eToro fees: how much does investing with eToro cost?

Before you start investing with eToro, you probably want to know how much trading with eToro costs. On this page, we describe how expensive it is to invest with eToro so that you can make an informed decision.

An account is 100% free

Opening a (demo) account with eToro is 100% free of charge. Even if you don’t want to invest with real money, you can use the professional tools offered by eToro. You can also participate in the social network and make use of various analyses. Even if you don’t want to invest with eToro, it is therefore attractive to open a demo. Use the button below to open a free demo at eToro yourself:

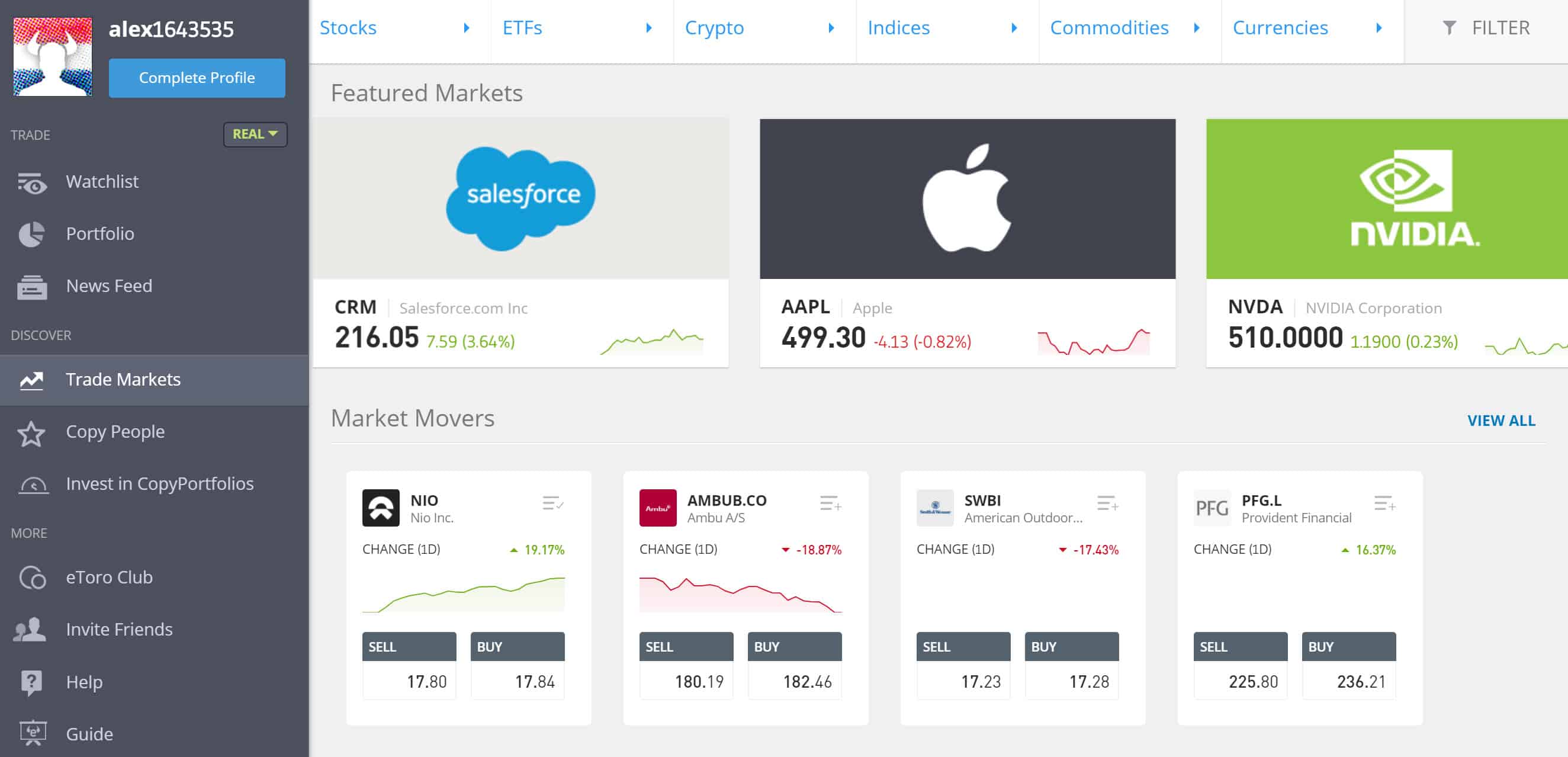

A big advantage of eToro is that you don’t pay commissions on the shares you buy, but other fees do apply. We’ve looked into this and it’s true. Because of this you can even buy one share for a few dollars and benefit from it. At eToro, you can, therefore, build a varied portfolio even with a small amount of money. Please keep in mind that other fees are applicable.

