Investing for dummies

Many people will be familiar with the book investing for dummies; you can see this article as the ultimate short guide for dummies. We try to teach you in as few words as possible about the interesting investment opportunities available to beginners.

Investing for dummies: what is investing?

More and more people discover that investing can be very interesting. Investing is buying & selling securities with the aim of making a profit. Many investors start trading shares. However, there are many other investment products with which you can achieve a good return.

How can you invest as a dummy?

Dummies often do not immediately know where to start investing. To help you on your way, we have listed the best options for you.

Active CFD trading

If you like to be active in investing, you can choose to trade actively using CFDs. You can then respond directly to price rises and falls of, for example, a share. This short-term way of speculating is especially suitable for the active trader who likes to be active on the stock exchange.

You can try active trading for free with a demo. This is recommended as active CFD trading can be complicated. Would you like to open a demo straight away to practice trading? Press the button below to compare different demo accounts:

Many people choose at some point to invest in shares for the long term. This can work out well: the average return on stocks is between 6 and 8%, which is a lot higher than the current savings rate. You can already invest in shares with only a few hundred pounds. However, with a smaller amount, it is more difficult to spread out your risks.

A good broker to buy & sell shares is eToro. At eToro, you can trade shares entirely without commissions. Use the button below to directly open an account with eToro:

Investing in an index fund

For many dummies, it might be wise to put their money into an index fund or ETF. An index fund follows an index passively: you then invest, for example, in a basket of shares listed on the FTSE. This is a passive way of investing that requires little or no knowledge. In addition, the management costs of a comparable fund are low, allowing you to achieve a higher return in the long term.

A good party where you can buy funds without any transaction fees is DEGIRO. By the way, this only applies for the funds that are included in the core selection: so take a good look at this before you get started. Use the button to directly open an account with DEGIRO;

What is the purpose of investing?

Some dummies may wonder what the ultimate purpose of investing is. In short, the goal is simple: to make a profit! However, the interpretation of this is very different from investor to investor. When you are young, for example, you can take some more risks. You then have a long investing horizon which gives you enough time for future recovery. Other investors want to run as low a risk as possible: if this is the case, it is better to invest in less risky investment products.

What is a stock exchange?

Investments are usually made on the stock exchange: the prices of shares are registered on the stock exchange. During trading hours, investors can then buy & sell shares on the stock exchange. When the demand for a share rises, the share price may rise. You no longer trade physically on the stock exchange: all investments are now sent digitally to the stock exchange via an online broker.

Investing for dummies & risk diversification

Many dummies forget the importance of risk-spreading when they start investing. Instead of really investing, they are mainly gambling. This is of course unwise: as a gambler, it is better to visit the casino.

By ensuring sufficient diversification, you reduce the chance that your investment portfolio will suddenly sharply go down in value. But how can you, as a dummy, apply more risk diversification? This can be done in various ways:

- Investment product: you can spread your investments over different investment products. For example, invest a portion in shares & a portion in bonds.

- Sector: you can spread your investments across different sectors: you can buy shares of construction companies and retail companies.

- Region: it is also wise to spread your investments over different regions. That way you reduce the impact of regional, socio-economic problems.

- Time: you can also spread your risks over time: step in staggered! By getting in the market on multiple moments you avoid investing a large part of your assets at the peak of the market.

Dummies often forget the costs

Many dummies immediately start investing enthusiastically, but then forget to keep an eye on the costs. However, the costs are critical: if you invest at too high a cost, this can severely limit your returns in the long term. This can quickly cost you thousands when you have invested a significant amount of capital.

The investment costs you pay differ greatly per investment product. In any case, you regularly have to deal with these costs:

- Purchasing costs: the broker charges costs when you buy an investment product. In some cases you pay a fixed commission.

- Ongoing costs: on some investment products you pay management costs. This is, for example, the case with an investment fund.

- Service costs: at some old-fashioned brokers you pay service costs for using the account. Fortunately, you can avoid these costs.

