Compound Interest Calculator (2024)

With this comprehensive compound interest calculator, you can instantly calculate how quickly your money can grow due to the effect of compound interest.

- Return: you can immediately see how much your deposit(s) could grow!

- Variation: you can calculate how much higher or lower your return may be.

- Lost by delay: you can instantly see how much money you would miss out on by waiting one year to invest.

As you can see, your wealth grows quickly when you invest year after year. Waiting to invest can also be an expensive decision. Do you also want to start investing? Click here to compare the best brokers.

How to use the compound interest tool?

- Initial deposit: Enter the amount you will deposit immediately.

- Monthly deposit: Enter how much you want to deposit each month.

- Expected return: Enter the return you expect to earn.

- Variation: Enter how much you think the return can deviate up and down.

- Compounding: Apply compound interest on a daily, monthly, semi-annual or annual basis.

What is compound interest?

Compound interest is also known as “interest on interest“. When you reinvest the return you earned, you earn interest on that as well. This can cause your wealth to grow exponentially, which allows you to build a large fortune if you have enough time. Compound interest is often referred to as the “8th wonder of the world”.

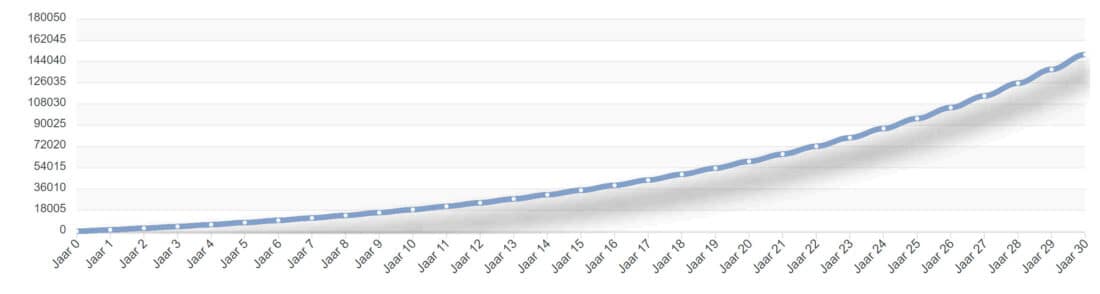

In the chart above, you can see how compound interest causes your wealth to grow further and further. In this case, we deposit $100 monthly at a rate of 8%.

Why time is your best friend: lost return

To build a large wealth, you primarily need one thing: time. With the compound interest tool, you can immediately see how much it would cost you if you had one less year to let your wealth grow.

For example, if you invest $100 monthly at a rate of 8%, you would achieve the following results:

- 30 years: $150,042

- 29 years: $137,396

This means that in this scenario, starting a year later will cost you $12,646 or more than 8% of the total return! For most people, setting aside a fixed amount of money each month is a suitable option. Do you want to know how to do this? Than read the special about ETFs.

What is the formula for calculating compound interest?

The formula for calculating compound interest is A = k(1 + i)t.

- A (amount): A stands for the final capital, which you calculate using the formula for compound interest.

- p (principal): is the amount that you deposit and on which you want to calculate compound interest.

- i: this is the interest rate divided by 100. For example, if the interest rate is 8%, then i is 0.08.

- t: the number of periods, for example 30 for 30 yeards.

If you invest $1000 for a period of 30 years at an interest rate of 8%, then you fill in the formula as follows:

- A = 1000(1 + 0.08)^30

- A = 1000(1.08)^^ 30

You can also use the formula to calculate compound interest on a daily, weekly, or monthly basis:

- Daily: for i, enter the expected daily return, and for t, enter the number of days over which you want to calculate the amount.

- Weekly: for i, enter the expected weekly return, and for t, enter the number of weeks over which you want to calculate the amount.

- Monthly: for i, enter the expected monthly return, and for t, enter the number of months over which you want to calculate the amount.

Take variance into account

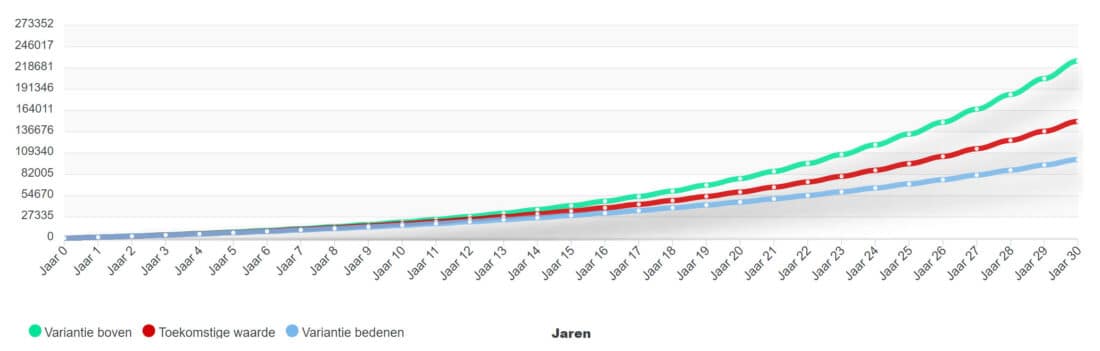

Many people use a compound interest calculator to calculate how much wealth they will possess on a certain date. It is important to take variance into account, because remember: past results do not guarantee future performance!

