DEGIRO review & experiences (2024): pros and cons

In this comprehensive DEGIRO review, you can read everything you need to know about this stock broker! I share my experiences so you can determine if DEGIRO is right for you!

What are the biggest pros of DEGIRO?

- Low fees: DEGIRO is one of the cheapest brokers on the market.

- Market leader: DEGIRO is a leading broker in many European countries.

- Free ETF: You can trade against low fees in ETF’s registered in the core selection of DEGIRO.

- Large selection: You can invest in thousands of investment products with DEGIRO.

What are the biggest cons of DEGIRO?

- Limited analysis: You can perform limited analysis with DEGIRO.

- No automatic DCA: You cannot automatically invest a set amount of money on a monthly basis.

- Exchange fees: You pay €2.50 yearly for each exchange you own stocks or ETF’s on.

- No demo: It is not possible to try DEGIRO for free with a demo account.

Do you want to try DEGIRO?

Are you curious if DEGIRO is right for you? Visit the DEGIRO website and discover what the possibilities are! With DEGIRO, it is also possible to open an account without depositing money:

What is DEGIRO?

DEGIRO is a European broker founded in 2008. With DEGIRO, you can invest in, among other things, stocks, bonds, options, and ETFs. Since 2019, DEGIRO has been acquired by the German company Flatex, but the company continues to operate under the name DEGIRO.

| Offer | Stocks, ETF's, bonds and derivatives |

|---|---|

| Minimum deposit | €0,01 |

| Minimum withdraw | €0,01 |

| Deposit money | Wire transfer & iDEAL |

| Fees | €3 on Dutch shares |

| Exchange costs | 0,25% currency exchange costs |

| Costumer service | E-mail & phone |

| Free demo | No |

How to open an account with DEGIRO?

Opening an account with DEGIRO is simple. At first, you only need to enter a username and password.

When you want to invest with real money, you do need to fill in some additional information. DEGIRO must verify your identity and address to prevent you from using the account for money laundering. In addition, you may need to complete a separate knowledge test for some investment products.

What types of accounts are offered?

The swiss replica patek philippe grand complications is designed for the connoisseur who appreciates the finest in watchmaking. This model features multiple complications, including a minute repeater, and is a testament to the enduring legacy of Swiss craftsmanship.

- Basic account: with the standard account, you can only invest with the money you deposit.

- Active account: you can invest on margin up to 50% of the liquidity value.

- Trader account: with this account, you can invest with up to 100% of the liquidity value.

- Day trader account: the risks are calculated differently within this account, which allows you to open even larger positions.

Often, it is not advisable to use margin. Only invest money that you can truly miss. When you do decide to invest on margin, you pay interest. In this case, the return on your investments must be significantly higher to still achieve a positive result.

Is DEGIRO reliable?

In my opinion, DEGIRO is a reliable broker:

- 17 years active: DEGIRO has been active for over 17 years.

- 7+ million European customers: DEGIRO is active in 19 countries.

- Segregated funds: your funds are stored separately from those of DEGIRO.

- Guarantee fund: securities up to €20,000 are 90% protected, and cash up to €100,000 is 100% protected.

- Positive reviews: DEGIRO scores well on Trustpilot with an average of 4,1.

DEGIRO fees: how much does it cost to invest with DEGIRO?

In this part of the review, I will discuss how much investing with DEGIRO costs.

Stock trading costs at DEGIRO

On the DEGIRO website, they try to hide the fact that there is also a €1 processing fee. In the overview below, I have added these costs for a more honest overview:

| Exchange | Costs |

|---|---|

| Netherlands & Belgium | €3 |

| United States & Canada | €1 |

| Tradegate (other EU countries) | €3,90 |

| Australia, Hong Kong, Japan & Singapore | €5 |

ETF costs at DEGIRO

| ETF exchange | Costs |

|---|---|

| Worldwide | €3 |

| Tradegate | €3,90 |

| Core selection | Free |

At DEGIRO, you only pay a €1 transaction fee for ETFs included in the core selection. However, there are conditions to this lower fee: you must invest at least €1000, and you may only open a position in a specific ETF once a month.

Keep in mind that ETFs also charge service fees. You can always examine the annual costs in the prospectus of a fund.

Bond costs

The costs for investing in options are clear: the transaction fee is always €3. This applies to Dutch, Belgian, Portuguese, and French bonds.

