Investing money: the 12 best ways to invest money

Do you want to successfully invest money in 2020, but do you have doubts about where to start? With our investment tips, you can make your money work for you! The great thing is that you don’t need a special diploma to take advantage of the many possibilities.

Where would you invest?

In my opinion, there is only one right moment to start investing: today! When you put money in a savings account for later, you know for sure that you will end up with less. Under the influence of inflation, you can invest less and less with the same amount of money in the future.

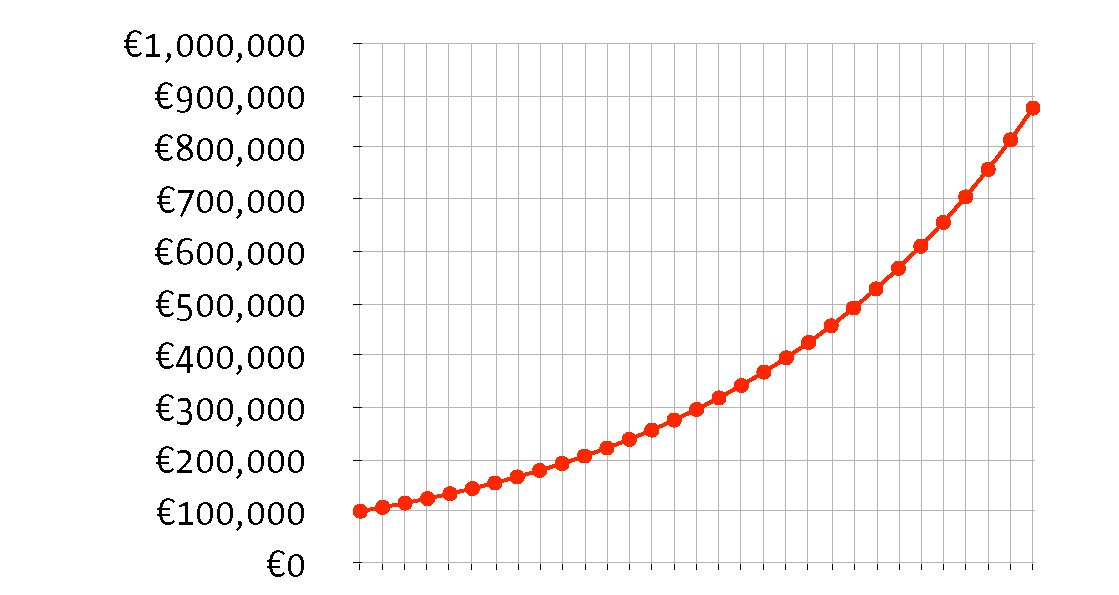

Moreover, by immediately starting to invest you can benefit from compound interest or return on return. Your money can grow exponentially if you invest the profits you make over and over again.

Your investment grows faster over time due to interest on interest

In this article, we discuss several attractive options to invest in:

- Shares

- Real estate

- Derivatives

- Investment funds

- Bonds

- Crypto coins

- Smart Traders

- Raw materials

- Startups

- Consumer loans

- Deposits

- Your pension

1 Investing in the stock market

The most popular form of investment is still an investment in shares. Many people still have a dusty image of investing in stocks. Buying shares is something for men with boring suits, isn’t it? Nothing could be further from the truth! Nowadays, you can buy and sell various stocks with the push of a button.