When the economy performs well or poorly, investment results can turn out to be better or worse than expected. Within the tool, you can add variance to see how much wealth you would build up in a favourable and less favourable scenario.

If you invest $100 per month for 30 years with a variance of 2%, your results could be significantly higher or lower:

- At a return of 6%: $101,025

- At a return of 10%: $227,793.

A difference in yield of 4% can make a 100% difference in your end capital!

Reducing Your Variance: Strategy

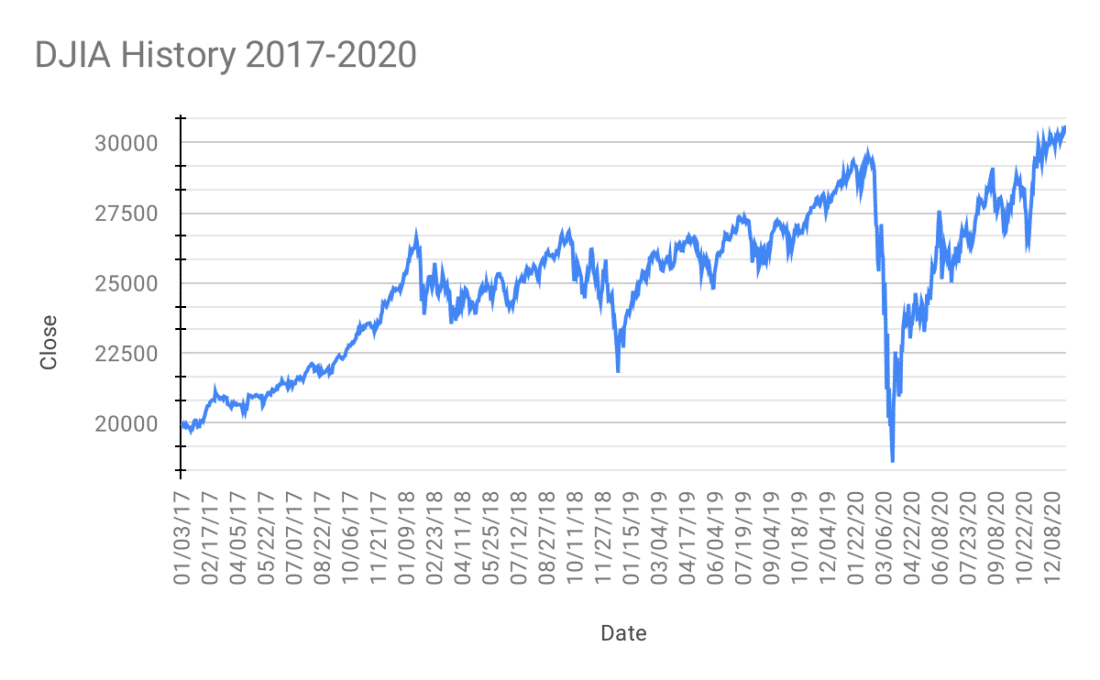

If you want to increase the chance of achieving a stable return in the long term, it is best to reduce the variance or volatility. The best way to reduce your variance is to spread your investments over time. If you invest a large sum of money all at once, there is a chance that the timing will be wrong. For example, if you had invested money just before the 2008 crisis, it would have taken a long time to see a return:

By investing a smaller amount monthly, you invest against both low and high prices, which allows you to benefit from an average return. The average return on the stock market was about 8% annually. Keep in mind that this return is subject to transaction fees and taxes.

Interest on Interest Visualization

Do you still not understand how interest on interest works in practice? In the table below, you can see how your capital grows further and further.

| Year | Starting amount | 10% interest |

|---|---|---|

| 1 | $10.000 | $1.000 |

| 2 | $11.000 | $1.100 |

| 3 | $12.100 | $1.210 |

| 4 | $13.310 | $1.310,10 |

| 5 | $14.620,01 | $1.462,01 |

As you can see, the received interest increases further every year.

Last tip: estimating interest on interest

Don’t have a calculator handy? With the so-called 72 rule, you can quickly calculate how long it takes to double your money with compound interest. Divide 72 by the interest rate you receive, and you’ll quickly see how long it takes to double your wealth with compound interest:

- 5 percent: 72/5 = 13.09 years

- 10 percent: 72/10 = 7.2 years

- 20 percent: 72/20 = 3.6 years

Frequently Asked Questions

With simple interest, you only calculate the interest on the initial deposit. With compound interest, you also take the interest earned on the interest into account.

You can get compound interest by reinvesting your interest or returns. For example, if you receive dividends, you can use them to buy new shares. You can add the interest on your savings account back into your account, which means you keep earning interest on your interest!

You can calculate returns over multiple years by taking into account both your returns on your investment and the returns earned on those returns. This type of calculation is also known as compound interest calculation. You can use the tool at the top of this page to easily calculate your returns over multiple years.

Do you want to get started with investing?

If you want to get started with investing and building your wealth, open an account with an online broker: