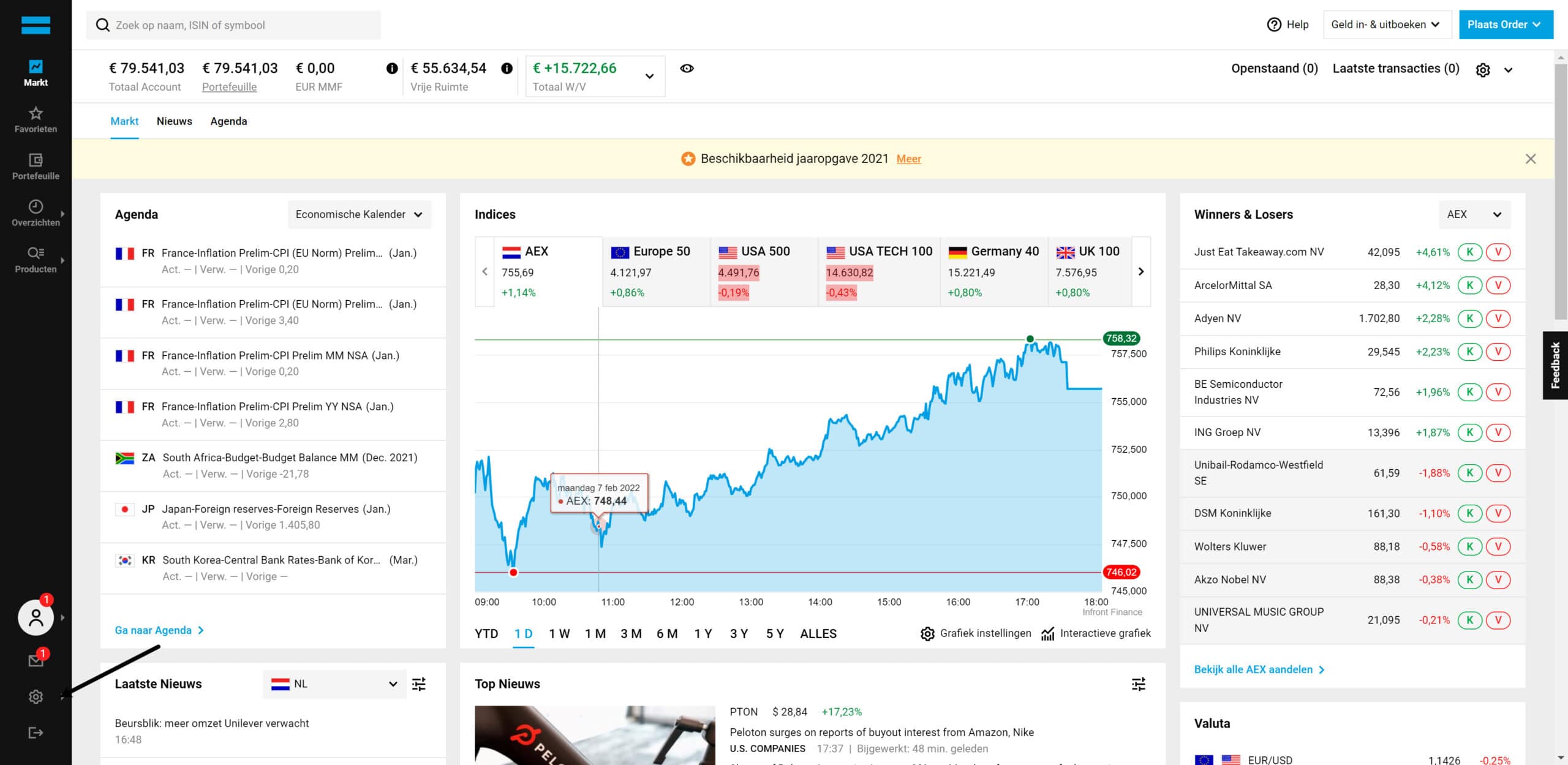

How to short sell with DEGIRO? – a user-friendly guide

You can short sell with DEGIRO, which means you speculate on a decreasing share price. In this short guide, we’ll discuss how to short sell with DEGIRO.