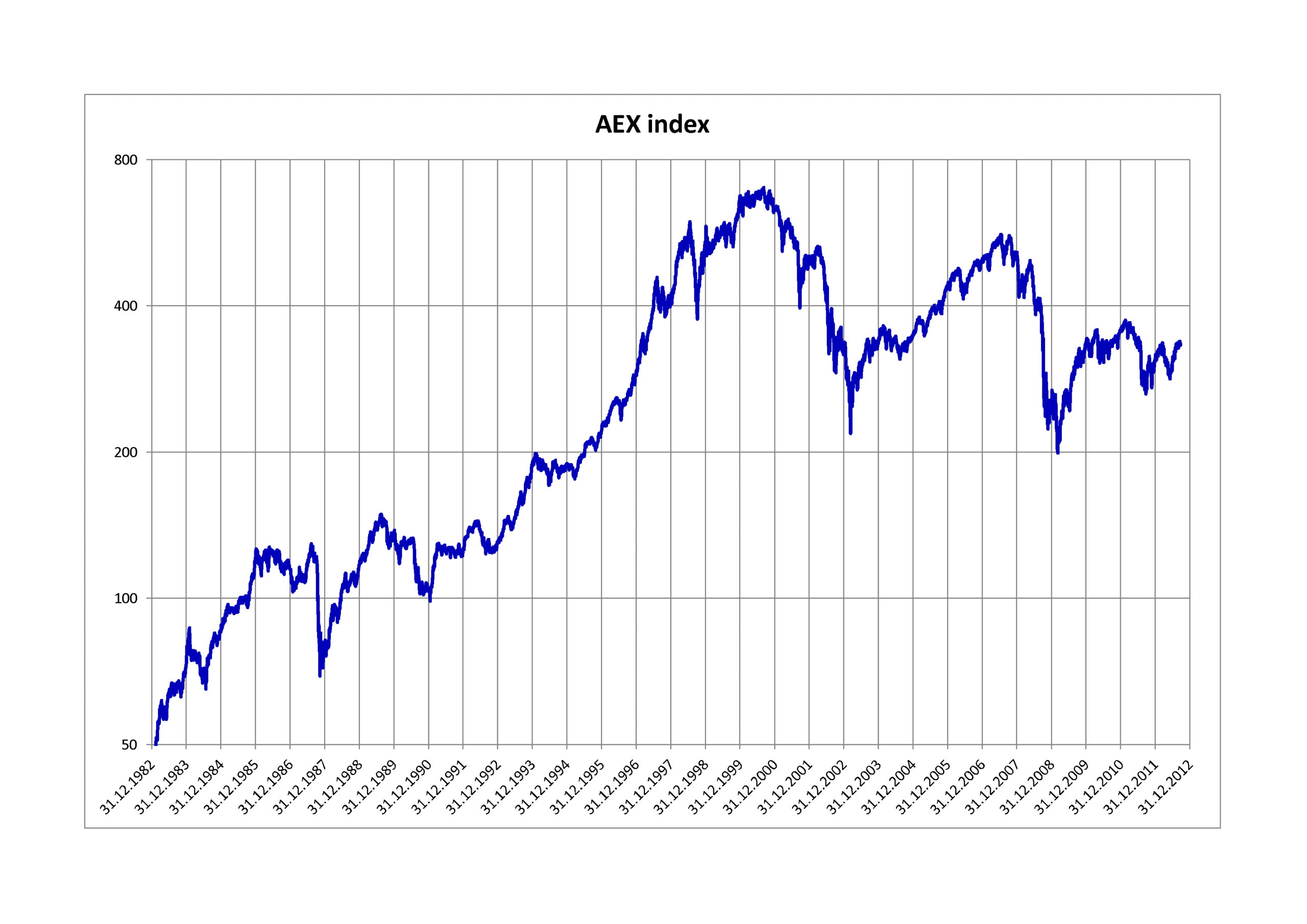

It is important to buy shares at different moments. Many people make the mistake of investing a large amount of money in shares all at once. However, it is very difficult to predict whether the stock market is on top or bottom. By stepping in staggered, you prevent yourself from stepping in at the top and therefore achieving a much lower return.

With investments in stocks, you can easily achieve a 5 to 8 percent return on an annual basis. By constantly reinvesting your return, your assets can grow considerably in the long term. Do you want to know where and how to buy shares? In our article about buying shares you can read all about it:

It is important to step in staggered

2 Investing in real estate

Investments in bricks are still unprecedentedly popular. This is not strange: with an investment in real estate, you can achieve a double return. When you buy and rent out a house, you have a fixed income stream. Moreover, the prices of houses increase in the long term. So, when you sell the house in the future, you will achieve a nice return again!

Especially in the current times, investing in real estate can be very attractive. Because of the low-interest rates, you can borrow money cheaply. At the same time, there is still a shortage of housing. As a result, the profit margin on renting out houses is high.

