How to invest in a warrant?

There are many different ways to grow your assets by investing in certain investment products. A relatively well-known investment method is investing in stocks, while a fairly unknown investment method is investing in warrants. Because this investment method is still unknown, we’d like to explain the method in this article.

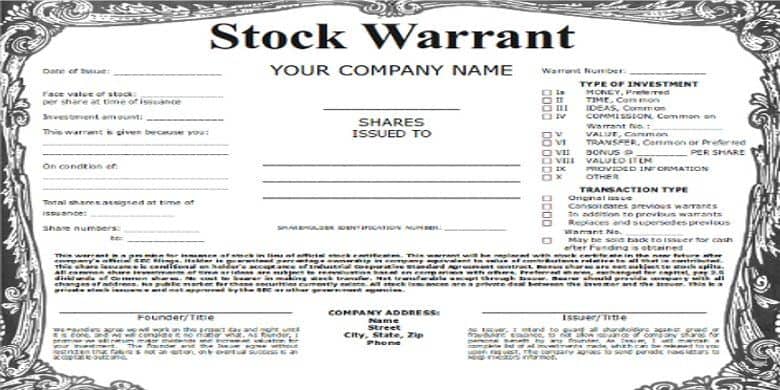

What is a warrant?

Warrants are derivates, or derivative investment products. A warrant has an underlying value, for example a stock, a bond or a currency. The price of the investment product has been set in advance. This price is also called the exercise price.

If you buy a warrant, you have the right (not the obligation!) to buy or sell an investment product before a certain date. The end date of the warrant is also called the expiration date. As a warrant holder, you may choose whether or not you wish to make use of this right. Please note: the right to buy or sell can only be exercised within a predetermined period. If this period has expired, the right will lapse and your warrant will be worthless.

In order to be able to buy a warrant, you pay a certain premium. This premium is part of the underlying value of the warrant.

Two types of warrants

There are two types of warrants. Firstly, there is the warrant that rises in value if the underlying investment product, for example the share, also increases in value. These warrants are also called call warrants. As a warrant holder of a call warrant, you have the right to purchase the underlying value of the item at the exercise price, or the predetermined price of the warrant.

Then there is the warrant that increases in value if the underlying investment product falls in value. If the underlying product – such as the stock – is worth less, you earn money. These warrants are also known as put warrants. If you have a put warrant, you have the right to sell the underlying asset at the exercise price, or the predetermined price of the warrant.

Warrants and options

Warrants and options are often confused. This is not surprising because warrants and options are very similar. Yet there is an important difference between the investment products. Warrants are actually issued by a bank or institution and options are issued by the stock exchange.

Investing in warrants

If you want to invest in warrants, you should look for a broker who offers this investment product. There are several reliable brokers who do this, including Binck. Before investing money, consider what kind of warrant you want to buy. This can be either a call warrant or a put warrant. Then you compare various warrants to each other to buy the best warrant. Now the trick is to make a profit with this investment by buying or selling the warrant at the right price.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.