Psychology & investing: better results

If you want to achieve better results with investing, you can learn a lot from social psychology. In this article we discuss some familiar psychological concepts that immediately ensure that you will achieve better investment results!

Case study: output of more than 100%

Many people are satisfied with a return of a few percent: ‘Well, it is more than I receive on my savings account‘, you also hear many people say. That is all well and good, but that way you do not profit maximally as it is certainly possible to achieve much higher returns.

Here you can use mass psychology: people often have a strong tendency to start from easily available information, this is also called the availability bias. When a company is mentioned in the news in a bad way, you quickly will see people selling the stock in bulk; it is precisely because this information is suddenly available that more and more people act on it without there necessarily being a reason to do so.

I myself always benefit from this kind of mass psychology, which gives me better results with my individual investments than most Dutch people. A while ago, for example, there was a regulatory problem with an online broker: Plus500. The regulator blocked several accounts temporarily because there was an administrative problem at the company: there was clearly a crisis of confidence.

Predictable as people are, you immediately saw a downward rally in the price. Nevertheless, the company was still very profitable and they paid high dividends. The problems were quickly resolved and the price was still very low. I immediately bought more than £10,000 in Plus500 stocks and within a few months this amount more than doubled!

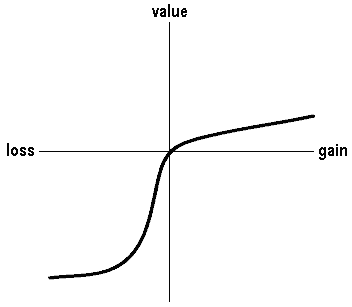

Prospect theory: risk aversion

From the above story, it quickly turns out that you do not have to settle for the average return on stocks. By wisely taking mass psychology into account, you can achieve better investment results than the majority of investors. Another interesting psychological theory that you can use when investing is the prospect theory.

According to this theory, we all have a strong risk aversion. The vast majority of people will opt for the safe option in an experiment; even when this turns out to be worse from a rational point of view. Consider the choice between a 90% chance at £10 and a probability of 10% at £0 or a probability of 50% at £100 and a probability of £50% at 0. The second scenario has a higher probable yield.

According to this theory, we all have a strong risk aversion. The vast majority of people will opt for the safe option in an experiment; even when this turns out to be worse from a rational point of view. Consider the choice between a 90% chance at £10 and a probability of 10% at £0 or a probability of 50% at £100 and a probability of £50% at 0. The second scenario has a higher probable yield.

However, many people will rather opt for the first option. This is because people are generally more inclined to avoid losses than to earn profits. When you are aware of the consequences of this theory, you can use a stronger investment strategy.

Eliminate the emotions when investing by determining in advance when you will take your losses and at which point you will take a profit. This is possible through the so-called stop loss and take profit. The biggest mistake that investors regularly make is to cut down on current profits too early and not to take losses when this is necessary. Now that you know better, you will not do this, and that will endure that you achieve better results with your investments!

Focussing on confirming your view of the world

Another mistake that people make over and over again is looking for confirmation of their own world view. We rarely look for information that goes against our perspective; usually we mainly look for information that corresponds to our way of thinking. As an investor, this is of course dangerous!

We also call this phenomenon the confirmation bias whereby we only search for the information that fits our prediction. Often we intuitively make a prediction and because we are only open to information that is consistent with this, we do not see that the investment may not be so strong at all. Therefore, always try to approach different perspectives as objectively as possible and try to use a system when selecting the stocks in which you are going to invest.

We also call this phenomenon the confirmation bias whereby we only search for the information that fits our prediction. Often we intuitively make a prediction and because we are only open to information that is consistent with this, we do not see that the investment may not be so strong at all. Therefore, always try to approach different perspectives as objectively as possible and try to use a system when selecting the stocks in which you are going to invest.

Moreover, negative information within our brains gets a stronger weight. As a result, we make a decision on the basis of negative information rather than on the basis of positive information. This is counterproductive. With a huge decline, as in the case study, a huge increase is possible afterwards. Keep your eyes and ears open and make sure you get the best results with your investments.

Establish a system!

The fact is that there are all kinds of systems in our brains that perhaps protect our ego, but that are also counterproductive for our results as an investor. It is therefore important to establish a system before investing. Write down on paper under which situations you will buy certain stocks, when you will sell them again and how you will deal with risks.

By working with a system and by being aware of the different psychological mechanisms that you can work against, you can ensure that you make decisions based on reason rather than on emotion.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.