How to buy shares online (2024)?

In this article you can read how you can buy and sell shares by using the internet. We will discuss where you can invest in stocks against low fees. After that, we teach you everything you need to know before you start buying shares online.

Years ago, buying and selling stocks was a cumbersome affair. To buy and sell shares, you often had to physically go to a bank, which charged high transaction costs. Fortunately, this is no longer necessary!

Nowadays, via an online broker, it is possible to invest in all well-known shares. With an online broker, you can quickly buy or sell a stock within minutes. The best broker for buying shares is currently eToro; with this broker, you can buy and shell shares without paying set commissions. Use the button below to open an account directly:

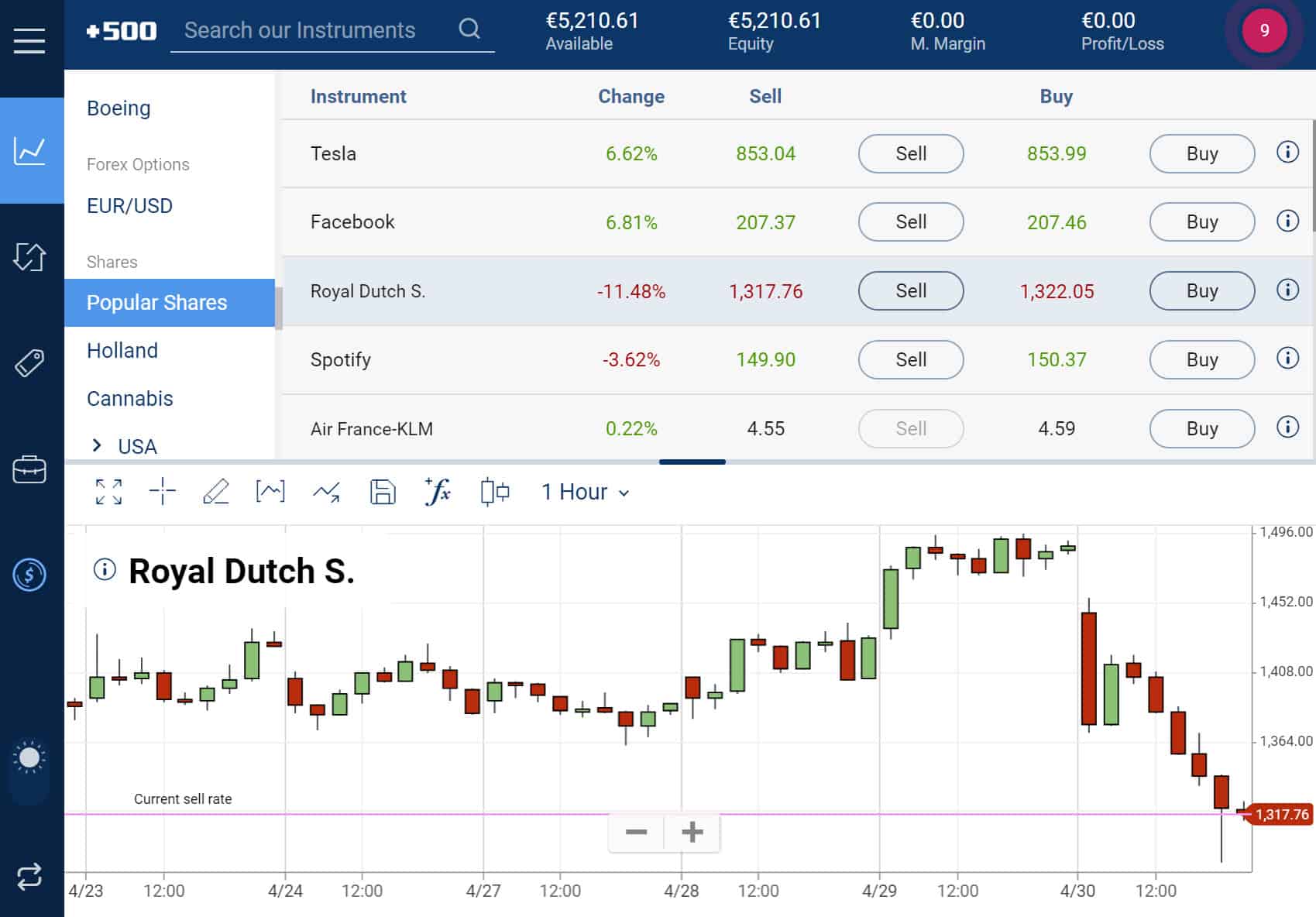

Do you want to actively trade shares using CFD’s? By actively trading the share markets you can react to economic developments. A good broker to trade in shares by using CFD’s is Plus500. Plus500 charges no commission on your trades, and you can try the options for free with an unlimited demo of $40.000. A big advantage of trading with Plus500 is that you can also place trades on falling prices (besides buying). Use the button below to directly open a free demo account at Plus500:

Buy & sell CFD shares at Plus500. Illustrative prices

Before you can buy shares, you have to go through a few steps. Below we take a look at what you have to do before you can start investing.

Step 1: Open a broker account

To buy shares, you first need to have an account with an online broker. A broker is a party that makes it possible for individuals to buy and sell shares. When selecting a broker, it is important to pay attention to the following:

- What are the transaction costs on (foreign) shares?

- How much support do you get from the broker

- Which shares can you trade with the broker?

- What additional functions does the broker offer you?

