How to buy Bitcoin with Citibank in 2023: A Step-by-step Guide

Cryptocurrencies, led by Bitcoin, have become popular recently. However, purchasing these digital assets can prove challenging, particularly for first-time buyers. Prospective investors often wonder whether they can buy Bitcoin using their bank accounts, particularly Citibank.

How to Buy Crypto with Citibank?

Currently, Citibank’s banking platform doesn’t provide the facility to purchase Bitcoin. However, you can still buy cryptocurrencies through third-party exchanges. Below is a table of several popular cryptocurrency exchanges compatible with Citibank.

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

You can buy crypto from your Citibank account using various payment methods, including bank transfers, ACH transfers, PayPal, Skrill, and credit/debit cards. Just open an account with one of the crypto exchanges in the table above to get started.

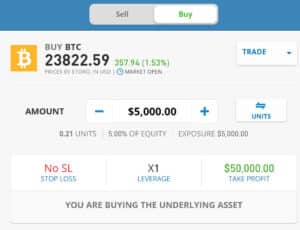

Once you have chosen a crypto exchange, follow these steps to buy Bitcoin with Citibank:

- Register an account with the crypto exchange of your choice.

- Verify your account by providing the necessary information.

- Deposit funds into your Citibank account.

- Select Bitcoin or the cryptocurrency of your choice and click the “buy” button.

What is Bitcoin?

Bitcoin (BTC) is a digital currency that operates independently of central authorities such as governments or banks. It is a cryptocurrency that you can use for transactions and payments without intermediaries. Instead, Blockchain technology, a decentralized ledger that records all Bitcoin transactions, forms the basis of Bitcoin.

First introduced in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto, Bitcoin has since gained widespread recognition and adoption. Its popularity has led to numerous other cryptocurrencies, each with unique features and uses.

While some cryptocurrencies aim to compete with Bitcoin as a payment system, others serve as utility or security tokens on different blockchains and emerging financial technologies. More and more costumers of Citibank invest in Bitcoin as well these days.

What is Crypto?

Cryptocurrency or crypto refers to the digital currency created using encryption algorithms as an alternative form of payment. The application of encryption technologies enables cryptocurrencies to function as both a currency and a virtual accounting system.

You need a cryptocurrency wallet to utilize cryptocurrencies. These wallets can be cloud-based software or stored on your computer or mobile device. The wallets serve as how you keep your encryption keys, which authenticate your identity and link to your cryptocurrency.

What is Citibank’s crypto policy? Is Citibank friendly to crypto?

Citibank has a positive outlook on cryptocurrency and does not impose any restrictions on its clients in carrying out transactions involving crypto assets either within or outside the bank. The financial institution is known for its forward-thinking approach to digital currencies.

In a news release last 2022, BusinessWire reported that Citibank is working on a solution enabling a crypto custody service. This step is in response to Citibank’s recent initiatives to strengthen its in-house teams specializing in cryptocurrency.

How to buy crypto safely with Citibank:

To ensure the safety of your investment, be cautious when purchasing cryptocurrency from any bank, including Citibank. Here are some guidelines to keep in mind:

- Use a reputable exchange that is compatible with Citibank.

- Enable two-factor authentication to secure your exchange account.

- Keep your cryptocurrency in a secure wallet, such as a hardware wallet.

- Only invest what you can afford to lose.

About Citibank:

Citibank is one of the leading financial institutions in the United States. Established in 1812, it has expanded to become one of the largest banks in the country, with headquarters located in New York City and branches spread across the United States, Europe, the Middle East, Africa, Latin America, and Asia Pacific. It has a diverse range of banking services and products catering to customers nationwide. It has 182 664 employees, according to Forbes.

As a subsidiary of Citigroup Inc., one of the world’s largest financial services corporations, Citibank has access to significant global resources. With operations in more than 160 countries and over 200 million customer accounts, Citigroup is a leading player in the international finance industry. The company serves over 100 million credit card clients and has a substantial market share of around 14% in the foreign exchange market.

Wrapping Things Up: How to buy Bitcoin with Citibank in 2023: A Step-by-step Guide

Purchasing Bitcoin using Citibank is a relatively straightforward process that involves linking your cryptocurrency account with the bank and buying your preferred digital currency through a reliable exchange. However, it’s crucial to be aware of Citibank’s somewhat unclear stance on cryptocurrency and the potential risks in investing in digital assets.

By following our guidelines for purchasing cryptocurrency securely with Citibank, you can reduce these risks and enjoy the advantages of owning digital assets. Always conduct your research, stay up-to-date, and only invest what you can afford to loss.

Auteur

Over Ryan Donato

Ryan is a passionate writer with love for storytelling. He discovered his passion for writing at a young age and has been honing his skills ever since. Ryan is a sports enthusiast and enjoys following the latest developments in the world of sports. He also has a keen interest in finances and constantly learns about investments and personal finance.