Dividend Investing: How to Invest in Dividend Stocks!

Dividend investors aim to build a steady income from their stock investments. Some dividend stocks pay out a large portion of their profits to shareholders. But how can you invest in high dividend stocks for yourself? In this article, we discuss the best options!

What is dividend?

Companies can choose to distribute a portion of their profits to shareholders in the form of dividend. You then receive an amount back in your investment account. Would you like to read more about how dividend payout works? Then read this article.

When you own enough high dividend stocks, you can build an annual income stream.

What is dividend investing?

Dividend investors invest in stocks that pay high dividends. These are often larger companies with a stable income stream. Think, for example, of banks, utility companies, and pharmaceutical companies.

Where is the best place to invest in dividends?

You need an account with a broker to invest in high dividend stocks. It is advisable to pick an affordable party: that way, you can avoid a large part of your profit going to transaction fees.

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

How can you benefit from high dividend stocks?

Method 1: High dividend stocks

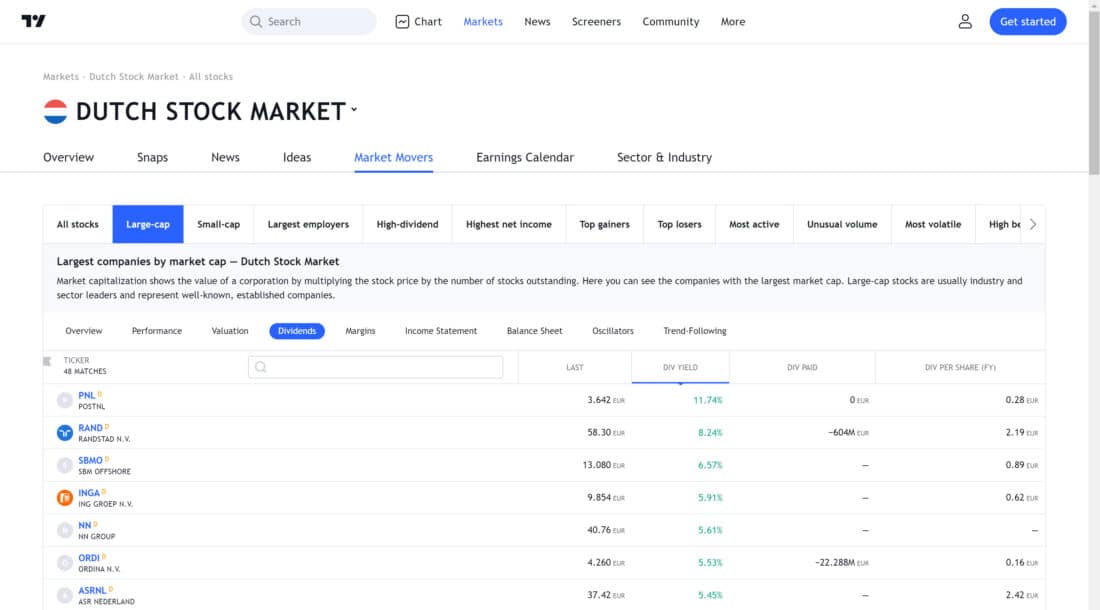

You can actively buy high dividend stocks and include them in your portfolio. You can easily find high dividend stocks on the website tradingview.com.

Navigate within the site to stocks and then sort by Dividend yield. You will then see which stocks offer the highest dividend yield.

Be sure to research whether it is not a one-time high dividend. Good high dividend stocks:

- Payout a stable or increasing dividend

- Have a relatively stable stock price

- Have existed for a long time and can continue to exist

Method 2: High dividend ETFs

It can be difficult to select the best high dividend stocks yourself. ETFs are the solution for this: an ETF tracks a certain index, allowing you to automatically invest in a selection of stocks.

High dividend ETFs only include stocks that pay a high dividend. Some examples of popular ETFs with a high dividend payout are:

- Vanguard FTSE All-World High Diivdend Yield

- VanEck Vectors Ms Developed Markets Dividend Lead

- Deka DAXplus Maximum Dividends UCITS ETF

- SPDR S&P US Dividend Aristocrats

Would you like to read more details about these high dividend ETFs? Then read this article!

Strategy for dividend investing

When you engage in dividend investing, it’s important to do so for the long term. The goal is to build a stable dividend over a longer period of time. Under the influence of crises, stock prices can temporarily decline. Furthermore, dividends are not guaranteed: for example, at the beginning of the COVID-19 pandemic, many companies temporarily stopped paying dividends.

You can protect yourself against such fluctuations by spreading out your investments: this is also called dollar cost averaging. This way, you enter at both low and high prices, which minimizes the impact of price fluctuations on your results.

As a dividend investor, you apply the buy and hold strategy: after all, you want to build a fixed dividend yield. It’s therefore extra essential to research the companies you want to invest in.

When selecting dividend stocks, you can choose from:

- Growth stocks: some stocks pay a small dividend but grow quickly. Dividend yield can increase in the long run.

- Dividend aristocrats: some companies (such as Coca-Cola) have been paying a stable yield for decades. Expect little growth, but stability.

