What is a bubble in the economy?

Sometimes things seem to be going very well in the economy for years. There are golden times and there seems no end to prosperity. But when there is a bubble in the economy, these good times can suddenly end. But what does a bubble mean and how can you recognize it? You can read all about it in this article!

What is a bubble?

A bubble is a situation in which the value of something increases dramatically for no apparent reason. The price is then far above the actual or intrinsic value. A bubble or bubble always ends up bursting with many investors losing their money.

How can you benefit from a bubble yourself?

As an investor, you can make a nice profit during a bubble. You do have to remember that it is very difficult to recognize a bubble. Afterward, people think everybody who did not see it should have been an idiot. However, when history has yet to be written, it is very difficult to make the right decision.

In any case, it is important to get out at the right time. The smartest investors also manage to benefit when the bubble burst. This is possible because nowadays, you can also make a profit when prices fall. Do you want to know how this works? Then read our article on this topic:

How can you recognize bubbles?

It is very difficult to spot economic bubbles. Entire governments and systems have collapsed because a bubble bursts apart. In retrospect, you can easily recognize a bubble, but if you are in it, this is a lot more difficult.

Still, some characteristics make it likely that there is a bubble:

- The market price is above the actual value.

- The underlying asset must be innovative in some areas.

- The actual return will not follow until a later point in the future.

- A bubble will pop at some point in the future.

That novelty is important is evident from the various hypes. The Bitcoin was a new technique that was blown up to enormous proportions. Also, packaged mortgages and tulips in 1600 were all new products. After all, it is a lot more difficult to determine the value of something new.

The moment when the return is expected is also important. This moment must be far enough in the future. After all, it takes time for an economic bubble to develop.

Ultimately, you only really know whether something is a bubble when it bursts. Until then, you can never claim with full conviction that there is a bubble.

What are the consequences of a bubble?

A bubble often has negative consequences for the economy. It is a form of wealth shift in which a large group of people loses a lot of money.

A small group of people is there from the start. For example, they buy Bitcoins for a few cents and see them rise to a value of tens of thousands of dollars. However, most people wake up (too) late and buy the Bitcoins after they have raised enormously.

Ultimately, you often see that a small group of people manage to become wealthy from a bubble, while a large group of people lose a lot of money. A bubble can even trigger a recession. This is more likely when the number of people losing their assets is high.

What is the first known bubble?

