Free investing (2024): can you invest for free in stocks?

Free investing may sound like a fairy tale to many people, but it’s actually possible! With some brokers, it’s possible to invest in stocks completely free of charge. With other brokers, you can try the options completely free of charge with an unlimited demo. In this article, we’ll look at where you can invest completely free of charge.

Where can you invest for free?

Are you curious about which brokers allow you to start investing for free right away? In the overview below, you can see immediately which brokers allow you to invest without paying commissions.

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 80% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

Is free investing really free?

They say there’s no such thing as a free lunch. This seems to often apply to the offers that exist around free investing as well. For example, an investigation by Finner.nl found that buying funds at Flatex is relatively pricier. The management fee for the Robeco Global Stars Equities EUR G fund is 0.5%. A comparable fund is offered at Flatex with a management fee of 1.25%.

Therefore, it’s always important to discover why a broker offers free investing as a service. Free investing can be truly free in certain situations. However, it’s essential to stay alert. Verify carefully if there are any other costs involved, and decide if you want to pay the “price” of free investing.

In the rest of this article, I’ll examine the brokers that offer free investing and reveal where you’re still spending money. By reading this article, you’ll know 100% transparently what the costs of free investing are.

eToro: Free Investing in Stocks

Most brokers charge fixed transaction fees. This isn’t the case with eToro. With eToro, you can trade stocks and ETF’s completely without fixed transaction fees. This makes eToro an interesting party to invest with, even with smaller amounts of money.

You can try out the possibilities at eToro completely free of charge and without risk with their unlimited demo. Use the button below to create an account for yourself:

Is investing with eToro really free?

eToro tries to lure customers in the hope that they will then invest in the riskier CFDs. With CFDs, you can speculate on rising and falling prices with leverage. This way of investing is risky but very profitable for the broker. However, trading CFDs is not mandatory, so as a private investor, you can really benefit from commission-free trading of stocks with this broker.

However, there are a few things to watch out for at eToro:

- Withdrawal fees: when you withdraw money from your account, you pay $5.

- Account in dollars only: your account is in dollars by default, and eToro charges 0.25% for converting euros (or other currencies) to dollars.

Would you like to know more about eToro? Then read my review about this broker.

DEGIRO: Free Investing in the Core Selection of Investment Funds & US Stocks

DEGIRO is a reliable broker where you can invest for free in some ETFs & US stocks.

It’s possible to trade funds included in DEGIRO’s core selection for free. However, there are conditions attached to this: you can purchase each fund only once a month, and you must do this for at least €1000. Since 2023 DEGIRO also charges €1 handling costs for your ETF order.

In 2023, DEGIRO also introduced free investing in US stocks. However, this is a bit misleading, as the company charges €0.50 for processing each order by default. You also pay 0.25% for converting euros to dollars at DEGIRO.

Would you like to try investing with DEGIRO? Then open an account with this broker right away:

Why is investing in the core selection free?

DEGIRO probably offers this option to attract new customers. It’s attractive to be able to invest in various funds without transaction fees.

