How to buy Microsoft stocks (2024)? – invest in Microsoft shares

Microsoft is an essential part of our society. Do you consider an investment in Microsoft shares? On this page, you can learn how to buy Microsoft stocks. You can also find an extensive analysis of the stock and examine the latest price data.

How to buy Microsoft stocks?

Are you considering investing in Microsoft by purchasing shares? Microsoft is a massive company that has performed very well over the past few decades. Buying Microsoft shares could be a good idea.

In the overview below, you directly see with which brokers you can buy & sell Microsoft shares:

| Brokers | Benefits | Register |

|---|---|---|

| Buy Microsoft without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of Microsoft! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of Microsoft with a free demo! |

What is the current stock price of Microsoft?

Are you curious about the current stock price of Microsoft? With the graph below, you can examine the stock price of Microsoft. You can also place an order directly by using the buy and sell buttons.

Company data of Microsoft

Below, you can see the key company data of Microsoft.

Analysis of Microsoft stocks

Before deciding whether to buy or sell Microsoft shares, it’s important to analyze the stock thoroughly. In the overview below, you can see how Microsoft has developed over the past period.

Stock prices of Microsoft of the last 5 days

In the table below, you can see the stock prices of Microsoft for the last 5 days:

What will the Microsoft stock price do in 2026?

Are you curious about what analysts think Microsoft will do in 2026 and the years that follow? We have combined the analysts’ forecasts using data from Alpha Vantage. Keep in mind that this figure is only a prediction of the stock price of Microsoft and that this prediction may not come true.

- Growing cloud business: Amazon has already proven that there is a lot of profit to be made in the cloud. Microsoft is growing rapidly in this division, with products like Azure and Office 365.

- Strong financial results: Microsoft has been delivering impressive financial results for years.

- Diversification: Microsoft offers both hardware and software at different price levels. This allows Microsoft to compensate for losses in one division with good results in another division.

- Global activity: Microsoft is active all over the world. This reduces Microsoft’s dependence on the financial situation in a specific region.

- Strong brand: Microsoft is globally recognized as a strong brand that is also excellent at innovating its services.

What risks should you consider when investing in Microsoft stocks?

- Dependency: Microsoft derives a large portion of its profit from Windows and Office. Therefore, it is important to monitor the demand for these products when considering an investment in Microsoft.

- Competition: Microsoft faces strong competition from both existing players and new companies.

- External factors: New legislation may put pressure on Microsoft’s results.

- Cybersecurity: Security is crucial for Microsoft. If hackers manage to gain access to the cloud, for example, the reputation can be severely damaged.

What are Microsoft’s biggest competitors?

Analysis of Microsoft stocks

If you are considering an investment in Microsoft’s stock, it is essential to conduct a thorough analysis first. Because the company is active in many areas and sectors, it can be difficult to get a total overview. For example, if the Xbox performs better than the PlayStation, this does not necessarily mean that the Microsoft stock price will also rise.

This is because another business unit could easily throw a wrench in the works. Therefore, you will need to apply a more holistic approach to analysing Microsoft’s stock. You can then look at various figures:

- How does the overall economy develop?

- What is Microsoft’s market share in different regions?

- How does Microsoft’s latest product perform?

- How is Microsoft’s profit developing?

- What is the profit-to-price ratio of the stock?

Beware of competition

Microsoft sells its products at relatively high prices, which can make it difficult to reach the lower market segments. As a result, there is a chance that competitors may take more market share away from the giant.

Microsoft also does not manage to maintain a leading position in all segments. For example, Apple has overtaken Microsoft in the field of mobile technology. Do you think Microsoft can become a leading player again in these types of lost segments in the future? Then it can be especially interesting to buy Microsoft stocks.

Microsoft has a strong financial position

An investment in Microsoft stocks is considered relatively safe: together with Johnson & Johnson, Microsoft has a better credit rating than the US government. This means that you would be better off lending your money to Microsoft than to the US government, which clearly speaks to the advantage of the company’s financial situation.

Step-by-Step Guide to Buying Microsoft Stocks

Step 1: Choose a reliable broker

Many people do not spend enough time selecting a good and reliable broker. Choosing an expensive broker can cause you to miss out on returns. Take a look at our overview of best brokers directly & invest in Microsoft:

Step 2: Analyze the stock

Before investing in Microsoft stocks, it is important to analyze the company thoroughly. You can do this by looking at the fundamental aspects of the company. For example, investigate how profits relate to the current stock price and whether the company has a lot of debt. Then compare the company with the competition: determine if Microsoft can still keep up.