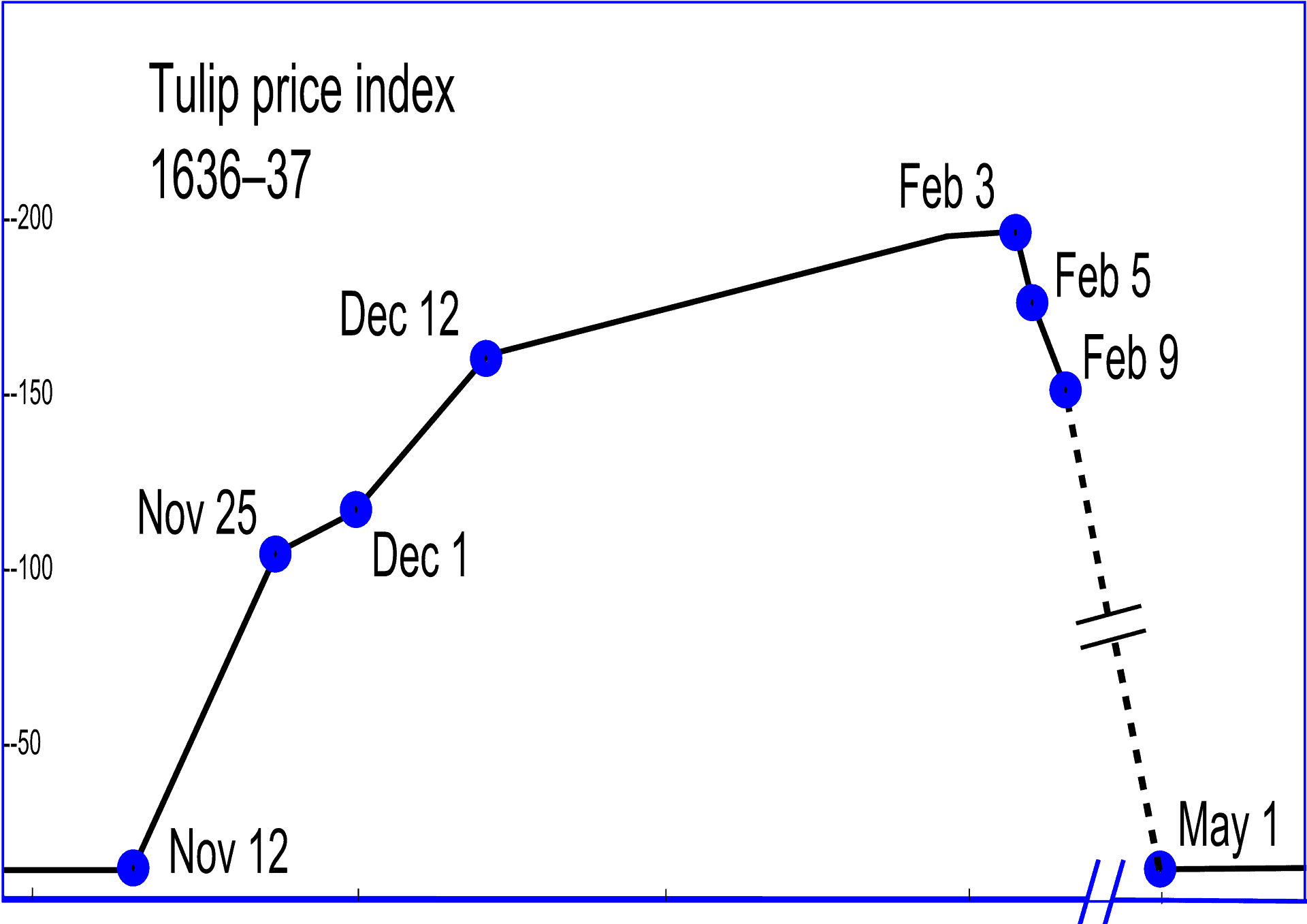

The first known economic bubble took place in the Netherlands. We travel back to the year 1630 when Amsterdam was in the golden age. Amsterdam was hugely successful and made loads of money by trading with other countries.

A plant from the Ottoman Empire turned out to grow well in the Netherlands and quickly gained popularity. The flower was seen as a status object by the wealthy aristocrats. If you had a garden full of tulips, you had to be very successful.

As a result, the price of a tulip quickly increased. When many people want something, you see that the price rises sharply. At one point you could even buy an entire canal house for a tulip. Of course, this sharp increase could not continue: in 1637 the price of tulips completely collapsed.

This was the first economic bubble to fall apart. Many other bubbles would follow throughout history.

How does a bubble unfold?

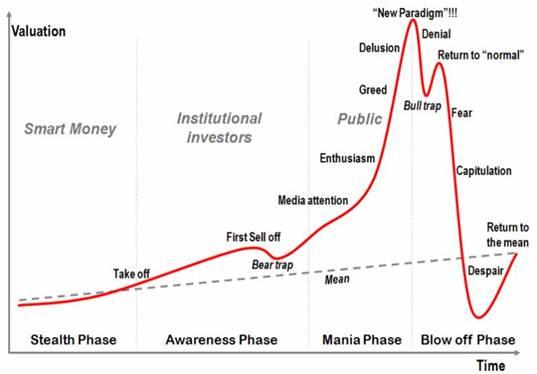

The research of the economist Hyma n P. Minsk can help us to understand how a bubble develops. According to him, every bubble follows a few fixed steps: displacement, boom, euphoria, profit-taking and panic.

