How to buy Hong Kong shares - invest in the Hong Kong stock exchange

Hong Kong is often seen as the gateway to China by many people. Many Chinese stocks are inaccessible to foreign investors. However, the shares listed on the Hong Kong Stock Exchange are freely tradable. In this article we will discuss how to invest on the Hong Kong stock exchange.

Where can you buy Hong Kong shares?

The prices that brokers charge for buying and selling Hong Kong shares vary widely. In the overview below you can see an overview of reliable stockbrokers you can use to invest on the Hong Kong stock market:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Hong Kong shares without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Hong Kong shares! 80% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Hong Kong shares with a free demo! |

Pay attention to the transaction fees when you select a broker to buy Hong Kong shares with. By picking a broker with low transaction fees, you can achieve a higher return on your investments.

How to buy stocks listed on the Hong Kong stock exchange?

You can buy Hong Kong stocks through the Hong Kong stock exchange or through the US stock exchange. Many large corporations are listed on both the Hong Kong and US stock exchanges.

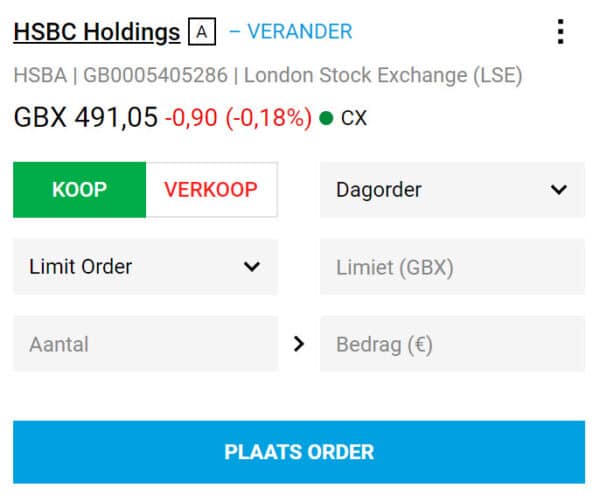

To buy a stock, you first need an account with an online broker. Then, search for the stock you want to invest in within your investment account. You can then open the investment directly at the prevailing price (market order) or at a fixed price (limit order). After you buy the share, it may take a few minutes before you see it within your account.

What are the benefits of investing in Hong Kong?

Since Hong Kong was converted into a special administrative region of China in 1997, the country has attracted a lot of investment. The country's financial sector is therefore well-developed and attracts a lot of money.

Hong Kong is situated in the centre of Asia and provides investment opportunities in various Chinese companies. The main benefits of investing in Hong Kong are:

- Access to Chinese companies through the Hong Kong stock exchange.

- Potentially higher returns on Chinese shares due to more growth potential.

- The ability to diversify your portfolio by investing in Hong Kong stocks.

What are the downsides of investing in Hong Kong?

Economic downturns

The Hong Kong stock market is closely tied to international markets. When an economic crisis occurs, there is a high chance that stocks listed in Hong Kong will also take a hit.

Geopolitical risks

There are also geopolitical risks associated with investing in Hong Kong. Social problems and China's growing influence over Hong Kong can slow down foreign investments. Furthermore, Hong Kong's economy is highly vulnerable to negative economic developments due to its heavy dependence on the financial sector.

In 2021, when China strengthened its grip on companies, many stocks listed on the Hong Kong stock exchange decreased in value. Chinese shares are often under pressure due to political pressure and regulations. This makes investing in Hong Kong stocks more uncertain.

How to achieve better results in Hong Kong?

When investing in the Hong Kong stock market, it is advisable to conduct thorough research on the companies. In the short term, you may see a lot of volatility in the market, but these strong movements do not necessarily reflect the real value of a company. Therefore, research the companies you want to invest in and study how China is performing on the global stage.

When investing in stocks listed on the Hong Kong stock exchange, it is recommended to follow these tips:

- Set an investment plan and determine how much you would like to invest in Hong Kong stocks.

- Do not invest emotionally: buy quality stocks and hold on to them for a longer period of time.

- Invest primarily for the long term. By investing for the long term, you can take full advantage of compound interest, which can exponentially grow your returns.

Monitor the exchange rate of the Hong Kong dollar

It is important to keep an eye on the exchange rate of the Hong Kong dollar. When investing in stocks listed on the Hong Kong stock exchange, you are indirectly investing in the Hong Kong dollar. When the share price rises, you receive the profit in Hong Kong dollars. If your currency loses value against the Hong Kong dollar, you can still lose money on your investment.

It is also possible to invest in the Hong Kong dollar itself by speculating on a currency's rise (or fall) in value. You can read about trading Forex this in this article.

What is the Hong Kong stock exchange?

The modern Hong Kong stock exchange opened on October 6, 1986, with 249 companies worth HKD 245 billion.

One interesting feature of this exchange is that the opening price of shares is determined by a pre-market session. The actual trading price of the shares is not determined until 9:20 a.m.

Another unique aspect is the one-hour lunch break that actually stops trading: the market is closed between 12 p.m. and 1 p.m.

The shares listed on the stock exchange are traded in lots. A lot may consist of 100 or 1000 shares, for example. It is not possible to buy 50 shares in this case. However, there are special markets where smaller quantities of Hong Kong shares can be traded.

Another intriguing rule is that limit orders must be placed close to the current share price: they cannot be more than 24 ticks away from the share price.

Hong Kong Share Index: Hang Seng Index or HSI

You can also invest in the Hang Seng Index or HSI. This index tracks the largest companies listed on the stock exchange in Hong Kong. By buying an ETF on this index, you can invest in a diversified basket of shares listed on the Hong Kong stock exchange.

Do you want to know how to invest in ETFs? In this article, you will learn everything you need to know!

| How to buy HSBC shares (2024)? – invest in HSBC stocks |