Many people are afraid to invest in real estate because they think it’s a lot of hassle. However, this does not have to be the case at all! You can hire other parties to take care of all administrative matters for a small percentage. Do you want to know how investing in real estate works? Read our extensive guide about investing in real estate for more information:

3 Speculating with derivatives

Speculation is also becoming more and more popular. This is mainly because active trading or speculation has become increasingly accessible. You can open an account with various brokers and immediately start practising with a demo.

A derivative makes it possible to speculate on rising and falling stock market prices in the short term. With derivatives, you can perform all kinds of interesting tricks: you can bet on a falling price or apply leverage to increase your potential profit (and loss!).

A good party to speculate with derivatives is Plus500. With Plus500 you can try out the possibilities with a demo for free. Use the button below to instantly open a free demo:

4 Investing in an investment fund

Do you have little time, but do you want to take advantage of the developments in the stock market? Then it can be attractive to invest in an investment fund. An investment fund is a fund that invests money in a certain group of investment products. Some funds invest, for example, in a certain region or a certain type of company.

In most cases, passive investment funds are the most attractive. For example, a passive investment fund follows the developments of a certain index. The costs of tracking a passive investment fund are relatively low. As a result, you can often achieve a higher return with this type of investment fund.

A good party to buy shares in an investment fund is eToro. At eToro you can invest in many investment funds. Use the button below to directly open an account:

5 Investing in crypto coins

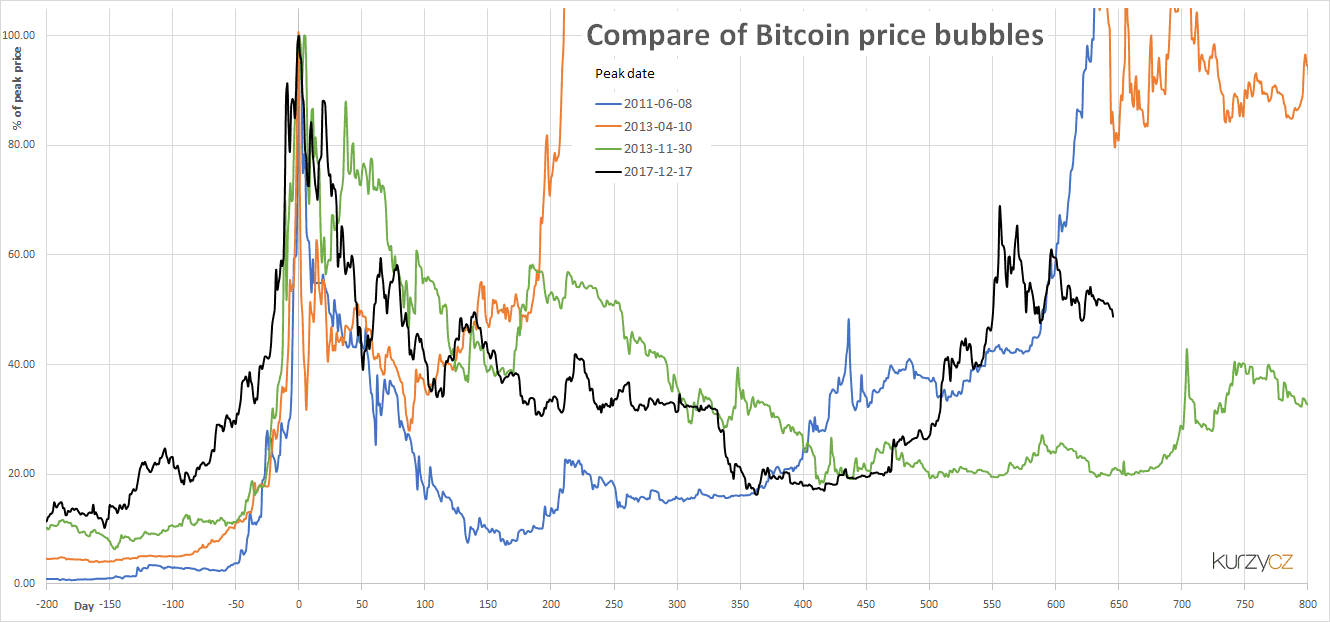

Crypto coins are still booming! The biggest hype has passed after the Bitcoin’s price plummeted in 2018. Yet, the technology behind the crypto mine is still rock solid. The fast and almost anonymous way to send money has some interesting applications.