Displacement

Investors become interested in a new investment product. This is due to new development. This could be a new technique or low-interest rates.

Boom

Due to the increased interest, prices start to rise. As a result of this increased interest, the new investment product receives even more attention. The upward trend that follows lures many people in that fear missing the boat.

Euphoria

The price of what the bubble relates to is reaching unprecedented heights. The price rises and rises and no one expects it to ever fall again. Investors lose their caution and buy blindly.

Taking profit

It is not easy to predict when a bubble will burst. Still, some people manage to take their winnings at the right time. It is wise to do this when there are clear warning signs. For me, this was the case with the Bitcoin hype when even the postman asked me if he should buy cryptocurrencies.

Panic

More and more people decide to take their profit. As a result, the price starts to fall. The decline causes investors to panic, and they start dumping their securities. Due to the much higher supply and the decreased demand, the price collapses completely. The bubble has burst!

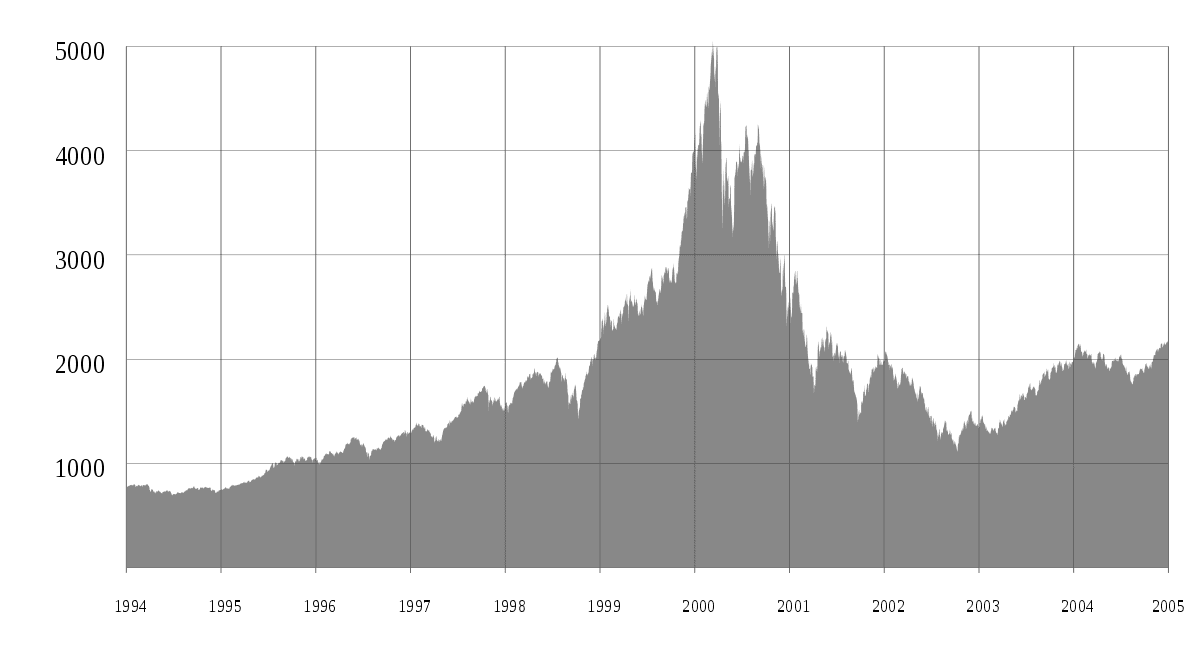

What is the internet bubble?

Internet companies were experiencing golden times in the late 1990s. The internet started to grow stronger, and it became clear how much potential this new technology had. Large companies such as Microsoft, Yahoo, and Google were characterized by rapid growth and became very popular in a short time span. Many other companies followed in their footsteps and wanted to surf the successful wave of the Internet.