DEGIRO options rates

- Options Euronext, Eurex, MEFF & IDEMM: €0.75 per contract

- OMX Nordic options: €1.75 per contract

- American options: $0.75 per contract

- Exercise an option €1 per contract

DEGIRO futures costs

- Futures NYSE, Eurex, IDEM, MEFF: €0.75 per contract

- OMX Sweden: €1.75 per contract

- American options: $0.75 per contract

- Execute future: €1 per contract

What are the currency conversion costs?

DEGIRO charges 0.25% for converting currencies. If you buy stocks in another currency than your own, you pay 0.25% in transaction fees.

It is also possible to convert currencies manually. When you convert a currency manually, you are charged €10 + 0.25%.

How much do you pay for prices?

The Amsterdam and American stock prices are completely free at DEGIRO. For live prices on other exchanges, you often have to pay money. The costs vary from a few euros to €10.50. If you want to trade on a foreign exchange, it is important to first examine out how much you will have to pay for the stock prices.

What are the costs of short selling?

At DEGIRO, you can also short sell a stock. With a short position, you speculate on a decrease in the stock price. The rates for this vary depending on the risk of the stock. You pay 1% on stocks with low risk and 2% on stocks with high risk.

How much do you pay for a deficit?

When trading on margin, you may experience a deficit. Try to avoid a deficit, since you pay high fees in this case:

- Closing a position because of an ongoing deficit: €50 + 0.5% (maximum €500)

- Costs for exceeding margin of 125%: €100 + 1% (maximum €500)

Are there any other special costs?

- Transferring portfolio: €20 per position + external costs

- Telephone orders: €10 surcharge

- Stock dividend: €7.50 per dividend

- Subscription to new issuance: €2 + 0.02%

- DEGIRO exchange connecting fee: €2.5 per exchange per year.

Example of a transaction

You buy the American stock Apple for €10,000. Your costs are:

- €2 in transaction fees on purchase and €2 in transaction fees on sale

- 0.25% in currency costs = €25

- 0.25% in currency costs when selling = €25

The total costs are then €54 or 0.54%.

Conclusion: what how high are the transaction fees at DEGIRO?

The fees are a positive point in the DEGIRO test. Of all the professional stock brokers, DEGIRO offers investing at relatively low costs. However, the connection fees of €2.50 per exchange mean that small investors are still losing a considerable amount of money annually. At a firm like eToro, small investors can invest without paying any commissions.

What is the software like at DEGIRO?

The basic functionalities are present, and opening or closing an order is relatively easy. However, the trading software offered by DEGIRO is relatively basic.

The analysis capabilities are quite limited. When you visit a company’s profile, you will see some basic information about the stock, such as a brief description and earnings per share. You can find more comprehensive analyses on other websites, which you can use to make your decisions. The lack of additional information is a disadvantage in this review.