Moreover, we see that cryptocurrencies do well, especially in uncertain times. During the corona crisis, for example, crypto coins are on the rise. Investors like to step into investment products without counterparty risk in uncertain times.

A modest investment in one or more crypto coins can generate a potentially high return for the brave investor. However, it is important to remember that the price can easily rise or fall by tens of percent within a short period. An investment in a cryptocurrency is therefore not for everyone. Do you want to know more about investing in cryptocurrencies? In our special you can read all about it:

The Bitcoin fluctuates sharply

6 Investing in bonds

You can make an investment portfolio somewhat more balanced by adding bonds. Bonds are loans issued by a company or government. As a bondholder, you periodically receive an interest payment on the bond. You can also make a price gain if the value of a bond rises in the meantime.

Investing in bonds is especially interesting when you have a short horizon for your investments. The return on bonds is lower, but the payouts are stable. This form of investment is therefore ideal if, for example, you are retiring soon. Would you like to know more about investing in bonds? In our special section you can read all about it:

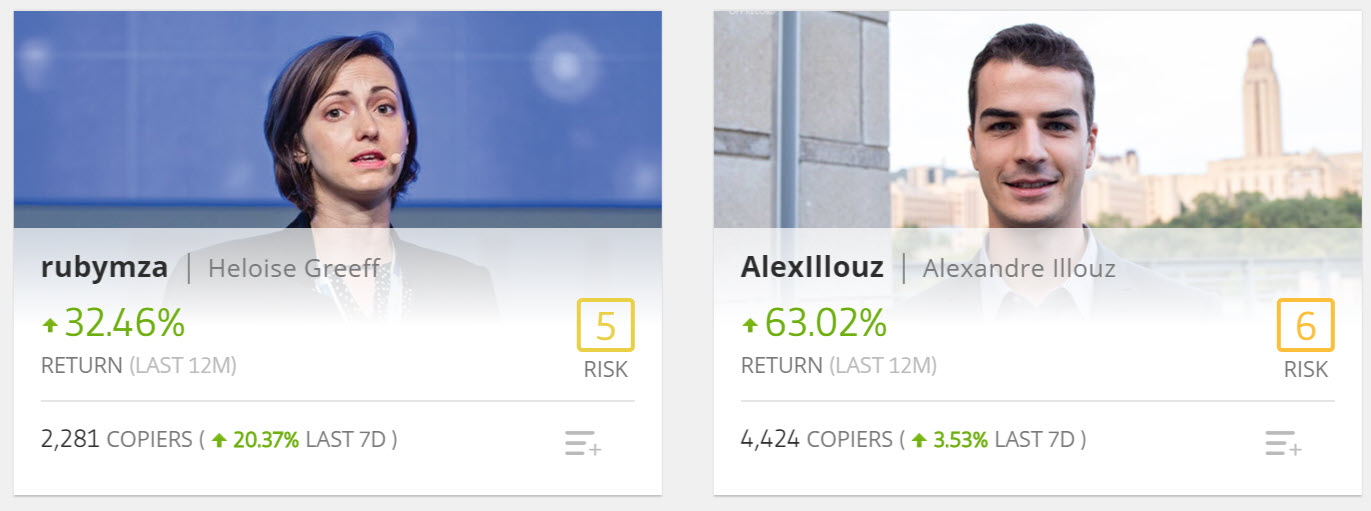

7 Tracking smart traders

Another investment option is following smart traders. There is a kind of Twitter, but for trading transactions. Skilled (and less capable) traders share their investments there. You can then copy these traders for free within your account.

However, it is important to investigate the traders well first. Check whether the way they invest suits your risk appetite. It is also important to check in between to ensure that the investor continues to perform well. These kinds of professional traders follow less fixed rules than, for example, an investment fund.