No management fees

At eToro, you pay no management fees. At some banks and brokers, you pay for the use of their services. For example, you have to pay a fixed percentage of service costs every month. Fortunately, this is not the case with eToro. Even if you copy other traders or follow professional portfolios, you don’t pay any additional transaction costs. This makes eToro an attractive option for investors who want to trade passively.

Bummer: you pay costs when withdrawing money

However, it is a pity that you have to pay the costs for withdrawing money at eToro. These costs are quite low: 5 dollars. However, this makes it more difficult for people with a small trading amount to achieve a positive return. After all, when you deposit $200, you lose 2.5% in costs to get the money back from your account. When you trade with larger amounts of money, this percentage will decrease. On paper, the amount seems small, but in practice, it can reduce your return considerably.

How high is the spread at eToro?

At eToro, you also pay a so-called spread. The spread is the difference between the bid and offer price. These transaction costs are calculated at each broker. For example, you can buy a share for $5 and sell it for $4.98. The difference constitutes the transaction costs you pay.

The spread can be different for each investment product. At the time of writing, you pay $0.78 for an Apple share, which is 0.2%. If you want to trade the Bitcoin, you pay $71 at the time of writing, which is 1%. On oil, you pay 5 cents per barrel at the time of writing, which is 0.12%. The spread changes constantly. Therefore, it’s always wise to check if the spread you have to pay is acceptable for you.

