The difference between a variable and fixed spread

With some brokers, you have a choice between variable and fixed spreads. But which is cheaper? In this article we review what spreads are and discuss the different features of variable and fixed spreads. This way you can make an informed decision.

What is the spread?

The spread is the difference between the buy and sell price of a stock at one specific moment. This difference is the commission the broker receives. For example, if you can buy currency pair EUR/USD for 1.2711 and sell it for 1.2709, the spread is 0.0002, which is also known as 2 pips.

The spread is relative, which means your transaction costs increase when you invest with a higher amount of money. Some brokers also charge fixed costs.

Variable and fixed spread

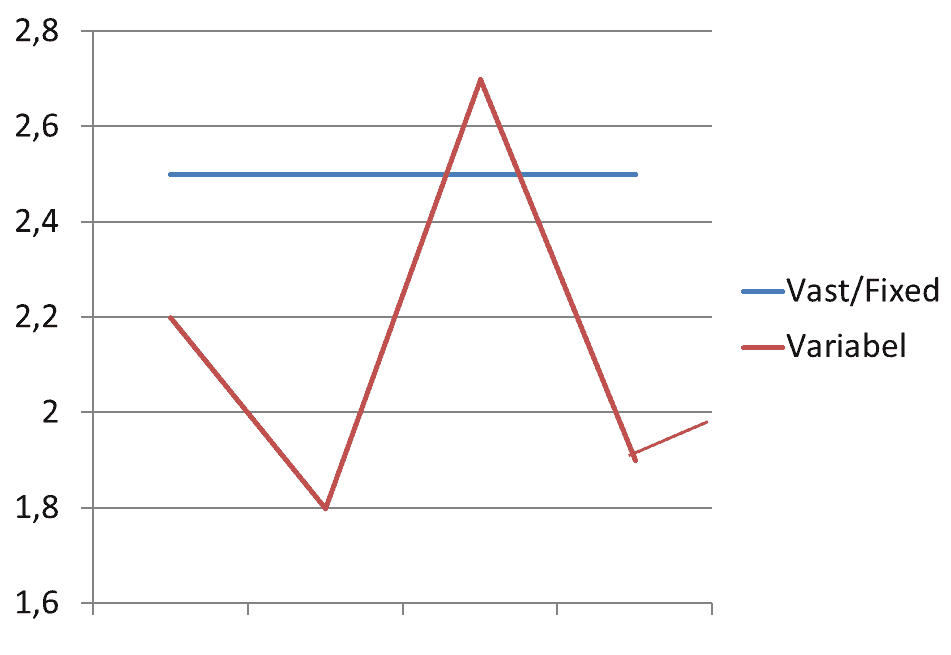

A variable spread is a spread that is dependent on the market situation, which can fluctuate. Trade volume plays an important role. When there is extreme volatility, it’s hard to realize the offered price, which means the broker may have to increase its variable spread. The variable spread is offered is often cheaper than a fixed spread, since the uncertainty is higher.

A variable spread is a spread that is dependent on the market situation, which can fluctuate. Trade volume plays an important role. When there is extreme volatility, it’s hard to realize the offered price, which means the broker may have to increase its variable spread. The variable spread is offered is often cheaper than a fixed spread, since the uncertainty is higher.

A fixed spread is the spread that is pre-determined. Regardless of how good or bad the market conditions are, the costs to open a transaction are the same. A fixed spread offers more certainty, but you pay a lot more for this certainty.

Variable or fixed spread?

I always recommend the variable spread. The costs per trade are a lot lower that way, which means you can save on your fees. You always see the spread you would pay for a transaction because the buy and sell price are set. If the spread is too high, you can always decide not to open a trade.

Under normal market conditions, the variable spread is a lot lower than the fixed spread. You can save a lot of money on fees when you trade frequently.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.