What is a ponzi scheme?

When you start investing you sometimes come across terms of which you probably have no idea what they mean. The term ‘Ponzi scheme‘ is a similar term. In this article we will explain what is meant by a Ponzi fraud in the investment world.

What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent scheme in the investment world, where old investors receive the money from new investors. Such a system has a chance of success as long as new investors enter it. Old investors are often promised extremely high returns to convince them to invest. Subsequently, everything is done to hide the origin of the return.

In the end, a Ponzi scheme can never last forever, and it collapses. In most cases, the Ponzi scheme is already stopped by the authorities, before it comes to a total collapse: there is then talk of Ponzi fraud.

How can you recognize Ponzi fraud?

The smart investor can easily recognize Ponzi fraud by paying attention to these characteristics. In fact, it is always important to stay sharp when investing over the internet.

High return at low risk

When you start investing, risk and return are always directly linked. When a fund offers you a high return at little or no risk, the alarm bells should ring. As an investor you are paid to take risks and the (potential) compensation increases when the risk increases.

There is no supervision

Reliable investments are actually always under the supervision of a regulatory party. In the UK, this is the FCA. If you have doubts about the legitimacy of an investment, you can always contact the regulator in your country.

Stable profit distribution

An investment almost never pays out a stable profit. Stock exchanges are unpredictable and volatile, so even in good economic times you will regularly lose money. When an investment product promises both a stable and high return, you have to be careful.

Ask to invest again

Ponzi schemes often ask investors to reinvest the amount they earn. This often happens at an even higher promised return. By asking investors to re-invest the money, the parties behind the Ponzi schemes prevent them from failing prematurely.

Complicated products

Investment products within a Ponzi scheme are often unnecessarily complicated. It is always important to only invest in products that you fully understand. This way you avoid losing a lot of money through investment fraud.

Professional appearance

Don’t let slick websites and beautiful photos fool you: modern crooks know exactly what to do to come across as reliable. Therefore, always investigate the party you want to do business with.

Active approach

When someone on the phone or on the street suddenly wants to sell you a great investment product, you have to be cautious. Professional institutions do not just sell their investment products over the phone.

Past results

Be sceptical about past performance: crooks can also easily falsify investment results. Therefore, ask enough critical questions to get the truth to the surface.

Who is Charles Ponzi?

The name Ponzi scheme, comes from the Italian Charles Ponzi. He used this technique in the 1920s in the United States. Yet, Ponzi was not the pioneer of this system, because a century earlier it was already described by Charles Dickens. Bernard Madoff was the one who set up the largest Ponzi scheme ever.

Ponzi started his fraud from an arbitration on stamps, in connection with shipments abroad. He became so successful that he earned a lot of money. In four months’ time Ponzi managed to raise millions of dollars.

The mistake of Ponzi

The fault in Ponzi’s system lay in the fact that he did not invest money, as he told the people. The money that came in from new investors, was used to pay out the old investors and the customer acquirers. Ponzi was blinded by this easy method of earning money. However, his charm allowed him to continue undisturbed for a long time. In the end, it was Clarence Barron who proved that he was a fraud.

The Ponzi fraud

Often Ponzi frauds are arranged in advance, but it also happens that well-intentioned investment plans become Ponzi frauds. This often happens when investors cannot be paid due to a disappointing return. Out of panic, the organizer can then attract new investors and use the money of the new investors to pay the old investors. The originally legal investment plan has now changed into a Ponzi scheme.

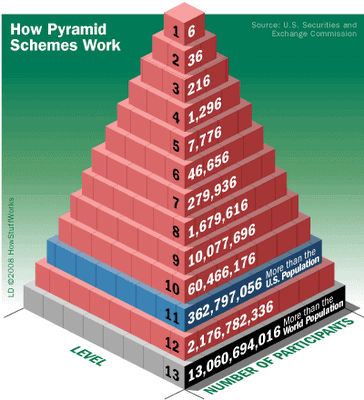

Pyramid game

Ponzi fraud resembles a pyramid game in some aspects, but can last longer. This is because fewer new participants are needed. For example, Bernard Madoffs Ponzi fraud lasted for about thirty years because he offered a high, but not absurdly high return. In spite of this, Ponzi frauds are sometimes erroneously called pyramid games.

In a pyramid game or pyramid fraud, the new participants must actively recruit new participants. They then share in the profits of the new participants. The problem, however, is that a sufficient number of new participants can never be found to provide income for the entire pyramid. The pyramid game also looks a bit like the corporate structure of MLM companies.

Example of Ponzi scheme

Let’s explain the working of Ponzi fraud using an example.

In the first month, 10 investors all deposit $1000. The fraudster promises to pay them a return of 50%. In the first month, the investors receive an amount of $5000, after which the fraudster still owns $5000.

In the second month, another 10 investors enter with $1000. The fraudster pays all 20 investors their return after which the fraudster still owns $5000.

In the third month another 100 investors enter with $1000. The fraudster leaves and steals the $105,000. All investors then lose their money.

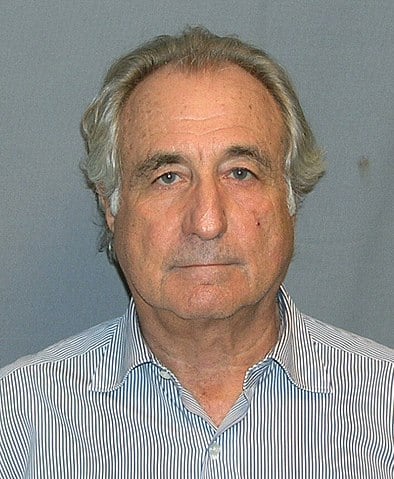

Who is Bernard Madoff?

A page with explanation about ponzi fraud can’t do without a paragraph about Bernard Madoff. This shady gentleman led the company Bernard L. Madoff Investment Securities from the year 1960 onwards. He used the company to set up a pyramid-like structure where the returns of new investors were used to pay out those of existing investors. Trust is essential in a similar structure: if too many investors leave, the house of cards would collapse.

On paper, he carried out a split-strike strategy in which he issued call and put options on the 35 most traded index-related stock market funds. The return on this would be around 10% each year and almost never recorded a loss. He worked with intermediaries who sign up new clients in exchange for commissions.

In 2008, he was arrested when it turned out that the whole concept was a big lie. Before he turned himself in, he paid out high bonuses to family, friends and employees.

Albanian Anarchy of 1997

In 1997, there were major riots in Albania. After the country separated from the communist system, a large network of Ponzi fraud arose. The government supported the schemes and more than two thirds of the country’s population invested in the schemes. In 1997, the system collapsed and half of the then domestic product went up in smoke. Many of the country’s residents lost their savings and large-scale violent riots ensued.

Contemporary Ponzi schemes

Even now there are many Ponzi schemes where people are seduced with unrealistically high returns. Don’t fall for it, chances are you’ll lose all your money!

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.