Do you want to know where you can invest in stocks? On our brokers compare page you can see the best brokers to start investing:

After opening an account with a broker, you can get started. First you need to determine what stock you want to buy. You can search for a company that you want to co-own. It is smart to start with a few companies that you know well.

Then it’s important to dig a little deeper. Don’t buy shares just because you think it’s a great company. Look at the annual figures to see how the company has performed in the past period. Also research the vision of the company and analyse whether it is likely that the company will continue to grow in the future.

The next step is to determine how many shares you want to buy. Especially in the beginning it is advisable to invest only with a small amount. Take your time to learn how the stock markets function. It is only smart to get started with larger amounts once you understand this market. You can even try buying and selling shares without risk with a demo account.

Step 4: select the type of order

When you go to buy shares, you also have to choose the type of order. When you buy shares, you first see the ask and the bid price. The ask price is the price at which sellers want to sell a share. The bid price is the price at which buyers want to buy a share. There is always a difference between this price. We also call this the spread.

When you buy shares, you can use different types of orders:

Market order

The market order is an order in which the shares are bought directly at the market price. The price can be more expensive with this type of order. Share prices fluctuate constantly. A market order is suitable for the investor who wants to hold shares for a long time. A few cents difference is less important when this is your strategy.

You have to be careful with market orders. When you place a market order outside the trading session, your investment can be a lot more expensive. The price of a share can increase considerably outside the trading session.

