How to invest in wheat and grains (2024)?

Do you want to invest in wheat & grain? Then you’ve come to the right page. We’ll discuss how you can invest in grains such as wheat, and also analyse whether this is a wise choice.

Where can you invest in wheat & grain?

You need an account with a broker to invest in wheat. In the overview below, you can see which brokers allow you to invest in these commodities.

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 82% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

How to invest in wheat?

Option 1: Invest in the price of wheat

You cannot invest in wheat by physically buying the commodity and storing it in your home.

Active trading in the price movement of wheat & grain is positive through derivatives. Derivatives make it possible to track the price movement of a commodity. Some examples of derivatives that allow you to track the price of grain & wheat are:

With a derivative, you do not invest in the wheat itself, but rather in the price of wheat. You can speculate on both a rising and a falling price with a derivative. If you want to speculate on a falling price, you can open a short position.

Option 2: Indirectly invest in wheat & grain with a fund

It is also possible to invest indirectly in wheat by buying an ETF. An ETF is a fund that tracks the price of a certain security.

An example of a comparable fund is the WisdomTree Wheat (GB00B15KY765). With this type of ETF, you can invest in the price movement of grain and wheat through derivatives. If you want to read more about investing in ETFs in detail, read this article.

Option 3: Invest in wheat & grain stocks

A final way to invest in wheat and grain is by buying stocks of companies that deal with these commodities. Keep in mind that your results will not move one-to-one with the grain price.

Some examples of grain & wheat stocks are:

- MGP Ingredients Inc.: this company supplies drinks made from grain products.

- Archer-Daniels-Midland Company: a multinational that processes and trades commodities.

- Bunge Ltd.: this company processes grains into consumer products.

Always do thorough research on the financial health of the company you want to invest in. Click here to read more about buying & selling stocks.

Price development of grains such as wheat

In 2023, the price of grains such as wheat increased due to the escalating tension in the conflict between Ukraine and Russia. Many grains are grown in these regions, and the tension can lead to shortages.

The price of grains such as wheat is determined by the interplay of supply and demand. In this case, you can see that the supply side is under pressure while the demand remains high. This caused the price to increase.

What is wheat?

Most people will know that wheat is a type of grain; in fact, it is one of the most cultivated grains in the world. This naturally results in a lot of supply, which is also reflected in consumption; wheat is one of the most eaten grains in the world, along with corn. However, there is a lot of variation possible within wheat.

Wheat can be divided into different types; there is winter wheat, summer wheat, and transitional wheat. This name refers to the moment of seeding. However, the wheat that is eaten in the Netherlands is not grown here; it is largely imported from, among others, China, the US, and Russia.

How is the price of wheat determined?

Wheat is a commodity that is almost always in demand. This is because we use wheat for many products, and people will always be hungry. The chance that demand for wheat suddenly drops sharply is therefore quite small.

The price of wheat is mainly determined by the supply side. For example, a failed harvest can lead to a sharp rise in wheat prices. It may therefore be wise to study how the harvest is going in the countries where wheat is grown.

Commodity without a dominant player

Wheat can be grown almost anywhere. As a result, there is no dominant player who can exert a lot of influence on the market. The largest producer of wheat is China, but countries such as India, Russia, America, and France also produce large quantities of grain & wheat.

Since there is not one player who controls the largest part of the market, countries cannot play political games with the commodity. This naturally benefits the stability of the commodity.