- Currency costs: when you invest abroad, you also have to pay costs for exchanging currencies.

Investing roadmap for dummies

You now know better what investment means and what you need to pay attention to. In the meantime, you are probably eager to start investing. Before you can really get started, it is important to go through this step-by-step plan. That way, you can determine whether you are really ready for it.

Step 1: are you ready?

Investing is not always suitable for everyone. It is important to ask yourself a few questions first:

- Do you have an amount of money in your account that you can spare in the near future?

- Are you prepared to take risks to achieve a higher return?

- Do you understand what investing means?

Only when you can answer YES to these questions will you be ready to start investing. If this is not the case, it is better to leave the money in a savings account for now.

Step 2: determine your risk profile

A good next step is to determine your risk profile. Not every investor feels equally comfortable taking large risks. Therefore, ask yourself the following questions:

- Do you mind large fluctuations in your investment results?

- Do you need the money back any time soon?

- Do you think a stable result is more important than a high profit?

When you answer YES to these questions, it is better to use a defensive strategy. You then invest in less risky bonds & shares. If you answer NO to these questions, you can take more risks. With an offensive investment profile, you often achieve a higher return in the long term. However, with a similar profile, your risks are also much higher.

Step 3: determine how you are going to invest

Many dummies forget to draw up a clear plan. Investing money arbitrarily without a plan, however, is not a good idea. Therefore, first think about how much money you want to invest and decide how much time you have to invest. Based on this information, you can decide what kind of investment products suit you best. An index fund requires little time and a small amount of capital, while active investment itself often requires more time and a larger amount of capital. By drawing up a clear plan, you can determine which investment method suits you best.

Step 4: determine where you are going to invest

I am a big fan of cycling, but fortunately, you don’t have to cycle to the stock exchange to buy shares. These days, buying and selling investment products such as shares is done entirely through the internet. When selecting a good provider, it is advisable to pay attention to the following aspects:

- Is the broker a reliable party?

- Is the broker’s software user-friendly?

- Can you invest at low transaction costs?

- Can you try out the possibilities with a demo?

- What is the minimum deposit to invest?

On the basis of the answers to these questions, you can determine whether a broker suits you. Would you like to know which broker you can best invest with? Then take a look at our comparison of best brokers and try out the different options:

Step 5: Stay sharp

It is then important to stay focused: draw up a strategy and follow the latest market developments. Try to make your decisions as much as possible on the basis of rational arguments. Many dummies make the mistake of letting their emotions guide them too much. This is a shame: in practice greed & fear are bad counsellors.

15 important investment rules for dummies

Rule 1: Saving is a requirement for every investor. Never invest with money you can’t afford to lose: that way you avoid getting into trouble because your car needs a repair.

Rule 2: Assume a realistic rate of return that does not exceed 8-10 % on an annual basis. Only with very hard work you can achieve a higher return.

Rule 3: focus on the long term: even if you invest in the short term, it is important to have a long-term plan.

Rule 4: Risk diversification is an important part of any investment strategy. By spreading your risks, you ensure a more stable and predictable return.

Rule 5: Look at the overall picture of your financial situation and determine on that basis what your investment strategy should look like.

Rule 6: remember that supply & demand determine the prices on the stock exchange. A sudden rise or fall does not necessarily mean that a company has lost its intrinsic value.

Rule 7: Take your investment horizon into account: when you are young you can take greater risks as you have more time.

Rule 8: do enough research: you work hard for your money and buying and selling bad stocks costs you money.

Rule 9: Research taxes: you often pay taxes on your investments as well.

Rule 10: limit the costs of your investments as much as possible. All the costs you save will give you more room to achieve a good return.

Rule 11: remember that beating the market is very difficult: even professional investors rarely succeed. Therefore, consider whether it is realistic that you will do so.

Rule 12: Don’t get out in bad times: that’s when you can make a lot of money on the stock market!

Rule 13: Beware of hiring investment advisors. By teaching yourself the basics you will save a lot of money.

Rule 14: Accept that it is almost impossible to predict the future. Proper management of your money & risks are therefore crucial.

Rule 15: In the end, your personal health is most important: therefore, make sure you can sleep well despite your investments.

Learning to invest is important

If you are still a dummy when it comes to investment, it is important to first learn how investment works. For this purpose, it is wise to first practise with free investment software. Don’t forget that investing is ultimately a serious business; a wrong decision can have serious consequences. You can start right away:

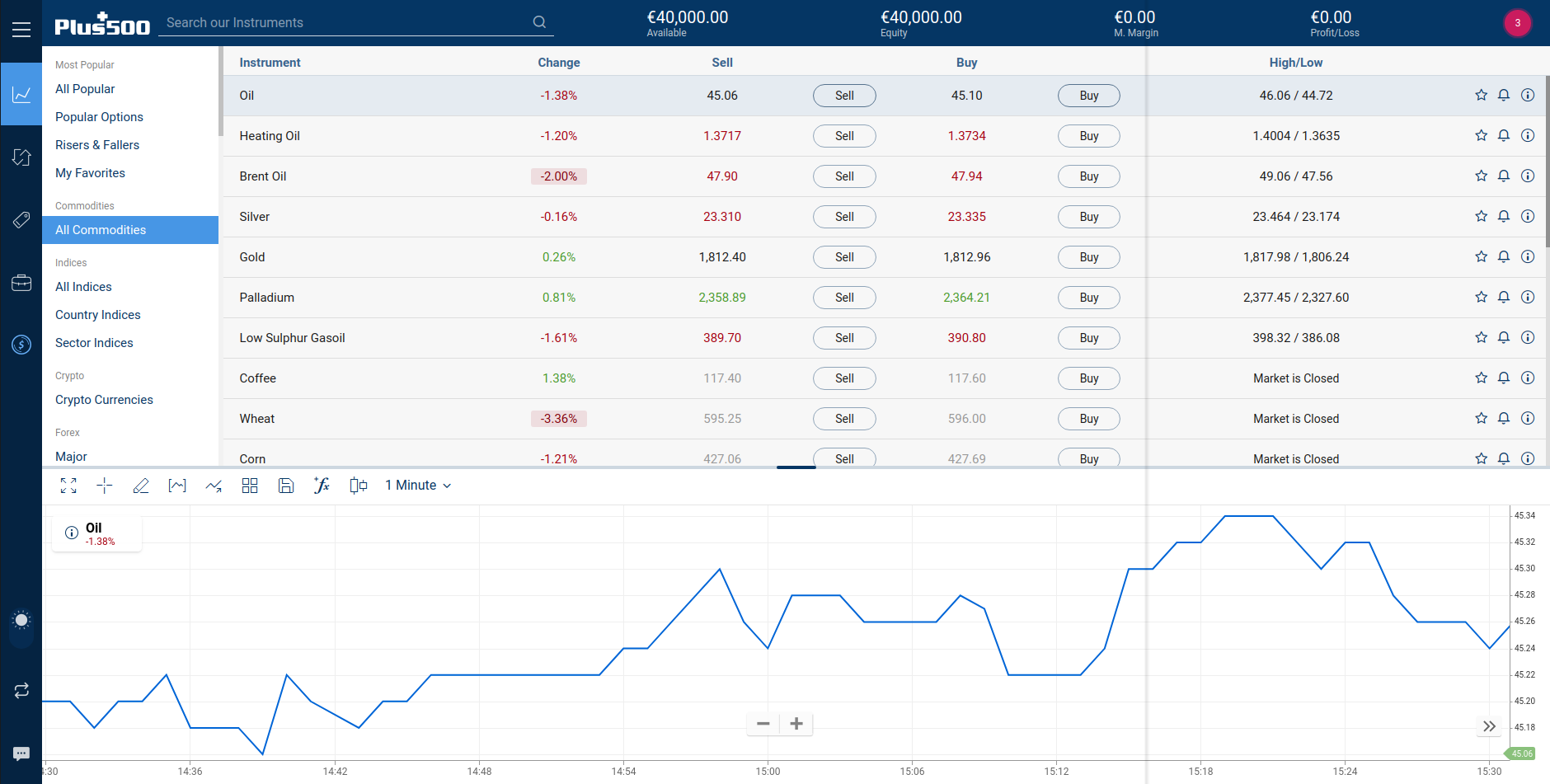

- Use the free investment software

- Open a demo account

- Start with a fictitious amount of $40.000

Many people have their doubts about a demo programme; however, this is not necessary. After all, the practice account is completely realistic and can also be used to trade with real money. The way the demo account works is therefore entirely in line with what it is like to invest with real money.

Investing with real money

When you have learned enough you can easily switch to the real money mode within the software. In real money mode you can deposit money yourself with which it is possible to trade shares and commodities CFDs. This allows you to take advantage of the smallest price fluctuations by using leverage.

Useful information for dummies

Dummies often do not yet know how to invest. It is therefore wise to learn a lot about investing first. This can of course be done by reading a book like ‘investing for dummies‘. However, this book is quite outdated and contains little information about the new possibilities that online investing can offer you.

It may therefore be wiser to first take a course on investing. On trading.info we have several useful resources that you can consult as a dummy; that way you can get started with a solid amount of knowledge!

The biggest recommendation when you want to get started quickly is our Plus500 tutorial. Use the button below to follow the tutorial directly and learn the basics:

What can dummies invest in?

As a new investor, you have many investment options. In this part of the article we will discuss what you can invest in as a dummy.

As a dummy, it is totally possible to buy shares. Some dummies may not know yet what stocks are; shares actually give you the co-ownership of a company. Stocks can change in value, so you can make a price gain. You can also get a dividend on your share; these are a kind of profit distributions.

Do you want to know the best way to buy stocks? In our special on buying & selling shares you will learn everything you need to know:

Bonds

If you prefer things to be calmer, you as a dummy should opt for bonds. Bonds are loans issued by a company or the government. Bonds have a limited risk, as you get your deposit back at the end of the term. During the term of a bond, the price of the bond can fluctuate. Would you like to know more about investing in options? Then read our article on the subject:

Derivatives

Derivatives are contracts on, for example, shares or bonds. This way of investing is especially attractive when you are going to invest with a small amount of money. An example of a derivative is the CFD or contract for difference; you can trade these derivatives with an online broker.

Do you want to know more about trading in derivatives? In our derivatives special you will learn everything you need to know about investing in derivatives:

Forex

Forex is another interesting investing option for dummies. Forex is the activity of trading in currency pairs. The price of currencies often moves up and down less quickly because it is the largest market in the world. Also, exchange rates are often easy to understand and you only have to look at global trends. This makes exchange rates more predictable than, for example, stock prices.

Do you want to know how investing in Forex works? Then read our special about investing in Forex right away:

Raw materials

Raw materials are also popular as an investment option. Nowadays, most people trade in raw materials via derivatives; yet it is also possible to make physical investments in gold and silver. However, in practice it is not possible to physically buy commodities such as sugar and coffee, which are usually traded in large quantities.

Do you want to know how investing in commodities works? Then read our special about investing in commodities:

Options

Finally, there are options, but options are very complex for most dummies. Among other things, you can use options for hedging where you can hedge the risks of an investment position when you expect a sudden sharp fall or rise. Do you want to know how options trading works? Then read our extensive manual:

A few final remarks for dummies

- Start small: do not invest large sums of money!

- Keep learning: try to discover new techniques all the time.

- Limit your loss: use a stop loss to limit your loss.

- Don’t follow dummies: don’t follow other dummies, walk your path.