How to Buy Bitcoin with Credit Agricole Bank: 5 Easy Steps

Are you interested in buying Bitcoin with a Credit Agricole Bank account? As cryptocurrencies become more mainstream, more banks offer services to buy and sell digital assets. In this article, we will guide you on how to buy bitcoin with Credit Agricole Bank and provide you with vital information to make an informed decision.

How to Buy Crypto with Credit Agricole Bank?

Credit Agricole Bank does not offer retail or institutional banking clients any services to buy or sell Bitcoin and other cryptocurrencies due to the lack of infrastructure to support trading services and cryptocurrency wallets on their platforms.

To purchase digital assets using your Credit Agricole bank account, you can deposit fiat currency into a licensed exchange. A credible and authorized exchange is crucial to prevent any potential bank freeze by Credit Agricole.

Here are a few of the cryptocurrency exchanges you can choose from:

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

While you can buy Bitcoin and other cryptocurrencies with your Credit Agricole bank account, you must connect to a registered broker that provides cryptocurrency services. This is because, as mentioned above, Crédit Agricole does not offer direct cryptocurrency services through its online banking platform.

After successfully registering with a cryptocurrency exchange, you can transfer funds from your Credit Agricole bank account to the exchange and start trading the digital asset of your choice.

Here’s how to get started in 5 easy steps:

- Open an account with one of the supported cryptocurrency exchanges.

- Verify your account and provide any necessary identification documents.

- Deposit funds into your cryptocurrency exchange account using your Credit Agricole Bank account.

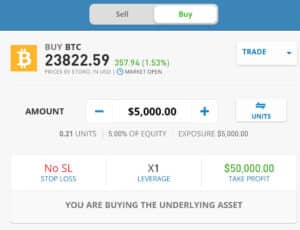

- Select Bitcoin as the cryptocurrency you want to buy in the trading software.

- Fill in the amount you would like to invest and press “Open Position.”

Storing your Bitcoin at Credit Agricole Bank

Storing your Bitcoin securely is an essential aspect of cryptocurrency ownership. While it may be tempting to leave your Bitcoin on an exchange or online wallet, doing so exposes you to significant risks such as hacking, theft, or loss of access.

There are various ways to store Bitcoin. Let’s take a closer look at each of these options:

- Hardware wallets: A hardware wallet is a physical device that stores your Bitcoin offline, away from potential online threats. These devices are designed to be secure and offer high protection for your cryptocurrency.

- Software wallets: A software wallet is a digital wallet you can install on your computer or mobile device. These wallets allow you to store your Bitcoin securely and have more control over your private keys than online wallets. However, they are still susceptible to online threats and require careful management to ensure security.

- Exchange Wallets: While leaving your Bitcoin on an exchange is generally not recommended for long-term storage, it can be a convenient option for short-term storage or trading purposes. However, exchanges are subject to security risks like hacking, theft, or bankruptcy. Choosing a reputable exchange and enabling two-factor authentication is essential to enhance your account’s security.

Whatever storage option you select, protecting your Bitcoin is essential. This includes keeping your private keys secure and backing up your wallet regularly. Be cautious of phishing scams, which can trick you into revealing your private keys or seed phrase.

What is the Crypto Policy of Credit Agricole Bank?

When it comes to the world of cryptocurrency, Crédit Agricole has taken a positive stance. The bank has no policies prohibiting users from depositing or withdrawing funds to and from regulated crypto exchanges.

Credit Agricole is a founding member of the Crypto Valley Association, representing the interests of Switzerland’s blockchain and cryptocurrency communities. The bank has also been involved in various initiatives, like launching a blockchain-based platform that facilitates buying and selling digital assets.

Credit Agricole is taking a proactive approach to cryptocurrency. It is a sign that it is crypto-friendly and open-minded about new digital innovations.

How to Buy Crypto Safely with Credit Agricole Bank

Cryptocurrency investments can be risky due to the market’s lack of a regulatory framework. However, there are several precautions you can take to ensure the safety of your funds and personal information.

Here are some essential guidelines to follow when starting with digital assets:

- Do thorough research before investing in any cryptocurrency. This includes looking into the coin’s history, development team, community, and any potential risks associated with the investment.

- Use a reputable and secure exchange when buying cryptocurrency through Credit Agricole Bank. Check with the bank for their recommended exchanges.

- Set up two-factor authentication on your Credit Agricole Bank account and the exchange you are using. This adds an extra layer of security by requiring a code and your password.

- Create strong and unique passwords for your Credit Agricole Bank account and cryptocurrency exchange. Use a combination of letters, numbers, and symbols, and avoid using easily guessable information.

- Consider transferring your cryptocurrency to a secure wallet you control after purchasing it through Credit Agricole Bank. This will provide an additional layer of security against potential hacks or theft.

- Understand the risks involved in cryptocurrency investment, as they are highly volatile, and their value can fluctuate dramatically over short periods. Only invest what you can afford to lose.

Following these guidelines, you can safeguard your funds and personal information while investing in cryptocurrency.

About Credit Agricole Bank

Credit Agricole is a French banking and financial services organization headquartered in Montrouge, France. The group comprises 39 regional banks of Credit Agricole S.A., one of France’s most extensive banking groups, and several other subsidiaries specializing in asset management, insurance, and other activities.

The companies within Credit Agricole offer a complete range of financial and banking services to more than 30 million customers across France, focusing on serving small- and medium-sized businesses and retail customers. Aside from its operations within France, Credit Agricole is also in over 50 countries globally.

Credit Agricole’s rich history dates back to 1885 when it was established as a cooperative bank for French farmers. Today, the group is one of the central banks in France and one of Europe’s largest banking groups. Regarding total assets, Credit Agricole is the second-biggest bank in France, trailing behind BNP Paribas and one of Europe’s top ten largest banks. The group recorded a revenue of €154.3 billion in 2021.

We Sell The Best Replica Watches in The United States, Canada, United Kingdom And Other Countries, With Cheap Prices And Reliable Quality. replicamade.io is The Best Place For You To Buy Replica Watches.

Browse luxurious and fascinating quality replica watches uk collection at our website.

Conclusion: Buying Bitcoin with Credit Agricole Bank

Buying Bitcoin and other cryptocurrencies with Credit Agricole Bank is a straightforward process. You can make safe and informed investments by connecting your crypto account with a compatible exchange and following the steps outlined in this article.

However, it is essential to be aware of the risks involved and only invest what you can afford to lose.

With careful planning and research, you can take advantage of the potential benefits of the cryptocurrency market with Credit Agricole Bank.

Auteur

Over Ryan Donato

Ryan is a passionate writer with love for storytelling. He discovered his passion for writing at a young age and has been honing his skills ever since. Ryan is a sports enthusiast and enjoys following the latest developments in the world of sports. He also has a keen interest in finances and constantly learns about investments and personal finance.