Are you convinced that Microsoft can continue to grow in the future? Then it can definitely be smart to invest in Microsoft by buying stocks.

Step 3: Determine the amount of your investment

Before buying Microsoft stocks, it is advisable to determine the amount of your investment. In most cases, it is not recommended to invest your entire deposit in only Microsoft stocks.

By diversifying your risks, you reduce the chances of losing money if the company still delivers poor results. Therefore, carefully consider what percentage of your investments you want to allocate to Microsoft stocks and calculate the amount you would like to invest in Microsoft based on that.

Step 4: Place an order

Once you are certain that you would like to buy Microsoft shares, you can place an order. For long-term investors, a market order will be sufficient: you will then buy the stocks directly at the most attractive price available.

An alternative is the limit order, which allows you to buy stocks only when the price has dropped to a certain level.

A brief overview of Microsoft Corporation

Microsoft Corporation was founded on April 4, 1974 by Bill Gates and Paul Allen. The company is headquartered in the city of Redmond, Washington, in the United States. The company develops various products and services for computers.

Microsoft Corporation is the world’s largest software company. Microsoft develops operating systems for PCs and office software packages. Microsoft is listed among the ten most valuable companies in the world.

Some well-known products of Microsoft

The company has developed many popular products. This popularity did not go unnoticed. Three employees became billionaires, while 20,000 employees became millionaires. The company developed several well-known products.

The MS-DOS operating system

In 1980, IBM offered Microsoft a contract to develop an operating system. This operating system became the well-known MS-DOS, which gave Microsoft a leading role in the market for operating systems.

Microsoft Windows

In 1984, Microsoft released the well-known Microsoft Windows. This graphical extension of the MS-DOS operating system became a great success.

On March 13, 1986, the company went public. Over the years, new versions of Windows were released: Windows 95, Windows XP, Windows Vista, and Windows 7. The software became more user-friendly, and a lot of attention was paid to the user interface.

In March 2004, the European Union sued Microsoft for abuse of power. Microsoft was accused of achieving a monopoly with Windows. The company had to pay a fine of 497 million euros. Such fines can damage a company’s reputation and affect its financial results. Therefore, pay close attention to the news when you consider an investment in Microsoft.

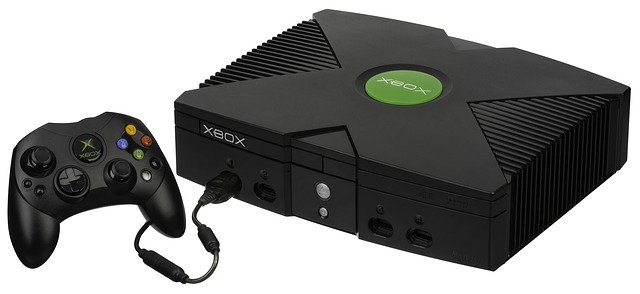

The Microsoft Xbox

Game consoles are popular, and Microsoft is still active in the race for the best console. In 2001, Microsoft launched the first Xbox. The company’s biggest competitors for game consoles are Nintendo and Sony.

Bill Gates and other leadership

Bill Gates is the well-known face behind Microsoft. As early as 1998, Bill Gates was no longer the formal leader of the company. Steve Ballmer became the president of the company at that time. In 2006, Gates stepped back even further, and Steve Ballmer took on more and more responsibility.

Under his leadership, things did not always go well: for example, Windows 8 was not a great success, and the acquisition of Nokia was not the best decision.

In 2014, he was succeeded by Satya Nadella. This new leader shifted the focus to Microsoft Cloud and also acquired LinkedIn. Moreover, there was a significant write-down on Nokia, and several employees were laid off. This new direction seems to be working well for Microsoft.

Bill Gates is still actively involved with Microsoft as a technology advisor and major shareholder. In his spare time, he is involved with the Bill & Melinda Gates Foundation, which supports various charitable causes.

There are plenty of reasons why an investment in Microsoft stocks could be interesting. The extensive product diversification and the fact that the company is globally active strongly contribute to Microsoft’s success.

Moreover, Microsoft owns various strong brands such as Windows, Office, and Xbox, and knows how to use marketing to achieve more success. This has enabled Microsoft to maintain a strong market share despite strong competition.

However, it is important to keep an eye on the always-changing market conditions. When competitors manage to take away market share, the company’s stock price may come under pressure. Therefore, always investigate how the company’s financial performance develops.

Finally, don’t forget to investigate whether Microsoft shares fit within your investment portfolio. Microsoft is a technology stock, which makes it more volatile than some other stocks. Therefore, determine for yourself whether the stock fits within your risk tolerance.