You need to have an account with DEGIRO to follow this tutorial. If you don’t have an account yet, use the button below to open one:

In brief: what is short selling?

When you short sell, you speculate on a declining stock price. For instance, you can short sell a stock. If the stock’s price then drops, you’ll earn a profit. However, if the price goes up, you’ll lose money.

Would you like to learn more about how short selling works? Then read the extensive short selling guide:

How to short sell with DEGIRO?

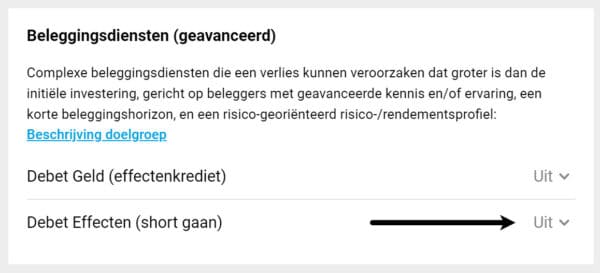

Before you can open a short position with DEGIRO, you need to enable this option first. To achieve this, navigate to the settings within your account.

Then, scroll down and enable debit securities.

Before you can enable debit securities (short selling), you need to take a short knowledge test. DEGIRO tests whether you have sufficient knowledge to open short positions. If you pass the test, you can enable the option.

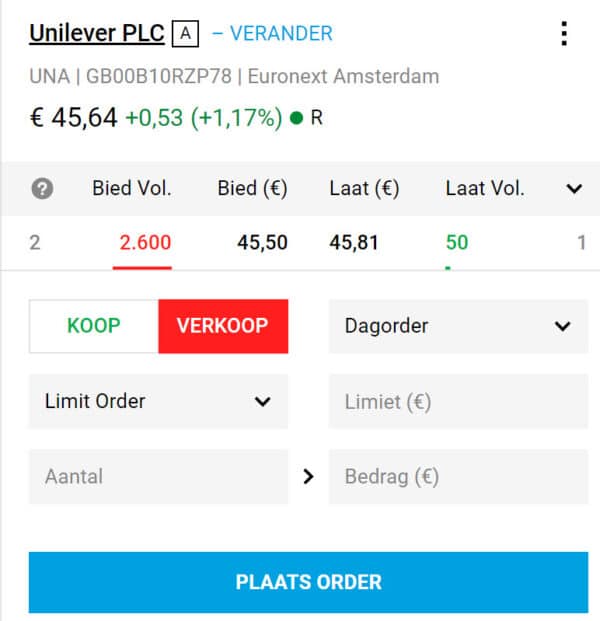

When you open a short position, you sell a security that you don’t already own. It is not possible to short a security that you already own; you would have to sell the securities you already own first.

Opening a short position works the same as opening a normal stock position. Simply enter the number of shares you want to short, and then click place order to submit the order.

It is recommended to use a limit order, as it allows you to set a price that you are willing to pay. With a market order, you may receive a less favourable price, especially in times of high volatility.

What to watch out for with short positions?

Short positions are risky investments. Your potential loss is unlimited: a stock cannot infinitely decrease, but it can infinitely increase.

As stock prices rise, your losses may increase. When the risk increases, DEGIRO may ask you to deposit more money, which is also known as a margin call. If you do not deposit more money, your positions can be closed automatically at a loss.

In rare cases, the counterparty may claim the stocks. DEGIRO can then close the position immediately or within a certain deadline, which can result in losses for you.

How much does short selling cost at DEGIRO?

Short positions are riskier, even for the broker. Therefore, DEGIRO charges extra fees for opening a short position.

The amount of these fees depend on the risk category of the stock. Currently, the fees are:

- Category A: 1%

- Category B: 1.5%

- Category C: 2%

- Category D: not possible

In addition, you also pay financing costs, known as debit interest. The debit interest on euro, dollar, and pound accounts is 3%, and on all other currencies, it is 4%.