The shares of internet companies were no longer valued like other shares were used to. The value of an internet company stock was now determined by looking at the growth and return. The profitability of a company was completely lost sight of. Investors believed that growth would be most important and that profit would eventually follow.

However, this enormous success was followed by the so-called ‘dotcom bubble‘, or the internet bubble. Due to the popularity of the World Wide Web and the notion that failure was impossible, investors massively bought shares of these companies. As a result, stock prices rose rapidly and then completely collapsed. The collapse happened because many companies in the sector were unable to meet expectations. Only the financially strong companies survived.

The real estate bubble

Another famous bubble is the real estate bubble that took place in 2008. Buying real estate often happens by using a mortgage. As a result, there is always a chance that the mortgagee will not be able to pay the monthly costs. In such a case, the banks become the owner of the property. They will put the home back on the market to make up for the failed mortgage payment.

In 2007-2008 this system failed, and we experienced the real estate bubble or credit crisis in the United States. It was made too easy for those with little wealth to get a mortgage. Ultimately, these people were unable to repay their mortgages. Banks could no longer sell these homes on the market, causing prices to collapse. The real estate bubble bursted as a result. Many banks went bankrupt and had to be bailed out by the government.

Accusing fingers quickly pointed at the too-liberal government policy. Banks were allowed to maintain smaller buffers for mortgages aggregated within bonds. This quickly resulted in complex financial products where it was unclear what the quality of the underlying mortgages was. Ultimately, the creditworthiness of the mortgages wrapped in bonds turned out to be lousy. In the aftermath of the credit crisis, banks were obliged to set up larger buffers.

The price of gold

When the economy is experiencing bad times, many investors often turn to invest in gold. This causes the price of this precious metal to rise enormously. You often see this in times of disaster.

This happened, for example, during the debt crisis in Europe. Gold prices continued to peak during this economic catastrophe. Ultimately, however, the price of gold fell sharply again. Within a bubble economy, you always fall deep after the high climb.

The natural development of an economic bubble

The natural development of an economic bubble

The cryptocurrency bubble

Another great example of a well-known economic bubble is the cryptocurrency bubble. Seduced by the media, many amateur investors decided to buy Bitcoins and other cryptos. Top after top was reached until the price hit well over $20,000. However, the coin itself had not yet proven its worth. It was barely used.

Bubbles are often created by a mass hysteria in which people lose sight of reality. This is also the case with the cryptocurrency bubble. The bubble burst and all kinds of hopeful people lost their dreams. Therefore, do not blindly follow the crowd and consider whether there is a basis for price development or whether it is just a bubble.

The stock bubble of 1929

Another well-known bubble is the bubble of 1929. The roaring twenties was a period in which it seemed impossible for anything to go wrong. Stock markets were up and up and America was doing well. At the end of the twentieth century, the tide seemed to be turning.

Factories produced too many products and sales lagged. As a result, factories decided to drop production en masse. Many people were fired and lost their incomes, resulting in a further decline in purchasing power. This puts the economy in a vicious, negative circle.

The stock markets crashed and the economic situation deteriorated rapidly. The crash on the American stock exchange eventually even contributed to the rise of Hitler and fascism in Europe.

How does a bubble form?

There is no single answer to how a bubble is created in the economy. Economists have different views on bubbles in the economy.

The post-Keynesian school believes that the economy will automatically alternate between boom and bust. People can naturally become overly optimistic in times of increasing demand. According to this teaching, it is not possible to prevent bubbles. It is, however, possible to absorb the consequences of the bubble to an extent by applying smart government policies.

The Austrian school believes that intervention in the economy causes differences in the economic cycle. The internet bubble is said to have been caused, for example, by the FED investing too much. Economists differ greatly in their views on economic bubbles. This makes it difficult to determine the causes behind them and the best approaches to solve them.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.