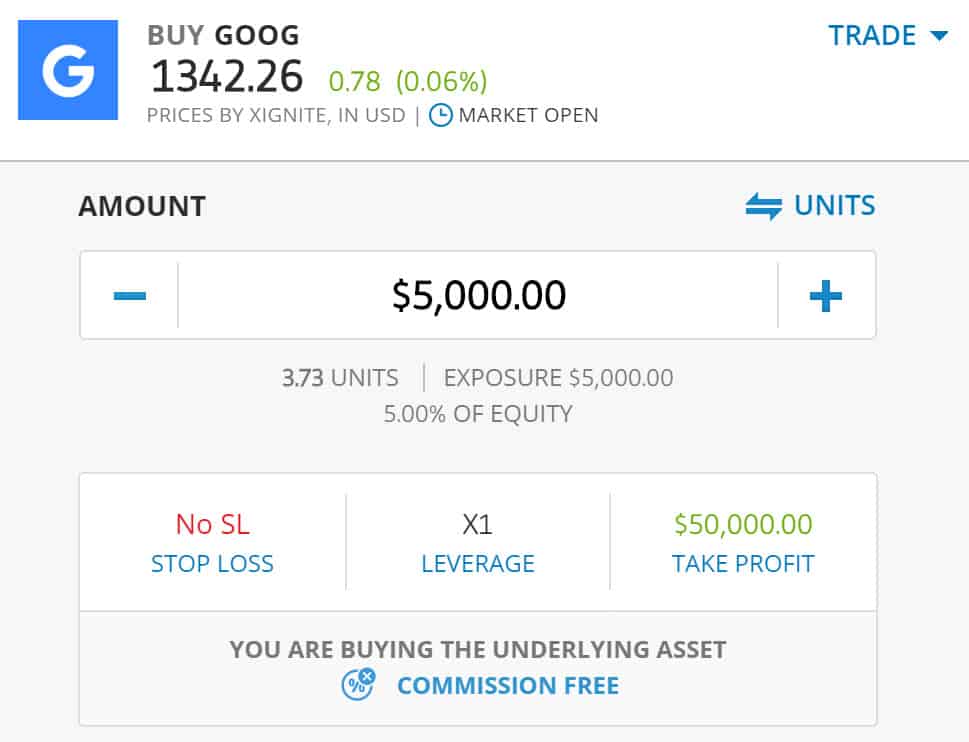

Placing a market order on a stock at eToro

Limit order

A limit order is only executed when a certain price is reached. This is useful if you are an active trader. It can also be useful to use a limit order in less volatile markets. In markets with little activity, the price can suddenly make strange jumps.

With a limit order, you are not certain that your (full) order will be executed. Are you sure you want to buy a certain stock? Then it can be smarter to use a market order. There are also specific type of limit orders. An all or none order is only executed when all shares are available at your limit price. A good for day order is removed if it is not executed before the end of the trading day.

Step 5: continue to optimize your equity portfolio

After you buy shares, the work doesn’t stop! Constantly ask yourself whether the shares in your portfolio still fit in well with your strategy. By doing so, you avoid losing a lot of money on shares that no longer fit perfectly with your current strategy.

Buying and selling shares by chance is often not a good idea. When you want to achieve good results, you have to consider various factors. With these tips you can make more money by buying and selling shares.

Spread within your investment

It is important to spread your investments sufficiently. Don’t just buy one type of stock. It is possible that a sector performs poorly compared to other sectors. A company can always go bankrupt. By buying shares in different companies you reduce the risk of a huge loss.

On the other hand, it is useful to remember that by spreading over different sectors you are not protected against economic setbacks. However, you can also handle this smartly. It’s wise to periodically buy shares for a fixed amount. Predicting the peaks and troughs is very difficult, but by buying shares at different times, you avoid entering the highest point.

Compound interest

Companies regularly pay dividends. Dividend is a profit sharing. Of course, you have the option to transfer this dividend to your savings account, but you can also choose to invest the dividend again. This can be a wise decision.

This is due to the principle of “compound interest”. When you reinvest the dividend in shares, you will also receive dividend on this amount. This increases your return in the long term exponentially. In five years’ time, you can quickly achieve ten percent extra return. So be smart and reinvest that return!

Watch your risk: reward ratio

Good investors always take the risks of their investment into account. The basic rule is simple: make sure your potential profit is higher than your potential loss. You must prepare a good plan before you buy a share. Consider at what price you take your loss and at what price you take your profit.

Suppose you buy a stock for an amount of $10. You expect the price to rise to $15. Your potential profit is then $5 per share. The price of a share can also drop to $9, which means that the potential loss is $1. Your ratio between risk and return is then 1: 5.

With this investment, you can earn five times more than you would lose. It is always wise to take positions with a favourable ratio between risk and return.

Control your emotions

One last important tip when buying shares is to control your emotions. In practice, we see that many investors leave lossy investments open for too long and cut profitable investments. This is because people are afraid of losing.

This is obviously not a wise investment strategy. Do you also want to fight against this instinct? Then prepare a plan in advance. That way you prevent your emotions from influencing your investment decisions too much.

When you buy shares in a company, you face various risks. Below we briefly discuss what to beware of.