Tip: Reinvest

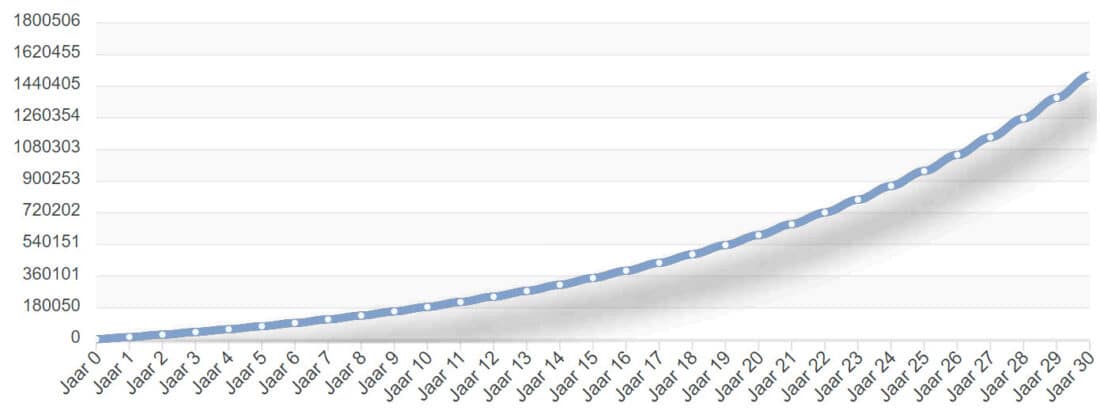

If you want to achieve the best results with your investments, it may be wise to reinvest your dividends. This way, you also receive dividends on your new investments, allowing your income to grow strongly over time.

In the example, you can see how your investment grows when you achieve an average return of 8% and invest $1,000 per month for a period of 30 years. Are you curious about how much your wealth can grow? Try this tool and find out where you end up!

Pay attention to the payout ratio

When investing in high dividend stocks, it’s advisable to pay attention to the payout ratio. The payout ratio shows the percentage of profits that the company pays out to shareholders.

Companies with too low of a payout ratio are not suitable for dividend investors. At the same time, companies with too high of a payout ratio are also a risk. Companies that pay out 70% or more in dividends have little reserves left. Additionally, these companies cannot invest in future growth, which can put the company in trouble.

Are you looking for the highest possible payout ratio? Then you can consider REITs (real estate investment trusts). These companies are required to pay out 90% of their net profit in the form of dividends. Since this is mostly rent, the business operation doesn’t have to be in danger.

What are the benefits of dividend investing?

- You build an annual source of income

- You work on a stable growth of your wealth

- With sufficient return, you fight against inflation

- Dividend stocks are less volatile/risky

What are the disadvantages of dividend investing?

- You have little room for capital gains

- Good dividend stocks are often expensive

- You need a lot of patience and discipline

How can you live off high dividend stocks?

It is the dream of the average investor: living off high dividend stocks. Whether this is possible depends on your spending pattern. You can reach this goal faster when you need less money. First determine for yourself how much you need to live on: for some people $2,000 may be enough, while others may need $5,000.

Then determine the average dividend yield that you expect to achieve: in this example, we assume 4%. If you require $2,000 per month, you will need $24,000 per year.

You can then calculate how many high dividend stocks you require by dividing €24,000 by 4% and multiplying by 100: in this case, you will need $600,000. If everything goes well, you could live off $600,000 in high dividend stocks.

However, be aware of the risks of investing: dividends are not guaranteed and results can be disappointing in bad times.

How safe is dividend investing?

Dividend investing can be relatively safer than investing in growth stocks. Companies that pay stable dividends have often been around longer and have a good track record.

However, investing is never 100% safe, and you always run the risk of losing money. Especially in the short term, stock prices fluctuate strongly. Therefore, only invest money that you can afford to lose so that you can ride out the full journey.

In extreme cases, even dividend stocks may temporarily stop paying out dividends, as was the case during the corona pandemic. Therefore, always have a plan B: relying entirely on stocks for your income is risky.

Is investing for dividends useful?

Whether dividend investing is worth it is a topic on which even economists do not agree. As early as 1961, economists Merton Miller and Frank Modigilani published the irrelevance theory, which indicated that dividends have no impact on returns. After paying out dividends, the money disappears from the company, causing the company to decrease in value by the same amount.

This theory assumes that companies are better at spending the amount on dividends than investors are. Economists Myron Gordon and John Linter, for example, published a theory indicating that investors prefer cash dividends because companies often cannot manage the money well.

Ultimately, the choice to invest for dividends is personal. If you psychologically prefer to build a stable income with dividend stocks, this can be interesting. At the same time, it is important to remember that there are many investment strategies that can also yield good results.

Conclusion: Is dividend investing right for you?

Dividend investing is not suitable for everyone. High dividend stocks are typically considered ‘boring,’ and young people often prefer to invest in cool technology stocks. However, this does not mean that dividend investing cannot be an attractive and relatively stable way to build income from your investments.

Do you have an interest in dividend investing, but do you also want to try other strategies? No problem! For example, you can also actively speculate with a small amount yourself or invest in crypto.