How to buy Bitcoin and Crypto with UniCredit Spa Bank [2023]

Do you want to buy Bitcoin and other cryptocurrencies with UniCredit Spa Bank but don’t know how to start? You’re in the right place! In this article, we will present you with a comprehensive guide on how to buy crypto with UniCredit Spa Bank.

How to buy Bitcoin with UniCredit Spa Bank?

UniCredit Spa Bank does not allow clients to buy, trade, or retain Bitcoin and other cryptocurrencies through their physical bank branches or online portal.

However, you can still purchase crypto through third-party exchanges. Start by choosing a compatible cryptocurrency exchange. Here are a few of them:

| Brokers | Information | Register |

|---|---|---|

| Speculate in popular crypto products with eToro! Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more | |

| Speculate on increasing & decreasing crypto prices with the CFD provider Plus500 using a demo account. 82% of retail CFD accounts lose money. |

After selecting an exchange, connect your crypto account with UniCredit Spa Bank.

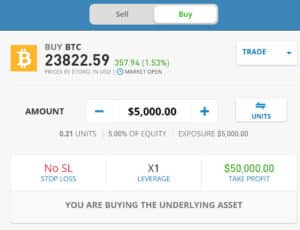

Then, follow these simple steps to buy Bitcoin with UniCredit Spa Bank:

- Open an account with the chosen crypto exchange.

- Verify your account by providing the necessary identification documents.

- Deposit funds into your account using your preferred payment method.

- Select the desired cryptocurrency in the trading software.

- Fill in the amount you wish to buy and press the open position button.

What Can You Do with Cryptocurrency?

Buying Bitcoin with UniCredit Spa is no longer limited to trading, buying, and selling. Innovative companies now offer crypto investors exciting options to utilize their digital assets.

Here are a few examples:

- Affordable money transfers

Cryptocurrencies enable fast, low-cost money transfers with fees significantly lower than traditional financial intermediaries.

- ‘Yield Farming’ with crypto

Earn steady interest on cryptocurrencies through lending and staking, although remember that it’s not risk-free or insured by government bodies.

- Censorship-resistant wealth storage

Cryptocurrencies like Bitcoin serve as an alternative store of wealth, immune to freezing by authorities.

- Investing in early-stage startups

Token-based fundraising democratizes investment in innovative startups, allowing a more comprehensive range of investors to participate.

- Private transactions

Some privacy-focused cryptocurrencies enable users for anonymous financial transactions. Users have the freedom to transfer money without the need to provide detailed explanations to the bank.

- Non-cash remittances

Cryptocurrencies enable non-cash remittances, which can be used for mobile top-ups or bill payments.

- Earning from content creation

Some platforms reward users with cryptocurrency for posting and curating high-quality content.

- Renting out hard drive space

Decentralized cloud storage solutions offer cryptocurrency rewards for renting out spare hard drive storage.

- Travel the world

Travel the world using cryptocurrencies as payment for flights, car rentals, and hotels through platforms. Convert cryptocurrency into local currency using Bitcoin ATMs in major cities. Even some space travel companies accept Bitcoin as payment.

- Purchase luxury items

Through cryptocurrency marketplaces, buy luxury goods like sports cars, including the iconic Lamborghini, fine art, and real estate. Tesla also accepts selected cryptocurrencies as payments for its vehicles.

Risks Associated with Buying Crypto and how to Mitigate Them

When buying Bitcoin or other cryptocurrencies with UniCredit Spa Bank or any other bank, it’s essential to be aware of the potential risks involved. Here are some of the risks you should be aware of:

- Market Volatility: Bitcoin and other cryptocurrencies are highly volatile assets. The value of cryptocurrencies can fluctuate rapidly, sometimes within hours or even minutes. Therefore, it’s crucial to keep track of market trends and be prepared to handle market volatility.

- Security Risks: When buying Bitcoin or other cryptocurrencies, you are responsible for the security of your digital assets. Hackers can gain access to your digital wallet and steal your cryptocurrencies. Hence, it’s essential to store your digital assets in a secure and private wallet and follow recommended security practices, such as enabling two-factor authentication and avoiding public Wi-Fi.

- Regulatory Risks: Cryptocurrencies’ legal status varies across countries and jurisdictions. Some countries have banned or restricted cryptocurrencies, while others have regulated them. So, staying informed about the regulatory landscape and understanding the legal implications of buying and selling cryptocurrencies is essential.

- Scams and Fraud: The crypto industry is rife with scams and fraudulent activities. Be wary of unsolicited offers, phishing scams, and fraudulent ICOs. Only trade on reputable exchanges and platforms, and do your due diligence before investing in any cryptocurrency.

- Liquidity Risks: Cryptocurrencies are relatively new assets with varying liquidity. Buying or selling cryptocurrencies may be challenging, especially during market volatility. Researching the liquidity of your chosen cryptocurrency and the exchange you plan to trade on is essential.

- Exchange Risks: When buying Bitcoin or other cryptocurrencies through third-party exchanges, there is always the risk that the exchange could be hacked or go bankrupt. Therefore, it’s essential to choose a reputable and trustworthy exchange and never leave your cryptocurrencies on the exchange.

Is UniCredit Spa Bank Crypto-Friendly?

UniCredit Bank is an institution that welcomes the use of digital assets. They do not place any restrictions on their personal or business clients for engaging in cryptocurrency transactions.

UniCredit Bank clients can confidently deposit fiat currency into licensed and regulated trading platforms.

About UniCredit Spa Bank

UniCredit S.p.A. is a prominent banking group with its headquarters in Milan, Italy. The bank was established in 1998 after the merger of Credito Italiano and Unicredito but traced its origins back to Banca di Genova, founded in 1870. It is Italy’s sole systemically important bank, as recognized by the Financial Stability Board in 2022. It ranks as the 34th largest bank in the world regarding assets.

UniCredit operates in corporate and commercial banking, investment banking, and wealth management. It is a pan-European bank with a strong presence in Eastern, Western, and Central Europe. Through its extensive European banking network, UniCredit offers market-leading products and services in 13 core markets, including Italy, Austria, Germany, and 11 Central and Eastern European countries.

Final Thoughts: Can you buy crypto with UniCredit Spa Bank?

UniCredit Spa Bank’s platform doesn’t currently provide the facility to buy Bitcoin and other cryptocurrencies. However, buying them through third-party exchanges is still possible. Following our step-by-step guide and taking necessary safety precautions, you can buy Bitcoin and other cryptocurrencies with UniCredit Spa Bank and enjoy the benefits of investing in cryptocurrencies.