The spread is the difference between the buy & sell price

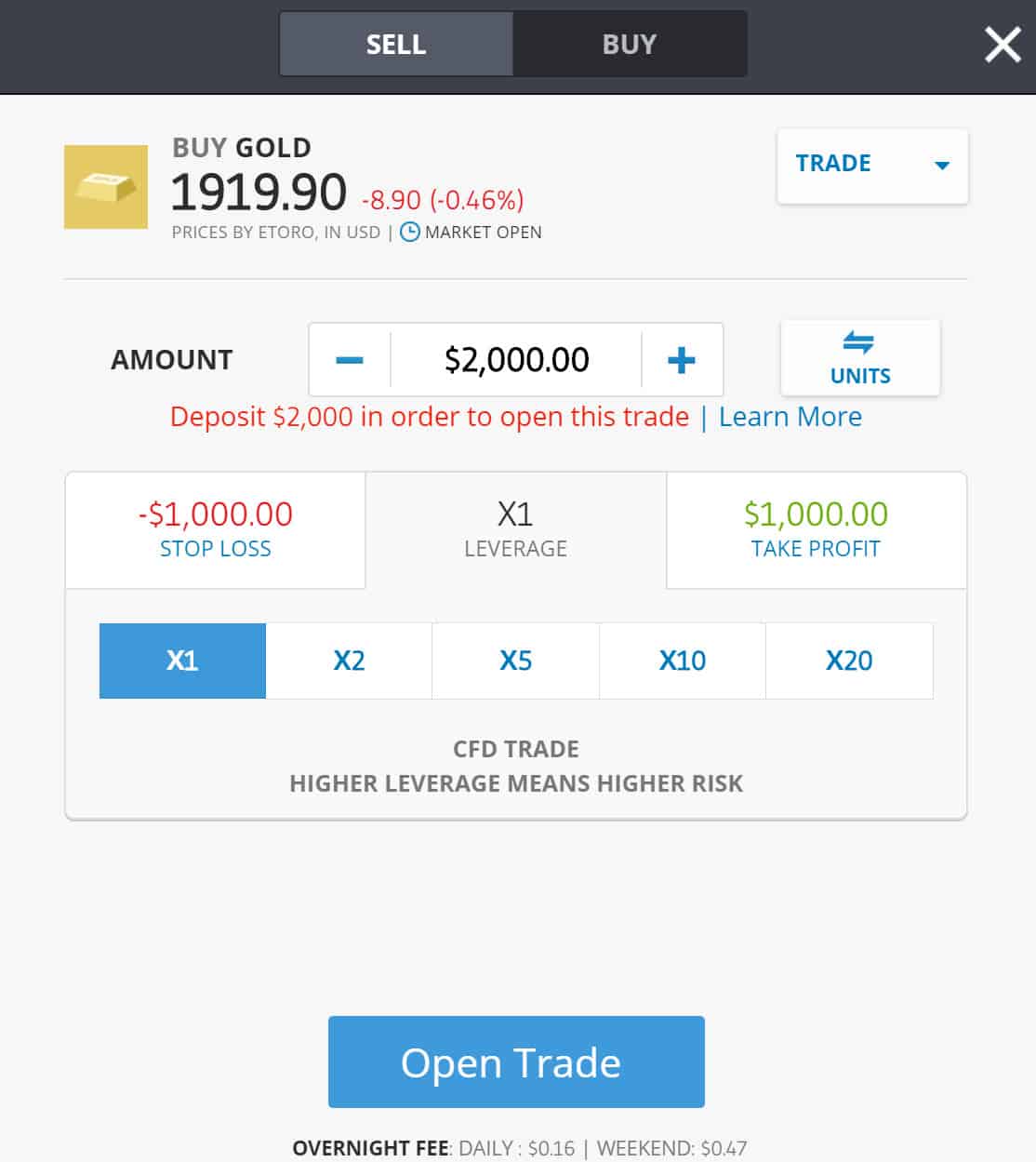

What is the cost of leverage?

It is also important to remember that you pay extra costs when you use leverage. We also call these extra costs the financing costs. When you use leverage, you open a larger position with a smaller amount of money. The broker will then lend you the rest of the money. If you close the position on the same day, you do not have to pay any extra costs.

This is different when you leave the position open. When you leave the position open for one night, you pay interest on your position. This is also called the night premium. With eToro you can immediately see how high the night premium is and how much you pay per day. In this way, you can make a well-considered decision whether you want to trade with leverage.

At the time of writing the night premium on EUR/USD on a long position is $0.000062. For gold, the night premium is $0.008153 per day and for the China50 index only $0.

Within the software, you can see the night premium of each effect

What are the minimum costs?

At eToro, minimum costs are charged for different product categories. Below we briefly mention the minimum costs:

- Currency: the minimum cost is 1 pip.

- Raw materials: the minimum cost is 2 pips.

- Indices: the minimum cost is 100 pips.

- Equities & ETFs: you pay a premium of 0.09% with CFDs.

- Cryptocurrencies are already trading at 1% cost.

Conversion costs

Another disadvantage of investing with eToro are the conversion costs. Accounts can only be held with eToro in dollars. If you transfer money into another currency, you pay conversion costs to convert your currency into dollars. For the most commonly used currency pairs, the conversion costs amount to 50 pips. This amounts to 0.0050 cents per currency unit. For more exotic pairs, the costs can increase considerably.

If you invest with eToro and your country does not use the dollar by default, you are automatically also subject to currency risk. The dollar can lose its value against the euro. Even with favourable investment results, you can lose money in this way. At the same time, of course, you can also make a profit when the dollar becomes worth more against your currency.

Cost of inactivity

It is important to use your eToro account regularly. If you do not log into your account for 12 months, you will incur costs for inactivity. These costs are $10 per month. No positions are closed to pay these extra costs. You can easily avoid these costs by logging in at least once a year. If there is no balance in your account, you will not incur any inactivity fees.

Conclusion: is eToro cheap?

eToro is certainly a good choice for the investor who wants to trade in shares without commissions. However, it is important to take the costs of withdrawing money and converting currencies into account. The latter is particularly detrimental to investors who use a currency other than the dollar.

Despite these inconveniences, eToro is certainly a good choice for the investor with a small to the medium-sized trading budget.

eToro risk warning

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.