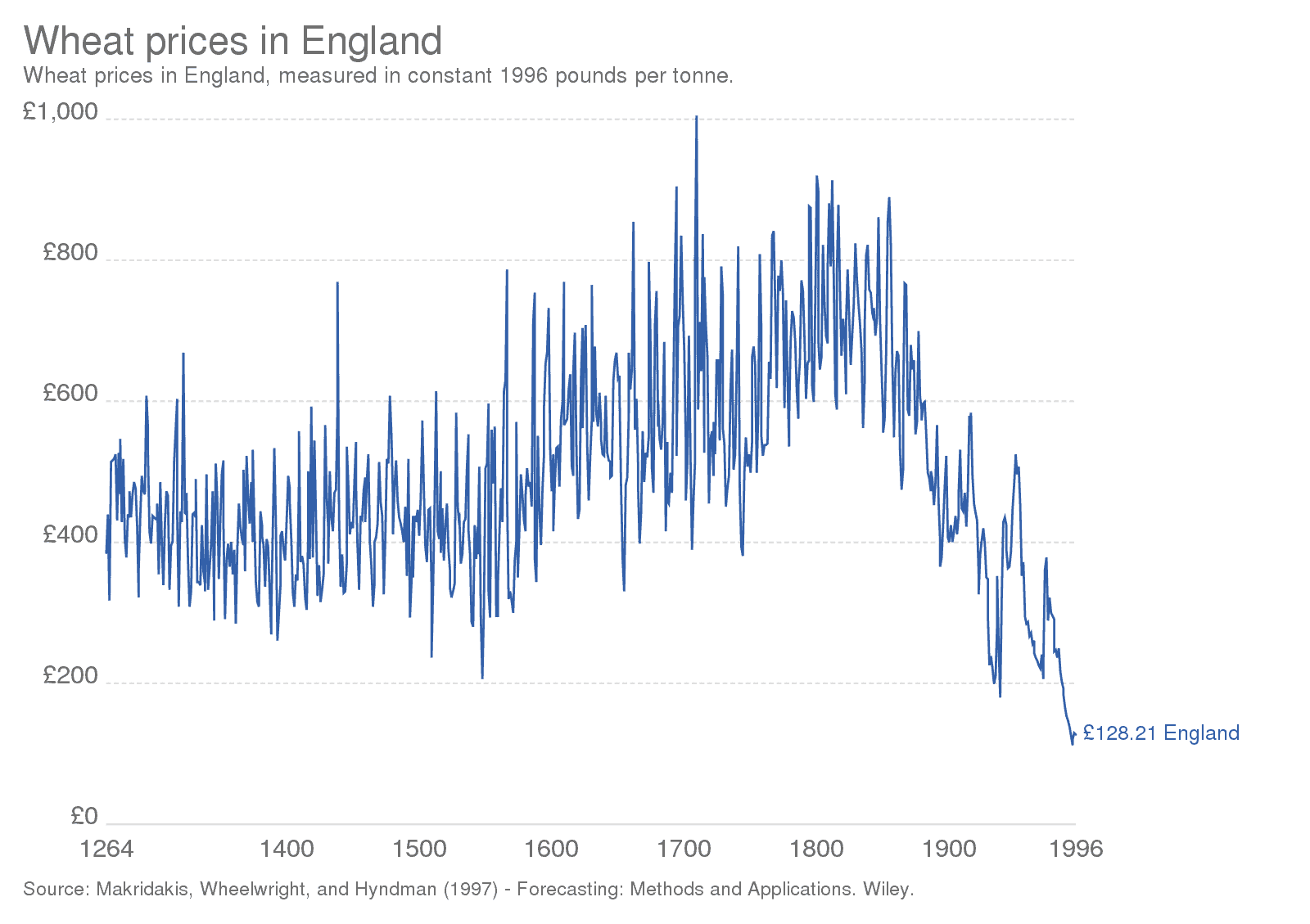

The development of wheat prices in England

On which exchange is wheat traded?

Commodities are often traded on a specific exchange. Wheat is traded on the CBOT or Chicago Board of Trade. One unit of wheat is 27.21 kilograms. In English, this is also called a bushel. The value of this amount is expressed in cents. When a bushel is worth 500, this means that you pay $5 per 27.21 kilograms of wheat.

On this exchange, contracts of 5,000 bushels are traded, which is almost 30,000 kilograms of wheat. Fortunately, with modern brokers, you can also invest in smaller amounts of wheat!

Which grain & wheat stocks can you invest in?

There isn’t really one company that focuses solely on wheat production. Therefore, you can only invest indirectly in wheat companies by investing in a company involved in agriculture. Let’s discuss some stocks that are active in this sector.

1. Buy Mosaic Company Stocks

Mosaic Company is a relatively new company, but is now a market leader in potato fertilizers in America. The demand for fertilizer is growing globally, and Mosaic Company performs well in this area as they operate in more than 50 countries. Therefore, buying Mosaic Company stocks can be attractive.

2. Buy Bunge Limited Stocks

Bunge Limited is a company that performs many agricultural activities. Wheat also plays a role in the business model of Bunge Limited, as the company regularly processes and transports wheat. Obviously, you are not directly investing in the price of wheat with Bunge Limited, but rather in a large agricultural enterprise. Therefore, it is important to first examine how the company performs.

3. Archer Daniels Midland Company

Another large company that is active in agriculture is Archer Daniels Midland Company . This company owns more than 600 facilities where crops are processed and sent all over the world. Also, with this company, you do not directly invest in wheat, but rather in the agricultural industry as a whole.

Some tips for investing in wheat

1. Analyze the supply side: It is clear that the price of wheat mainly depends on the supply side of the market. Therefore, it is wise to make a good analysis of the supply side of the market and to make a move only when there is an indication that the harvest is exceptionally bad or good.

2. Efficiency & population growth: In the long term, the demand for wheat is likely to continue to grow; the world population is still increasing and as a result, there are morehungry people who need to be fed. However, developments in the agricultural market can simplify the cultivation of wheat, which can result in a higher supply with fewer resources.

3. Diversify your chances: It is always wise to diversify your risks when investing. By investing in wheat & grains at different times, you increase the chance of a positive result. Also, do not forget to diversify your investments across different sectors and regions.

4. Practice: Start investing in wheat & grain only when you have gained enough experience. Click here to practice investing first with a free demo.

Frequently Asked Questions about Investing in Wheat & Grain

The price of wheat is strongly influenced by climate developments. When the weather is unfavourable and there are many crop failures, the price of wheat can increase significantly. The industrial demand can also have an impact on the price of wheat. This was seen, for example, after 2005 when wheat was increasingly used to create ethanol, a biofuel.

The growing world population also naturally has a positive impact on the price development of wheat.

In practice, corn is more often used to create ethanol (a biofuel). This is lucrative, and you can see that more and more farmers have switched from wheat to corn. This could cause scarcity in the future, leading to further price increases. Wheat, for example, is widely used for pasta and pizza, and I personally can never get enough of those.

Wheat is, of course, used for food. However, human consumption is not the primary use for wheat. For example, wheat is used to generate biofuels.