You can try tracking traders for free with a demo at eToro. By using the demo you have nothing to lose! Use the button below to directly open a free account:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Select the traders you trust

Select the traders you trust

8 Investing in raw materials

Investing in raw materials can be smart. At the moment, we consume more raw materials than will be added in time. Some important raw materials such as oil and natural gas could, therefore, be completely depleted in a few decades. Increasing demand together with increasing scarcity can of course only push up prices further.

Are you interested in investing in raw materials yourself? You can do this, for example, by participating in funds that follow the price of a commodity. You can also invest in companies that are active in a particular commodity. For the brave investors, you can also speculate directly in the price of a commodity with, for example, futures.

Do you want to know how to invest in the various raw materials? We have listed the possibilities for you in our special about investing in raw materials:

9 Investing in startups

Another popular option is investing in startups. Of course, you can put your hard-earned money into your neighbour’s business idea. However, this is not always the best option. Fortunately, there are all kinds of crowdfunding networks where you can directly invest in a business idea.

Investing in a startup is quite risky. Only a handful of startups will be successful in the end and there is a risk that you will lose the entire investment. At the same time, you can also achieve a ridiculously high return when you make a good decision. Companies like Facebook and Apple were once small startups too…

10 Investing in consumer loans

We already showed that you can make money with bonds by lending money. However, interest rates on bonds are relatively low. You can therefore also choose to invest in consumer loans or P2P. The interest you can earn on these types of loans quickly rises to four percent.

However, you have to take into account that during economically bad times fewer people can pay off their loans. In such a case, you can lose a substantial part of your investment. Investing in consumer loans is therefore not for everyone.