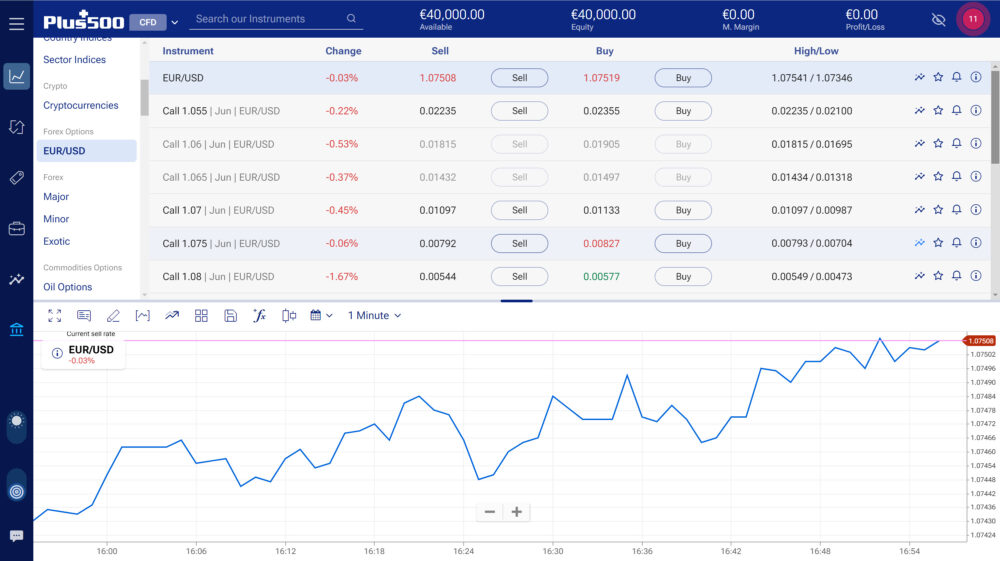

Plus500: trade CFDs without fixed commissions

If you prefer to actively speculate on, for example, stocks, then CFDs are suitable. With CFDs, you can place orders in both rising and falling markets. This allows you to always respond to the latest market developments.

Remember that CFDs are risky investment products, with which you can quickly lose your entire investment.

At Plus500, you do not pay fixed commissions on your investments. Click here if you want to try out the possibilities completely free with a demo:

Illustrative prices

Is trading with Plus500 free?

Investing with Plus500 is not 100% free: you pay various other costs:

- Financing costs: if you hold the position for more than one day, you pay interest on it.

- Spread: you pay a spread on your investments.

- Inactivity fees: if you do not use the account for a longer period of time, you pay inactivity fees.

Why can you invest without fixed commissions at Plus500?

Plus500 still makes money from its customers, among other things by charging financing fees for positions that are open for more than a day. In addition, a spread is charged. The spread is the difference between the buying and selling price of a stock. Therefore, when investing with Plus500, calculate whether your return is proportionate to the costs you incur.

At Trading212, you can also invest without commissions in more than 7,000 shares and ETFs. The Trading212 application looks good, and you can also invest in fractional shares. Fractional shares are parts of shares, which allows you to invest in expensive shares with a small amount of money.

At Trading 212, It is also interesting that you can automatically invest percentages in different shares. This allows you to apply diversification to your portfolio without much effort.

Is investing with Trading212 free?

Just like with many other brokers on the list, the broker hopes that you will invest in CFDs, since this is more profitable for them. Trading212 also charges additional costs:

- Conversion costs: Trading212 charges 0.15% for exchanging currencies.

- Depositing: Trading212 charges 0.7% when you deposit more than €2,000 within your account.

iDealing: not recommended for ‘free’ investing

Another option for free investing is iDealing. However, iDealing proves that free investing can be very expensive. The broker is of low quality: the platform is disappointing, and the customer service is hard to reach. The broker boasts €0 in costs for stocks, bonds, and ETFs on its website.

Is investing with iDealing free?

Investing with iDealing is not free, as many other costs are charged:

- Quotes: you pay €1 per month for streaming live Euronext quotes.

- Dividends: you pay €0.30 each time for dividend payouts.

- Withdrawals: you pay €5 for withdrawing money from your account.

- Reports: you pay €36 for an overview of your account.

Conclusion: is free investing REALLY free?

In this article, I have listed the most well-known brokers that offer free investing. Keep in mind that brokers are never non-profits; they will always try to make a profit.

For example, free stockbrokers try to make a profit by:

- Hidden costs: some brokers charge fees for extra services.

- CFDs: other brokers hope that you will invest in CFDs, which they make a profit from.

- Selling orders: some brokers sell your orders for money.

- Higher prices: some brokers sell funds or stocks at higher prices.

As you can see, it is important to pay extra attention when a broker offers free investing. However, I am not against free investing myself. If you pay close attention, you can really save a lot on transaction fees.

For example, I use DEGIRO to buy ETFs from the core selection without commissions, Trade Republic to buy Dutch stocks, and eToro to buy US stocks. By cleverly combining different brokers, you can get the most out of your investments.

Frequently Asked Questions about free investing

In the past, many brokers offered a free bonus to try out investing. Unfortunately, those times are over. According to new legislation, it is no longer allowed to give free bonuses to new investors. If you do come across this, avoid the party! It is not allowed to give a free bonus to new investors.

Free investing is especially interesting for people with a small budget. When you want to buy shares with little money, transaction costs can add up quickly. $3 in costs on a $100 transaction means you lose 3% on your transaction. When you make a transaction of €10,000, this percentage is only 0.03%. The chance that you achieve a return of 3% is much lower than the chance that you achieve a return of 0.03%.

If you want to invest with a small amount of money, a party where you can invest for free is extra attractive.

It is important to choose a broker that charges low costs. Transaction fees can significantly reduce your return. In the long term, you can miss out on thousands of euros with a more expensive broker.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.