Company specific risks

A company can do business remarkably badly. This happens, for example, when a company commits fraud or publishes a risk warning. You can protect yourself against this risk by buying many shares.

Sector-specific risks

Sometimes a particular sector can do badly as well. A drop in oil prices for example, means that oil companies are doing less well. You can protect yourself against sector-specific risks by spreading your investments over different sectors.

Market risks

Sometimes the entire economy goes down. This happened, for example, during the credit crisis of 2008. Make sure you don’t invest all your money in stocks at once. That way you avoid getting in on top. It is also important that you don’t immediately need the money that you invest. This gives you time to wait for the markets to recover.

Currency risks

When you buy foreign shares, you also have to consider the currency risks. When you buy shares in a foreign currency, there is a risk of losing money because your currency decreases in value. You can cover this risk by using derivatives.

There are two strategies you can apply when you are going to buy shares. We will discuss both methods below.

Many people buy stocks and hold them for a longer period of time. You can do this with a securities account at a traditional broker. When you buy shares in the long term, it is important to research the companies carefully. It is wise to verify whether the company will remain profitable in the long term.

Short term: speculate on stocks

You can also actively trade in shares. By speculating you can place orders on short-term rises and falls. It is best to use a derivative such as the CFD for this purpose. With CFD’s you can respond to rapid price increases and price drops.

- You can buy and sell CFD stocks with as little as $100.

- You can apply leverage which makes it possible to trade with bigger amounts.

- You can speculate on falling prices by going short.

- With orders, you can automate your trading activities.

What you should know before buying stocks

Before you buy stocks, you must understand how stocks work. In this section we answer frequently asked questions about shares.

What are stocks?

A stock is a kind of document of ownership. If you own stock in a company, you are a co-owner of the company. You will therefore often be paid a share of the company’s profits in the form of dividends. Most people, however, also own stocks because they anticipate a change in price. This is also called market speculation Read here to learn more about stocks.

What are dividends?

When you buy stocks you should consider the importance of dividends. When a company makes a profit, the company may decide to distribute a portion of the profits to the shareholders in the form of dividends. Pay close attention to the dividend when you buy a stock. The dividend partially determines the result you achieve with your investments. Read here all about dividends.

How do you determine when you should buy a stock?

When you want to be successful in trading CFD stocks, it is important to time your trades well. There are two methods you can use to time your trading activities:

- Fundamental analysis: analyse the potential of the companies.

- Technical analysis: analyse the price patters of the stock.

Do you want to learn how to trade in stocks? Read our trading for beginners course:

Using two examples, we show how buying shares can work.

When you physically buy a share from a broker, this share becomes yours. In this example you can buy the Apple share for an amount of $200. When the stock rises to $250 over a period of 5 years, you sell the share again. You then achieve a nice return of 25% or 5% on an annual basis.

You can also choose to speculate on a price drop of a stock using a CFD. By going short you can benefit from a decreasing stock price. When the price is $300 you decide to go short. The price of the share drops to $250 three days later. In this case, your profit would be $50.

By using leverage you do not have to invest the full $300 to execute this investment. You can already make a similar investment with an amount of $30. Your return would rise to 50% if you apply a leverage of 1:10. Thus, with active speculation, both the potential return and the potential risk increase.

Trading stock using CFDs

You can trade stocks using CFDs. With CFD brokers, you pay a low fee that is dependent upon the size of your order. The costs start at a few pence, meaning you can also trade with relatively small amounts.

Trading stock CFD’s also has other benefits. You can use leverage to magnify your results. However, it is important to remember that losses are also magnified using leverage. CFDs are contracts that stipulate an underlying value where the difference between the price you open and close a position determines your profit or loss.

Practice with a demo first!

Are you eager to start buying and selling stocks? Understandable! However, it is wise to start slowly. You can open a free demo account with various brokers. With a demo account, you can try trading shares without risk. Use the button below to open a free demo at a broker:

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.

1 Comment

I am a straight A* Alevel student (maths, economics and history) with a decent amount of financial capital; I was wondering if you could teach me technical analysis.