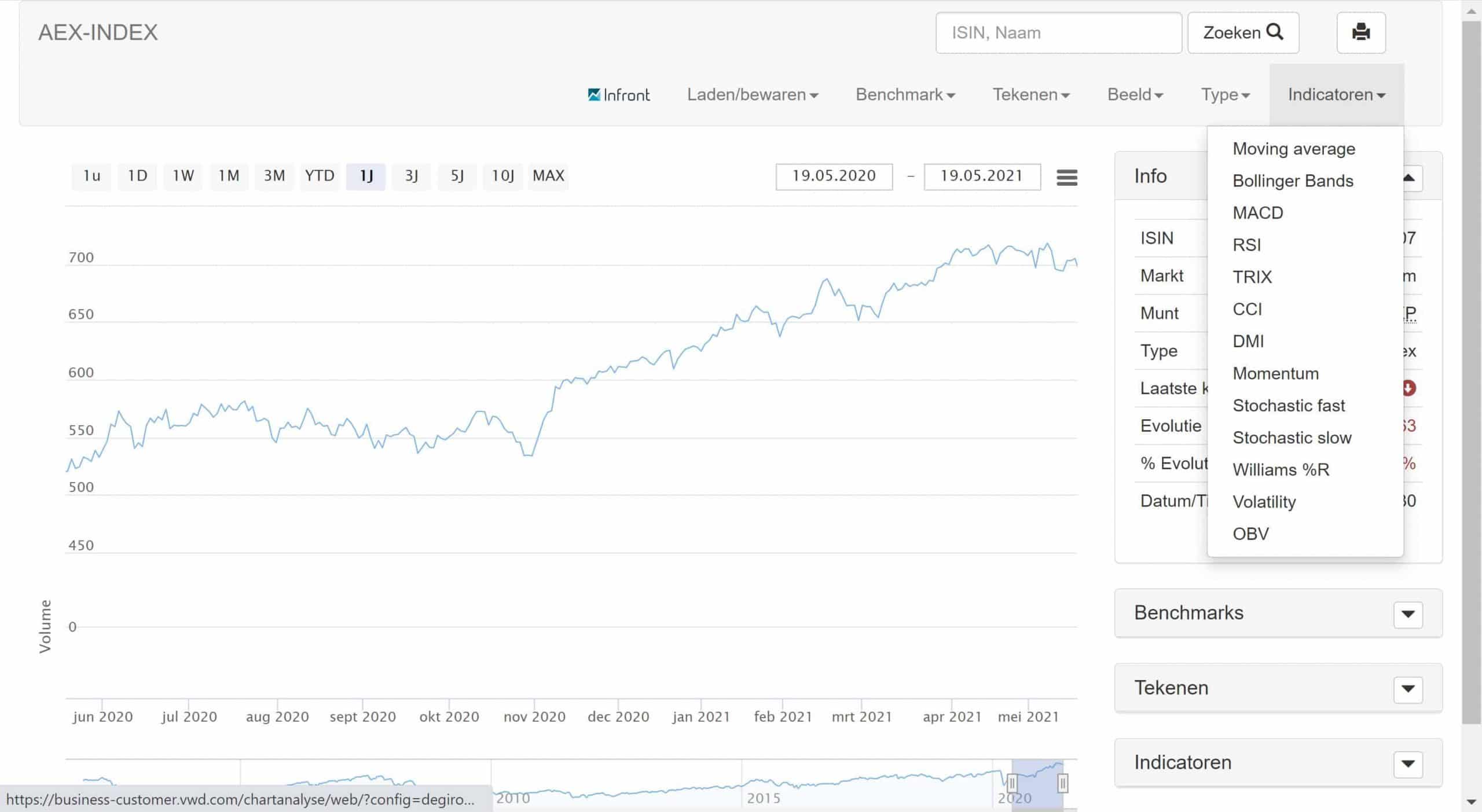

Technical analysis

The options for performing technical analysis are adequate at DEGIRO. You can choose between dozens of indicators, and you can go back up to ten years. Apart from these analysis options, DEGIRO does not offer advice or any other form of education.

You can choose from various technical indicators at DEGIRO

Dividend and information provision

Dividends are automatically credited. The information provision within the online software could be better; it is sometimes unclear, for example, when dividends are credited. DEGIRO’s software is not the most user-friendly compared to the software of other brokers.

What is the mobile application like?

DEGIRO’s software is also available as a mobile application. The mobile application has roughly the same functionalities as the online web trader. You can place orders and add stocks to your favorites list using the mobile platform. This makes it possible to follow your investments on the go and make some adjustments if necessary.

The mobile platform, like the web trader, is not very extensive, but it offers the functionalities you would expect. The mobile platform scores adequately in this review.

Education and guidance

At DEGIRO, you can find some information about investing within the investor academy. The videos on the site are clear and can help you get started. However, there is no advanced information available that can help you make investment decisions. DEGIRO does not score very high in terms of education and guidance within this review.

What are the trading options at DEGIRO?

One of the most important elements when evaluating a broker is the range of investment products. The range of options offered by DEGIRO is extensive: with 60 exchanges, you can invest in exotic destinations such as Turkey or New Zealand. You can also choose from various investment products, from stocks to funds and from leveraged products to bonds.

DEGIRO guide: how to place an order with DEGIRO?

I have been using the DEGIRO software for several years now and have invested a significant amount of money through the platform. In this brief DEGIRO guide, I will show you how to place an order with this broker.

By using the search bar, you can find a stock or fund in which you want to invest. You can search a stock by entering the name, the ISIN (Securities Identification Number), or the symbol.

Click on the buy button to open a position in the asset.

The order screen will open. Within the order screen, you can choose from two types of orders:

- Market order: you open the position immediately at the prevailing price.

- Limit order: you set a price at which you want to buy the stock.

If you would like to protect your funds, you can also choose to enter a stop loss. A stop loss is a value at which you automatically close the position. After buying a stock, you need to create a separate order to automatically close it at a certain loss.

Then click on place order to place the order on the stock exchange.

In the overview, you can find all your investment positions:

If you want to sell your investment, simply click on the sell button.

DEGIRO Tradegate: everything you need to know

It is also possible to place orders on the Tradegate stock exchange. Tradegate receives a small commission for every trade it carries out. It is important to be extra careful with these types of “shadow exchanges” since the price formation is often less transparent.

