many stock indices are dominated by a handful of companies. When these companies have already built up a strong position, there is not much room for further growth.

When you choose passive investing, you choose a stable, but not particularly high return. If you want to achieve a higher return, you will have to take greater risks and look for trends.

It is also more difficult to follow your conscience when you invest passively. A passive index fund follows all the shares in an index regardless of how they make money. This can include companies that commit fraud, pollute the environment or produce weapons. By investing passively and not doing any research into the companies you invest in, you are partly responsible for these things.

Moreover, there are often unique opportunities in the market. You have to invest a lot of time to find them, but they are there. During the corona pandemic, for example, you could have bought shares in companies that produced mouth masks. When the economy is down, it can also be smart to invest in relatively safe havens like gold and silver.

Would you rather try active trading yourself? Nowadays, this is possible with just a small amount of money! Use the button below and learn how to buy shares yourself:

Active or passive investing: which is better?

Of course, this depends entirely on what you yourself are willing and able to do. If you have little experience and do not feel like doing research, then passive investing is usually the best option. Due to the low transaction costs, passive investing is also suitable when you invest small amounts and the risks are also considerably lower.

Do you still want to look for those unique opportunities in the stock market? In that case, active investing can be more attractive. In this way, you retain full control over your portfolio and only invest in products that suit you.

The best strategy for passive investing

But what is the best strategy for passive investing? If you really want to limit the risks of your investments as much as possible, it is best to opt for dollar cost averaging. You then buy a fixed number of units each month within a passive fund. In this way, you buy at both the lows and the highs.

I often buy just a bit more when the prices have fallen a bit more: that way I get a discount on the purchase price. I strongly believe that what goes up, must come down, but in return what goes down, must go up. In the long run, productivity grows and over the last 100 years, you can see that the economy has only grown.

In the long run, by periodically investing a sum of money passively, you can build up a nice sum. Through the power of compounding, whereby you reinvest your return, your capital grows exponentially. When you start investing young, you have a greater chance of building up a large fortune.

Beware of these common mistakes

Even though passive investing sounds simple, you can still go wrong. It is important not to act emotionally. For most people, it is smart to deposit money periodically and then not to look at it. When you do look at it, there is only the chance that you will sell your shares without a good reason. That way, you miss out on recovery and soon lose a lot more money on your investments.

Another mistake is paying too high fees. Passive investing is supposed to be cheap: you don’t need analysts and, if you’re smart, you don’t have to pay transaction costs when buying a fund. Every pound you save in transaction costs helps you achieve a higher return.

Another mistake is to start too late: the best time to start passive investing is actually today. After all, you need time for your capital to grow. By entering the fund periodically, you avoid entering at the wrong moment. Therefore, there is no good reason to wait with investing.

Finally, make sure you have enough diversification: it is a common mistake to assume that by investing passively you automatically diversify your risks. By no means is every passively managed fund well-diversified. When you invest in a gaming ETF, for example, sometimes you only buy shares in a handful of companies which are also active in the same market. Therefore, always research what you are investing in by buying a passive fund.

The most passive way of active investment

Day trading is a lot more active than investing in a fund. By setting up a good system, however, you can ensure that active investing can be carried out as passively as possible. It is precisely investors who carry out a set of rules every day who often achieve the best results. In this way, you only need to be actively involved with the market to a limited extent.

Here it is important to choose some securities that you are going to keep an eye on. This could for instance be some shares or currency pairs; in any case it is important to have this clear to yourself. Subsequently, you can watch every day if there is a certain pattern on which you can act; in this case there are actually three possible situations.

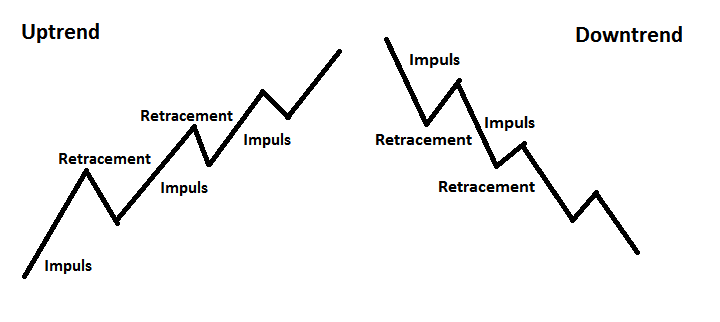

Situation 1: trend, the price goes down or up. When the trend is down, you sell after the rise and when the trend is up, you buy after the fall.

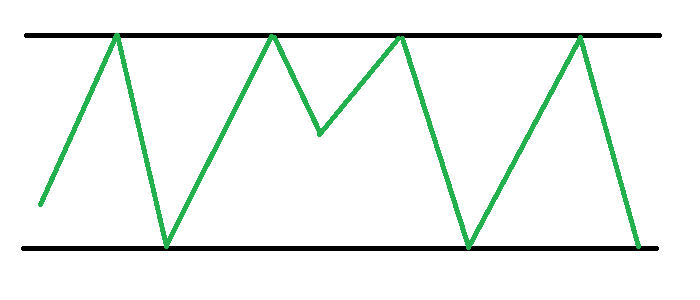

Situation 2: consolidation, the price moves mainly between two points. Sell the security at the highest point or buy the security at the lowest point.

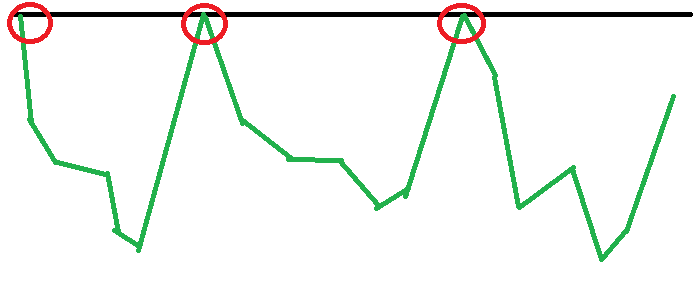

Situation 3: trend reversal, is there a horizontal level which the price has not been able to break through for a long time? Then there is a big chance for a reversal of the price.

By using orders, you can ensure that your investments are executed automatically. This way, you do not have to constantly monitor the market.

Would you like to try this method of semi-active investing yourself? You can do this with an online broker! Use the button below to open a free demo with a broker:

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.