11 Putting your money on a deposit

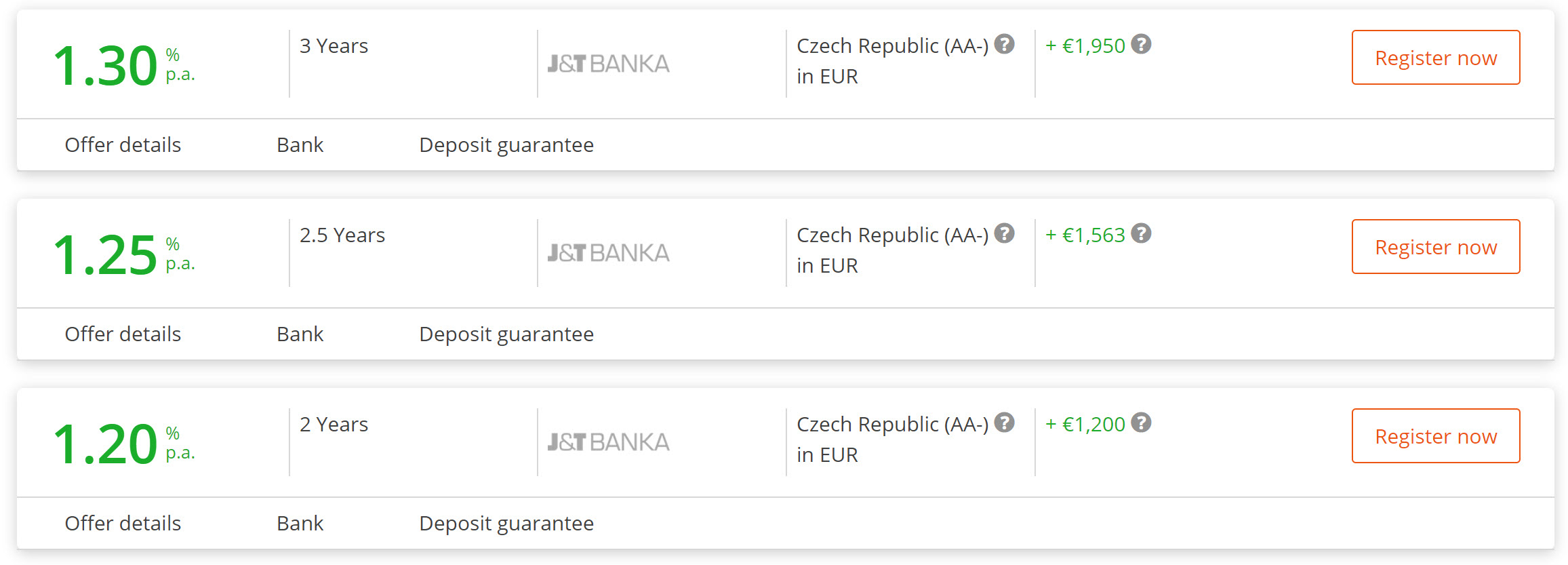

Worldwide the interest rates on saving accounts are disappointing: you can consider yourself lucky if you still receive interest. If you want to put some of your money in a bank and still get a positive return, it can be wise to look around. In some countries you can still find less well-known banks that offer a higher interest rate. You often have to keep the money in your account for a fixed amount of time.

Yet many people find saving money on a foreign bank account a scary idea. The company Raisin has found a solution for this. Through Raisin, you can easily save at foreign banks without compromising your safety. In most cases, the money you invest in a deposit is safe up to $100,000! Even if the bank collapses, you won’t lose a penny.

Would you like to browse through the banks with higher interest rates? Use the button below to directly visit the website of Raisin:

With Raisin, you will receive a higher return on your savings

12 Investing for your retirement

You can never start to early with building up your pension. If you start investing early, you will receive a much larger amount at the end due to the power of compound interest. Many governments also provide benefits to people who save for their retirement.

What’s the best investment now?

There is not one clear best investment option. What the best investment is depends strongly on your wishes & goals. Below we discuss the various factors you can take into account when selecting an investment:

The risk

Not every investment is equally risky. If your time horizon is longer, and you have a higher risk appetite, you can choose more speculative investment products. It is wise to create a healthy mix between more risky investments and relatively safe investments.

The duration

Not every investment is suitable for every term. Think carefully about how long you can miss the money. You can invest in the short term (up to five years), the medium-term (up to 10 or 15 years), or the long term. In the longer term, you have more time for recovery, which makes risky investments more attractive.

The amount

You also have to think about the amount of money or assets you want to invest in. For an investment in real estate, you need a larger starting capital than for an investment in a share. It is always important to invest only with money that you do not need in the coming period.

Preference & knowledge

Finally, it is important to choose a preferred investment product. Only invest in products that you understand sufficiently and conduct research before you put your money where your mouth is. That way you avoid disappointment.

Draw up your investment plan

It’s not wise to invest at random. Therefore, take a moment to examine your financial situation. How much money is coming in, and what buffer do you at least need for future expenses? That way, you immediately have a clear overview of the amount you can spare.

You can then divide the money you want to invest over various investment products. Determine for which period you can put the money aside in any case. By planning your finances as if you were running a business, you will achieve better results in the long term.

Sustainable investment

More and more people find it important to also invest sustainably. By investing in a better planet and future, you can influence the faith of our planet. In many countries you receive tax benefits when you invest in sustainable projects.

Frequently Asked Questions about investing

In the last part of the article, we answer some frequently asked questions about investing.

What is investing?

Investing is sacrificing money, time, or manpower to achieve a long-term goal. Nowadays, we mainly talk about investing money to achieve a positive return. Investing is usually focused on the long term.

Can anyone become an investor?

Yes, it is! As long as you are of age and have some money available, you can become an investor. Nowadays, you can invest from as little as $100 in all kinds of financial products. However, it is important to remain realistic. With a small amount, you will of course also achieve a small result.

Is it risky to invest money?

It is always risky to invest money. However, how risky differs greatly per investment product. For example, an investment in a government bond is much less risky than an investment in the Bitcoin. That’s why it’s important to investigate carefully what the risks are of the type of investment you’re considering. This way, you can select investment products that fit your risk appetite!

From what amount can you invest?

In theory, you can invest as little as $1. With $1, however, you will not achieve a high return. The minimum amount you can invest with differs per investment product. It is advisable to only start investing when you can miss a minimum of $100.

Auteur

Over Alex Mostert

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.