During opening hours, DEGIRO uses the Xetra reference exchange to determine the price. Outside opening hours, the spread can increase significantly, which increases your transaction fees. Therefore, apply the following precautions when investing via Tradegate:

- Opening times: only invest during the trading hours of the reference stock exchange.

- Limit order: by using a limit order, you make sure you do not pay more for the stock than you planned.

Depositing & withdrawing money with DEGIRO

You can deposit & withdraw money from your account at any moment. Dutch citizens can use iDEAL, while users from other European countries can deposit money by using wire transfer. A disadvantage in this DEGIRO review is that it is impossible to deposit money by using a credit card.

It is possible to withdraw your money to a bank account in your name. In my experience, you often receive the payment within 24 hours on your bank account.

Costumerservice DEGIRO

You can reach the costumer service of DEGIRO 24/7 per email on [email protected]. Furthermore, it is possible to reach DEGIRO by phone on weekdays through +31 20 261 3072 between 7 in the morning and 9 in the evening.

In my experience, DEGIRO handles their costumer inquires quickly and professionally, which is a big plus in this review.

Invest for your retirement with DEGIRO

Dutch citizens can also use DEGIRO to invest for their retirement. You can skip this section in the review if you are located in another European country.

- Locked account: you can only access the funds in your account when you reach retirement age.

- Deductible from your income in box 1: you can deduct the money you deposit on your retirement account from your taxable income in box 1.

- No wealth tax: you do not pay tax in box 3 on your pension account.

One advantage of pension investing with DEGIRO is that you retain complete control over your funds. You can decide for yourself which investment products to buy and sell. This can also be a disadvantage: it can be complex to determine how to rebalance a portfolio as your retirement age approaches.

As a pension investor, you are entirely on your own with DEGIRO, which makes pension investing with DEGIRO only suitable for experienced investors.

These are the costs you pay when you invest for your retirement with DEGIRO:

- Management fees: you pay a minimum of 0.2% in service fees on your portfolio.

- Transaction costs: if you incur more than 0.2% in transaction fees, these will be added on top.

- Connection fees: you pay €1 per month per exchange.

The other costs are comparable to those of a regular account. I am enthusiastic about pension investing with DEGIRO as you have more control than with other providers & pay low fees.

Conclusion review: is it smart to invest with DEGIRO?

DEGIRO is a strong player in the European market that cannot be ignored. The low fees (especially on ETFs listed in the core selection) are a clear advantage. However, the analysis options are limited, which makes DEGIRO less suitable for active traders.

Do you want to open an account with DEGIRO? Click the button below and open a free account now:

FAQs about DEGIRO

DEGIRO is much cheaper than many other competitors. The traditional banks are far behind DEGIRO. How is it possible that DEGIRO is so much cheaper than the competition?

This is due to several decisions they have made. First, they have an office in Sofia, which keeps wage costs low.

DEGIRO also regularly lends out securities; this is necessary to enable short selling. Lending out securities carries a small risk.

Finally, DEGIRO utilizes its economies of scale. Currently, DEGIRO is active in 19 countries. This makes it possible to keep the operational costs per client low, which results in relatively low transaction fees.

DEGIRO is suitable for the individual investor who has some capital. DEGIRO is a broker that can be used to purchase stocks and mutual funds. For example, you can buy popular stocks or trade on the S&P500 with DEGIRO.

In addition to these standard products, it is also possible to trade in bonds, options, and futures at DEGIRO. The range of products is extensive, and transaction costs are low.

Investing with DEGIRO is relatively safe: your securities are held in a separate custodian bank, which means you do not lose them if DEGIRO would file for bankrupcy.

Since DEGIRO can lend out your securities, you do have a counterparty risk. There is always collateral available which would minimize the risk. Nevertheless, some investors find this scary and are afraid of losing part of their investment. If you share this view, you have to look for a broker that does not do stock lending.

Since the takeover of DEGIRO by Flatex, the entire company is officially called flatexDEGIRO. Since Flatex has a banking license, DEGIRO can also use oit. This means that customer balances are protected up to €100,000 through the deposit guarantee scheme.

You cannot invest automatically on a periodic basis with DEGIRO. However, you can choose to transfer money to DEGIRO via automatic debit every month. You will then receive an email when the money has been received, and you can manually purchase the securities in which you want to invest.

The minimum deposit at DEGIRO is only €0.01!

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.

1 Comment

i want to buy facebook shares